Deer Lodge County Beneficiary Deed Revocation Forms (Montana)

Express Checkout

Form Package

Beneficiary Deed Revocation

State

Montana

Area

Deer Lodge County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Deer Lodge County specific forms and documents listed below are included in your immediate download package:

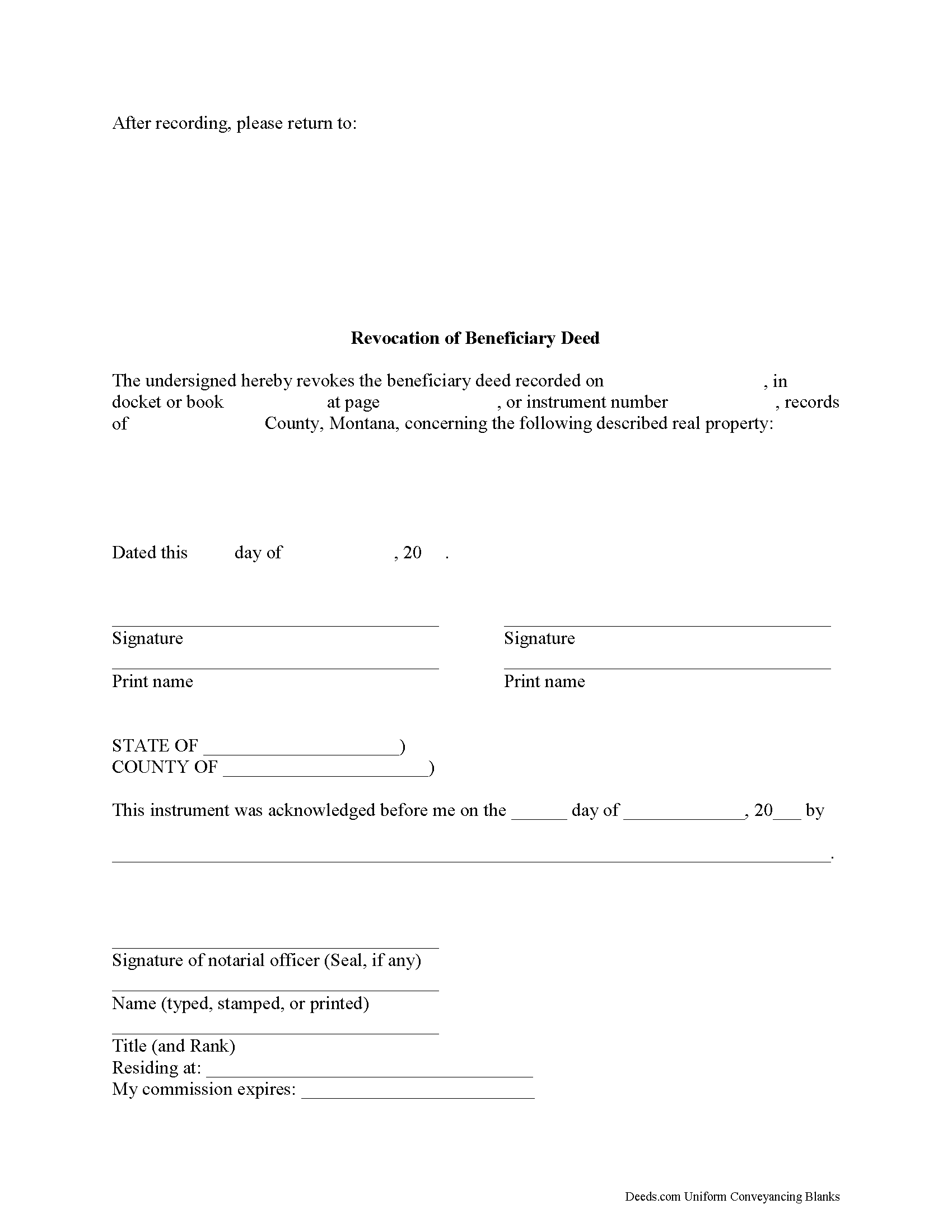

Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 3/13/2024

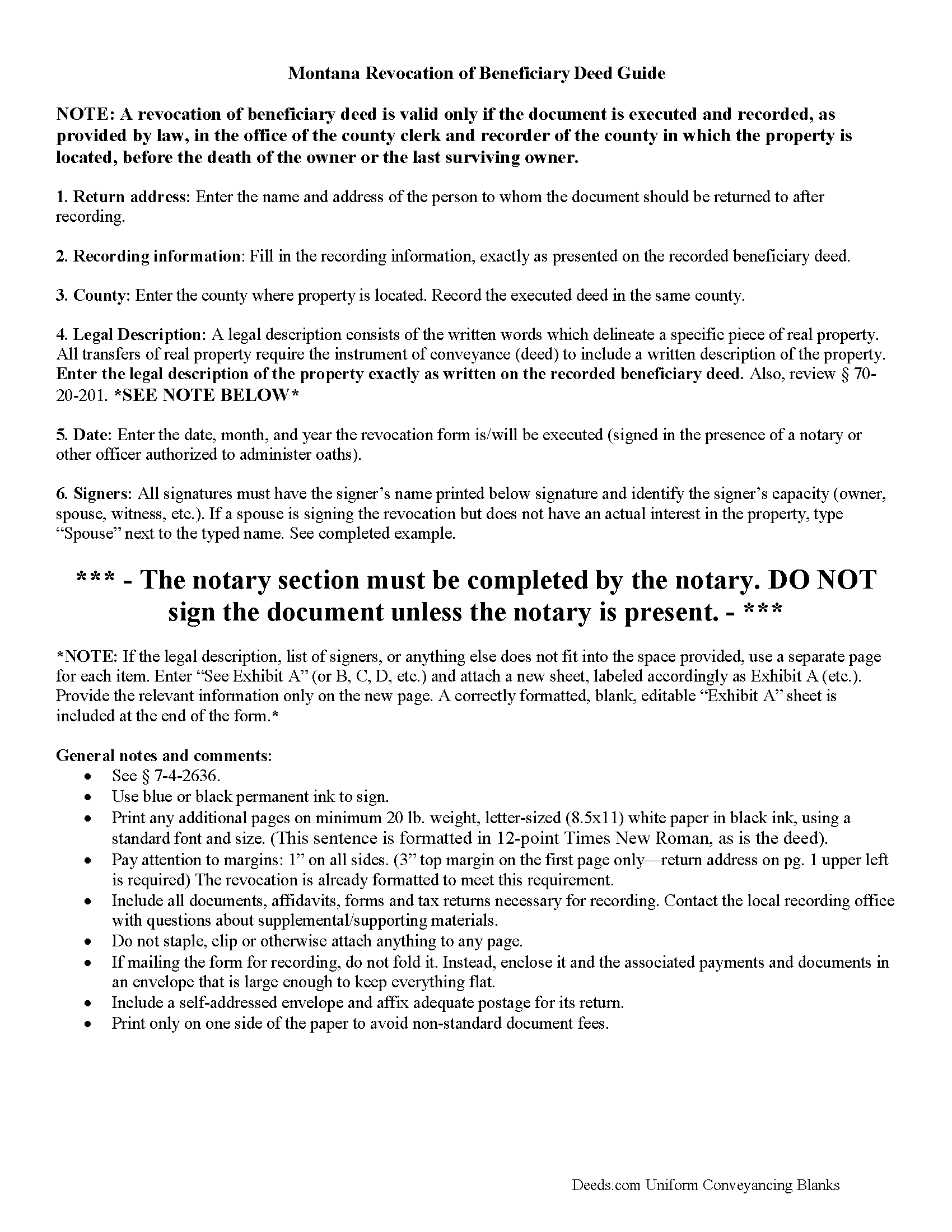

Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/24/2024

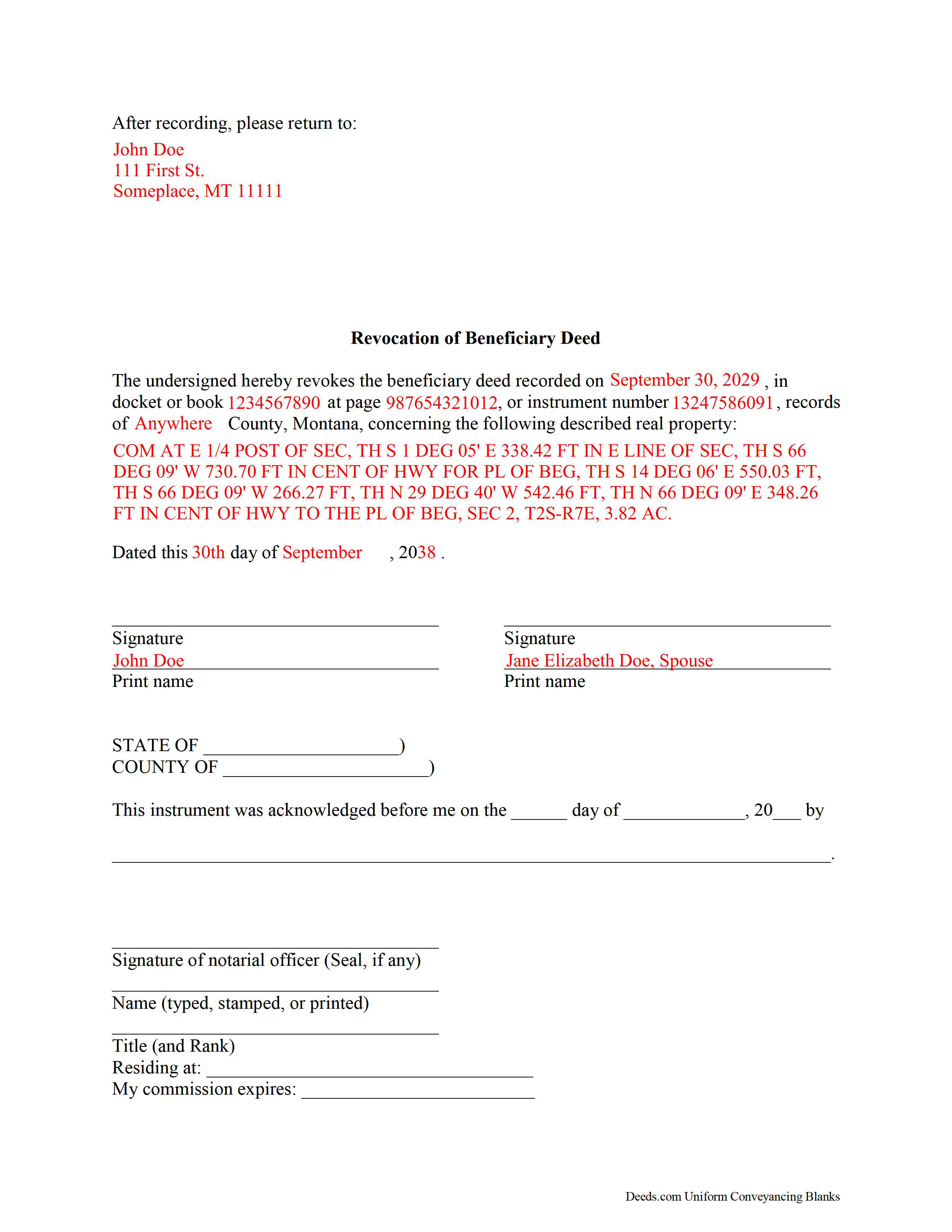

Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

Included document last reviewed/updated 3/29/2024

Included Supplemental Documents

The following Montana and Deer Lodge County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Montana or Deer Lodge County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Deer Lodge County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Deer Lodge County Beneficiary Deed Revocation forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Beneficiary Deed Revocation forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Deer Lodge County that you need to transfer you would only need to order our forms once for all of your properties in Deer Lodge County.

Are these forms guaranteed to be recordable in Deer Lodge County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Deer Lodge County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Beneficiary Deed Revocation Forms:

- Deer Lodge County

Including:

- Anaconda

- Warm Springs

What is the Montana Beneficiary Deed Revocation

Revoking a Montana Beneficiary Deed

A revocation of a recorded beneficiary deed must be lawfully executed and recorded during the owner's life or it has no effect.

In 2007, the Montana Legislature enacted the state's beneficiary deed law, found at Montana Code Annotated Section 72-6-121. All following parenthetical references identify the part of that section which contains additional information.

Beneficiary deeds are nontestamentary documents that convey a potential future interest in real property, but they only become effective when the owner dies (11). Until that point, the owner retains absolute title to, control over, and use of the property, including the freedom to modify or revoke the beneficiary designation, or to sell the property to someone else. This flexibility is what makes beneficiary deeds so useful; it allows the owners to respond quickly if circumstances change. Note that if the real property is owned as joint tenants with right of survivorship and if the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner (6).

If an owner executes and records more than one beneficiary deed concerning the same real property, the document recorded closest to the owner's death is the effective beneficiary deed (8). Even though the recording date directs the transfer, it makes sense to execute and record a revocation because it adds an endpoint to the original deed and helps to preserve a clear chain of title (ownership history). This is important because any perceived irregularities can add unnecessary complexity to future sales of the property.

Revoking a beneficiary deed is a simple process, but it may not be appropriate in all cases. Contact an attorney with specific questions or for complex situations.

(Montana BD Revocation Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Deer Lodge County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Deer Lodge County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4321 Reviews)

Mitchell S.

April 25th, 2024

This service was very helpful, quick, inexpensive and easy to use. Should I ever need it again, I know right where to go.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Lorie S.

April 24th, 2024

It was available to download immediately

Thank you!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Audra P.

March 2nd, 2021

Deeds.com was so easy to use and understand. So fairly priced too in my opinion, worth every penny! Thank you deeds.com and I'm grateful my county uses and encourages using them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janice l.

June 12th, 2021

Exact form needed with perfect instructions. Easy Peazy!

Just got my fully recorded document back today. Saved hundreds.

Just make sure and read all the instructions .

Thank you for your feedback. We really appreciate it. Have a great day!

GLENN A M.

November 26th, 2019

I loved the easy to understand and use system, very user friendly.

Thank you!

Debra C.

March 27th, 2020

Excellent service. Love the site.

Thank you for your feedback. We really appreciate it. Have a great day!

Zunika B.

December 18th, 2020

Was quick and easy compared to visiting downtown where the recorders office is closed or just the thought of mailing important documents and waiting until someone hopefully reaches back out to you. All responses were timely and process was easy. No complaints.

Thank you!

Johnnie G.

July 6th, 2020

We had hoped, as this was direct through our State recorder's office, State-specific data would be pre-filled in. Also there is no help when transferring the home title from a Revocable Trust to the living Trustee and new spouse (no example given, no help for which code to use). And the example doesn't match the prior deed revision format submitted by our attorney. So, not the best experience. We may have to get an attorney involved...what we were hoping to avoid

Thank you for your feedback. We really appreciate it. Have a great day!

Constance F.

August 27th, 2021

Quick and easy download with instructions and a sample document to ensure conformity to the different jurisdictions.

Thank you!

Eileen D.

August 5th, 2020

Very easy to use. The example form was a big help in making sure I had the forms filled out correctly.

Thank you!

Christine H.

June 23rd, 2020

Easy to use. Customer service is very responsive!

Thank you!

Isabel M.

December 20th, 2018

Easy and quick...I highly recommend this site:)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Griselle M.

February 9th, 2021

This is my third time using Deeds.com and they don't disappoint. Their customer service is outstanding - absolutely excellent - via messages, I communicated with them immediately and 24/7 - on weekends and at night. I would not even try another service as they provide excellence which is so rare these days.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan A.

April 18th, 2019

Very convenient. Instructions and samples are a plus because I often see documents incorrectly completed. Take the time to do it right.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.