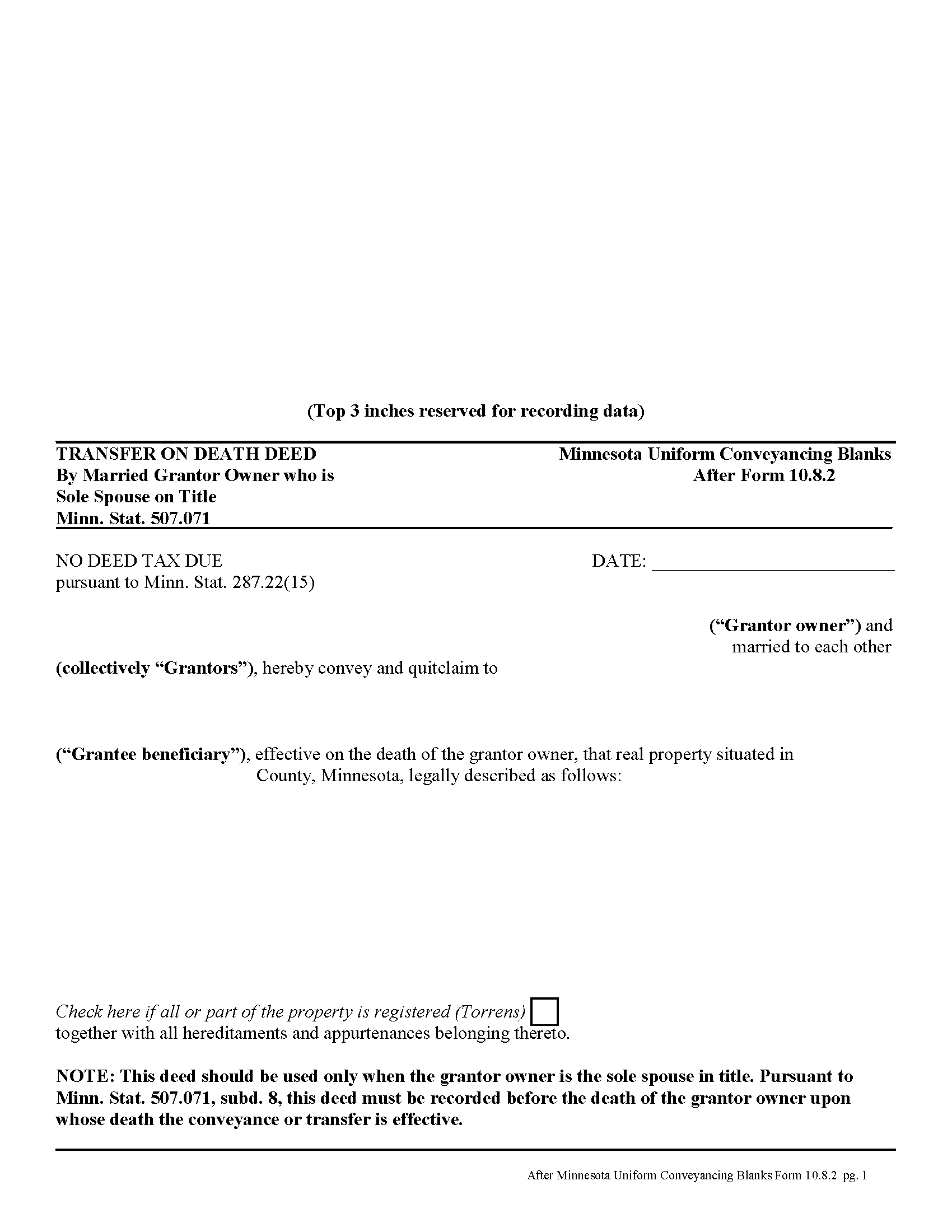

Rock County Transfer on Death Deed by Married Sole Owner Form

Rock County Transfer on Death Deed by Married Sole Owner

Fill in the blank form formatted to comply with all recording and content requirements.

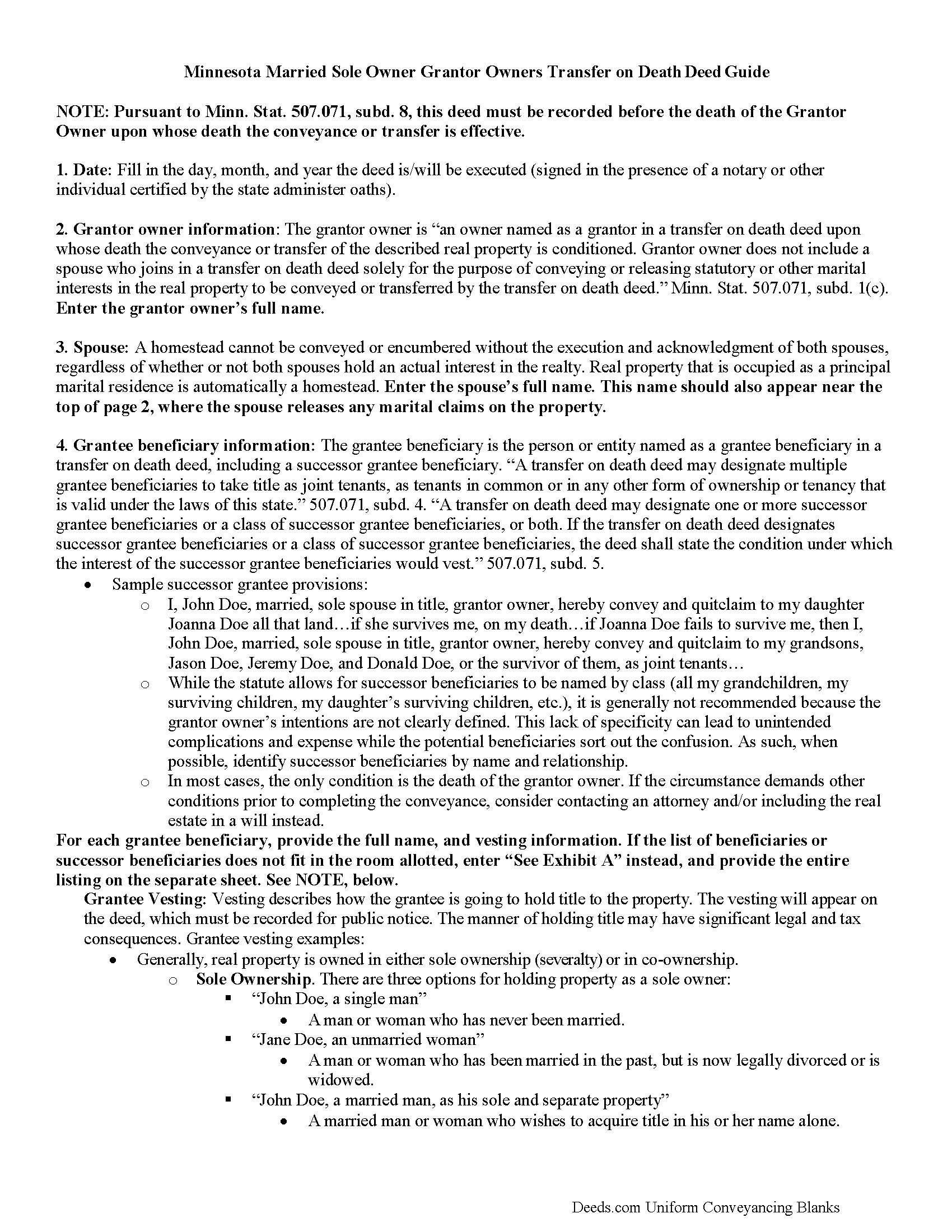

Rock County Transfer on Death Deed by Married Sole Owner Guide

Line by line guide explaining every blank on the form.

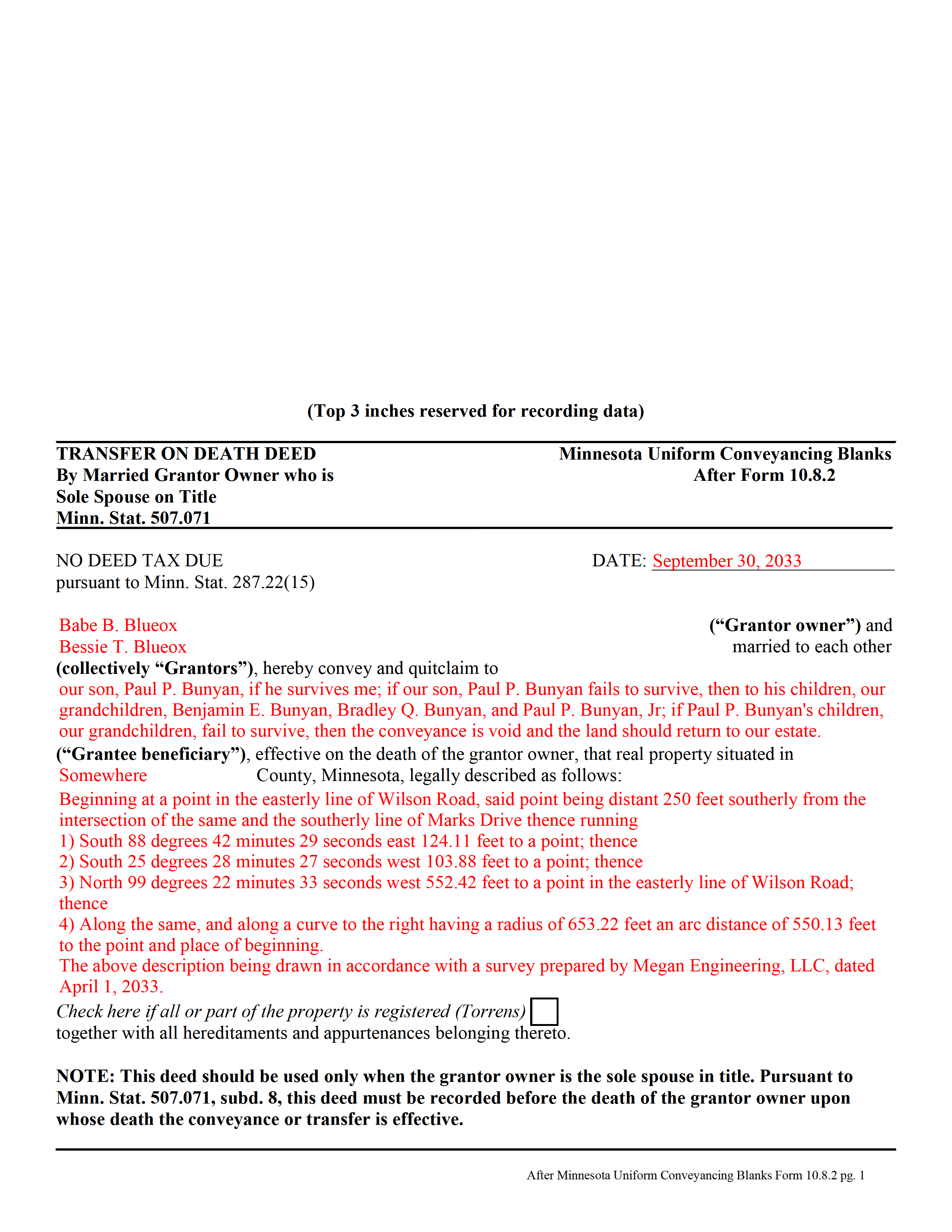

Rock County Completed Example of the Transfer on Death Deed by Married Sole Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Rock County documents included at no extra charge:

Where to Record Your Documents

Land Records Office

Luverne , Minnesota 56156

Hours: 8:00am to 5:00pm M-F

Phone: (507) 283-5022

Recording Tips for Rock County:

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

- Ask about their eRecording option for future transactions

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Rock County

Properties in any of these areas use Rock County forms:

- Beaver Creek

- Hardwick

- Hills

- Jasper

- Kenneth

- Luverne

- Magnolia

- Steen

Hours, fees, requirements, and more for Rock County

How do I get my forms?

Forms are available for immediate download after payment. The Rock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rock County?

Recording fees in Rock County vary. Contact the recorder's office at (507) 283-5022 for current fees.

Questions answered? Let's get started!

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. One such situation occurs when a married property owner holds sole title to the real estate he or she wishes to convey with a transfer on death deed. A correctly-completed basic statutory form is valid in most cases, but because the owner's husband or wife may be able to claim spousal interest in the property, these deeds require the spouse to sign a statement releasing any marital rights. Without this release, the non-probate transfer on death may not occur, and the property could revert to the deceased owner's estate for probate distribution instead. To prevent such unintended outcomes, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who are the sole spouse on the property's title.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married Sole Owner Package includes form, guidelines, and completed example)

Important: Your property must be located in Rock County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Married Sole Owner meets all recording requirements specific to Rock County.

Our Promise

The documents you receive here will meet, or exceed, the Rock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rock County Transfer on Death Deed by Married Sole Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Carol M.

January 13th, 2020

Great service

Thank you!

LISA B.

December 5th, 2019

GOT WHAT I NEEDED FORMS WORKED FINE.

Thank you!

Rhonda E.

March 10th, 2021

Quick, easy, well-priced, and I have the forms that I need. PDFS download easily and are fillable! Thank you, Deeds.com!

Thank you!

Karen F.

July 29th, 2022

Very easy to understand instructions. I was able to order, download and print.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark J.

January 28th, 2021

Straightforward, no issues.

Thank you!

Darryl S.

April 16th, 2020

These guys saved the day! Very good at what they do and deliver AS ADVERTISED!! My county's recorder's office was closed to the public due to the COVID-19 pandemic, and the recorder's office did not offer the service I needed online. Attempting to close on a home the following day, I was in immediate need of a deed for property that I previously owned to provide to the underwriters for my pending loan. I thought I was dead in the water and would miss my next day closing date. Strolling the internet for options, I came upon DEEDS.COM. After reading the posted reviews, I thought I would give them a try. Within 10 minutes of placing my order, I received ALL the information I requested about the property I previously owned. Thank you DEEDS.COM for the prompt, courteous, and professional service. You guys are ROCK STARS!!! I closed on my new home.

Thank you so much for your kinds words Darryl, glad we were able to help.

John H.

April 19th, 2021

I haven't begun yet, but this looks like what I need.

Thank you!

Carolyn A.

October 18th, 2019

Easy to use!!

Thank you!

Roberta U.

August 4th, 2022

Thanks for the quick reply Will use in future. Thanksgivings

Thank you!

Marcus F.

April 15th, 2025

Great resource! I was in a bind being out of state and deeds.com came through in a pinch for a very good price! If I need esigning again this is where I'll be coming.

Your words of encouragement and feedback are greatly appreciated. They motivate us to maintain high standards in our service.

Robert W.

November 20th, 2019

very good forms and easy to print and read. I need a notary form from a different state. We are both from the state of Michigan. This would make it easier to complete out of the State of Utah. Thanks Robert W.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly E.

January 23rd, 2021

This process could not have been made any easier!! Very easy instructions to follow and the response time was incredible! Thank you!

Thank you!

Thomas C.

January 20th, 2020

Customer service was excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven M.

January 31st, 2019

They always get me the information I need, in a timely manner.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce S.

August 5th, 2019

Download very easy. Forms are just what I need. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!