Rice County Transfer on Death Revocation Form

Rice County Transfer on Death Revocation Form

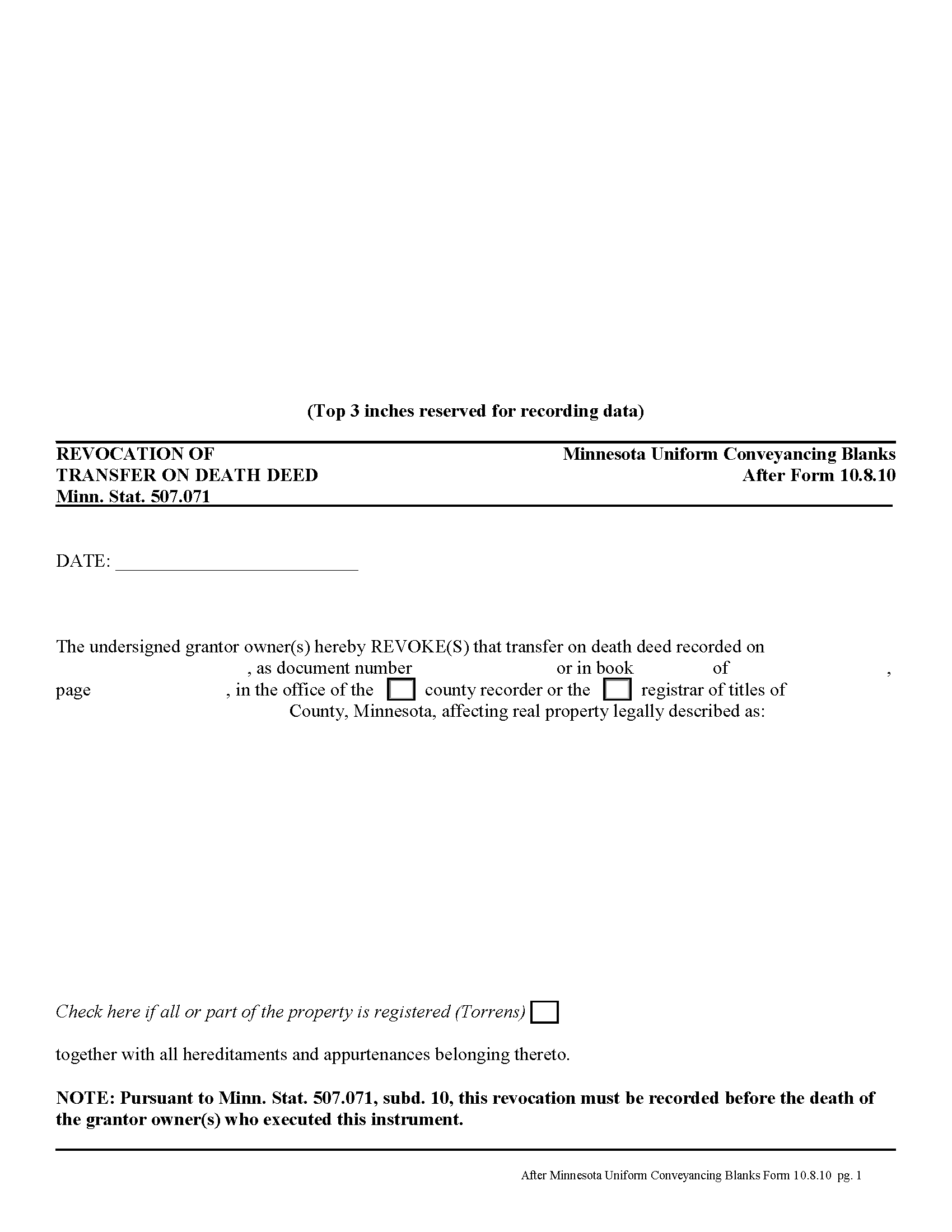

Fill in the blank form formatted to comply with all recording and content requirements.

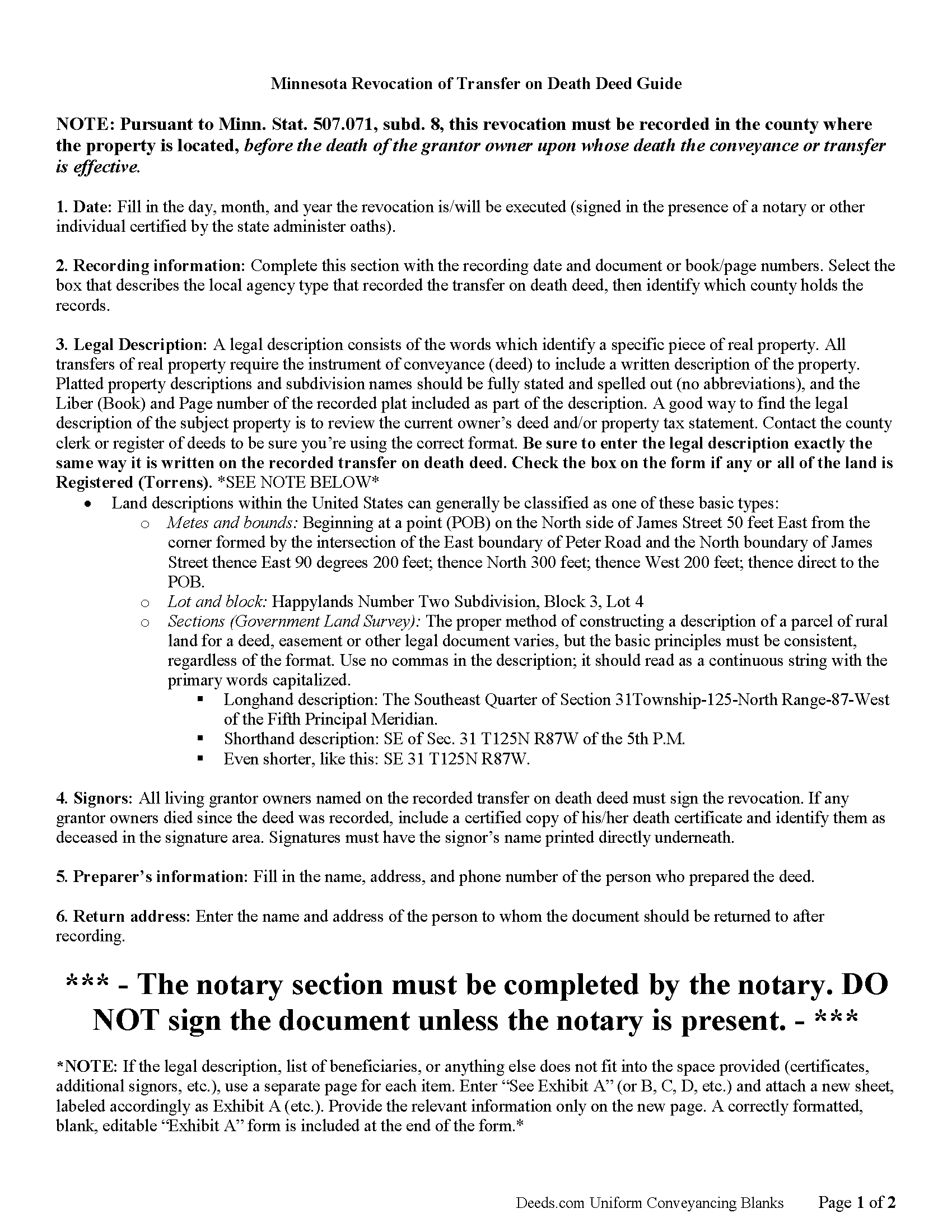

Rice County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

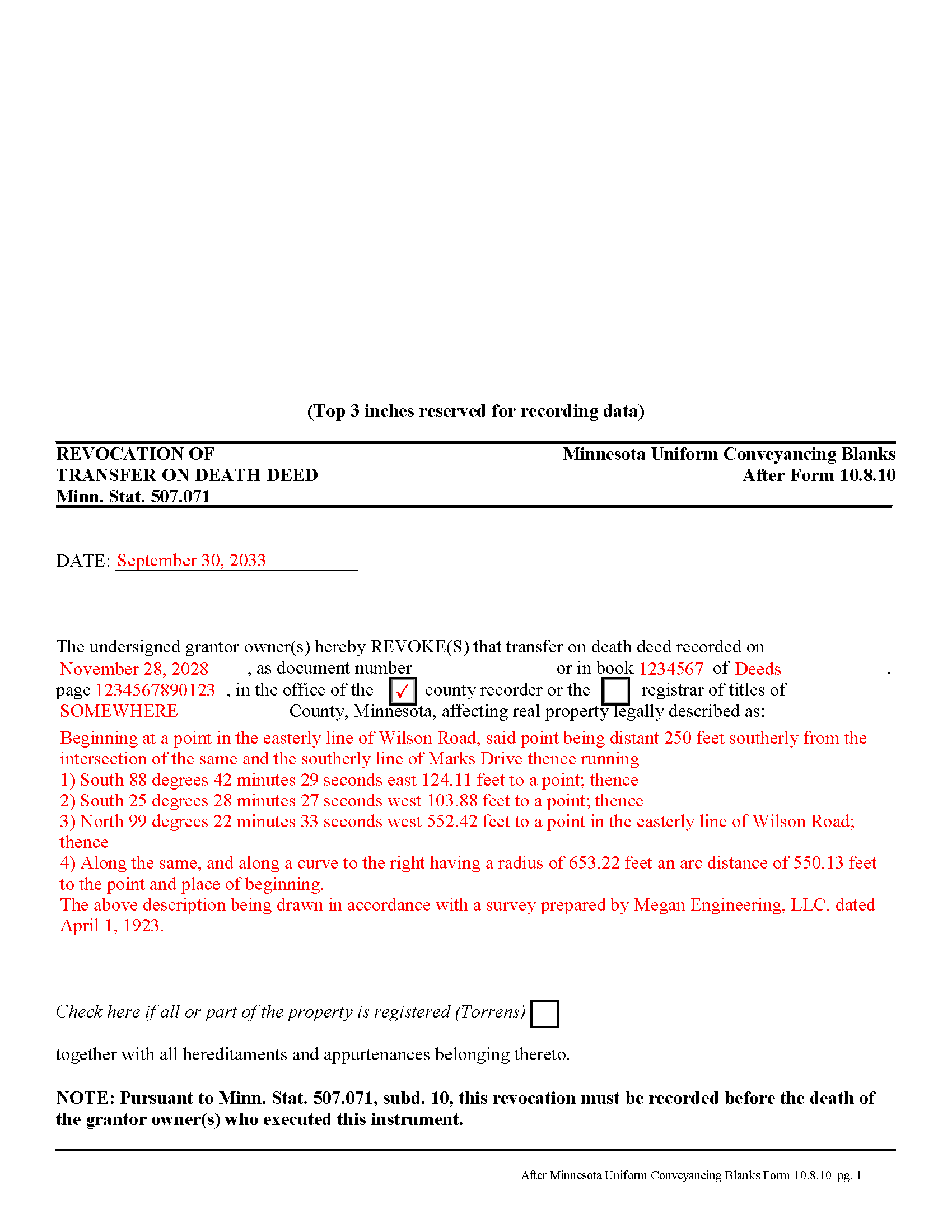

Rice County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Rice County documents included at no extra charge:

Where to Record Your Documents

Rice County Recorder

Faribault, Minnesota 55021

Hours: 8:00am to 4:30pm M-F

Phone: (507) 332-6114

Recording Tips for Rice County:

- Bring your driver's license or state-issued photo ID

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

- Ask about accepted payment methods when you call ahead

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Rice County

Properties in any of these areas use Rice County forms:

- Dundas

- Faribault

- Kilkenny

- Lonsdale

- Morristown

- Nerstrand

- Northfield

- Warsaw

- Webster

Hours, fees, requirements, and more for Rice County

How do I get my forms?

Forms are available for immediate download after payment. The Rice County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rice County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rice County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rice County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rice County?

Recording fees in Rice County vary. Contact the recorder's office at (507) 332-6114 for current fees.

Questions answered? Let's get started!

Minnesota's transfer on death deeds are governed by Minn. Stat. 507.071.

Transfer on death deeds offer an excellent alternative for people who wish to designate a beneficiary for their real estate, while remaining outside the complexity of the probate process. Life is unpredictable, however, and the grantor owner of the property might wish to change or revoke the previously recorded transfer on death deed. The same statute covering the deed also includes a section about revoking it (subd. 10).

There are several ways to revoke a transfer on death deed in Minnesota:

1. Complete and record a statutory revocation form (subd. 25). This is the source for the general revocation form. The statute states that a transfer on death deed "may be revoked at any time by the grantor owner or, if there is more than one grantor owner, by any of the grantor owners. To be effective, the revocation must be recorded in the county in which at least a part of the real property is located before the death of the grantor owner or owners who execute the revocation." The revocation is not effective . . . until the revocation is recorded in the county in which the real property is located.

2. Minnesota transfer on death deeds allow grantor owners full use of and control over the property to be conveyed. If the grantor owner who executed and recorded a transfer on death deed decides to convey the same property to a third party using anything "other than a transfer on death deed, all or a part of such grantor owner's interest in the property described in the transfer on death deed, no transfer of the conveyed interest shall occur on such grantor owner's death and the transfer on death deed shall be ineffective as to the conveyed or transferred interests, but the transfer on death deed remains effective with respect to the conveyance or transfer on death of any other interests described in the transfer on death deed owned by the grantor owner at the time of the grantor owner's death."

3. "If a grantor owner executes and records more than one transfer on death deed conveying the same interest in real property or a greater interest in the real property, the transfer on death deed that has the latest acknowledgment date and that is recorded before the death of the grantor owner upon whose death the conveyance or transfer is conditioned is the effective transfer on death deed and all other transfer on death deeds, if any, executed by the grantor owner or the grantor owners are ineffective to transfer any interest and are void." (subd. 13)

NOTE: a correctly executed, acknowledged, and recorded transfer on death deed cannot be revoked by a will. (subd. 19)

To summarize, once a transfer on death deed is recorded, there are three primary ways to revoke it: a revocation form, conveying the property to a third party by another kind of deed (warranty, quitclaim, etc.), or by executing and recording a new transfer on death deed with a different beneficiary. They may also be invalidated as part of a final divorce decree, but that is part of a different process. To maintain the most clarity in the chain of title (ownership history), however, it makes sense to record a revocation before changing anything else about the status of real estate covered by a transfer on death deed.

Remember that the revocation must be recorded, DURING THE GRANTOR OWNER'S LIFE, in the county where the property is located.

(Minnesota TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Rice County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Rice County.

Our Promise

The documents you receive here will meet, or exceed, the Rice County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rice County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Scott W.

March 31st, 2020

Wow! That was easy! I was expecting a more difficult process. Upload your docs and wait for a response. Which was minutes later. I would give it 6 stars.

Thank you for your kind words Scott, glad we could help.

Alan S.

September 19th, 2019

Very easy. Worked well. Will be glad to use the service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Armando R.

December 13th, 2022

Great service and support!

Thank you!

Carol S.

November 18th, 2020

Excellent ...easy, timely!

Thank you for your feedback. We really appreciate it. Have a great day!

Tierre J.

January 3rd, 2019

I put in two orders. I did not get any results from either order and I am still waiting for my refunds.

Thank you for your feedback. Sorry we were not able to pull the information you requested. We reviewed your account and the payment voids were processed as your were notified. Sometimes, depending on your financial institution, it can take a few days for the pending charges to fall off of your statement reporting.

Esfir K.

October 3rd, 2022

I had to call 3 times, two calls were hanged up on me. Thank you to 3rd representative, who helped me with my question. Unfortunately, I do not know her name. She was very patient, kind, professional. I am very thankful for her help.

Thank you!

Billy R.

May 18th, 2021

Thank you...........easy process........Billy C

Thank you!

Sophia G.

February 11th, 2022

Hassle free service , and don't have to wait in line

Thank you for your feedback. We really appreciate it. Have a great day!

Eileen B.

April 5th, 2022

I was quoted $525 to do the exact same thing from Deeds.com for only $25. Seems like a no brainer to me!

Thank you for your feedback. We really appreciate it. Have a great day!

MYRON J.

October 24th, 2019

Great way to track and save forms.

Thank you!

Peter R.

February 26th, 2020

Great site makes this procedure easy to do,thanks

Thank you!

Richard H.

October 5th, 2022

Excellent service, very user friendly

Thank you!

Gene L S.

April 12th, 2019

Exactly what I needed, at a reasonable cost.

Thank you Gene.

Kimberly K.

January 29th, 2020

Easy to use was very satisfied with service would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph S.

March 31st, 2022

The website was very easy to use. I rate it a five star

Thank you for your feedback. We really appreciate it. Have a great day!