Jackson County Specific Power of Attorney for the Sale of Property Form

Jackson County Specific Power of Attorney for the Sale of Property

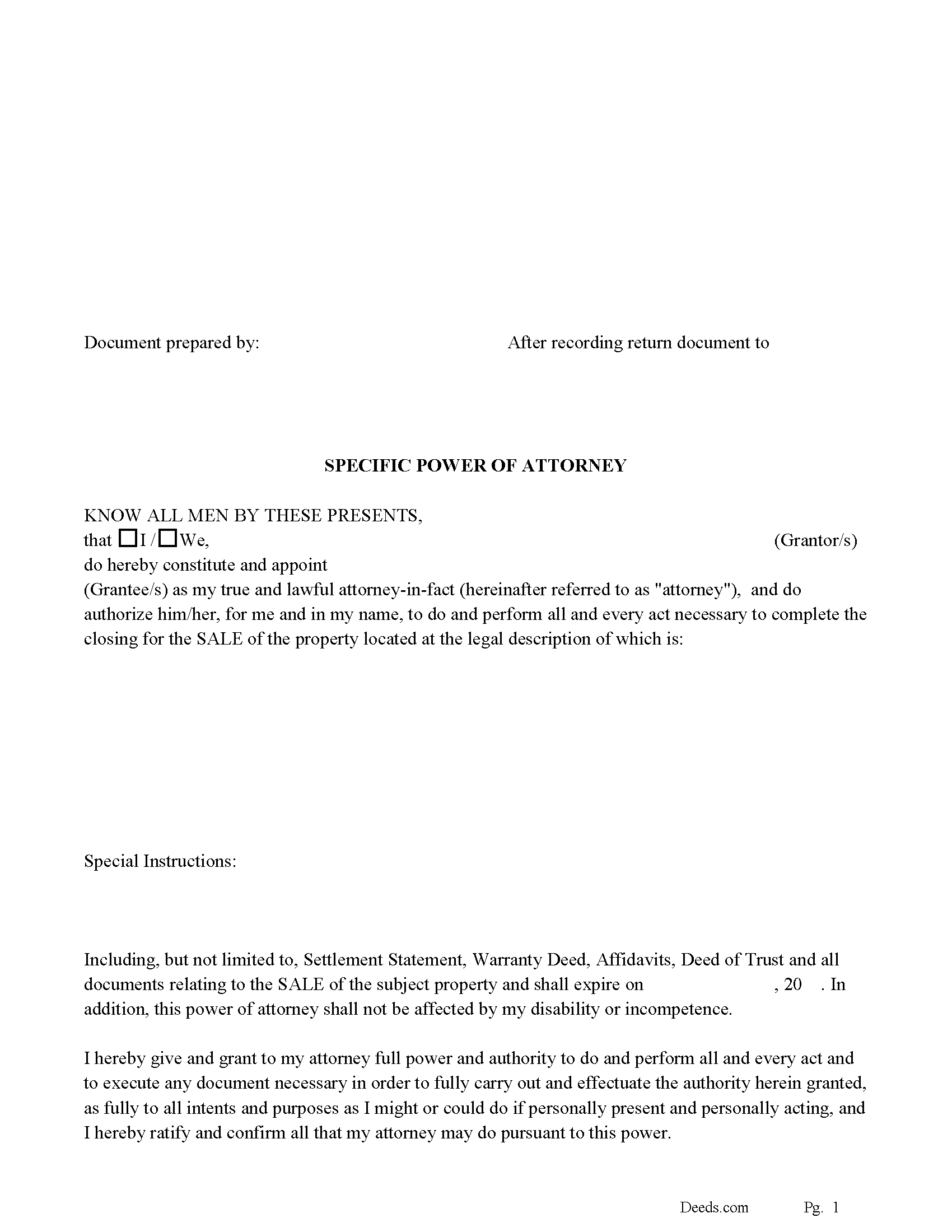

Fill in the blank form formatted to comply with all recording and content requirements.

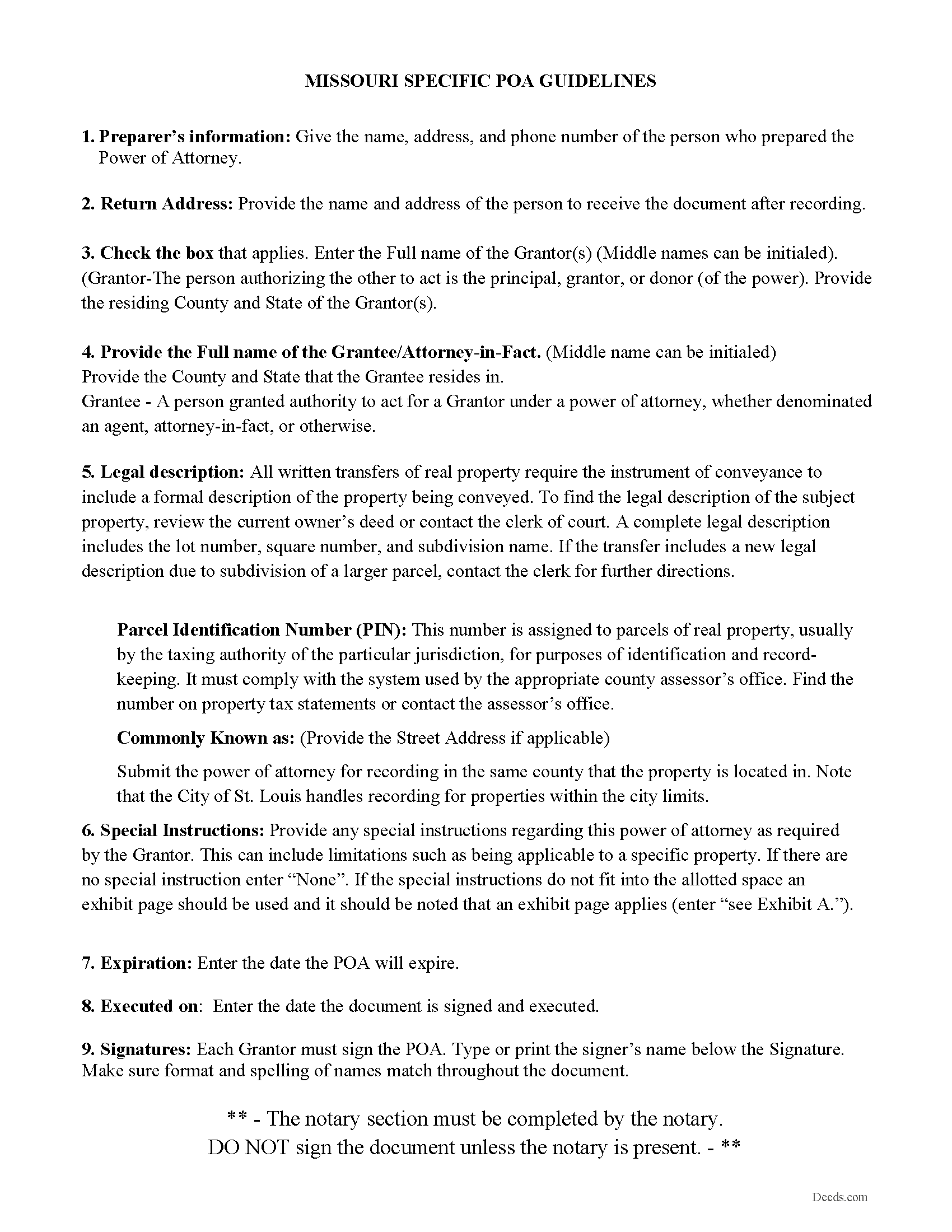

Jackson County Specific Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

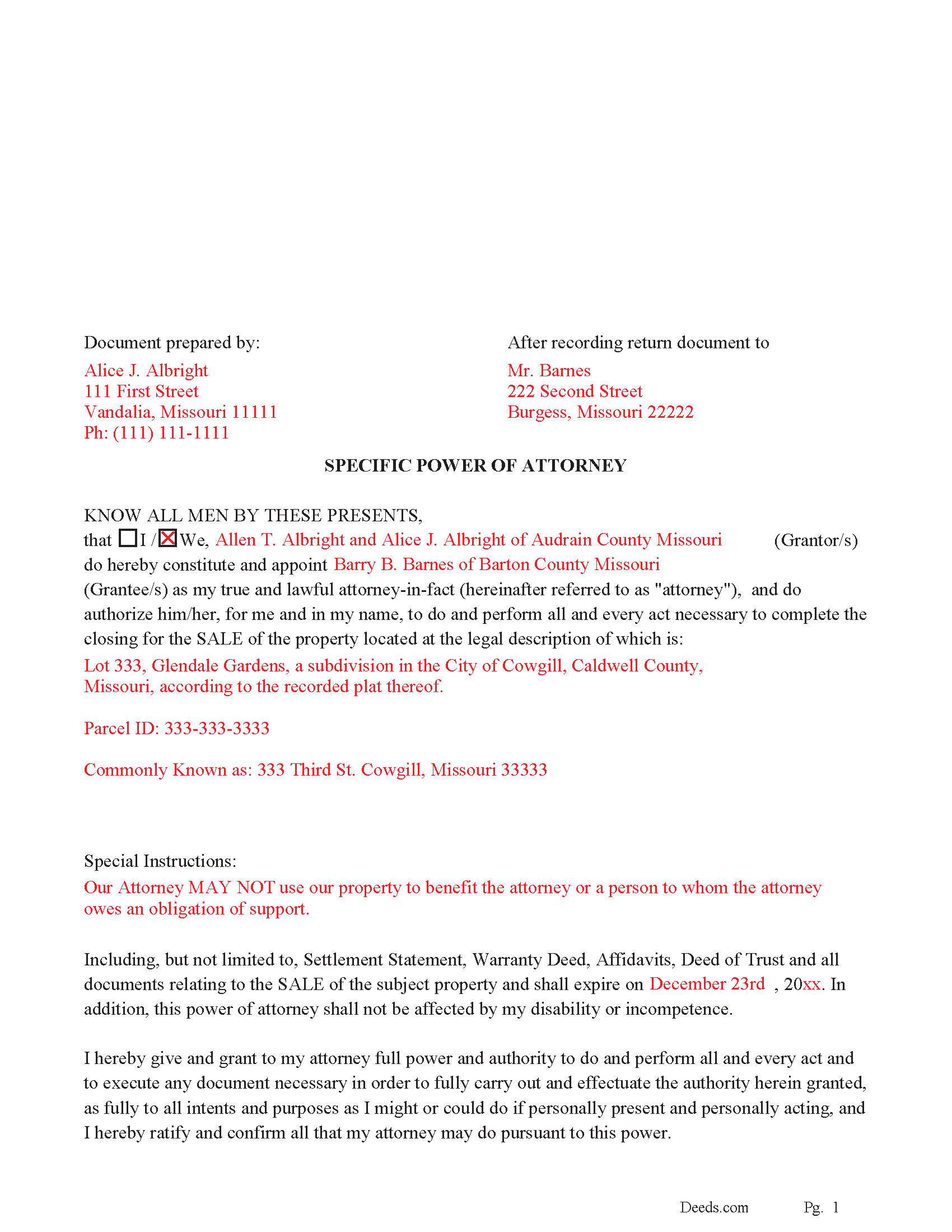

Jackson County Completed Example of the Specific POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Jackson County documents included at no extra charge:

Where to Record Your Documents

Jackson County Recorder of Deeds

Kansas City, Missouri 64106

Hours: 8:00am - 5:00pm Monday through Friday

Phone: (816) 881-3191

Recorder of Deeds Department (use for all mail)

Independence, Missouri 64050

Hours: 8:00am - 5:00pm Monday through Friday

Phone: (816) 881-4483

Recording Tips for Jackson County:

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

- Verify the recording date if timing is critical for your transaction

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Blue Springs

- Buckner

- Grain Valley

- Grandview

- Greenwood

- Independence

- Kansas City

- Lees Summit

- Levasy

- Lone Jack

- Oak Grove

- Sibley

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at (816) 881-3191 for current fees.

Questions answered? Let's get started!

Use this form to authorize an attorney-in-fact to do and perform all and every act necessary to complete the closing for the SALE of a specific property. This form expires on a date of your choice and includes a "Special Instructions" section in which you can further limit or define the powers granted by you to your attorney-in-fact.

This POA is durable and shall not be affected by your disability or incompetence.

For use when the subject property is located in Missouri.

(Missouri SPOA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Specific Power of Attorney for the Sale of Property meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Specific Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Michelle H.

October 23rd, 2020

Deeds.com was easy to use, convenient and I will definitely be using your services in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

FEDERICO T.

June 21st, 2019

It was a little confusing to retrieve the documents. I was waiting for an email, but then I went toyour portal and I saw the messages and the document.

Thank you for your feedback Frederico.

JAMSHEAD T.

December 13th, 2020

An excellent service. Exactly what one would hope for in the 21st century.

Thank you for your feedback. We really appreciate it. Have a great day!

Veronica T.

September 14th, 2021

Great Service! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul K.

August 18th, 2021

too much money

Thank you for your feedback. We really appreciate it. Have a great day!

Larry M.

August 19th, 2021

Everything went well except that any information that I typed in on the computer download moves upward so that the letters or numbers are somewhat elevated above the line that should be even with the words on the form. I think it will be acceptable to the county recorder, but I don't especially like to submit things that appear uneven. I asked for help but just received a robotic reply that said to take steps that I already had done. So unless you know a way to correct this I likely won't use your forms again.

Thank you!

Dennis D.

November 7th, 2019

Downloaded perfect. Can hardly wait to get them done.

Thank you!

Beverly R.

February 2nd, 2022

This was a wonderful experience, easy fast and convenient. Thank you for all your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark W.

May 9th, 2019

Easy, simple and fast. I am familiar with deeds in my state and these looked correct. The common missed document of TRANSFER OF REAL ESTATE VALUE document was also included. Kudos on being complete.

Thanks Mark, we really appreciate your feedback.

Magdy G.

July 13th, 2020

Very fast and efficient service. Everything was done online. Did not need any help.

Thank you!

Brenda M.

February 3rd, 2021

I was glad that I paid to get a copy of the gift deed it help me out a lot and the copy of the example how to fill everything out was great

Thank you for your feedback. We really appreciate it. Have a great day!

Gertrude M.

January 31st, 2023

Rating 5 stars

Thank you!

Roger J.

December 3rd, 2020

I found the service easy to use and very helpful.

Thank you!

Matthew G.

February 19th, 2019

Second time using Deeds.com. Easy and professional

Thank you Matthew. Have a great day!

Elijah H.

December 24th, 2018

Deeds.com worked very well for me. Very Simple packet. And my County uses the same website

Thanks for the kinds words Elijah, we really appreciate it.