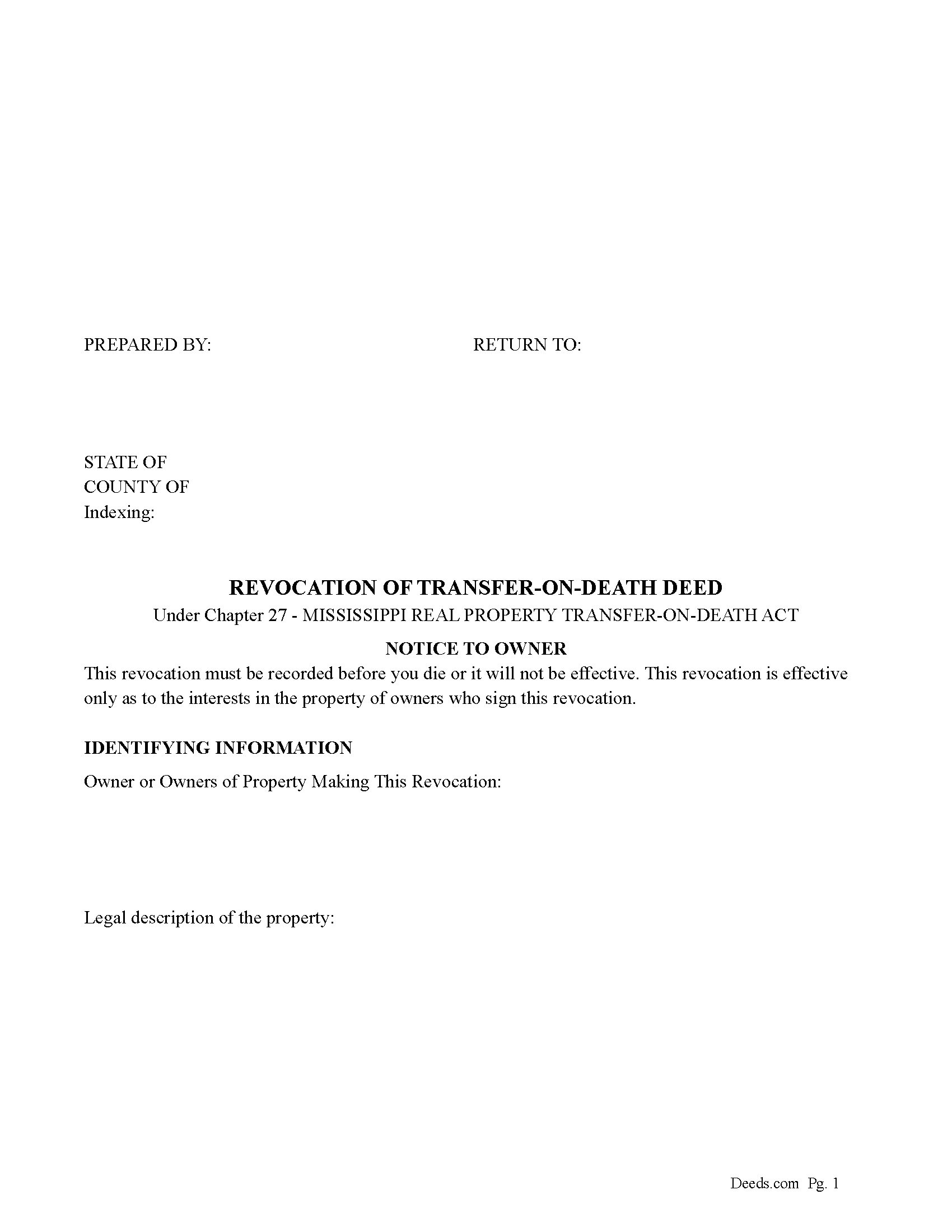

Madison County Revocation of Transfer on Death Deed Form

Madison County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

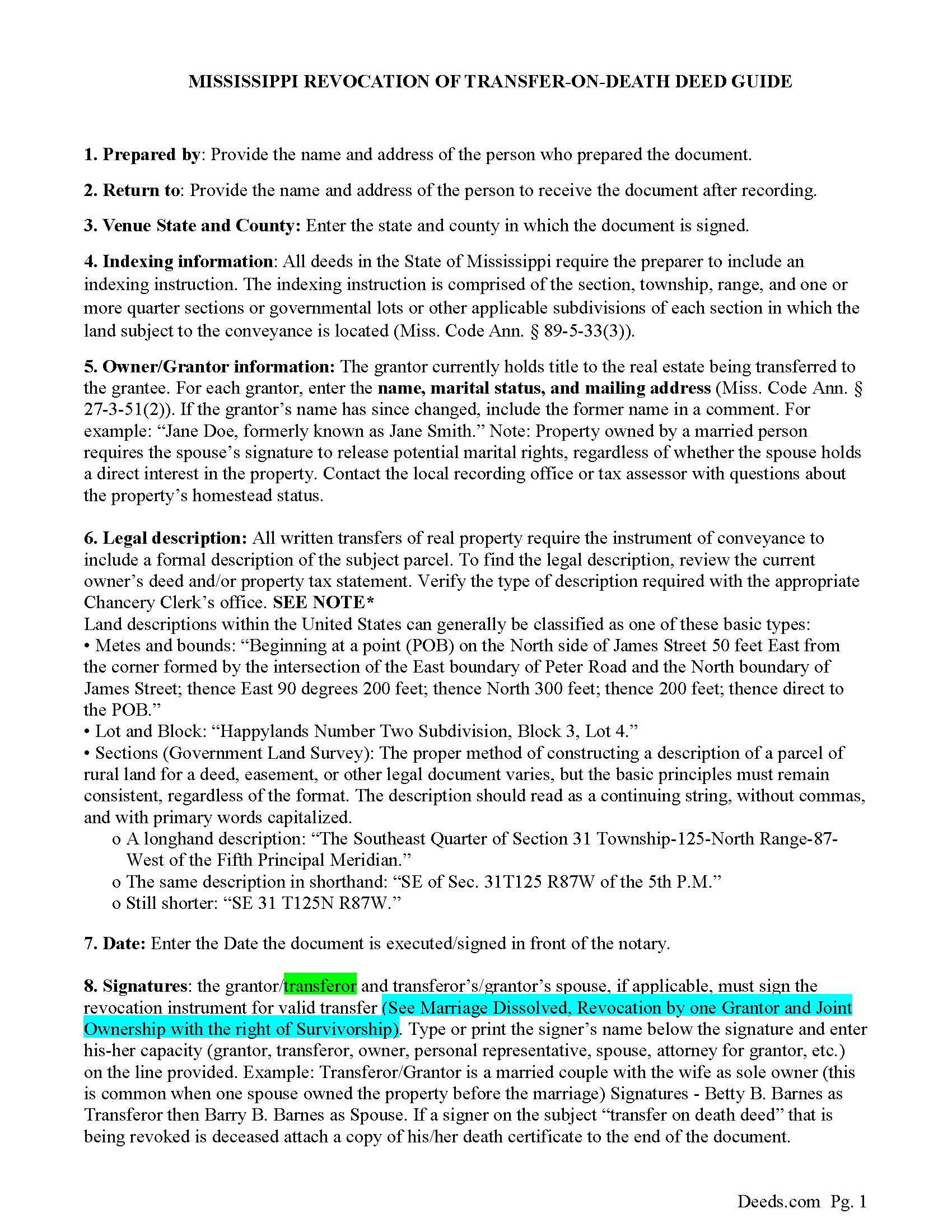

Madison County Guidelines for Revocation of Transfer on Death Deed

Line by line guide explaining every blank on the form.

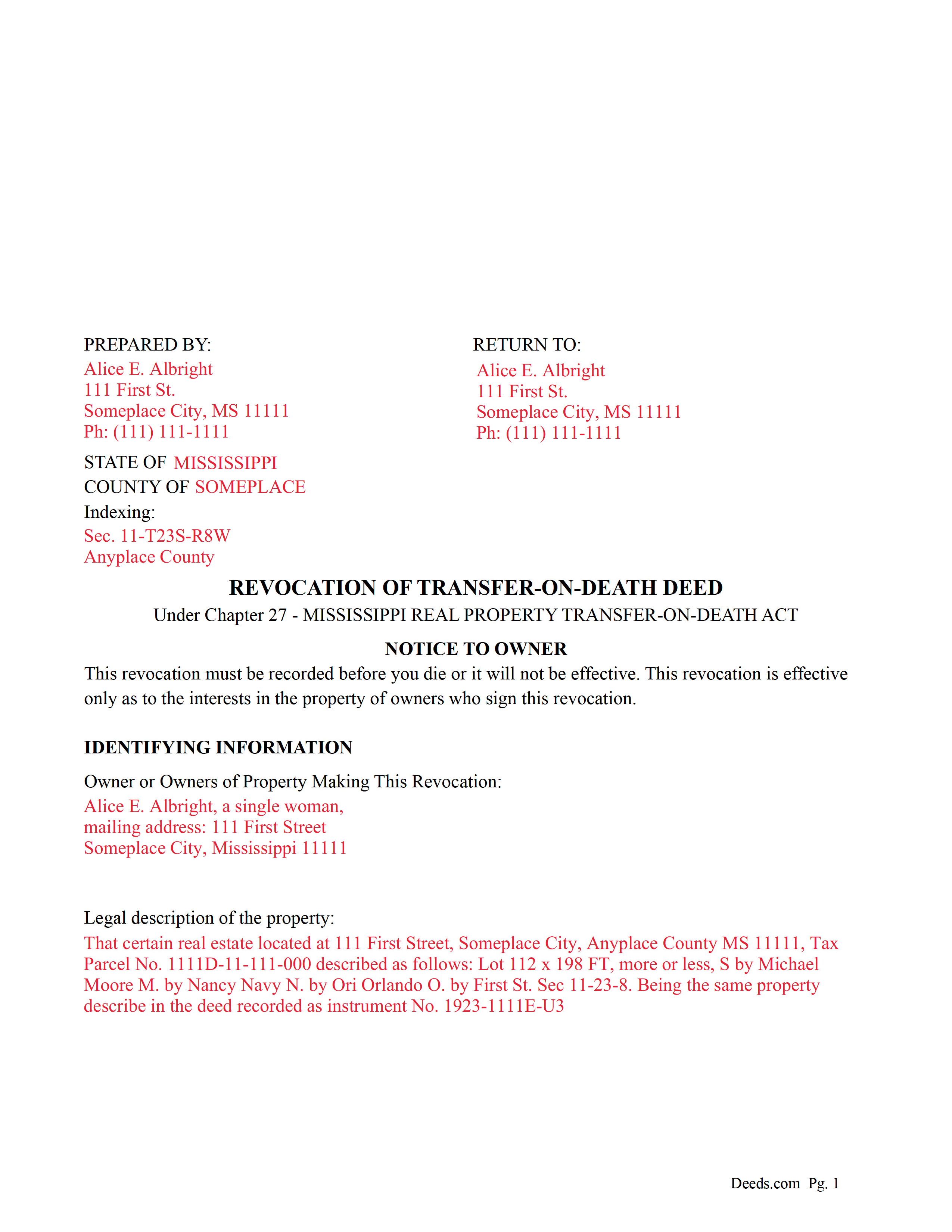

Madison County Completed Example of a Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Madison County documents included at no extra charge:

Where to Record Your Documents

Madison County Chancery Clerk

Canton, Mississippi 39046

Hours: 8:30 to 4:30 M-F

Phone: (601) 859-1177

Recording Tips for Madison County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Madison County

Properties in any of these areas use Madison County forms:

- Camden

- Canton

- Flora

- Madison

- Ridgeland

- Sharon

Hours, fees, requirements, and more for Madison County

How do I get my forms?

Forms are available for immediate download after payment. The Madison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Madison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Madison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Madison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Madison County?

Recording fees in Madison County vary. Contact the recorder's office at (601) 859-1177 for current fees.

Questions answered? Let's get started!

Use this form to revoke or partially revoke a previously recorded Revocable Transfer on Death Deed.

Section 91-27-21 - Revocation by instrument authorized; revocation by act not permitted

(a) Subject to subsections (d) and (e), an instrument is effective to revoke a recorded transfer-on-death deed, or any part of it, if the instrument:

(1) Is one (1) of the following:

(A) A subsequent transfer-on-death deed that revokes the preceding transfer-on-death deed or part of the deed expressly or by inconsistency; or

(B) Except as provided by subsection (b), an instrument of revocation that expressly revokes the transfer-on-death deed or part of the deed;

(2) Is acknowledged by the transferor after the acknowledgment of the deed being revoked; and

(3) Is recorded before the transferor's death in the official records of the chancery clerk of the county where the deed being revoked is recorded.

(b) A will does not revoke or supersede a transfer-on-death deed.

(c) If a marriage between the transferor and a designated beneficiary is dissolved after a transfer-on-death deed is recorded, a final judgment of the court dissolving the marriage operates to revoke the transfer-on-death deed as to that designated beneficiary.

(d) If a transfer-on-death deed is made by more than one (1) transferor, revocation by a transferor does not affect the deed as to the interest of another transferor who does not make that revocation.

(e) A transfer-on-death deed made by joint owners with right of survivorship is revoked only if it is revoked by all of the living joint owners.

(f) This section does not limit the effect of an inter vivos transfer of the real property.

(Mississippi Revocation of TODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Madison County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Madison County.

Our Promise

The documents you receive here will meet, or exceed, the Madison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Madison County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

J O.

July 18th, 2020

It's okay, seems you need to make it easier to search deeds on properties without having to go through a lot of researching issues, make it simple!

Thank you!

Christopher M.

February 5th, 2024

Awesome company. Fast, friendly, professional.

We are delighted to have been of service. Thank you for the positive review!

Richard M.

January 9th, 2020

Needed some help at the beginning but once I was into the program it was smooth sailing.

Thank you!

Gloria H.

December 17th, 2020

Very content with the service received. The document was recorded in the city in no time. Will definitely use Deeds.com again in the near future.

Thank you!

roby m.

March 16th, 2021

I found exactly what I needed and the download system allowed me to use the files immediately. Will use the service again.

Thank you for your feedback. We really appreciate it. Have a great day!

Jenni R.

April 19th, 2023

Dry convenient and had just the form I needed and included directions, filled out sample form and other resources. Will recommend and use again if needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem. Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description! Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

Sally P.

June 22nd, 2023

I cannot thank the staff at Deeds.com enough for all of their assistance and their quick and their most pleasant responses. They were extremely quick and efficient to help me to file my documents. Thanks for everything and I will definitely be referring folks to your site.

Our team is deeply committed to providing efficient, reliable assistance and it's always rewarding to know we've made a difference for our customers. Your kind words about our quick and pleasant responses are much appreciated and will certainly serve as an extra boost of motivation for our team.

We also sincerely appreciate your intention to refer others to our site. Your trust and confidence in our service means a lot to us, and we're grateful to have you as part of the Deeds.com community.

Bernardo M.

March 11th, 2022

You think you're purchasing 1 form for $25 but you are getting several which explains the $25. My printer ran out of black ink and I couldn't change the color of the text so that it would print. I couldn't copy and paste it to Word and work on it there. I'm going to purchase ink today so that it will at least print right. I will have to retype the text in Word; not good.

Thank you for your feedback. We really appreciate it. Have a great day!

Dawn M.

October 26th, 2020

So helpful and quick! The response time and kindness was amazing! The steps were easy to follow as well. We will definitely be using Deeds.com in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Susan M.

May 12th, 2022

Simple and straightforward

Thank you for your feedback. We really appreciate it. Have a great day!

Myron L.

November 29th, 2020

The forms were not identical to the county's version but it met my needs.

Thank you!

Jeffrey M.

December 1st, 2021

Great service. It had all the forms I needed.

Thank you!

Gary A.

March 15th, 2019

I believe this is the way to go without the need of a lawyer. Fast downloads, very informative, Now the work starts

Thank you Gary.

John C.

February 26th, 2024

Ease and speed of recording are remarkable. This is especially true of deeds with problems: I often get feedback within minutes and can correct problems immediately and still complete the filing in the same day. I wish more counties accepted electronic filing! It would be helpful to list counties that do/do not accept electronic filing so I would not have to upload documents to find out my effort was fruitless.

We are grateful for your feedback and looking forward to serving you again. Thank you!