Garfield County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust Form

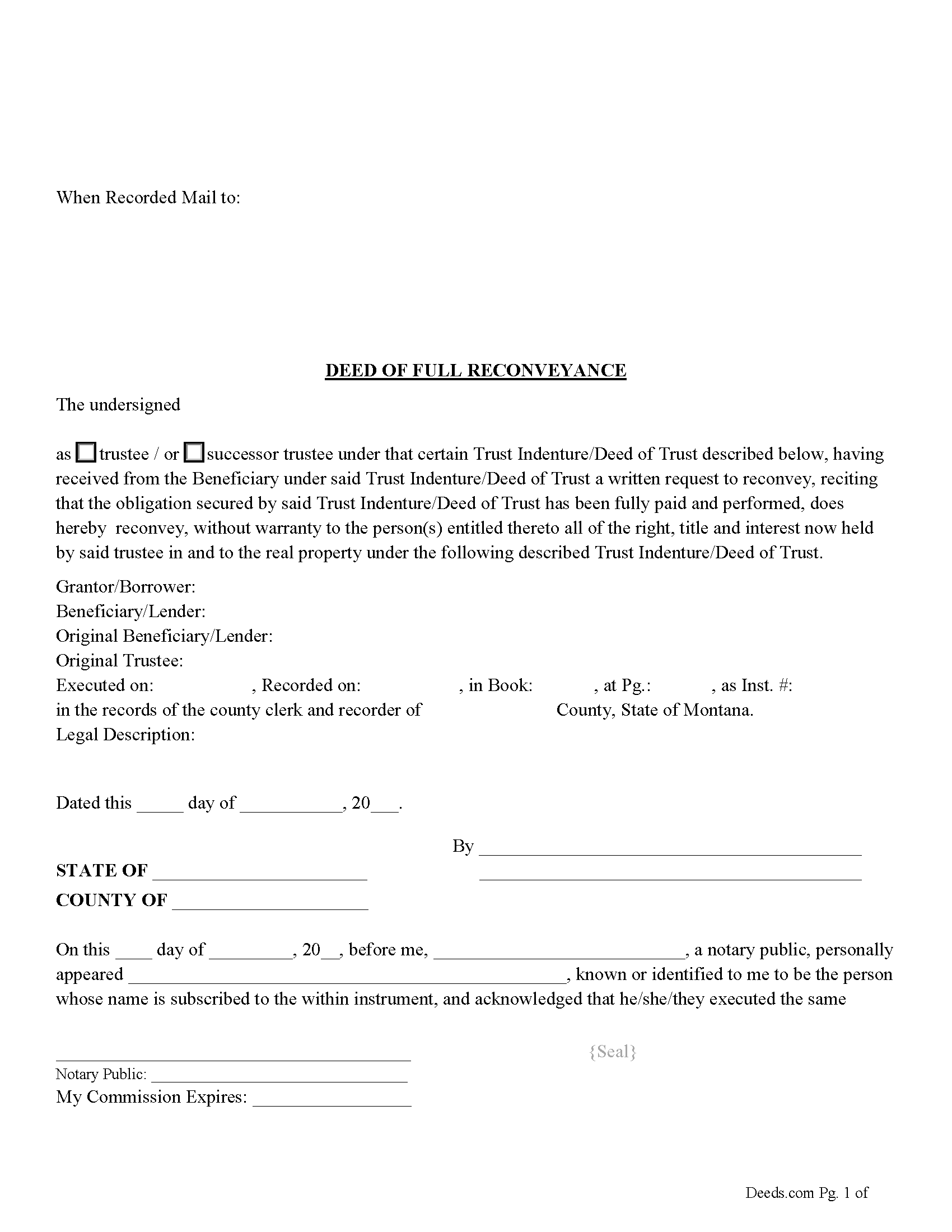

Garfield County Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

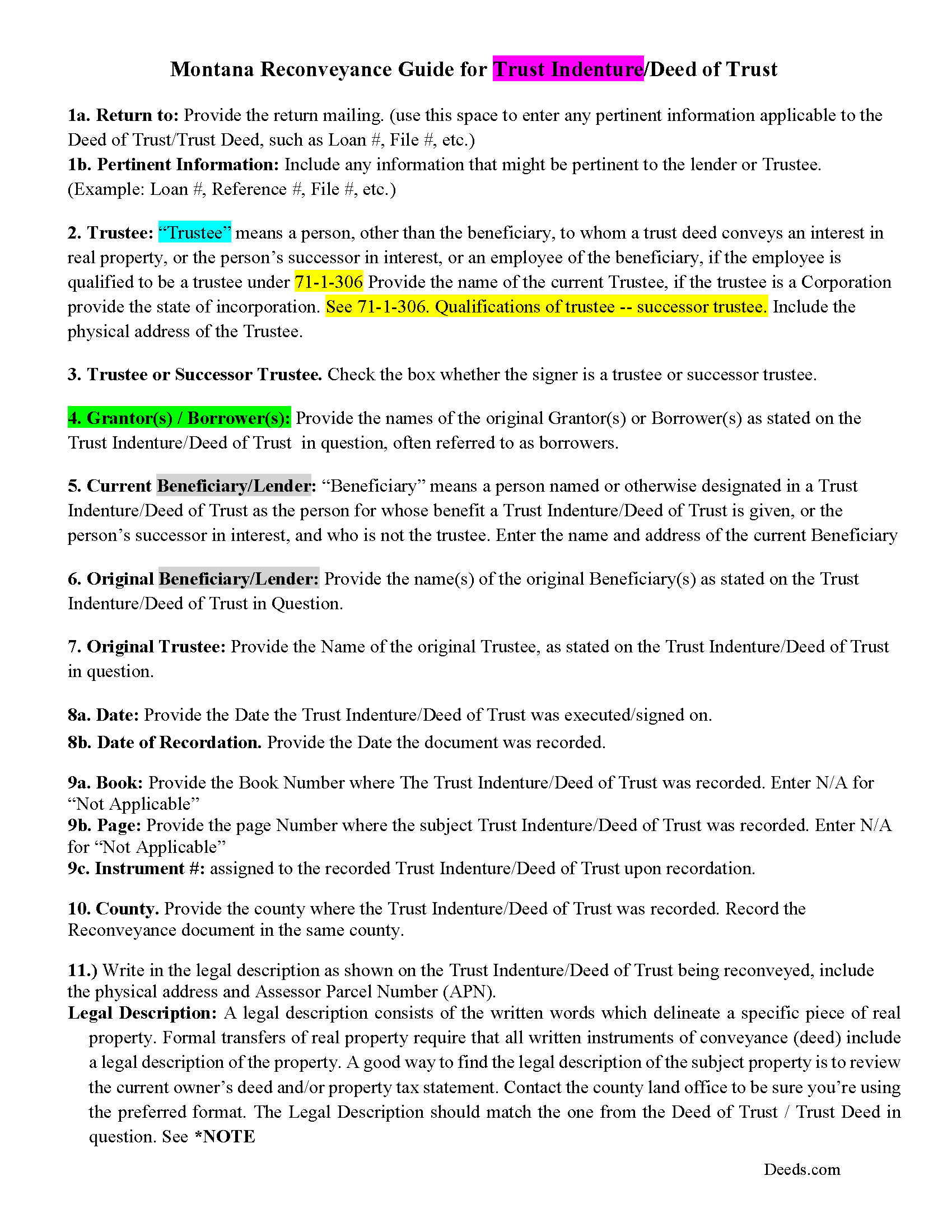

Garfield County Deed of Full Reconveyance Guidelines

Line by line guide explaining every blank on the form.

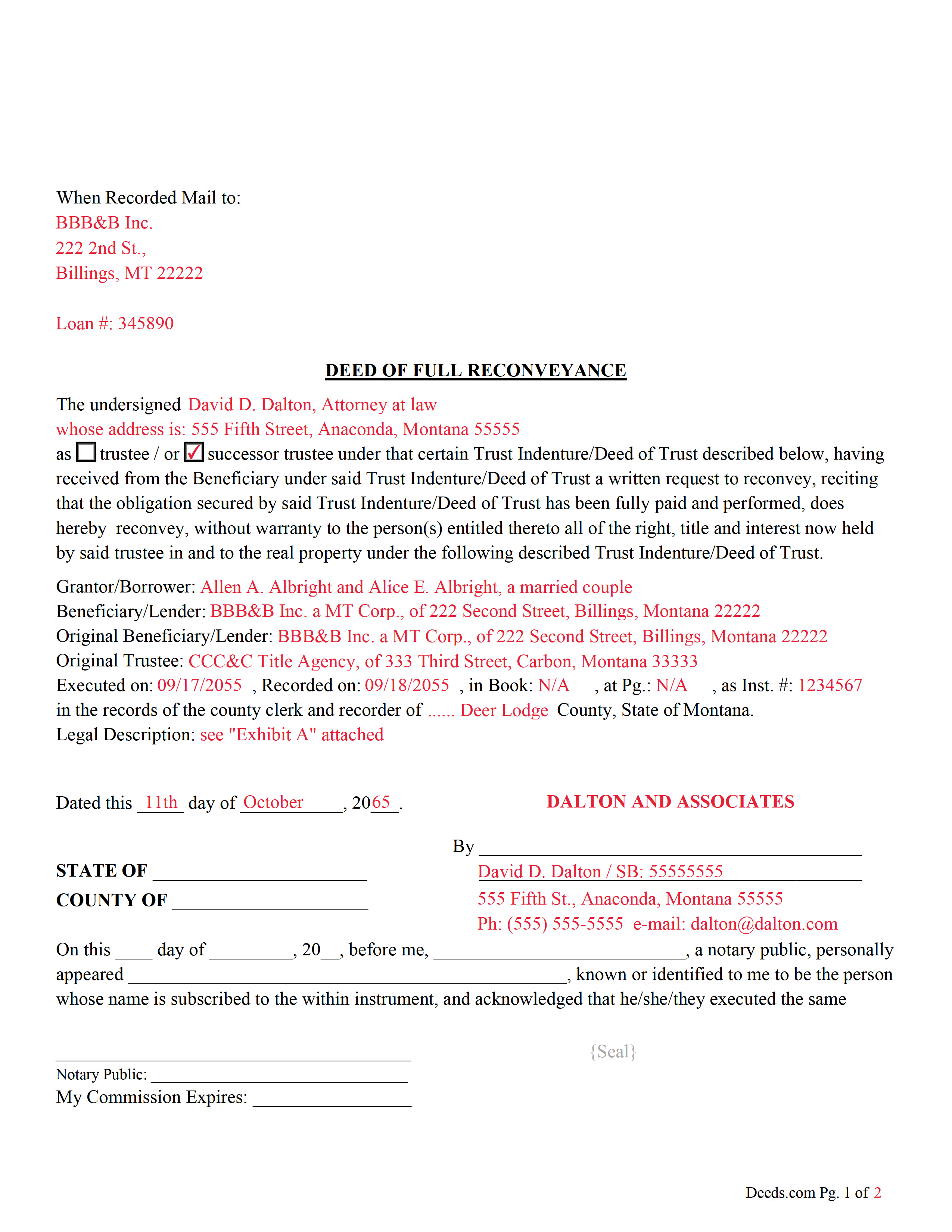

Garfield County Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Garfield County documents included at no extra charge:

Where to Record Your Documents

Garfield County Clerk / Recorder

Jordan, Montana 59337

Hours: 8:00 to 5:00 M-F

Phone: (406) 557-2760

Recording Tips for Garfield County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Garfield County

Properties in any of these areas use Garfield County forms:

- Brusett

- Cohagen

- Jordan

- Mosby

- Sand Springs

Hours, fees, requirements, and more for Garfield County

How do I get my forms?

Forms are available for immediate download after payment. The Garfield County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Garfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Garfield County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Garfield County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Garfield County?

Recording fees in Garfield County vary. Contact the recorder's office at (406) 557-2760 for current fees.

Questions answered? Let's get started!

This form is used by the trustee or successor trustee to reconvey a trust indenture/deed of trust when it has been satisfied/paid in full.

71-1-307 Reconveyance upon performance -- liability for failure to reconvey

(1) Upon performance of the obligation secured by the trust indenture, the trustee, upon written request of the beneficiary or servicer, shall reconvey the interest in real property described in the trust indenture to the grantor. If the obligation is performed and the beneficiary or servicer refuses to request reconveyance or the trustee refuses to reconvey the property within 90 days of the request, the beneficiary, servicer, or trustee who refuses is liable to the grantor for the sum of $500 and all actual damages resulting from the refusal to reconvey.

(2) If a beneficiary or servicer has received a notice of intent to reconvey pursuant to 71-1-308 and has not timely requested a reconveyance or has not objected to the reconveyance within the 90-day period established in 71-1-308, the beneficiary or servicer is liable to the title insurer or title insurance producer for the sum of $500 and all damages resulting from the failure.

(3) In an action by a grantor, title insurer, or title insurance producer to collect any sums due under this section, the court shall award attorney fees and costs to the prevailing party.

(Montana DOFR Package includes form, guidelines, and completed example) For use in Montana only.

Important: Your property must be located in Garfield County to use these forms. Documents should be recorded at the office below.

This Deed of Full Reconveyance - for Trust Indenture/Deed of Trust meets all recording requirements specific to Garfield County.

Our Promise

The documents you receive here will meet, or exceed, the Garfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Garfield County Deed of Full Reconveyance - for Trust Indenture/Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Gerry C.

February 6th, 2021

Forms appear to be most current and instructions clear. Inserting grantor/grantee information onto form a bit "clunky" however no major issues. I will be using services again.

Thank you!

Leslie S.

February 12th, 2020

The site was quick and easy to find information I needed. It also provided extra paperwork that would assist me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

timothy h.

November 12th, 2020

Too complicated and too expensive

Sorry to hear that Timothy, we do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

Michael O.

April 18th, 2019

Received everything that was promised.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl M.

April 12th, 2020

Easy.

Thank you!

Betty G.

February 4th, 2020

I was very impressed with your site! My experience was excellent. Made my quest an easy one. Thank you!

Thank you so much Betty. We appreciate you!

Lawrence W.

January 17th, 2019

Great so Far!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Juanita G.

February 5th, 2025

Easy and efficient service. The communication is on point. Thank you!

Thank you for your positive words! We’re thrilled to hear about your experience.

David K.

April 4th, 2019

Excellent instructions to guide one through the warranty deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael C.

January 16th, 2019

I would appreciate being able to increase the size of the blocks such as the Grantor block and the legal description block where information is enter on the form and to adjust the font. Otherwise great product,

Thank you for your feedback Michael. We do wish we could make that an option. Unfortunately, adhering to formatting requirements (specifically margin requirements) leaves a finite amount of space available on the page.

Michael R.

April 11th, 2023

This process was so easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chris D.

December 10th, 2020

Easy and affordable. I would recommend deeds.com

Thank you!

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna J.

June 29th, 2019

Doesn't have samples pertaining to me. Still searching for correct wording forGRANTORS (plural) so its legally written.

Thank you for your feedback. We really appreciate it. Have a great day!

Claudia S.

January 24th, 2023

Very user friendly! Processing is very fast. I would highly recommend using Deed's.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!