Marshall County Correction Deed Form

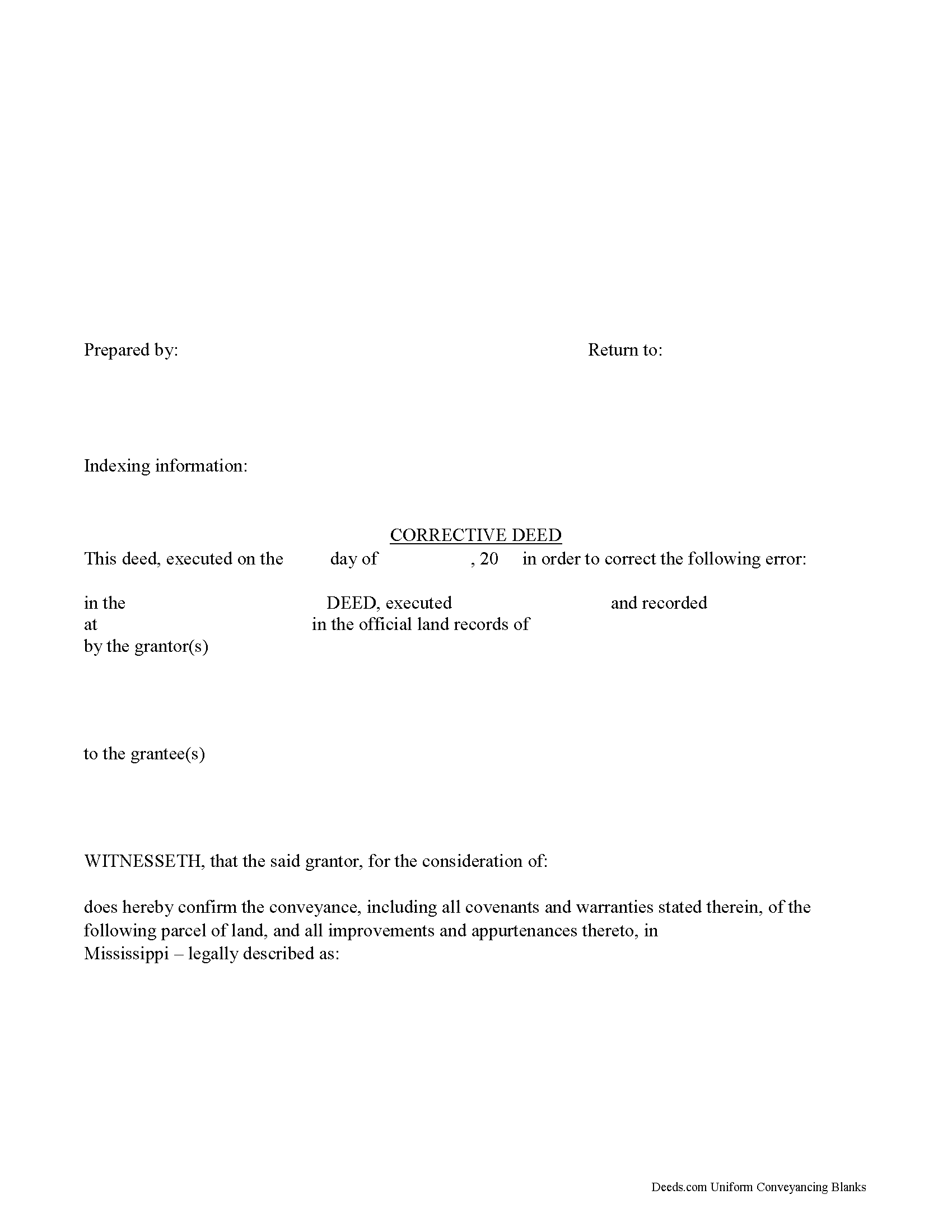

Marshall County Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

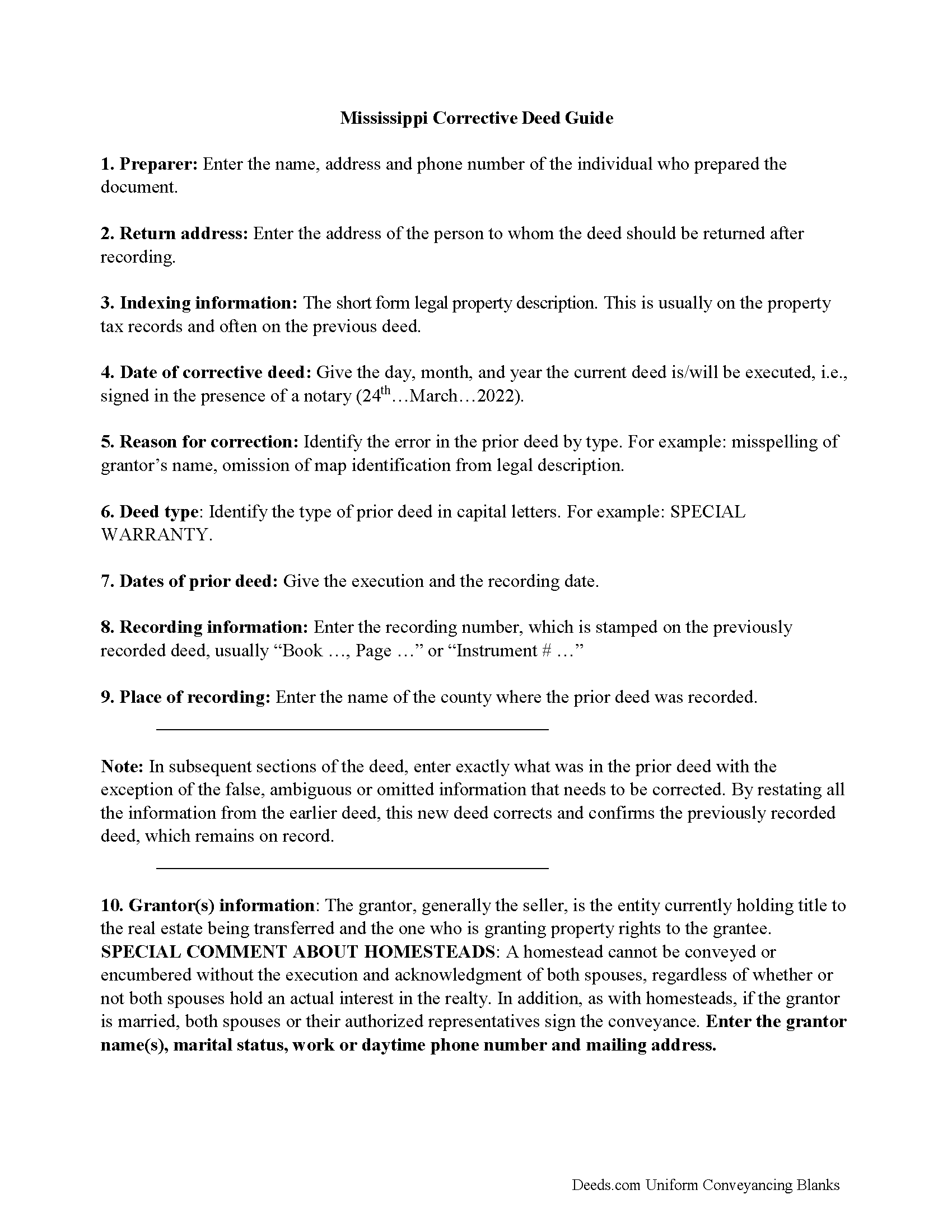

Marshall County Correction Deed Guide

Line by line guide explaining every blank on the form.

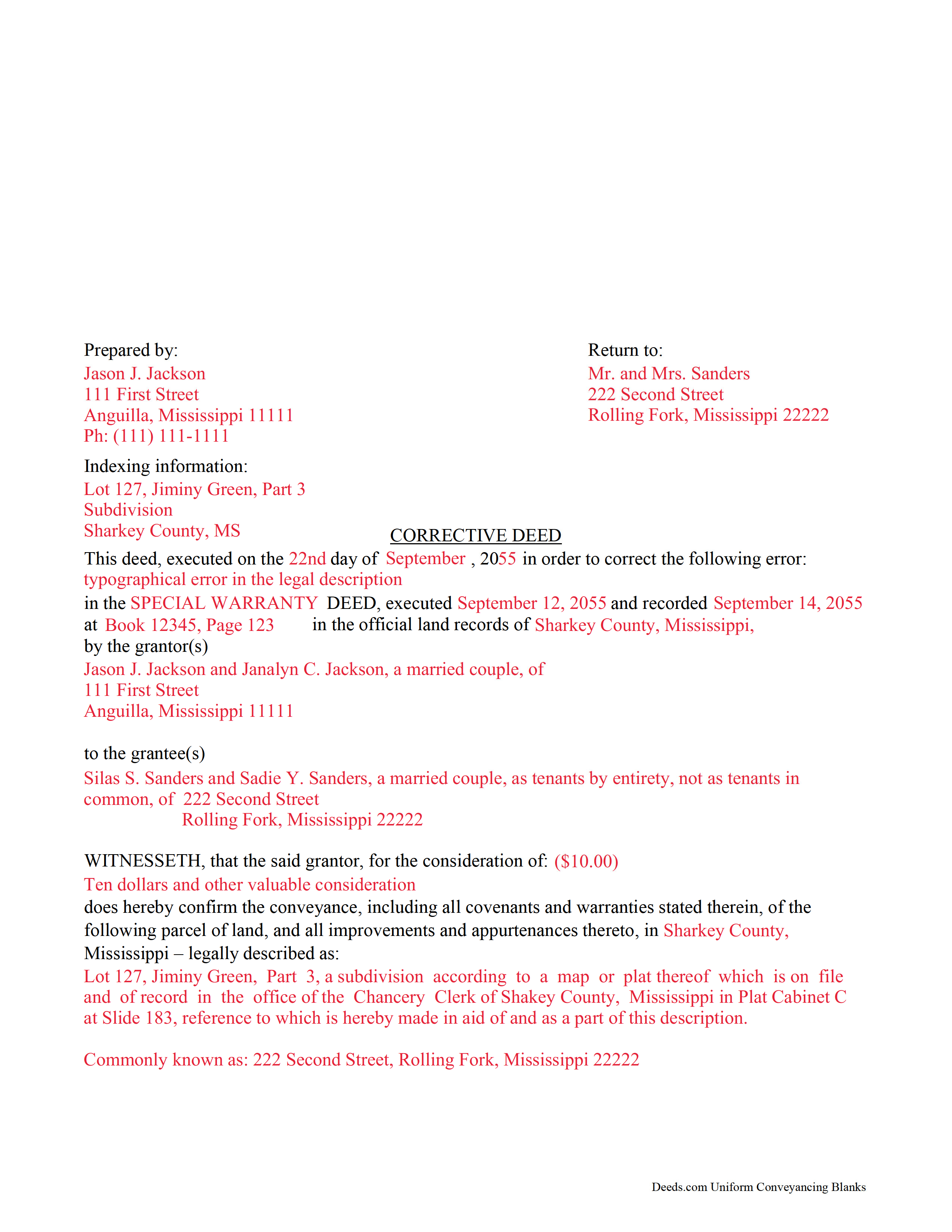

Marshall County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Chancery Clerk

Holly Springs, Mississippi 38635

Hours: 8:00 to 5:00 Monday thru Friday

Phone: (662) 252-4431

Recording Tips for Marshall County:

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Byhalia

- Holly Springs

- Lamar

- Mount Pleasant

- Potts Camp

- Red Banks

- Victoria

- Waterford

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (662) 252-4431 for current fees.

Questions answered? Let's get started!

Use the corrective deed to amend a previously recorded warranty, special warranty, or quitclaim deed with an error that could affect future title transfer.

A corrective deed is, in effect, an explanation and correction of an error in a prior instrument. As such, it passes no title, but only reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The corrective deed must reference the original conveyance it is correcting by type of error, date of execution and recording, and recording number and location. Beyond that, it restates the information given in the prior deed, thus serving as its de facto replacement. The prior deed, which constitutes the actual conveyance of title, remains on record and will receive a marginal cross-reference to the subsequent recording of a corrective deed.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title or adding/subtracting a portion of land to the legal description of the property, usually require a new deed of conveyance instead of a mere corrective deed. When in doubt, seek legal counsel to determine the most appropriate instrument for a case that involves such a material change.

(Mississippi CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Shirley P.

June 14th, 2019

Very easy to use, download and print. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ben F.

April 14th, 2019

My initial review during download and before reading the guide and forms looks promising.

Thank you!

Matthew C.

March 29th, 2022

Your Transfer on Death Deed is fine and you have plenty of information about that part. But where is the Confirmatory Deed that is required in many jurisdictions in order to actually pass ownership of a property when the Transfer on Death Deed becomes effective? IT IS MISSING!!

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Ann P.

August 19th, 2025

Was hoping I would be sent copies on paper so I can fill them out without a desk computer

We appreciate your feedback. Our forms are delivered instantly as digital files, so customers can download and print as many copies as they need. This way, you have the flexibility to complete them by hand if you prefer.

James W.

June 10th, 2019

It turned out that I was able to search for what I needed on the local county website, which is what your site suggested be tried. I was impressed with your honesty and practical instructions for searches your site gave. I'm pretty sure I'll be back.

Thank you for your feedback James. Glad to hear we were able to steer you in the right direction.

Paul K.

August 18th, 2021

too much money

Thank you for your feedback. We really appreciate it. Have a great day!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Phyllis M.

August 3rd, 2019

Using your site was very easy. I found what my friend said she wanted easily and downloaded it to retype her quitclaim deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard H.

October 5th, 2022

Excellent service, very user friendly

Thank you!

Julie Z.

December 7th, 2024

Just getting started with this process, but I was delighted to find this resource to speed up the decision making. Excellent! Very helpful!

Thank you for your positive words! We’re thrilled to hear about your experience.

Earnestine C.

September 4th, 2019

Informative and instruction clear and concise, which made it easy for a person without real estate knowledge to acquire needed information. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Judith L.

August 19th, 2019

I bought a package for doing a mineral deed in Sheridan County, Montana. I will now try to use it and we'll see, I guess, how easy it may or may not be, etc. Check back later perhaps for more details~

Thank you for your feedback. We really appreciate it. Have a great day!

Ann C.

October 18th, 2023

Very responsive and helpful. Made a big task quite easy and effecient. I would highly recommend. Reasonable fees as well

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

arturo b d.

September 30th, 2021

just what I needed...thanks

Thank you!