Merrick County Assignment of Deed of Trust Form

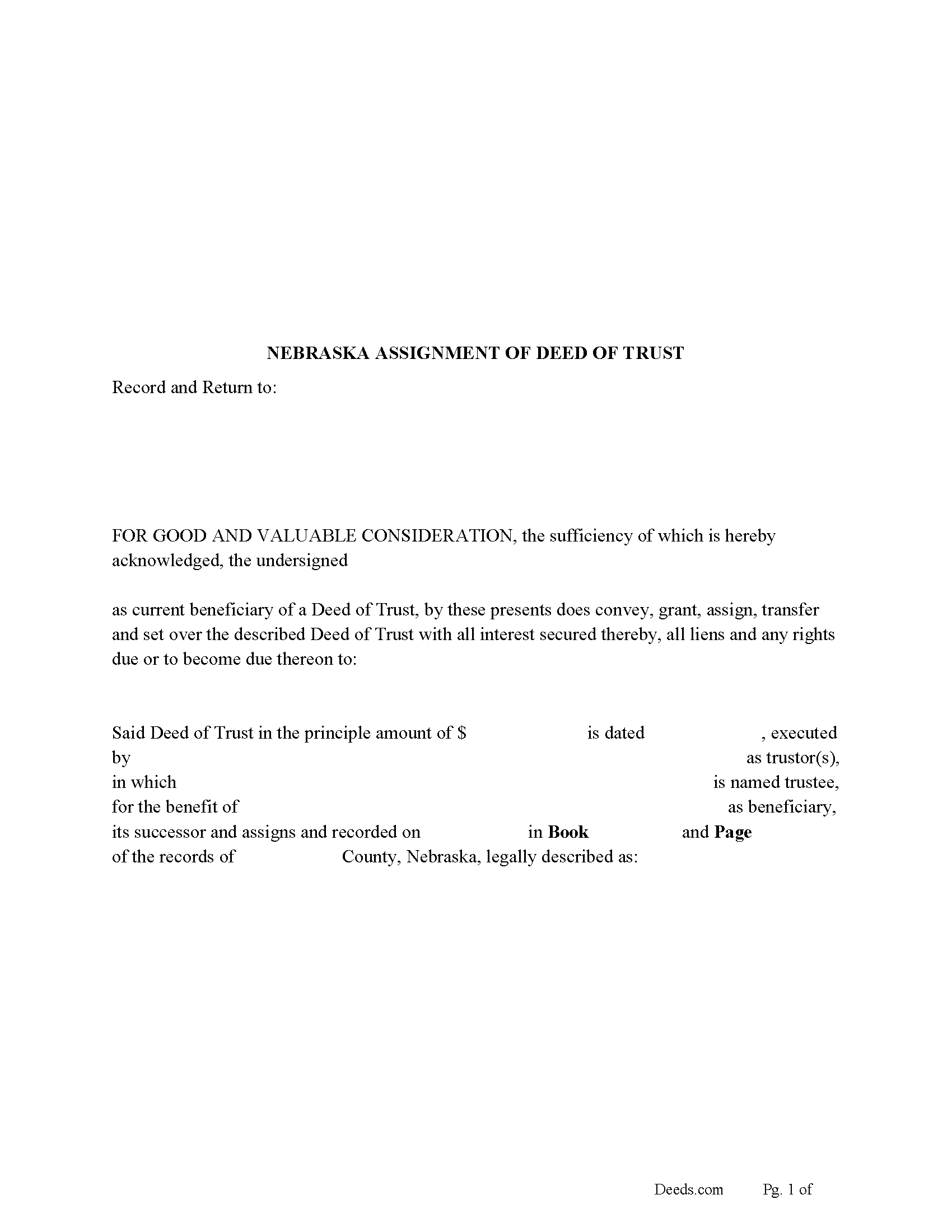

Merrick County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

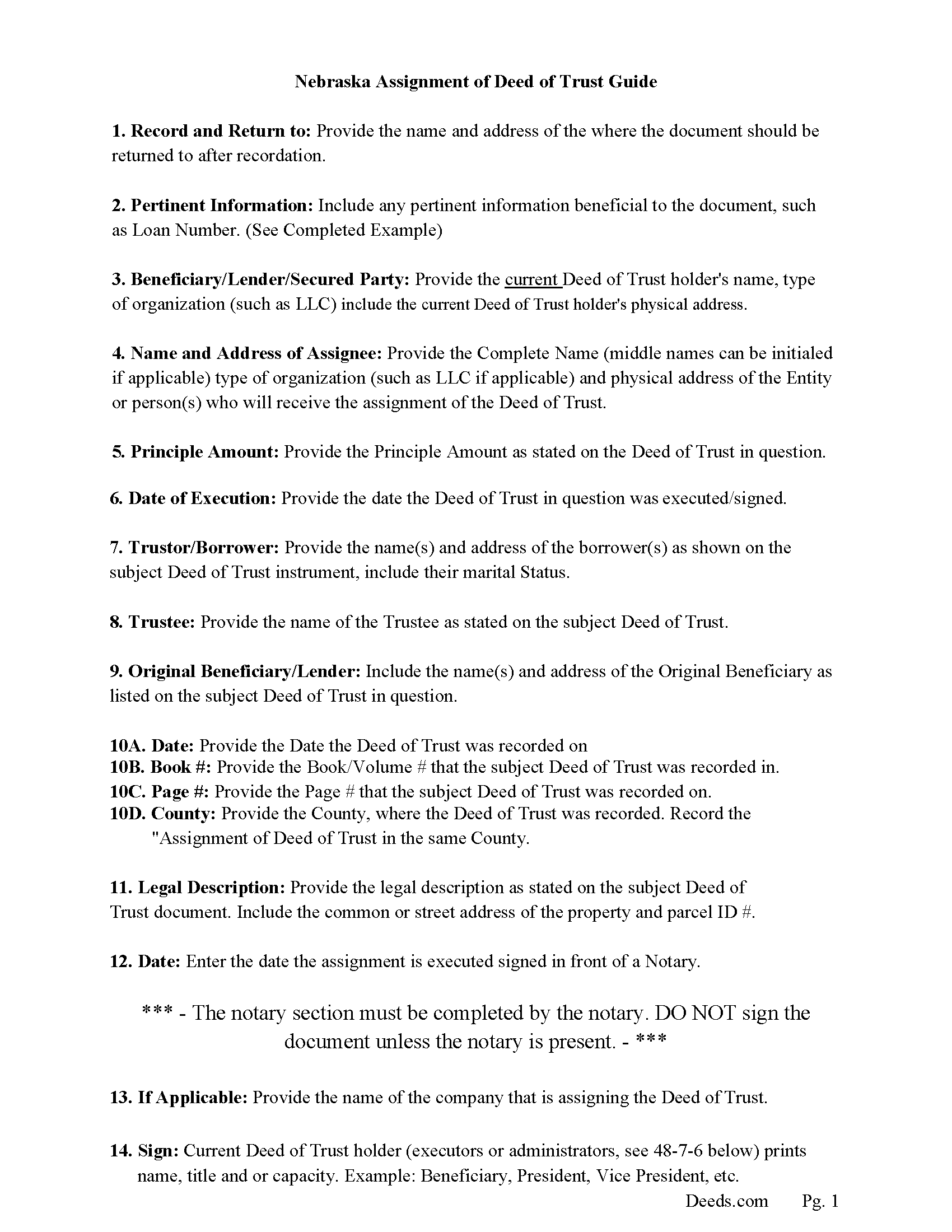

Merrick County Assignment of Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

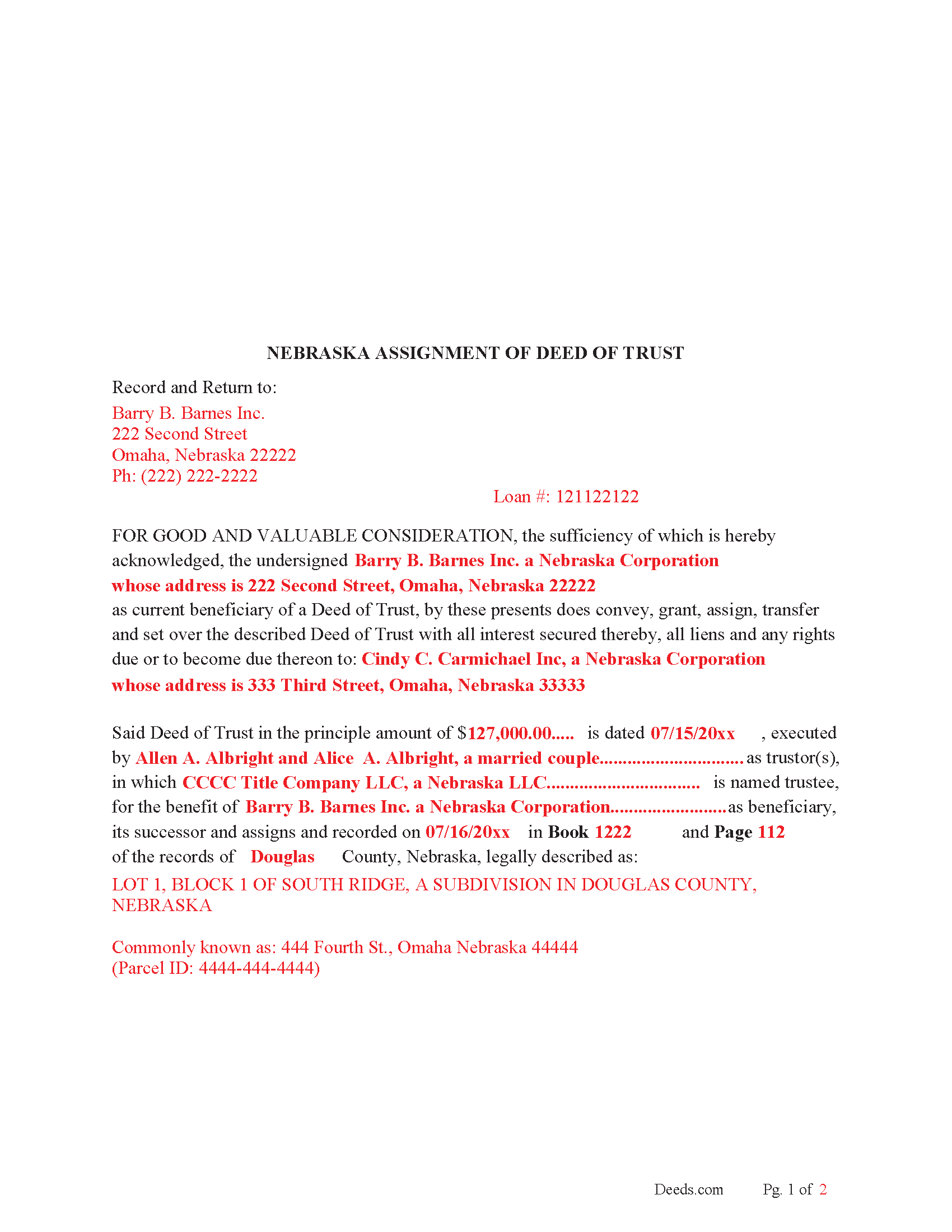

Merrick County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

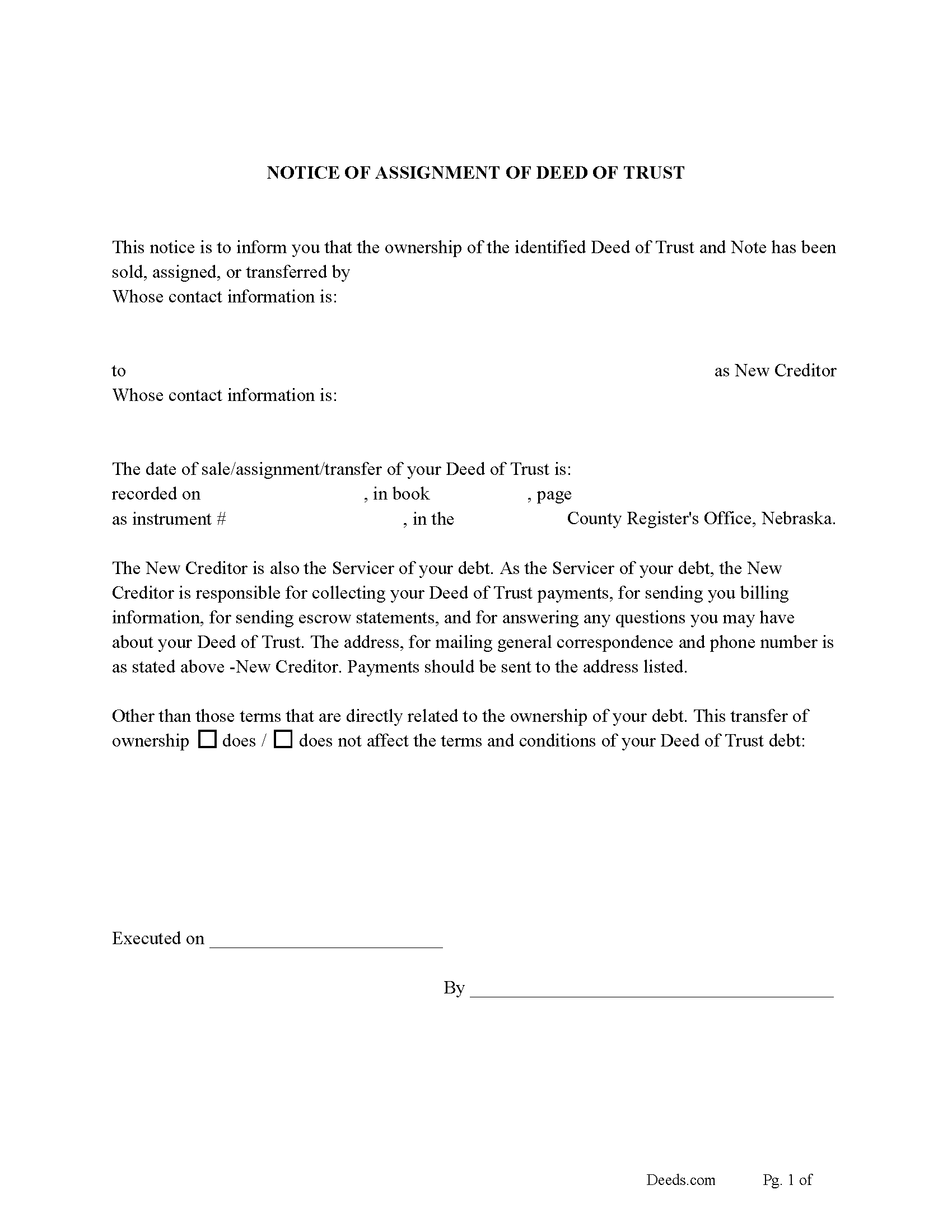

Merrick County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

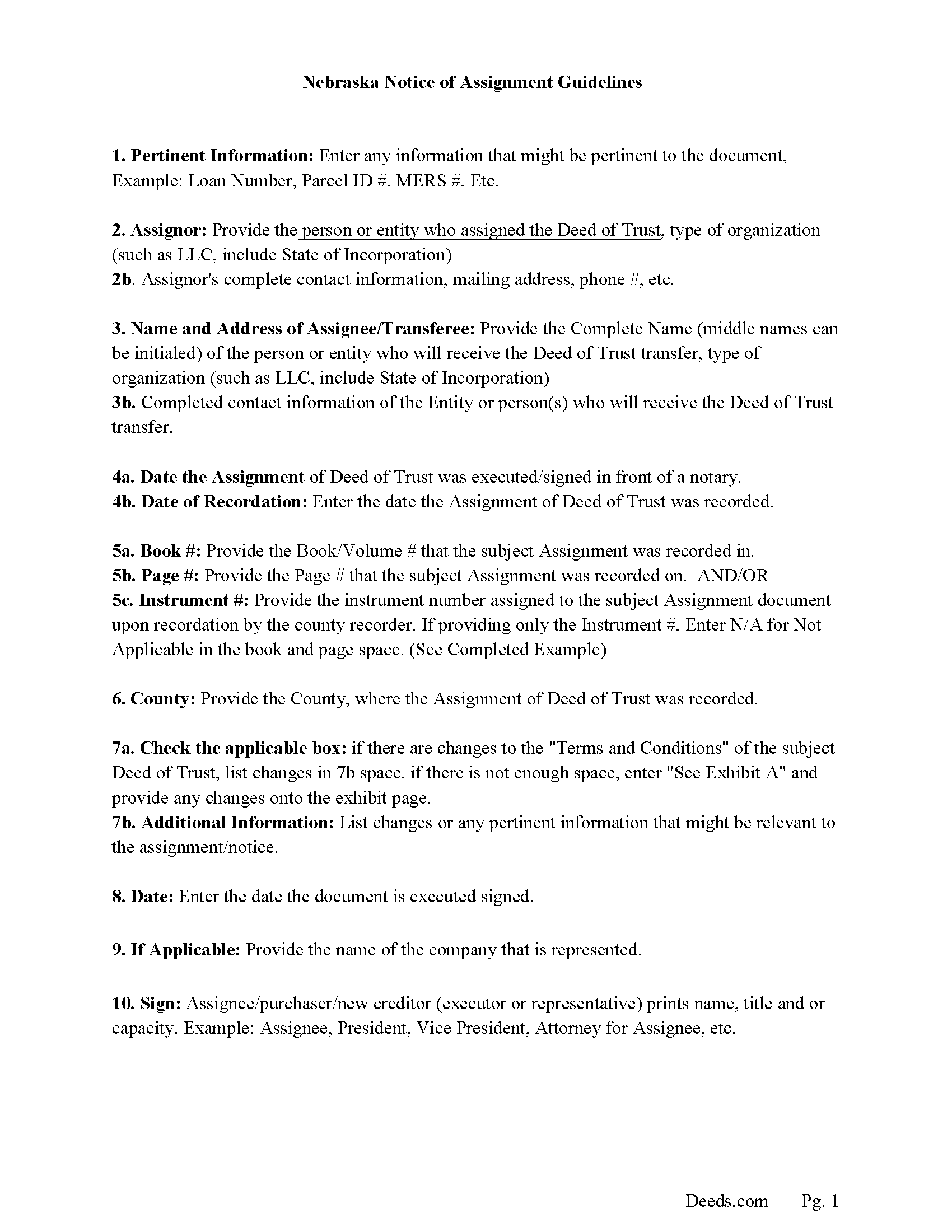

Merrick County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

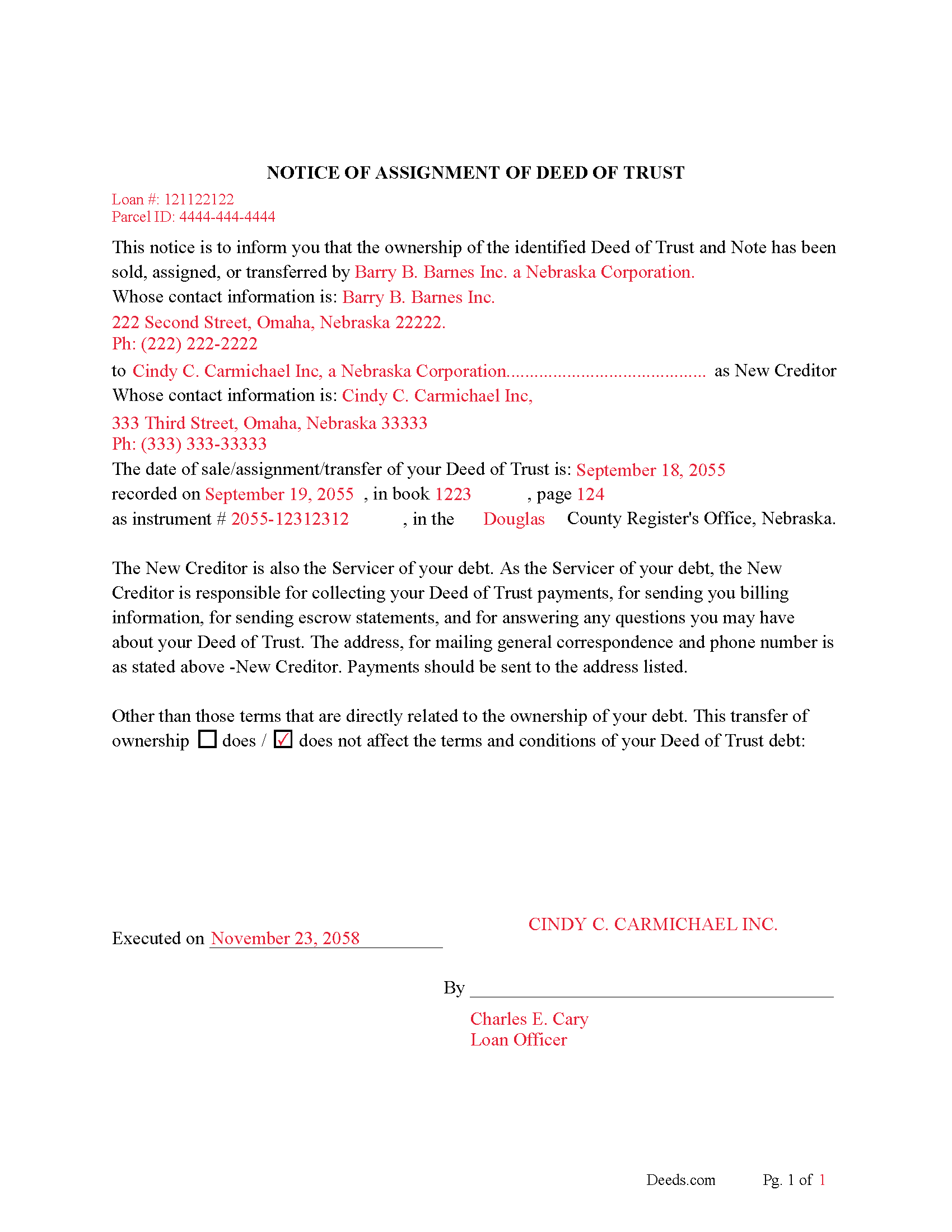

Merrick County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Merrick County documents included at no extra charge:

Where to Record Your Documents

Merrick County Register of Deeds

Central City, Nebraska 68826

Hours: 8:00am-5:00pm M-F

Phone: (308) 946-2881

Recording Tips for Merrick County:

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Merrick County

Properties in any of these areas use Merrick County forms:

- Archer

- Central City

- Chapman

- Clarks

- Palmer

- Silver Creek

Hours, fees, requirements, and more for Merrick County

How do I get my forms?

Forms are available for immediate download after payment. The Merrick County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Merrick County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Merrick County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Merrick County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Merrick County?

Recording fees in Merrick County vary. Contact the recorder's office at (308) 946-2881 for current fees.

Questions answered? Let's get started!

A Deed of Trust assignment, also referred to as an "Assignment of Deed of Trust", occurs when the beneficiary/lender of the loan transfers their loan obligations to a third party. The lender usually assigns a Deed of Trust by selling it to a new bank or lender. This form can be used by the current beneficiary/lender even if the Deed of Trust in question states a different beneficiary/lender.

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Nebraska Assignment of DOT Package includes form, guidelines, and completed example) For use in Nebraska only.

Important: Your property must be located in Merrick County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Merrick County.

Our Promise

The documents you receive here will meet, or exceed, the Merrick County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Merrick County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Teresa R.

February 13th, 2020

Zero problems, ended up with quality documents. Will use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda L.

July 7th, 2021

The service was excellent. The fee to use Deeds was more than I expected however, but the service was excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roy S.

January 5th, 2022

The website is easy to maneuver and information needed was readily available. Thanks so much!

Thank you!

William S.

August 5th, 2020

Assuming that the downloads went without a hitch, the system was easy to follow and execute.

Thank you!

Joy V.

December 24th, 2018

Very helpful and efficient!

Thank you for your feedback. We really appreciate it. Have a great day!

Raecita H.

March 19th, 2022

This was the first time I had ever had to fill out a Warranty Deed, so if it was not for your example form on how to fill one out, I would be still be here completely lost. I had originally gone to another site for a Warranty Deed & they wanted double the amount of your price & their website had no examples forms. I am so happy with your site & service. Thank you for giving us the opportunity to be able to download the forms as much as we need to because as many mistakes I made,I had to print quite a few to be able to get it done right.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dwayne H.

November 3rd, 2020

The Oregon TODD transfer on death deed template worked great and was easy to use. They had instructions and a guide that had good pointers to filling everything out. It took about 2 weeks to mail in my filled TODD and receive it back from the county with their stamp. Would definitely use this service for other documents

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sunny S.

November 23rd, 2020

Easy to use and quick turnaround. I would use again.

Thank you!

ROBERT P.

August 26th, 2022

Got what I needed

Thank you!

Gertrude F.

April 24th, 2022

I like that DEEDS.com has a variety of forms tht I may need. However, I was disappointed that I am not able to save the PDF forms after I fill in the spaces. If I need to edit anything, I have to go back to the blank form and redo the whole thing. Perhap I am doing something wrong.

Thank you!

Yehong M.

November 27th, 2019

everything worked well,

Thank you!

Karl H.

January 5th, 2021

Still in process, but it is well explained. I would recommend it to anyone in Texas.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda M.

February 25th, 2022

Quick easy

Thank you!

Tanya B.

May 4th, 2022

Very convenient way to record documents without leaving the office. Responses to any questions have always been very quick. Would recommend using the site to anyone who needs to record documents and wants to save valuable time.

Thank you!

David Q.

April 14th, 2020

Very easy...great service.

Thank you!