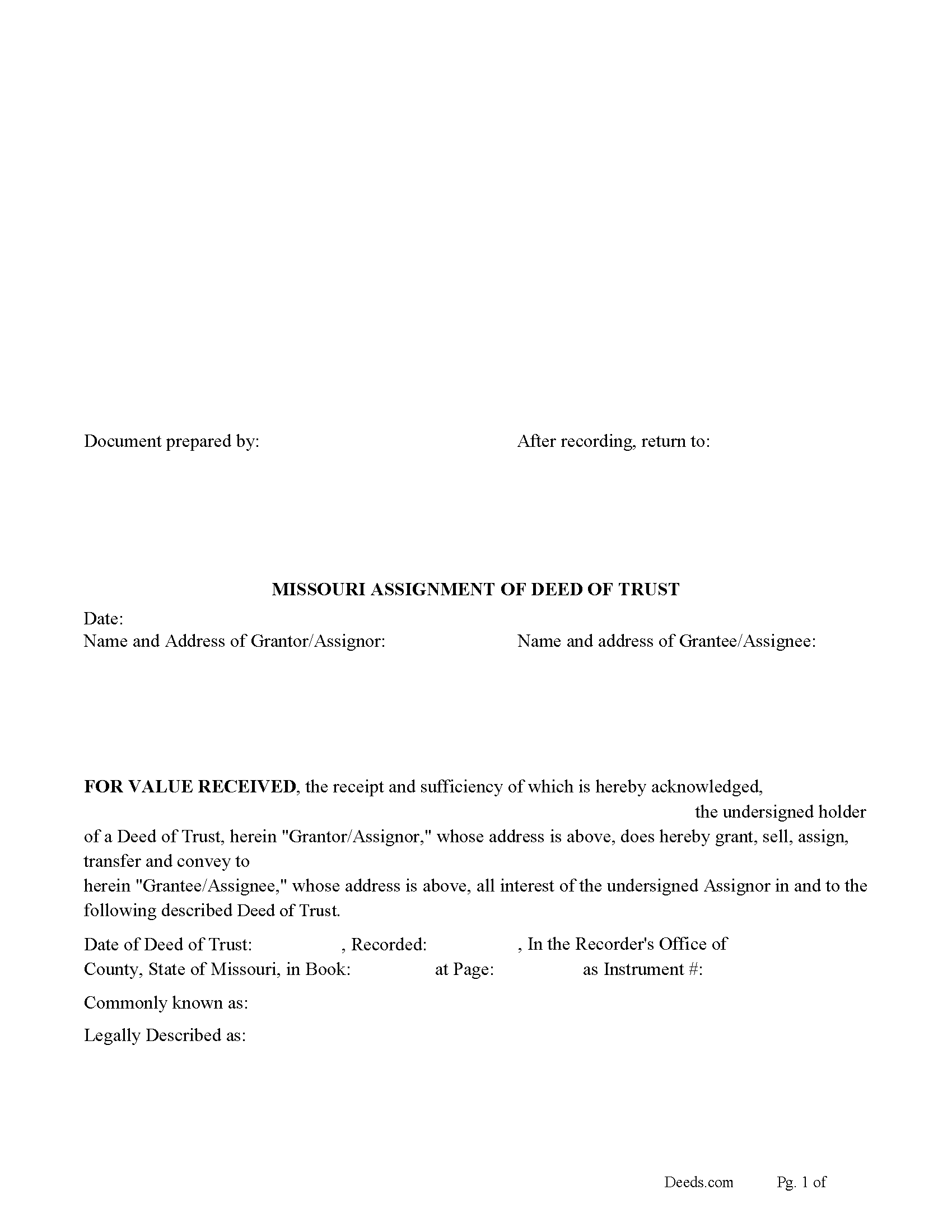

Clay County Assignment of Deed of Trust Form

Clay County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

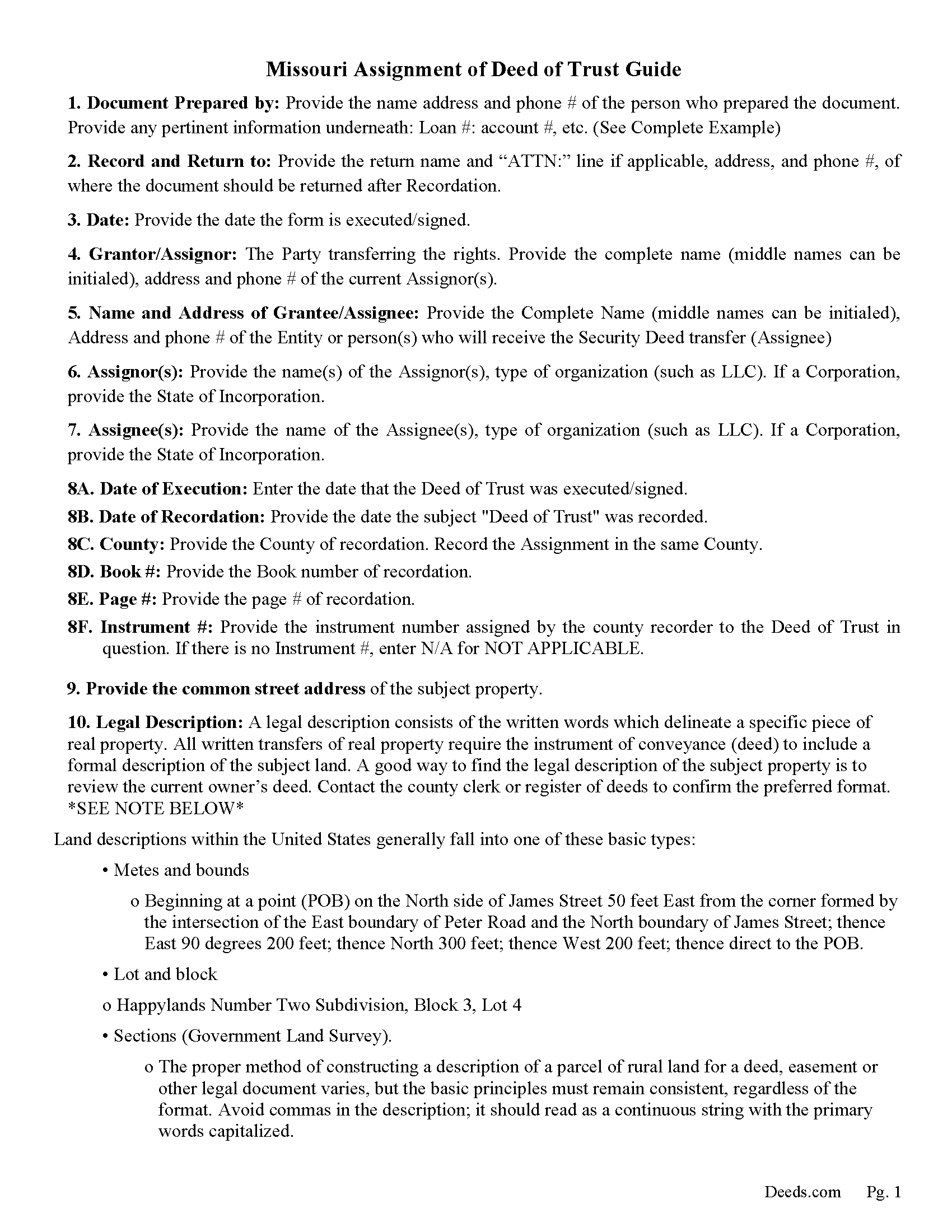

Clay County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

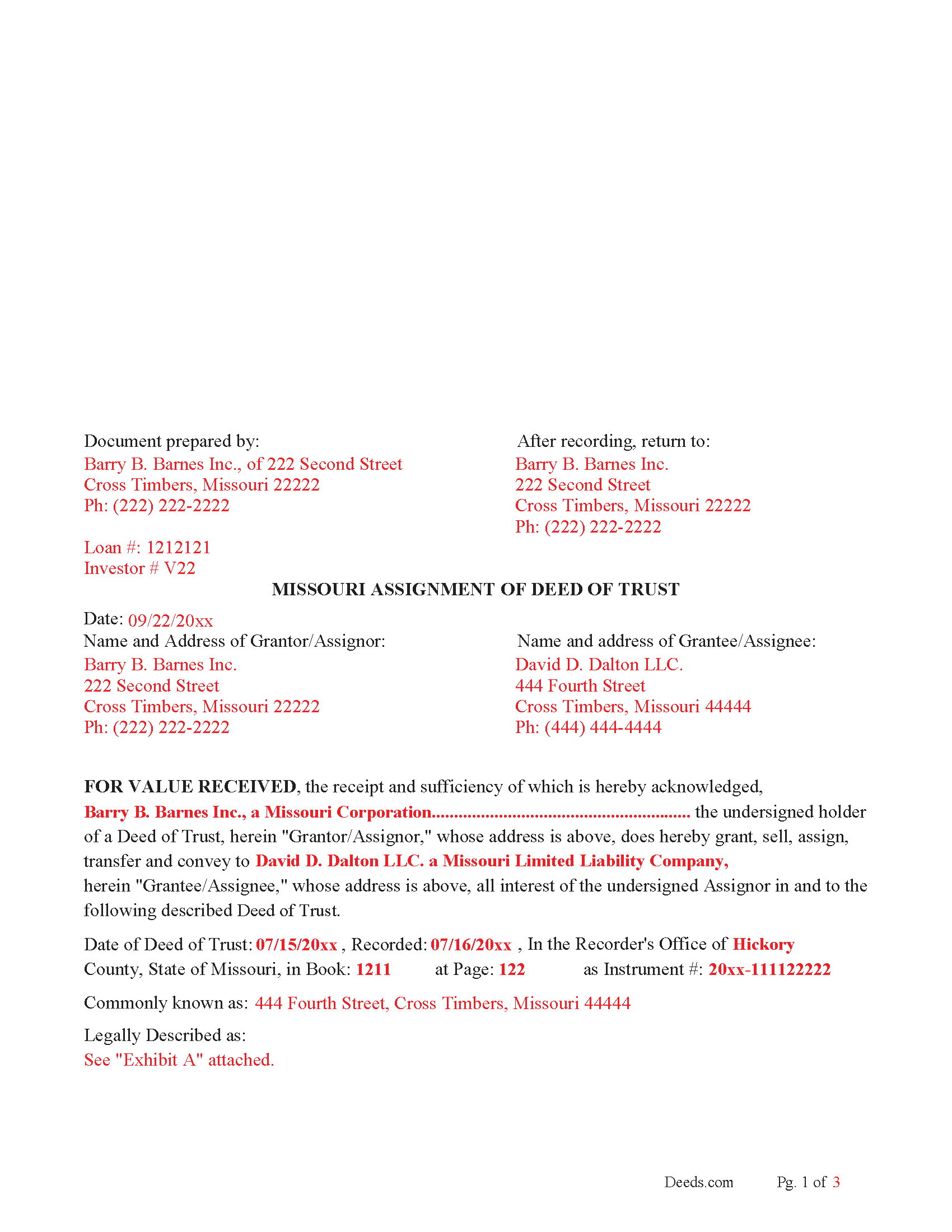

Clay County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

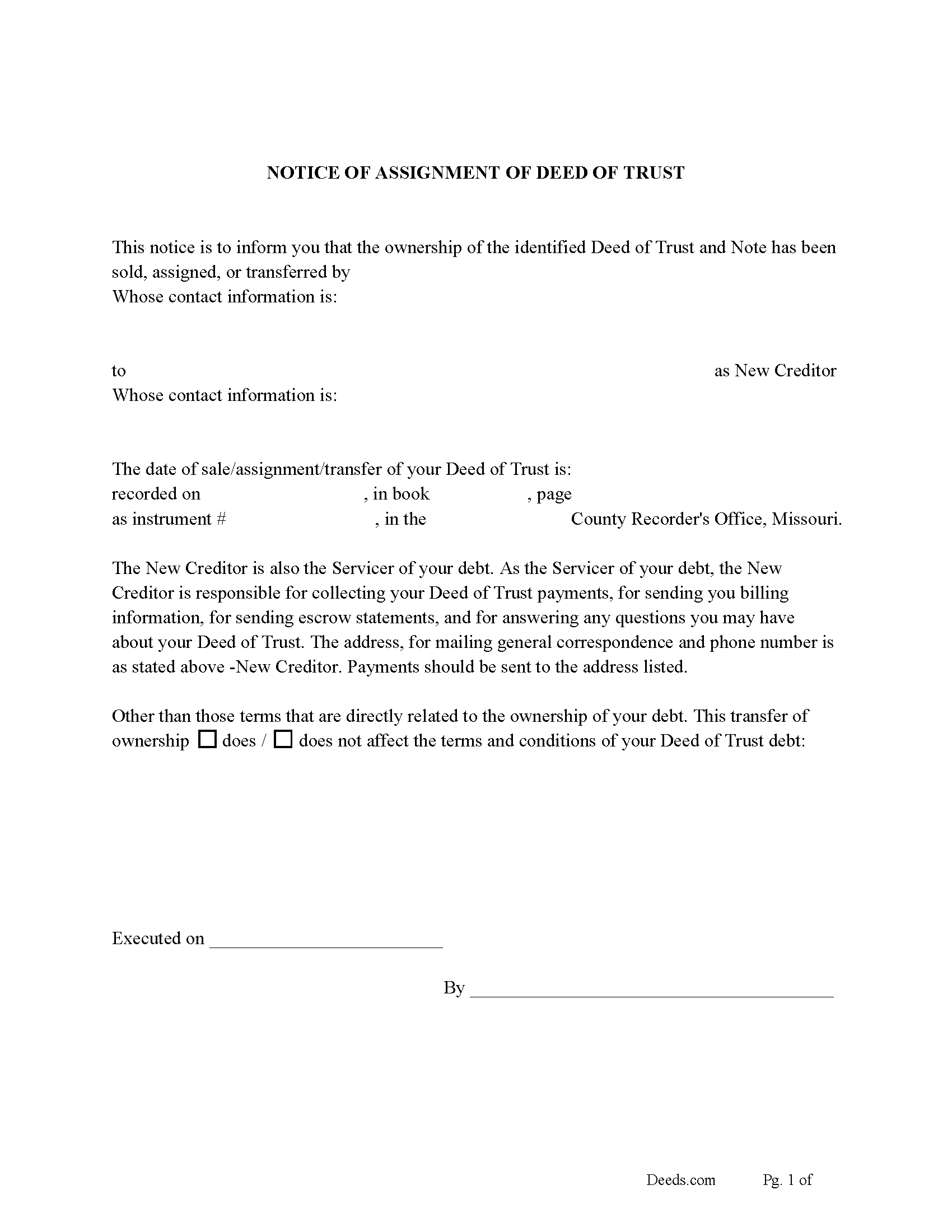

Clay County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

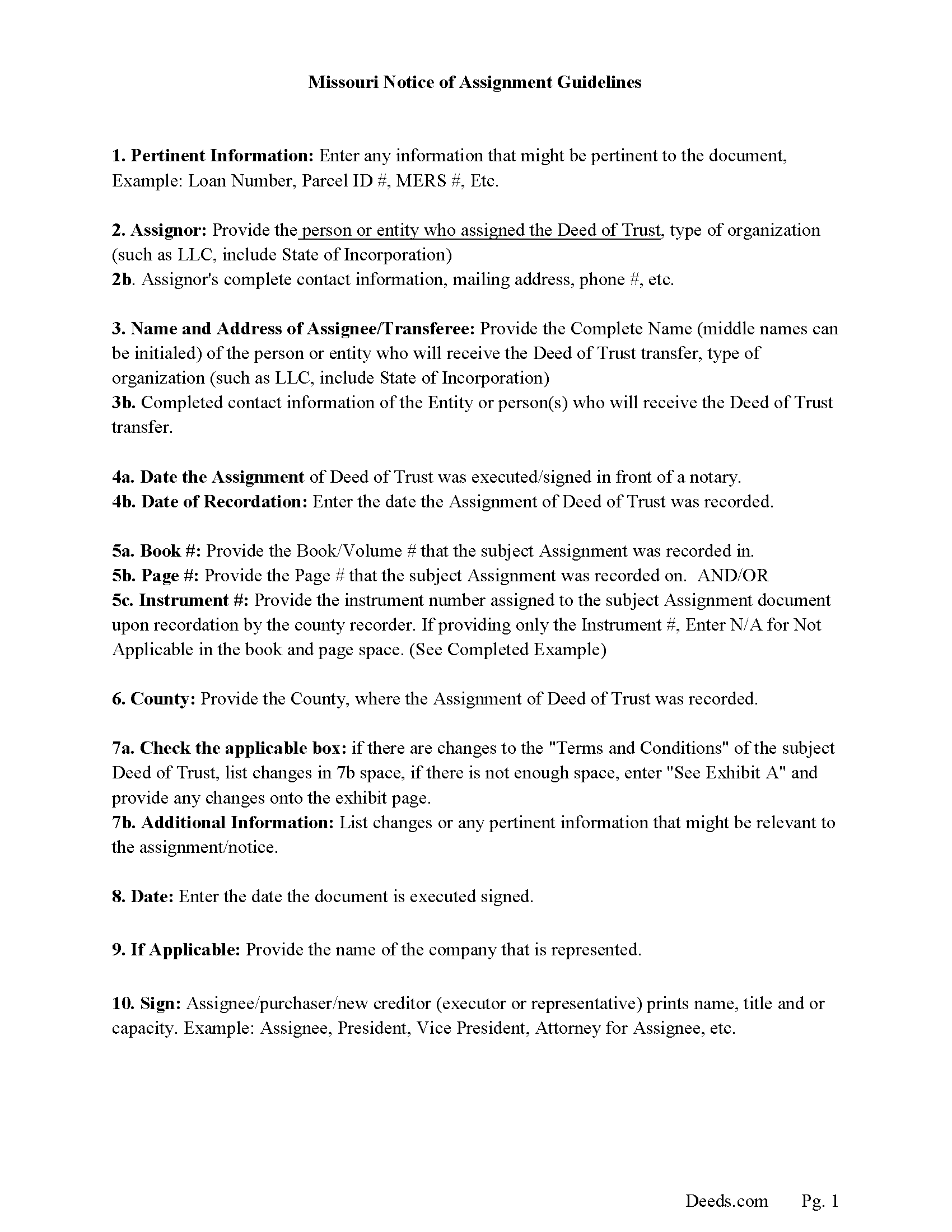

Clay County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

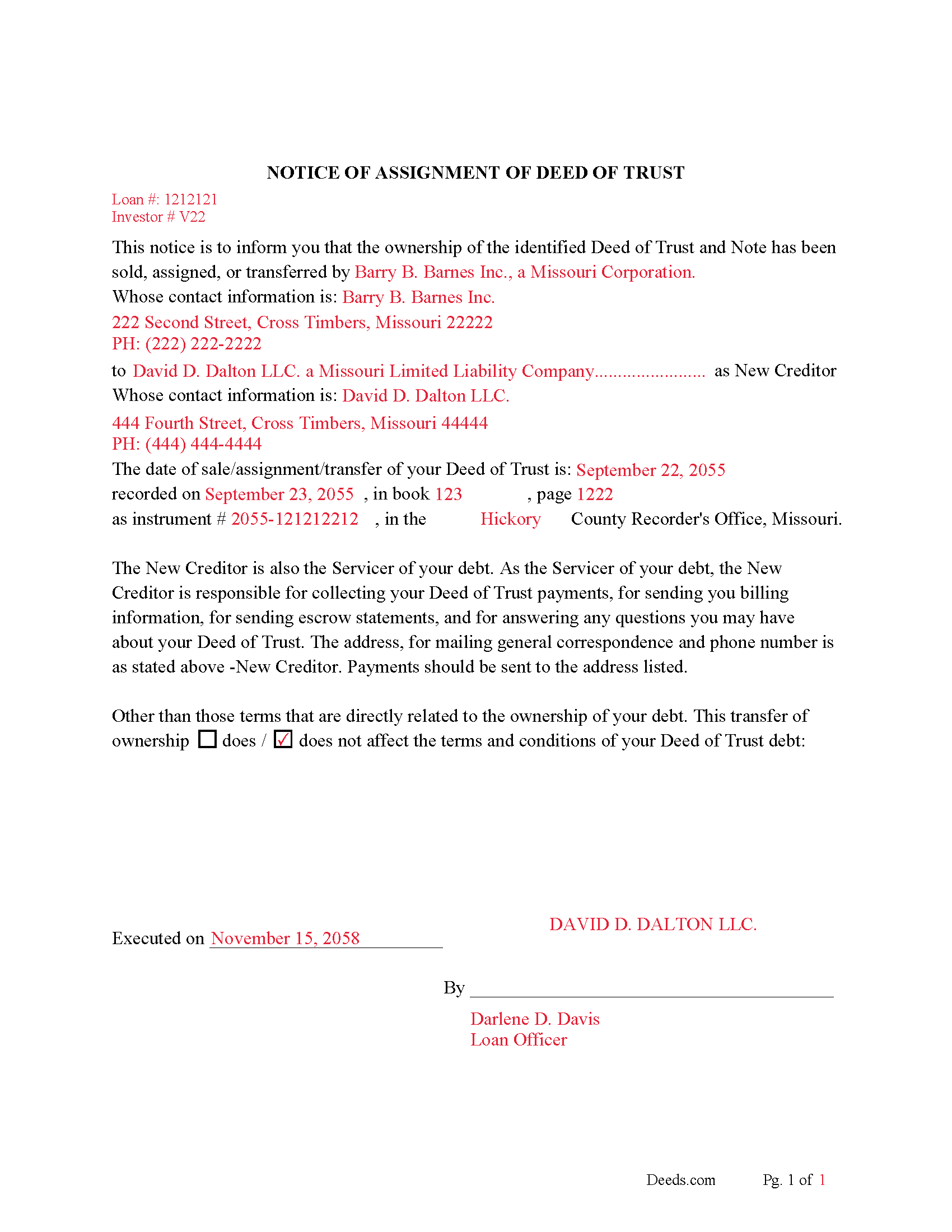

Clay County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Clay County documents included at no extra charge:

Where to Record Your Documents

Clay County Recorder of Deeds

Liberty, Missouri 64068

Hours: 8:00 to 5:00 M-F / Recording until 4:00

Phone: (816) 407-3550

Annex Office

Kansas City, Missouri 64118

Hours: 8:00 - 1:30 & 2:30 - 5:00 M-F / Recording until 4:00

Phone: (816) 407-3450

Recording Tips for Clay County:

- Ensure all signatures are in blue or black ink

- Both spouses typically need to sign if property is jointly owned

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Clay County

Properties in any of these areas use Clay County forms:

- Excelsior Springs

- Holt

- Kansas City

- Kearney

- Liberty

- Missouri City

- Mosby

- Smithville

Hours, fees, requirements, and more for Clay County

How do I get my forms?

Forms are available for immediate download after payment. The Clay County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clay County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clay County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clay County?

Recording fees in Clay County vary. Contact the recorder's office at (816) 407-3550 for current fees.

Questions answered? Let's get started!

This form is used by the current holder to transfer/assign their interest in a Deed of Trust to another party. This is usually done when a Deed of Trust has been sold. An Assignment of Deed of Trust must have the grantor(s) and grantees listed on the first page (RSMo 59.310). An Assignment of Deed of Trust must have the legal description on the first page, as required by law (RSMo 59.330 & 59.310). If a document does NOT meet standardization requirements it will become non-standard and a $25.00 non-standard penalty will be charged, in addition to the normal recording fees. (RSMo 59.310)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Missouri Assignment of DOT Package includes form, guidelines, and completed example) For use in Missouri only.

Important: Your property must be located in Clay County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Clay County.

Our Promise

The documents you receive here will meet, or exceed, the Clay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clay County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Bobby V.

October 30th, 2019

Great

Thank you!

Nora P.

January 10th, 2019

I'm typing along and suddenly I can't fit anything more into the page and there's plenty of room. This is my 2nd time using this site. No problem the first time years ago. Now it's an issue, looks like I'll need a typewriter to finish the form. Where do I find a typewriter?!! I can't complete the legal description!

Thanks for your feedback Nora. If you are unable to find a typewriter you can always do as the guide suggests and use the included exhibit page.

Steven M.

January 31st, 2019

They always get me the information I need, in a timely manner.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin B.

November 6th, 2020

Nice and easy

Thank you!

Richard H.

January 29th, 2020

Excellent service--couldn't be more complete and useful !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael T.

January 23rd, 2021

This site was recommended to me. The deed worked just fine for recording a property transfer (Warranty Deed). What I like is that there is a 1 time fee, not a subscription. I would highly recommend. It saved us $2000 in closing costs and fees.

Thank you!

Lori A.

February 14th, 2023

It was quick and easy. A little expensive but convient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori F.

January 20th, 2021

That was easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Luwana C.

April 2nd, 2019

I think the Website takes out a lot of leg work, Makes it easier to take care of paperwork 10 times faster.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert D L.

July 31st, 2023

Found the forms to be very easy to use, instructions very clear and helpful. Recording office was surprised the forms were exactly what they required. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leonard D.

May 2nd, 2019

I'm still working on it. I'm surprised that it appears so much information has to be included about beneficiaries.

Thank you!

KIMTIEN L.

April 5th, 2022

VERY GOOD INFORMATION ESPECIALLY FOR ME WHO IS IN CALIFORNIA AND OWN PROPERTY IN FLORIDA.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel R.

August 26th, 2020

It all looked pretty easy to navigate. Forms are just now downloaded so I'll see how opening, filling-out goes. I'm encouraged. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie F.

February 24th, 2019

I am so glad I found Deeds.com. You had exactly what I needed and made it easy to download. I have bookmarked you in the event of further inquiry. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tina C.

August 26th, 2021

Quick and easy ordering and download. Appreciated that I could get the form that is used in my county. Would have like to be able to add paragraphs to form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!