Jackson County Disclaimer of Interest Form

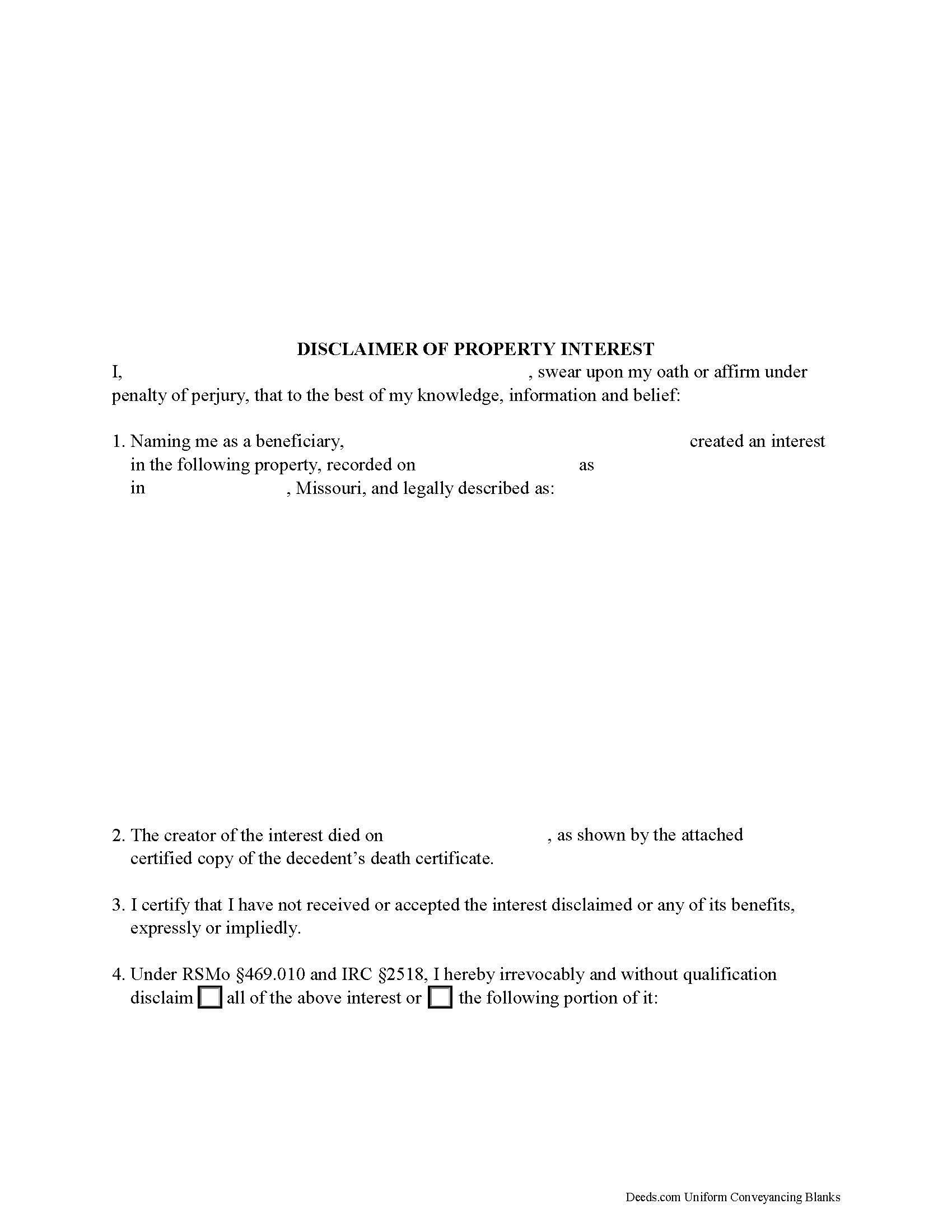

Jackson County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

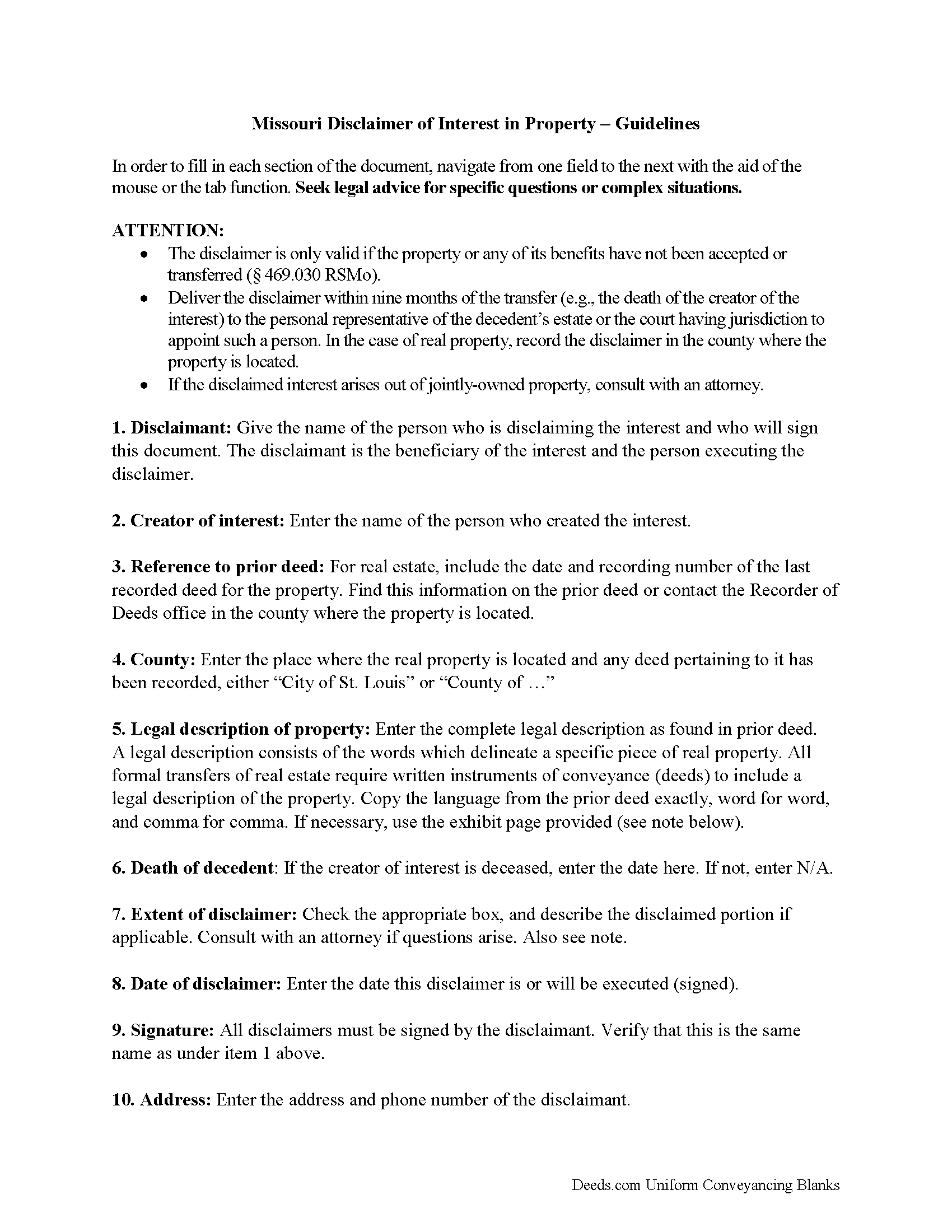

Jackson County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

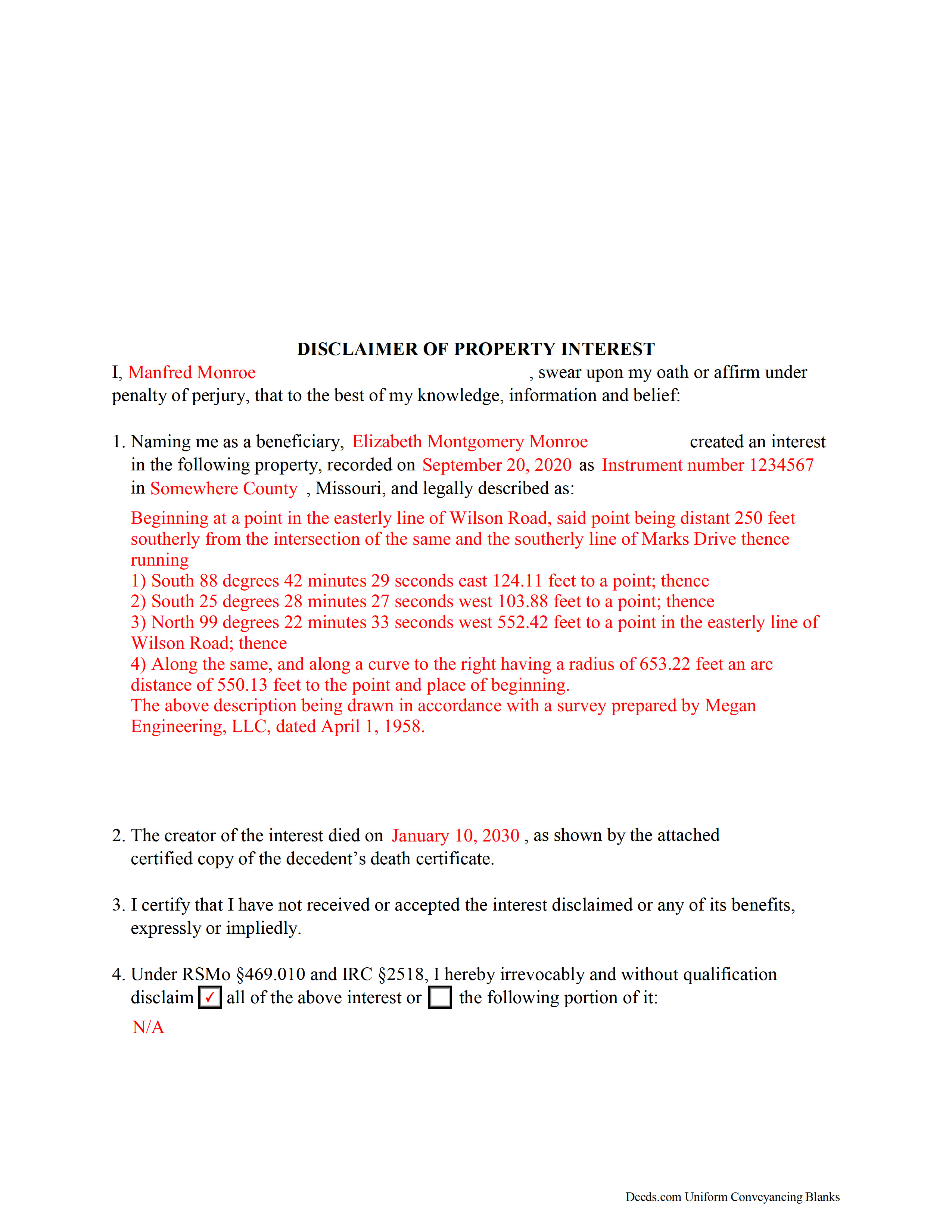

Jackson County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Jackson County documents included at no extra charge:

Where to Record Your Documents

Jackson County Recorder of Deeds

Kansas City, Missouri 64106

Hours: 8:00am - 5:00pm Monday through Friday

Phone: (816) 881-3191

Recorder of Deeds Department (use for all mail)

Independence, Missouri 64050

Hours: 8:00am - 5:00pm Monday through Friday

Phone: (816) 881-4483

Recording Tips for Jackson County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Blue Springs

- Buckner

- Grain Valley

- Grandview

- Greenwood

- Independence

- Kansas City

- Lees Summit

- Levasy

- Lone Jack

- Oak Grove

- Sibley

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at (816) 881-3191 for current fees.

Questions answered? Let's get started!

Under the Missouri Revised Statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (469.010). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (469.020).

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant.

Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the transferor or his representative or the holder of legal title (469.020). In the case of real property, acknowledge the disclaimer as is required for a deed and record it in the county where the property is located. In addition, deliver a copy of the disclaimer to the person or legal entity with current custody or possession of the property.

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors (469.010), so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Missouri DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Thomas F.

February 18th, 2021

Very convenient!

Thank you!

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

Veronica G.

November 11th, 2020

Excellent service A+

Thank you!

Jeff R.

December 10th, 2020

Easy process to receive service. thank you

Thank you!

Robert D.

March 7th, 2019

These forms made it so easy to update the property deed and the instructions and sample filled out form were most helpful. You might want to add some brief information on when or why to use the Acknowledgment in Individual Capacity notary form. In my case the notary was required to use it but also filled in the brief notarize section on the Affidavit as well. She said the one on the Affidavit had some value because it showed she had witnessed the my signature. But this was only after I suggested both be filled in as she initially thought to just strike through it and just use the Acknowledgment in Individual Capacity form.

Thank you for your feedback. We really appreciate it. Have a great day!

Michaela D.

February 27th, 2019

I purchased this form to add my boyfriend to the deed of our home. He owns his own business so he cannot be on our mortgage. The guide doesn't clearly explain adding a person rather than focusing on transferring during a purchase or selling of a home. For future, I'd recommend make a few different examples for those who are trying to use this for the other options a Quit Claim Deed is needed for.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda W.

January 22nd, 2021

Fast service. From the time I sent my Quit Claim Deed to deeds.com, and six hours later my deed was recorded. It was painless, great convenience.

Thank you!

Maribel P.

July 14th, 2023

Thank you so much for providing simple but very significant documents one can basically do PRO SE, without any additional huge counsel expenses and yet be legitimate enough to officially file them as state law allows and extends to basic documents processing and filings. Thank you so much for the professional documents provided as they do the proper job. MP

Thank you for the kind words Maribel. Glad we were able to help!

Theresa J.

March 27th, 2023

The beginning of the process was very simple. In the middle now waiting for the invoice to move forward.

Thank you for your feedback. We really appreciate it. Have a great day!

Georgana T.

May 28th, 2019

Not clear information on ownership, which is what I wanted.

Sorry to hear that we were unable to find the information you need Georgana. Your account has been credited. Have a wonderful day.

Joyce H.

August 11th, 2020

I found the site very easy to use and upfront about the cost. I had tried two other sites both of which had hidden costs until after I filled out the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara P.

August 13th, 2024

So easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

paula b.

July 18th, 2022

Very helpful and easy to download, thankyou.

Thank you!

jack b.

December 21st, 2018

good form, reasonable fee

Thank you Jack. We really appreciate you taking the time to leave your feedback. Have a great day!

Cheryl C.

September 1st, 2021

Very pleased. I spent a fair amount of time chasing a blank form only to be told it couldn't be given to me - I had to go through my attorney. Going thru the deeds.com was a breeze; the blank form looked exactly like one I had filed before :-)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!