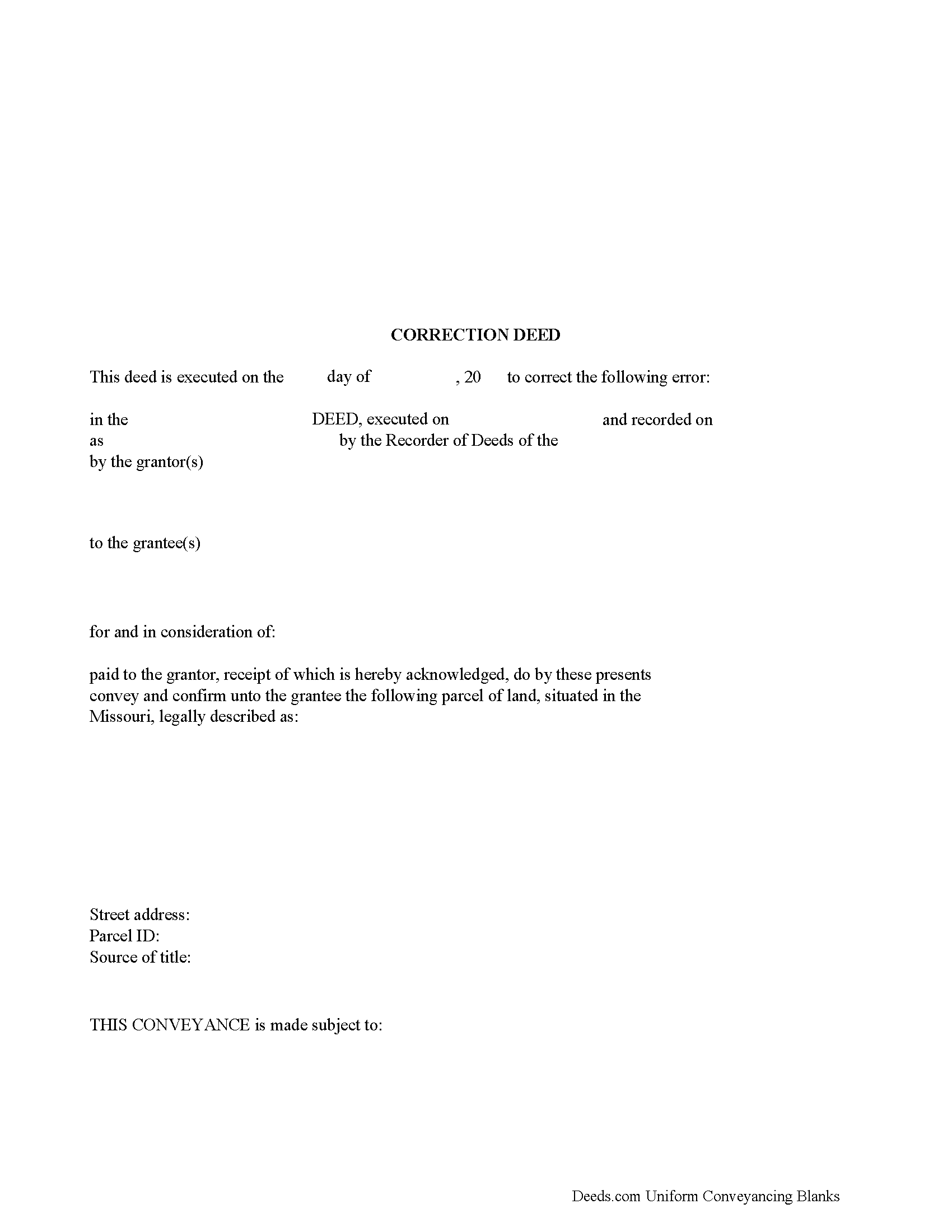

Stone County Correction Deed Form

Stone County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

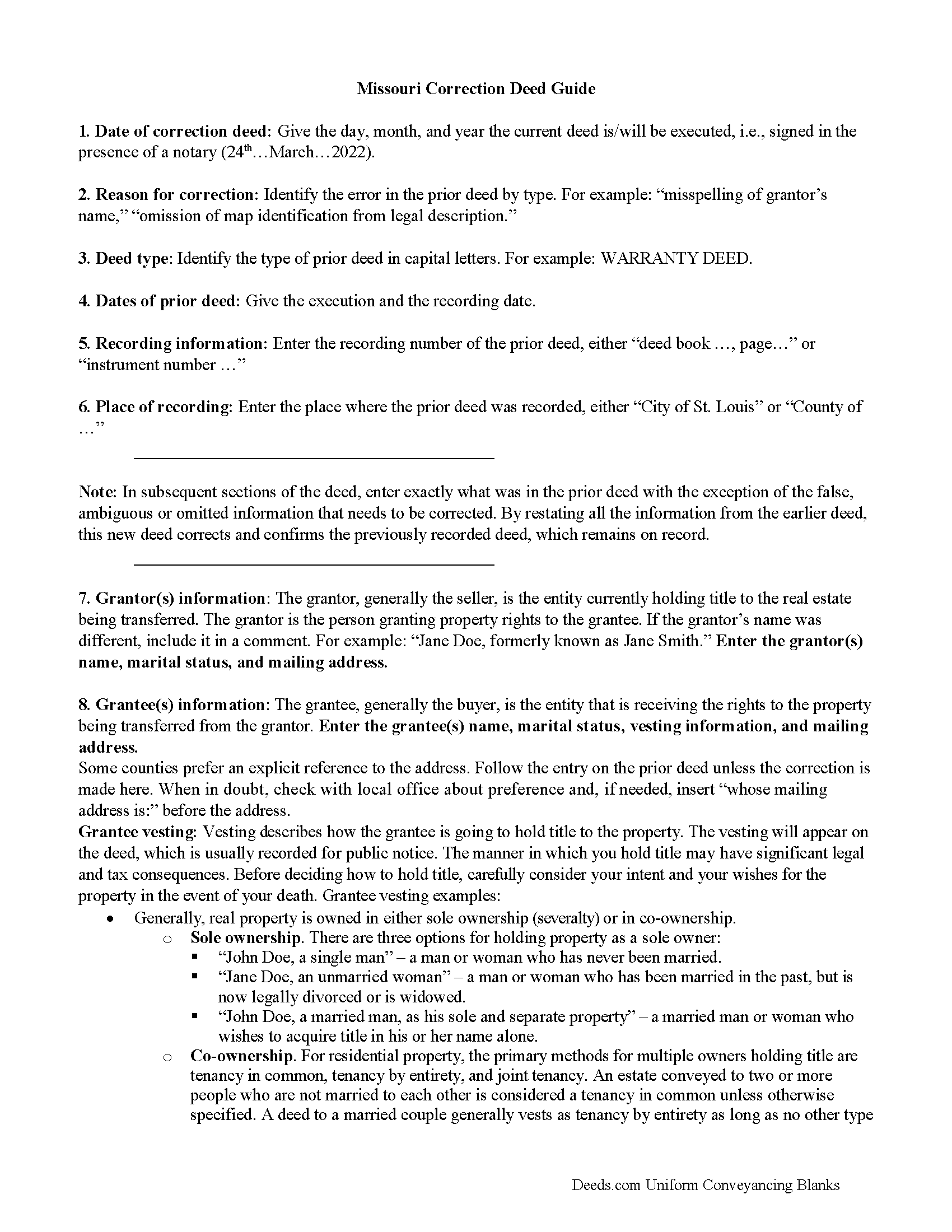

Stone County Correction Deed Guide

Line by line guide explaining every blank on the form.

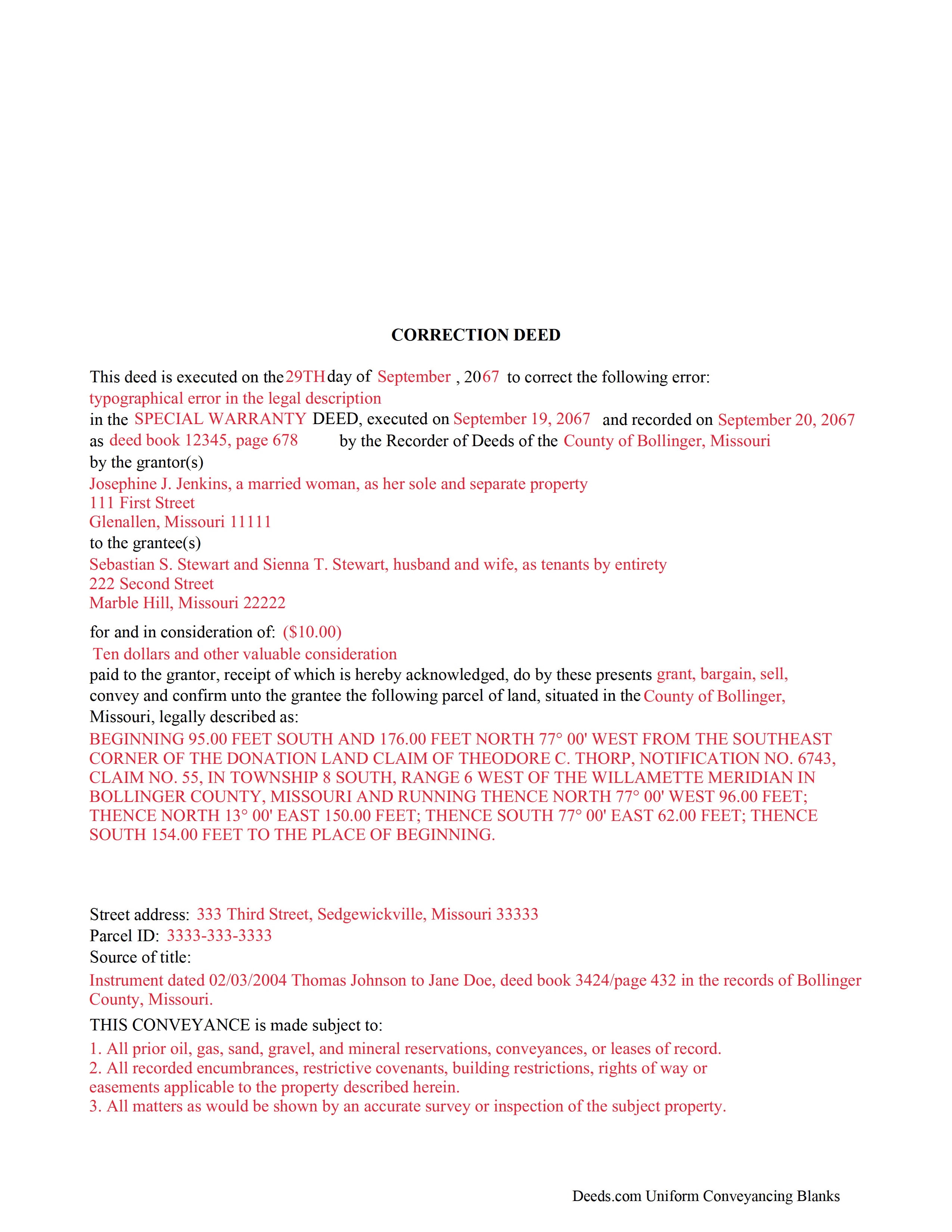

Stone County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Stone County documents included at no extra charge:

Where to Record Your Documents

Stone County Recorder of Deeds

Galena, Missouri 65656

Hours: 8:00 to 4:00 Monday through Friday

Phone: (417) 357-6362

Recording Tips for Stone County:

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Stone County

Properties in any of these areas use Stone County forms:

- Blue Eye

- Cape Fair

- Crane

- Galena

- Hurley

- Kimberling City

- Lampe

- Ponce De Leon

- Reeds Spring

Hours, fees, requirements, and more for Stone County

How do I get my forms?

Forms are available for immediate download after payment. The Stone County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stone County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stone County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stone County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stone County?

Recording fees in Stone County vary. Contact the recorder's office at (417) 357-6362 for current fees.

Questions answered? Let's get started!

Use the correction deed to correct an error in a warranty, special warranty, conveyance, or quitclaim deed in Missouri.

A corrective deed is in effect an explanation and correction of an error in a prior instrument. As such, it passes no title, but only reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance it is correcting by type of error, date of execution and recording, and recording number and location. Beyond that, it restates the information given in the prior deed, thus serving as its de facto replacement. The prior deed, however, which constitutes the actual conveyance of title, remains on record.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title, changing the vesting information or the legal description of the property, require a new deed of conveyance instead of a confirmatory deed.

(Missouri CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Stone County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Stone County.

Our Promise

The documents you receive here will meet, or exceed, the Stone County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stone County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4584 Reviews )

Melody P.

February 23rd, 2021

Thanks again for such excellent service, and always a pleasure!

Thank you!

Rebecca H.

May 22nd, 2021

I thought the forms were reasonably priced, the instructions included in the packet were thorough, and the examples helpful. Thank you for the additional CDR forms too. I contacted the Recorder's office via email with a question and Jennifer Bowser answered promptly. Job well done! However, when I delivered the deed and Real Property Transfer Declaration to the Clerk's office in Lafayette, the clerk was unfamiliar with the Declaration document being submitted and it took some time to convince her to submit the form without charging the recording fee. She even tried to phone the recorder's office for clarification, but no one answered. There then was an additional form at that office that I had to complete called Recording Request/Transmittal Form. I would suggest including that form with instructions in your on-line packet to speed up the process when a Deed is delivered to the County Clerk's satellite office. I do not expect every clerk to know all the particulars of recording requirements but a little knowledge wouldn't hurt.

Thank you for your feedback. We really appreciate it. Have a great day!

Dave W.

November 7th, 2023

Very handy when clueless about filling out a form. Saved hours of research.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Earnest K.

January 8th, 2025

I used the "personal representative's deed." There were a few errors, after I went to record it at the county recorder's office. For #7, it should've stated "The estate of Joe Schmoe, hereby grants Mr. Personal Representative....." instead of, "I Mr. Personal Representative, as personal representative, hereby grant to personal representative...." The person at the recorder's office said you cannot state "you are granting property to yourself." Just fix that, and everything else is fine.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Omid B.

January 14th, 2021

Super efficient, extremely responsive , and above all quick turnaround. Thank you! Will definitely use your services again!

Thank you!

Tierre J.

January 3rd, 2019

I put in two orders. I did not get any results from either order and I am still waiting for my refunds.

Thank you for your feedback. Sorry we were not able to pull the information you requested. We reviewed your account and the payment voids were processed as your were notified. Sometimes, depending on your financial institution, it can take a few days for the pending charges to fall off of your statement reporting.

Steven b.

November 21st, 2021

We used this document in 2018 and it was acceptable to Jackson County Missouri. It worked and is valid. Very happy with the product.

Thanks for the kind words, glad to see you back again. Have a great day!

Dennis M.

November 26th, 2020

Very quick and easy to use. Deeds.com saved me a lot of money!

Thank you!

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

Matthew M.

February 15th, 2023

Needed copy of deed in trust. Found info here, paid on line and then printed the docs. Easy to use, no driving to city offices, No parking fees, no waiting in line. Done fast and easy. Love it.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy F.

December 29th, 2018

I thought your site was focused on my specific county, but it wasn't. Therefore, I did not complete a transaction.

Thank you for your feedback Judy. Our site is national, we focus on all jurisdictions. Have a great day.

Laurie S.

May 24th, 2023

This was amazingly easy to access.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jim B.

December 22nd, 2021

Would be great if you would just put all of these documents into ONE .pdf.

Thank you for your feedback. We really appreciate it. Have a great day!

Peggy G.

May 19th, 2019

This is an easy document to complete and file. Thank you for having the completed sample for review.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda R.

December 21st, 2020

This site was a great help to us. It was worth the money to get it right!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!