Nemaha County Affidavit of Death Form

Nemaha County Affidavit of Death Form

Fill in the blank form formatted to comply with all recording and content requirements.

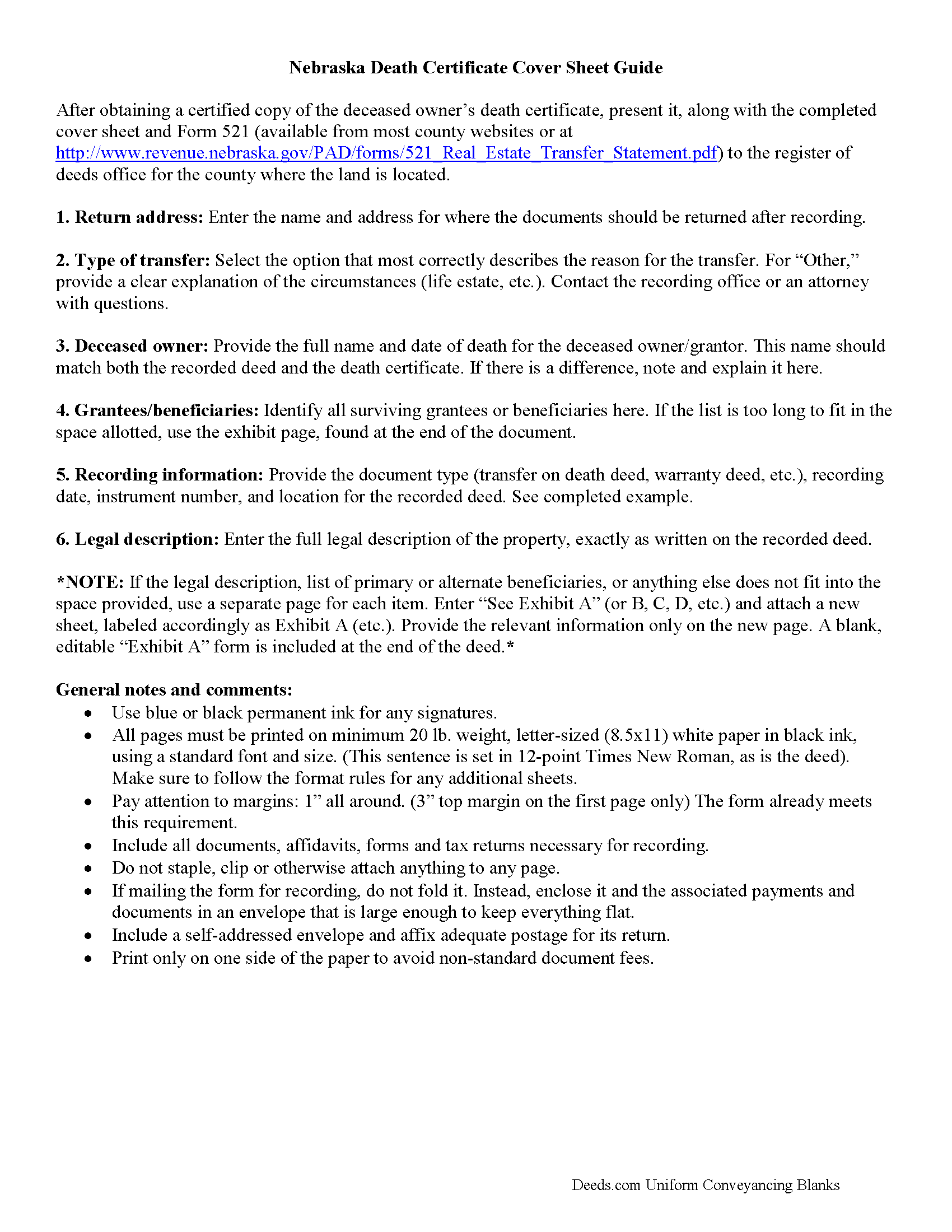

Nemaha County Affidavit of Death Guide

Line by line guide explaining every blank on the form.

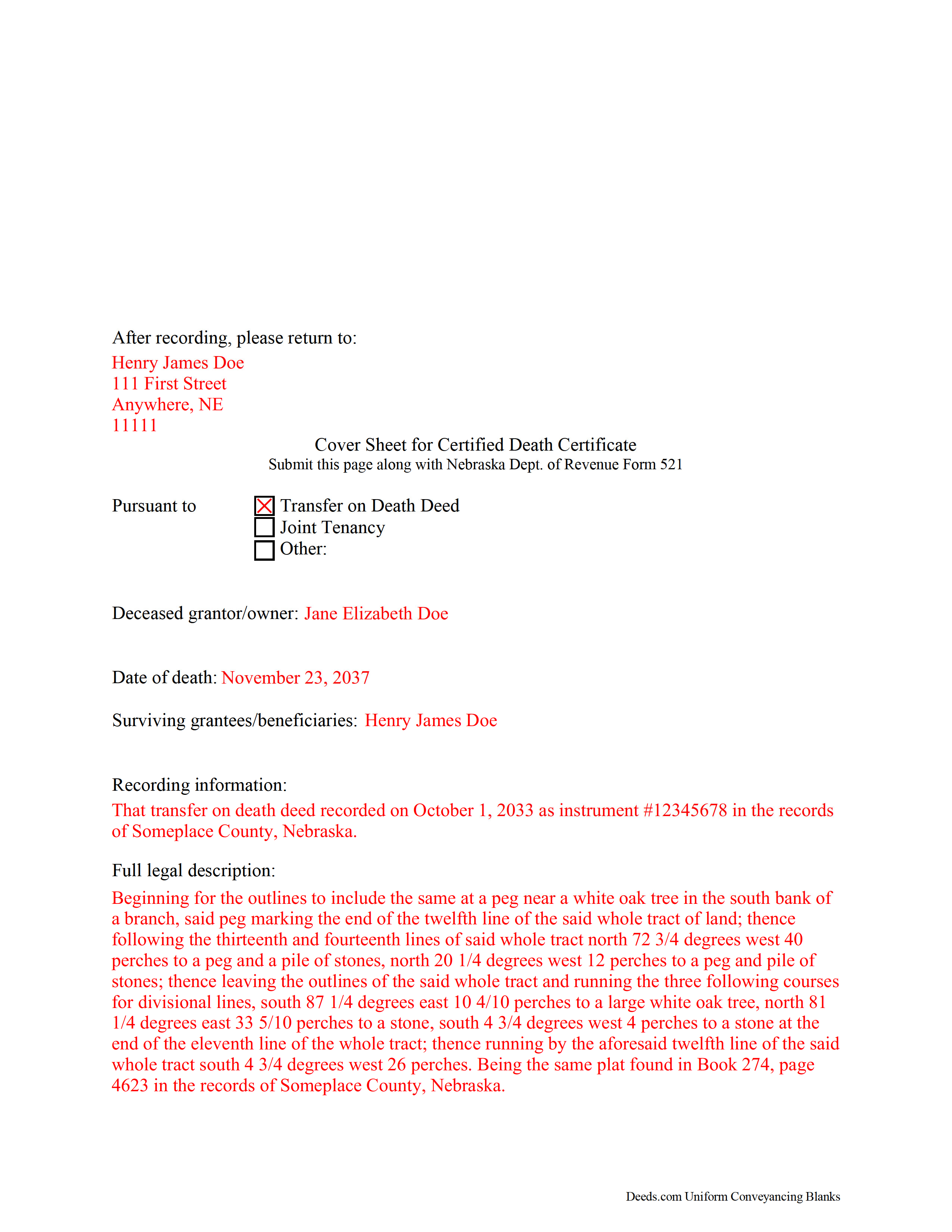

Nemaha County Completed Example of the Affidavit of Death Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Nemaha County documents included at no extra charge:

Where to Record Your Documents

Nemaha County Register of Deeds

Auburn, Nebraska 68305

Hours: 8:00am-5:00pm M-F

Phone: (402) 274-4213

Recording Tips for Nemaha County:

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Nemaha County

Properties in any of these areas use Nemaha County forms:

- Auburn

- Brock

- Brownville

- Johnson

- Julian

- Nemaha

- Peru

Hours, fees, requirements, and more for Nemaha County

How do I get my forms?

Forms are available for immediate download after payment. The Nemaha County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Nemaha County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Nemaha County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Nemaha County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Nemaha County?

Recording fees in Nemaha County vary. Contact the recorder's office at (402) 274-4213 for current fees.

Questions answered? Let's get started!

Confirming a Transfer of Nebraska Real Estate after Death of principle.

Under Nebraska Revised Statutes section 76-214, deeds and other instruments transferring title submitted for recording must be accompanied by a statement containing details about the transfer. Form 521, found on the websites for most counties or at http://www.revenue.nebraska.gov/PAD/forms/521_Real_Estate_Transfer_Statement.pdf meets most of these requirements.

Transfers resulting from a property owner's death, such as those under transfer on death deeds or joint tenancies, may require additional information (76-214(1), (2)). In those situations, including a cover sheet that contains the extra details assists the recording office and reduces the chance of delays in processing.

Each case is unique, so please contact an attorney with specific questions or for complex situations.

(Nebraska AOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Nemaha County to use these forms. Documents should be recorded at the office below.

This Affidavit of Death meets all recording requirements specific to Nemaha County.

Our Promise

The documents you receive here will meet, or exceed, the Nemaha County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Nemaha County Affidavit of Death form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Darrell J.

February 22nd, 2021

Easy to use, rapid response, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!

Kirk G.

October 23rd, 2021

Excellent! I will be back!

Thank you!

DOYCE F.

September 25th, 2019

Very helpful.Thank you

Thank you!

Allen M.

June 18th, 2022

Fast,quick and easy to work with. Not confusing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Danna F.

May 29th, 2020

VERY INFORMATIVE

Thank you!

Christine L.

May 17th, 2020

I was very pleased with your service. You got me the information I required within one day. Thank you!

Thank you!

Linda s.

October 10th, 2020

This was such an easy process and even tho you had to pay a $15 - to me it was well worth not having to drive downtown etc or take the risk of mailing the documents (fearing that they would get lost). I'll be using this from now on...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paula V.

April 15th, 2025

Fast, easy, helpful instructions. I’ll use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!

Terry M.

December 2nd, 2021

Application is not well laid out. I guess it does the job but leaves a lot to be desired. Hard to follow

Thank you for your feedback. We really appreciate it. Have a great day!

Yvette D.

January 15th, 2021

Excellent service and customer support. Thank you for your help and time.

Thank you!

Maria S.

February 26th, 2021

The website made it very easy to navigate and order what I needed. Thank you.

Thank you!

Dorothea H.

November 23rd, 2020

I am so glad I chose Deeds.com for my forms! The directions were clear and comprehensive, and the form allowed for customization far beyond the free forms I had looked at before. I highly recommend this site!

Thank you for your feedback. We really appreciate it. Have a great day!

Denise G.

May 7th, 2020

It would be helpful if an email was sent to notify you of any additional invoices needed, documents were accepted and/or recorded. It is not always convenient to check your website on a daily basis to determine the status of the requesting recordings.

Thank you for your feedback. We really appreciate it. Have a great day!

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!