Broadwater County Disclaimer of Interest Form

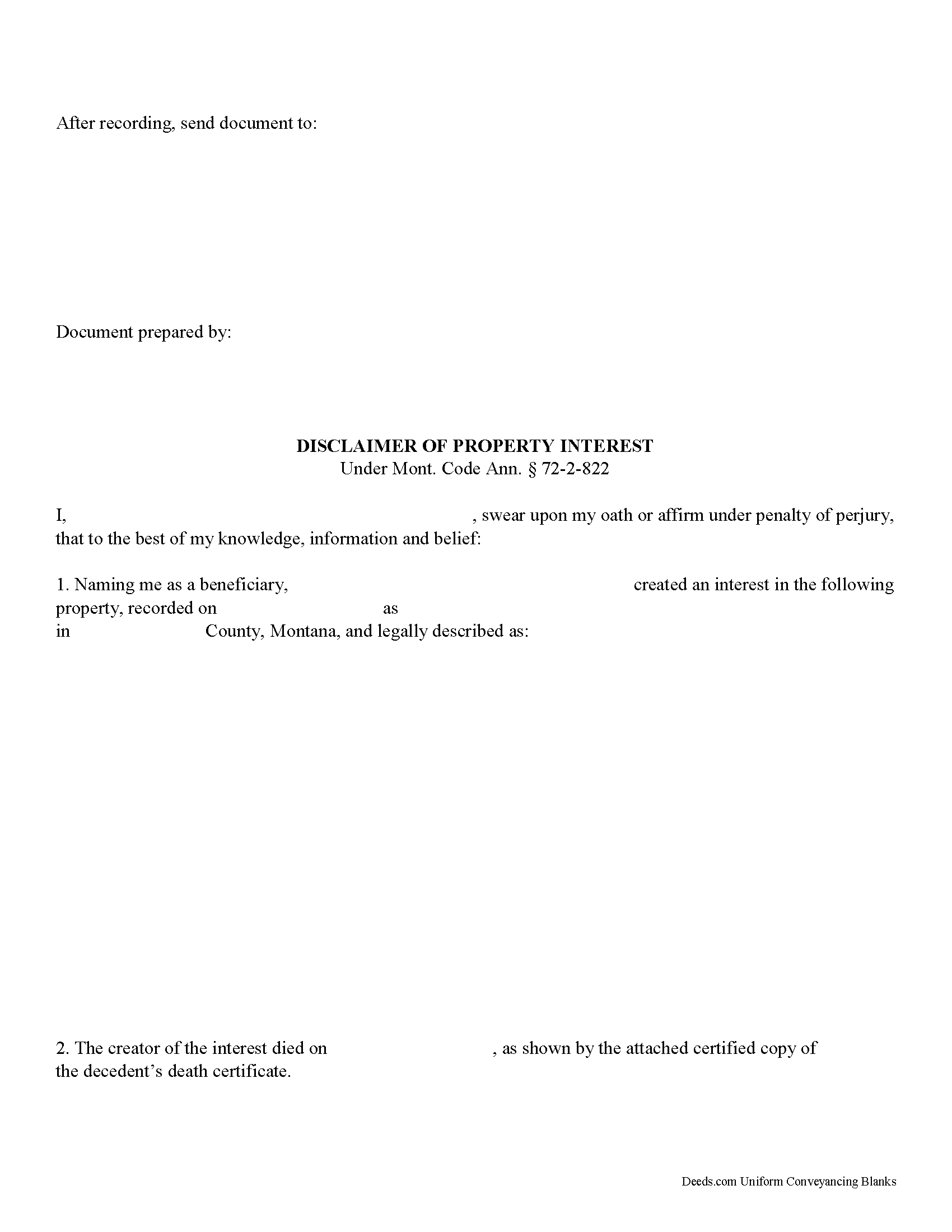

Broadwater County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

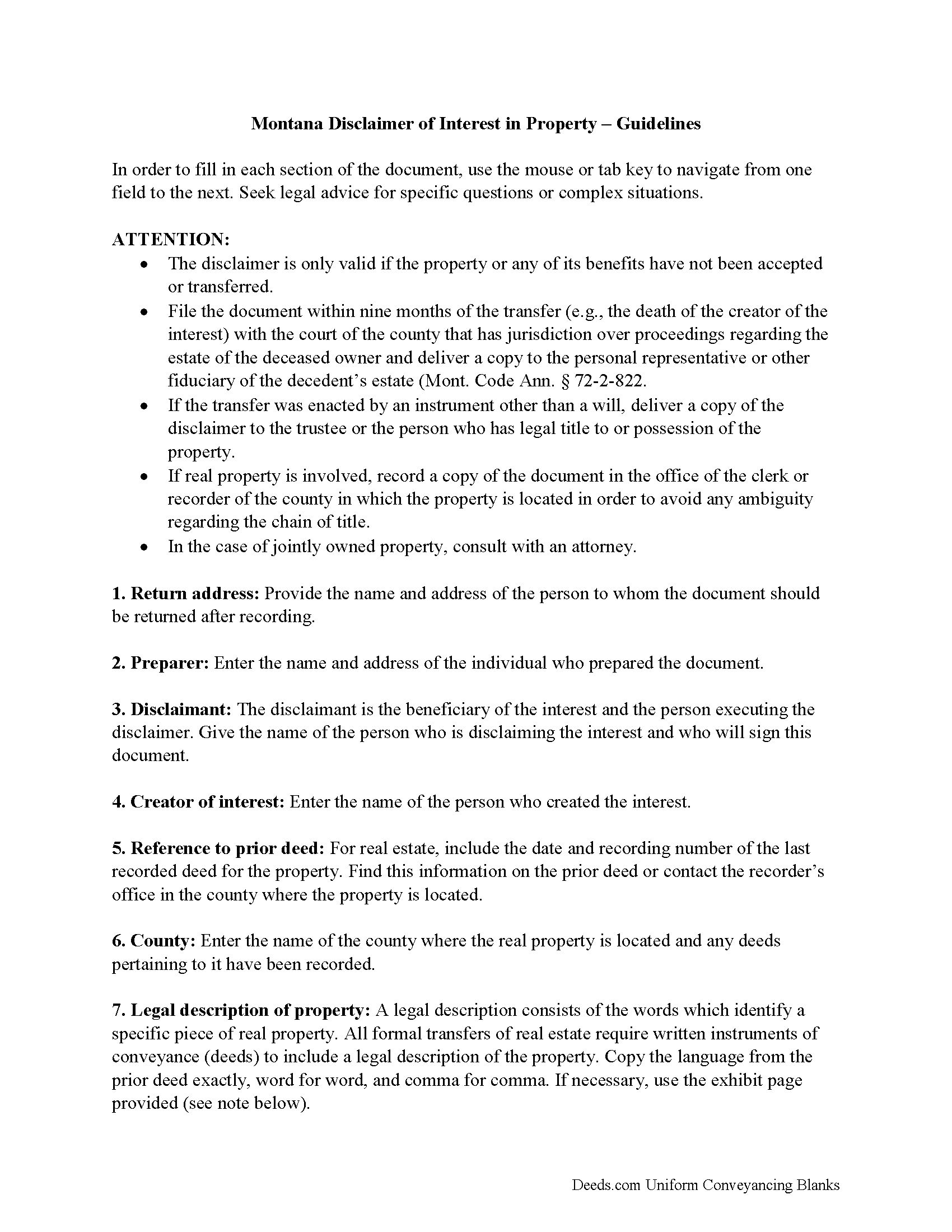

Broadwater County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

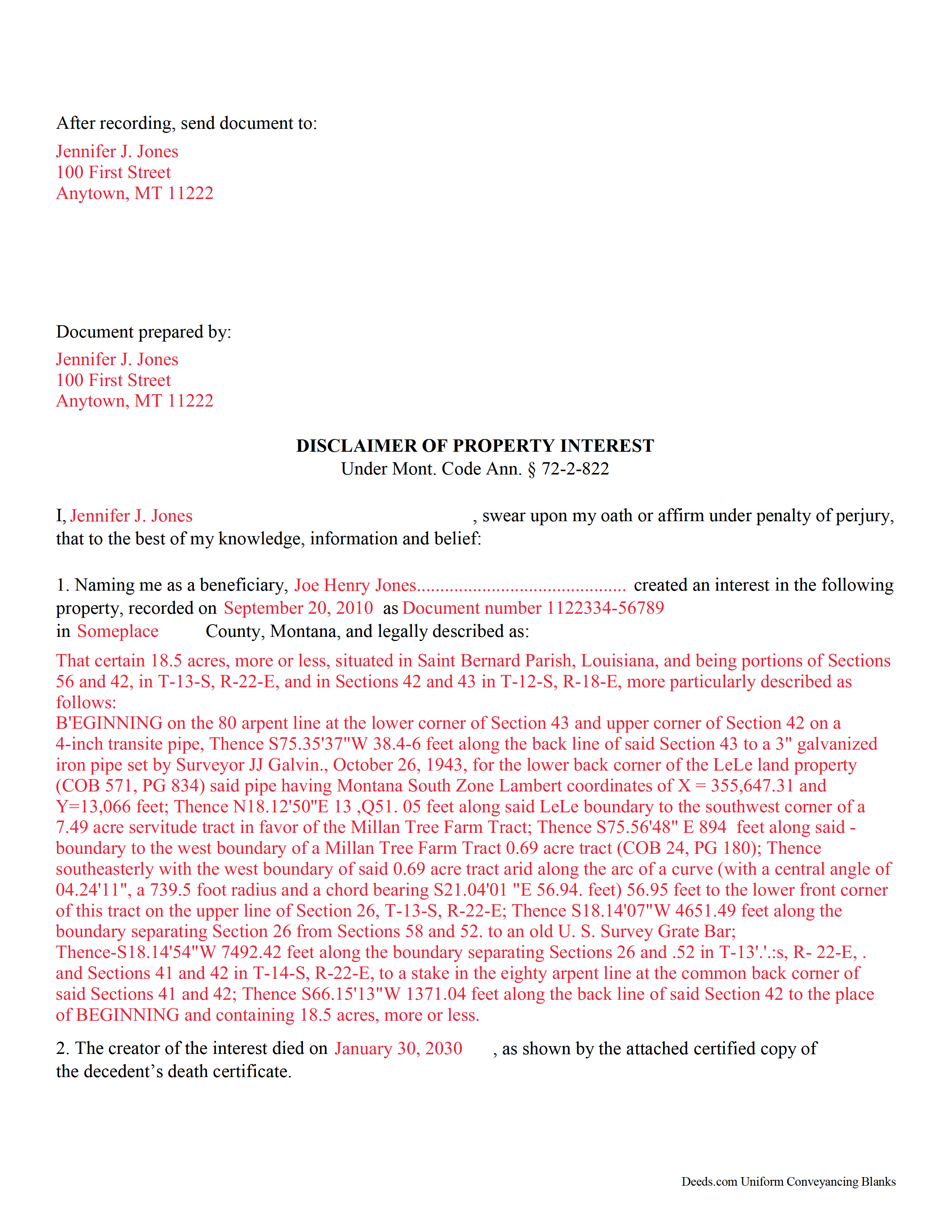

Broadwater County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Broadwater County documents included at no extra charge:

Where to Record Your Documents

Broadwater County Clerk / Recorder

Townsend, Montana 59644

Hours: 8:30 to 4:30 M-F

Phone: (406) 266-3443

Recording Tips for Broadwater County:

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Broadwater County

Properties in any of these areas use Broadwater County forms:

- Radersburg

- Toston

- Townsend

- Winston

Hours, fees, requirements, and more for Broadwater County

How do I get my forms?

Forms are available for immediate download after payment. The Broadwater County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Broadwater County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Broadwater County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Broadwater County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Broadwater County?

Recording fees in Broadwater County vary. Contact the recorder's office at (406) 266-3443 for current fees.

Questions answered? Let's get started!

Montana Disclaimer of Property Interest

Under the Montana Code, the beneficiary of an interest in property may disclaim the gift, either in part or in full (Mont. Code Ann. 72-2-822). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (72-2-822).

TITLE 72. ESTATES, TRUSTS, AND FIDUCIARY RELATIONSHIPS

CHAPTER 2. UPC -- INTESTACY, WILLS, AND DONATIVE TRANSFERS

Part 8. General Provisions Concerning Probate and Nonprobate Transfers

Disclaimer Of Interest In Property

72-2-822.Disclaimer of interest in property. (1) In this section:

(a)"Future interest" means an interest that takes effect in possession or enjoyment, if at all, later than the time of its creation.

(b)"Time of distribution" means the time when a disclaimed interest would have taken effect in possession or enjoyment.

(2)Except for a disclaimer governed by 72-2-823 or 72-2-824, the following rules apply to a disclaimer of an interest in property:

(a)The disclaimer takes effect as of the time the instrument creating the interest becomes irrevocable, or, if the interest arose under the law of intestate succession, as of the time of the intestate's death.

(b)The disclaimed interest passes according to any provision in the instrument creating the interest providing for the disposition of the interest, should it be disclaimed, or of disclaimed interests in general.

(c)If the instrument does not contain a provision described in subsection (2)(b), the following rules apply:

(i)If the disclaimant is not an individual, the disclaimed interest passes as if the disclaimant did not exist.

(ii)If the disclaimant is an individual, except as otherwise provided in subsections (2)(c)(iii) and (2)(c)(iv), the disclaimed interest passes as if the disclaimant had died immediately before the time of distribution.

(iii)If by law or under the instrument, the descendants of the disclaimant would share in the disclaimed interest by any method of representation had the disclaimant died before the time of distribution, the disclaimed interest passes only to the descendants of the disclaimant who survive the time of distribution.

(iv)If the disclaimed interest would pass to the disclaimant's estate had the disclaimant died before the time of distribution, the disclaimed interest instead passes by representation to the descendants of the disclaimant who survive the time of distribution. If no descendant of the disclaimant survives the time of distribution, the disclaimed interest passes to those persons, including the state but excluding the disclaimant, and in such shares as would succeed to the transferor's intestate estate under the intestate succession law of the transferor's domicile had the transferor died at the time of distribution. However, if the transferor's surviving spouse is living but is remarried at the time of distribution, the transferor is deemed to have died unmarried at the time of distribution.

(d)Upon the disclaimer of a preceding interest, a future interest held by a person other than the disclaimant takes effect as if the disclaimant had died or ceased to exist immediately before the time of distribution, but a future interest held by the disclaimant is not accelerated in possession or enjoyment.

A disclaimer is irrevocable and binding for the disclaiming/renouncing party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits. If the interest arises out of jointly-owned property, seek legal advice as well.

(Montana DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Broadwater County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Broadwater County.

Our Promise

The documents you receive here will meet, or exceed, the Broadwater County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Broadwater County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kimberly J H.

August 1st, 2023

The Washington State Transfer on Death Deed I purchased worked perfectly.

Thank you for your feedback. We really appreciate it. Have a great day!

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

Richard L.

February 13th, 2021

Thanks for the complete and reasonably priced set of docs. I was specifically looking for and glad to find a current version of a TOD deed following the California extension.

Thank you for your feedback. We really appreciate it. Have a great day!

Helen M.

April 13th, 2023

All forms were exactly what I needed. Thank you Immediate, smoothly downloaded and printed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jessica F.

February 8th, 2020

Found exactly what I was looking for in a matter of minutes at a very reasonable fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nawal F.

June 1st, 2023

Friendly user

Thank you!

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Juanita B.

November 12th, 2020

Very easy and fast transaction. Thank you for complete set of forms needed for property transfer.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen H.

August 10th, 2019

EASY!!

Thank you!

William W.

April 22nd, 2022

No fuss-No muss. Very easy!

Thank you!

Donna B.

November 24th, 2020

Got exactly what I was looking for and for one price! Accessing the documents was super easy! Love this site and will definitely recommend to family and friends!

Thank you!

Valerie R.

October 7th, 2020

My expereince with Deeds.com was easy and efficent. Great way to efile documents during these trying times.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara K.

June 10th, 2023

Found what I needed quickly, easy website to maneuver. Like having a sample to look at along with instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth F.

February 14th, 2022

This was great other than exemption codes did not populate and I couldn't refer to it.

Thank you for your feedback. We really appreciate it. Have a great day!

Alberta P.

April 14th, 2019

form was east to use...instructions came in handy.

Thank you for your feedback. We really appreciate it. Have a great day!