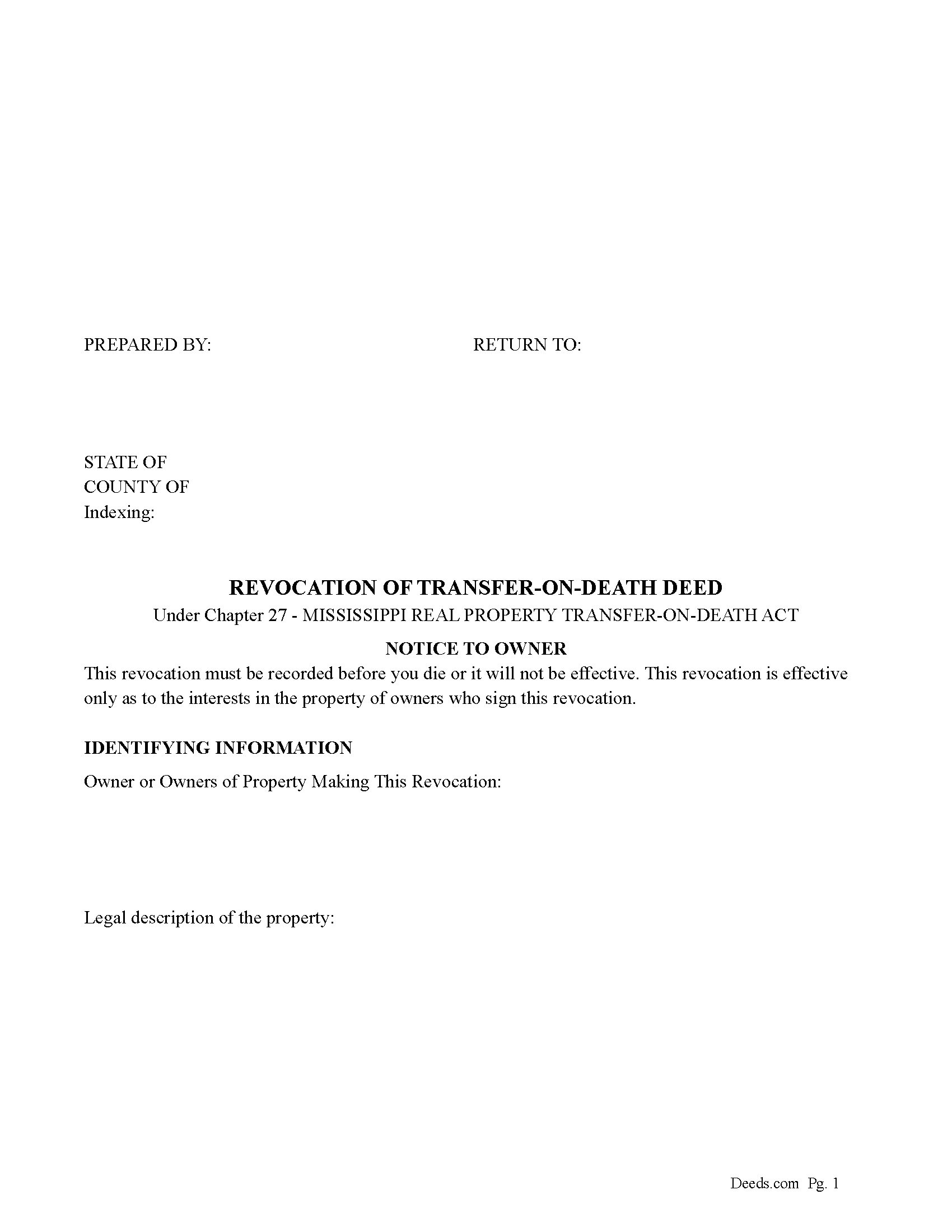

Marshall County Revocation of Transfer on Death Deed Form

Marshall County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

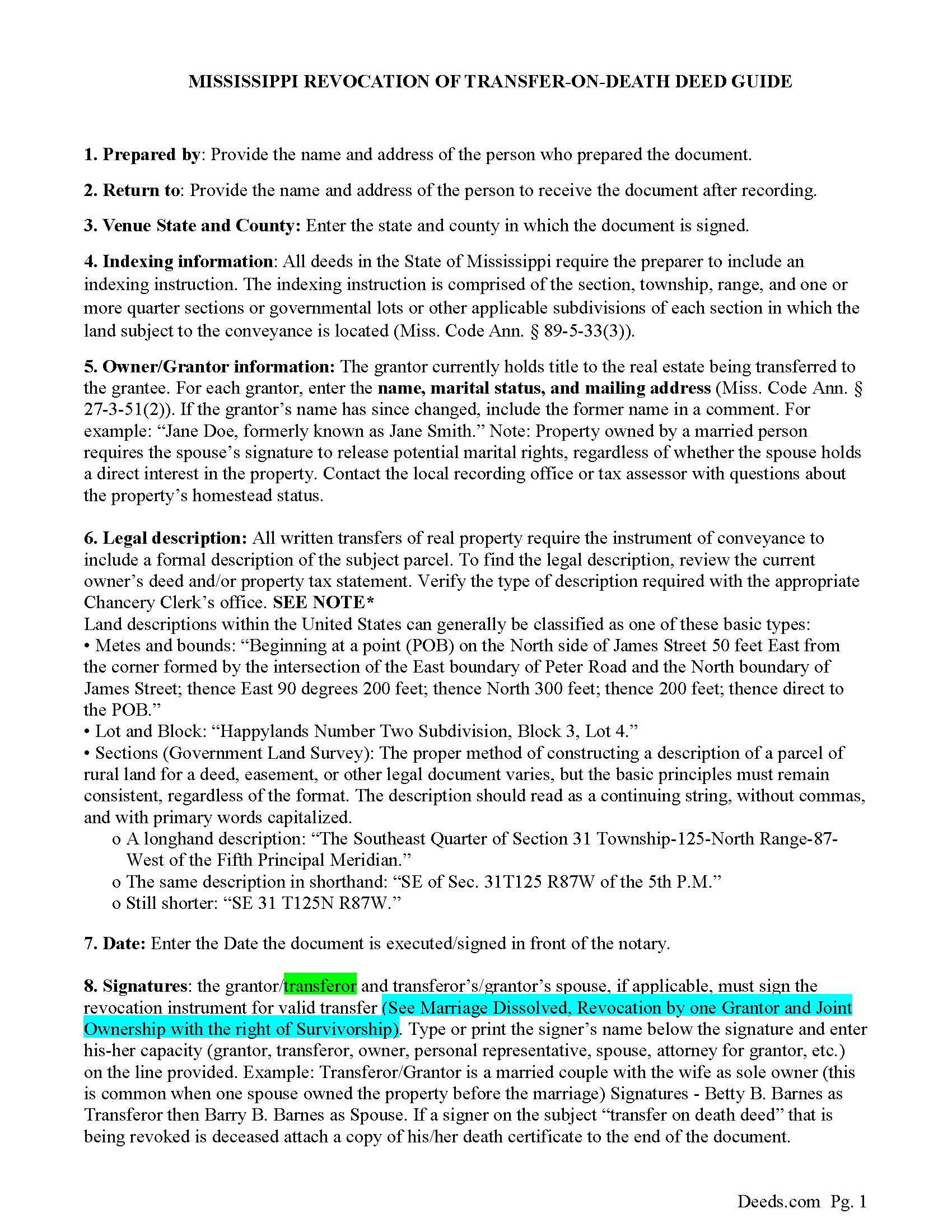

Marshall County Guidelines for Revocation of Transfer on Death Deed

Line by line guide explaining every blank on the form.

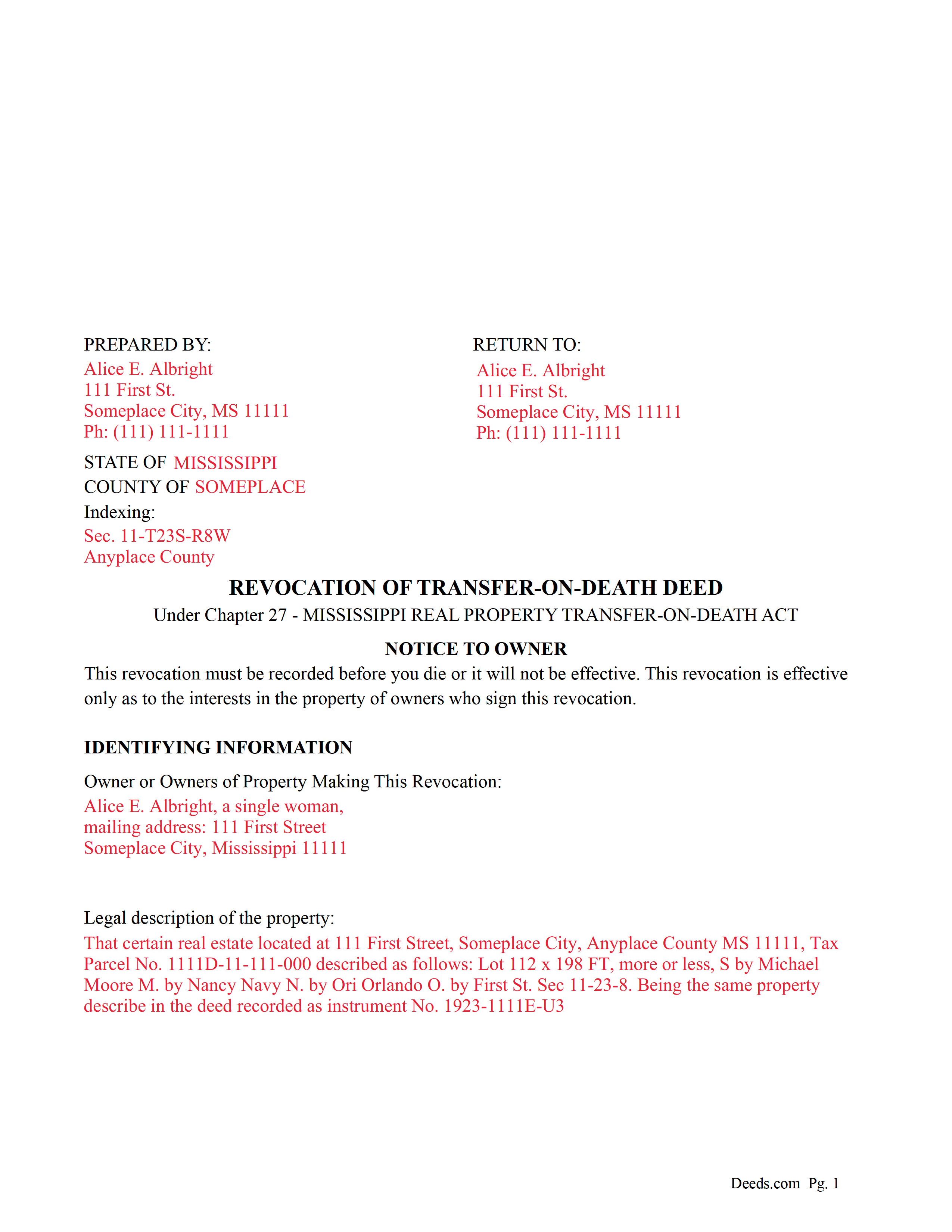

Marshall County Completed Example of a Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Chancery Clerk

Holly Springs, Mississippi 38635

Hours: 8:00 to 5:00 Monday thru Friday

Phone: (662) 252-4431

Recording Tips for Marshall County:

- Ensure all signatures are in blue or black ink

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Byhalia

- Holly Springs

- Lamar

- Mount Pleasant

- Potts Camp

- Red Banks

- Victoria

- Waterford

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (662) 252-4431 for current fees.

Questions answered? Let's get started!

Use this form to revoke or partially revoke a previously recorded Revocable Transfer on Death Deed.

Section 91-27-21 - Revocation by instrument authorized; revocation by act not permitted

(a) Subject to subsections (d) and (e), an instrument is effective to revoke a recorded transfer-on-death deed, or any part of it, if the instrument:

(1) Is one (1) of the following:

(A) A subsequent transfer-on-death deed that revokes the preceding transfer-on-death deed or part of the deed expressly or by inconsistency; or

(B) Except as provided by subsection (b), an instrument of revocation that expressly revokes the transfer-on-death deed or part of the deed;

(2) Is acknowledged by the transferor after the acknowledgment of the deed being revoked; and

(3) Is recorded before the transferor's death in the official records of the chancery clerk of the county where the deed being revoked is recorded.

(b) A will does not revoke or supersede a transfer-on-death deed.

(c) If a marriage between the transferor and a designated beneficiary is dissolved after a transfer-on-death deed is recorded, a final judgment of the court dissolving the marriage operates to revoke the transfer-on-death deed as to that designated beneficiary.

(d) If a transfer-on-death deed is made by more than one (1) transferor, revocation by a transferor does not affect the deed as to the interest of another transferor who does not make that revocation.

(e) A transfer-on-death deed made by joint owners with right of survivorship is revoked only if it is revoked by all of the living joint owners.

(f) This section does not limit the effect of an inter vivos transfer of the real property.

(Mississippi Revocation of TODD Package includes form, guidelines, and completed example) For use in Mississippi only.

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Irwin C.

August 25th, 2023

For starters, enrolling was as easy as could be. Then, it only took minutes before my entry was formatted and filed. Finally, when I asked a question, I got an answer within a few minutes. Couldn't be happier with service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matthew D.

February 16th, 2019

Fantastic forms easy process couldn't be happier! Thanks

Thank you Matthew!

Kimberly M.

December 5th, 2019

I love Deeds.com. I've never had any issues with the service, getting documents back, etc.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karina C.

March 27th, 2020

The process was very convenient, fast, and efficient. I appreciated the messaging feature which provided real-time communication. I would certainly recommended this service to anyone needing it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nga C.

January 5th, 2022

I am so happy to discover the Deeds.com website. It is worth to pay the package fee and the recording fee for my beneficiary deed in AZ state. It is so convenient, I highly recommend everybody to use the service. Thank you and thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Irma G.

April 30th, 2021

Although I did not use the forms yet, it appears very easy to understand and navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Kyle E.

November 8th, 2023

Works great thank you for saving us driving time!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa M.

October 28th, 2021

This is super convenient however, I wish I knew which forms I needed for my Affidavit Death of Joint Tenant situation. That would help. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

janice l.

June 12th, 2021

Exact form needed with perfect instructions. Easy Peazy! Just got my fully recorded document back today. Saved hundreds. Just make sure and read all the instructions .

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer M P.

December 14th, 2022

Locating the deed I needed was not too hard. I love that you can download and complete it on your time frame.

Thank you!

Mary C.

August 30th, 2022

The Deeds.com site made is relatively simple to download a Beneficiary Deed form specific to St Louis, which is great, because neither the city or state provide this. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Larry G.

July 20th, 2022

After purchasing the Quit Claim Deed, I felt I had purchased something I could have gotten free somewhere else. But after reviewing all the other information Deed.com provided, I realized you saved me a lot of time that would have been wasted on research. Money well spent.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda M.

February 25th, 2022

Quick easy

Thank you!

Russell L.

November 9th, 2021

Your Personal Representative's Deed and example for the state of PA were extremely helpful. Exactly what I needed! Two feedback comments: 1. Valuation Factors/Short List in my download is an outdated table dated July 2020. The PA Dept of Revenue website has a more current table dated June 2021. (Maybe same for Valuation Factors/Long List, which I didn't use.) 2. Notarization section on deed page 3 has a gender-related input needed, which confused the Notary Public representative where I live in the state of CO. Notary input the word she to apply to my wife, but wasn't clear to him if the gender input applied to the Grantor or the Notary. He assumed Grantor. Also in our non-binary world, some might find that wording offensive. Thanks again for your documents. Russ Lewis

Thank you!

Lynn T.

June 16th, 2021

great service, thank you

Thank you!