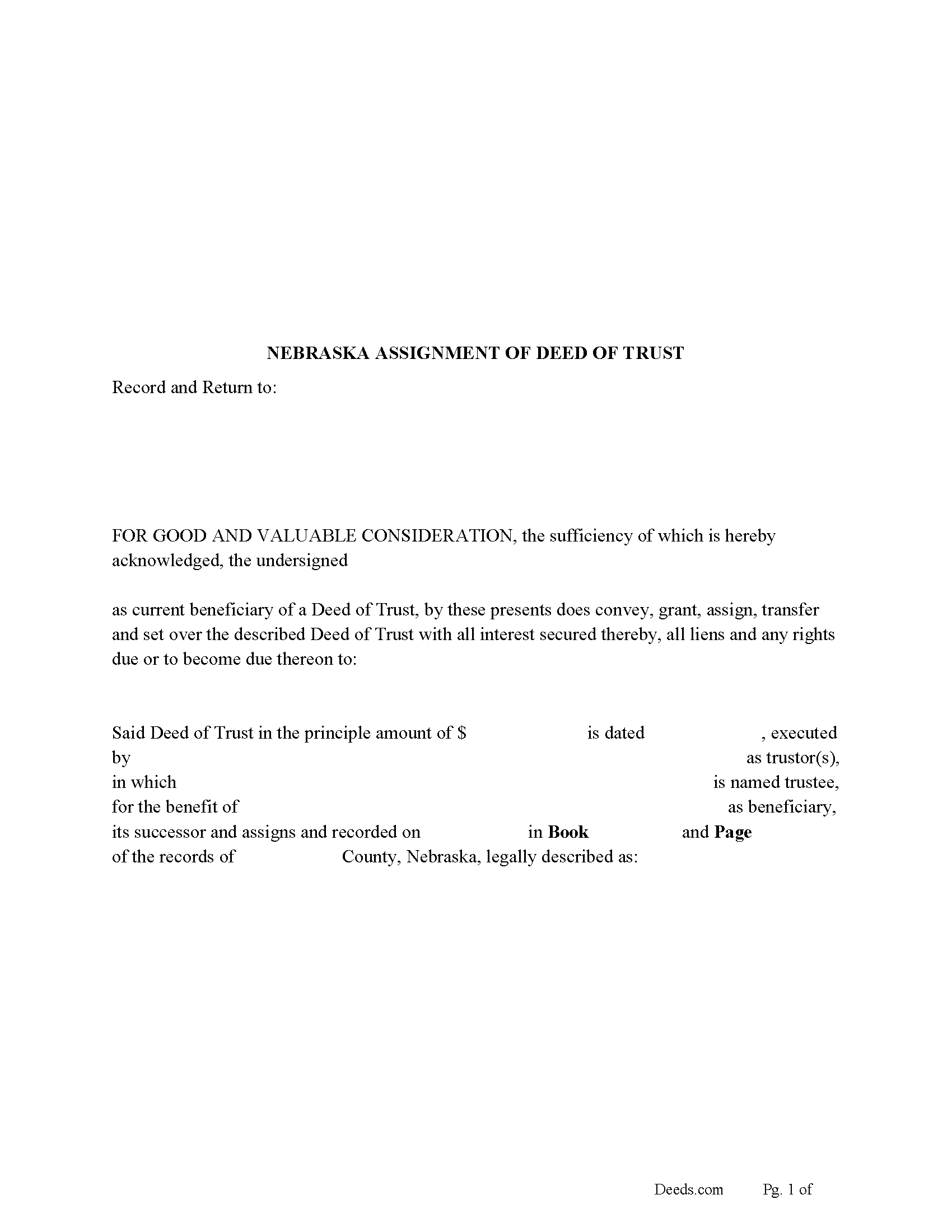

Scotts Bluff County Assignment of Deed of Trust Form

Scotts Bluff County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

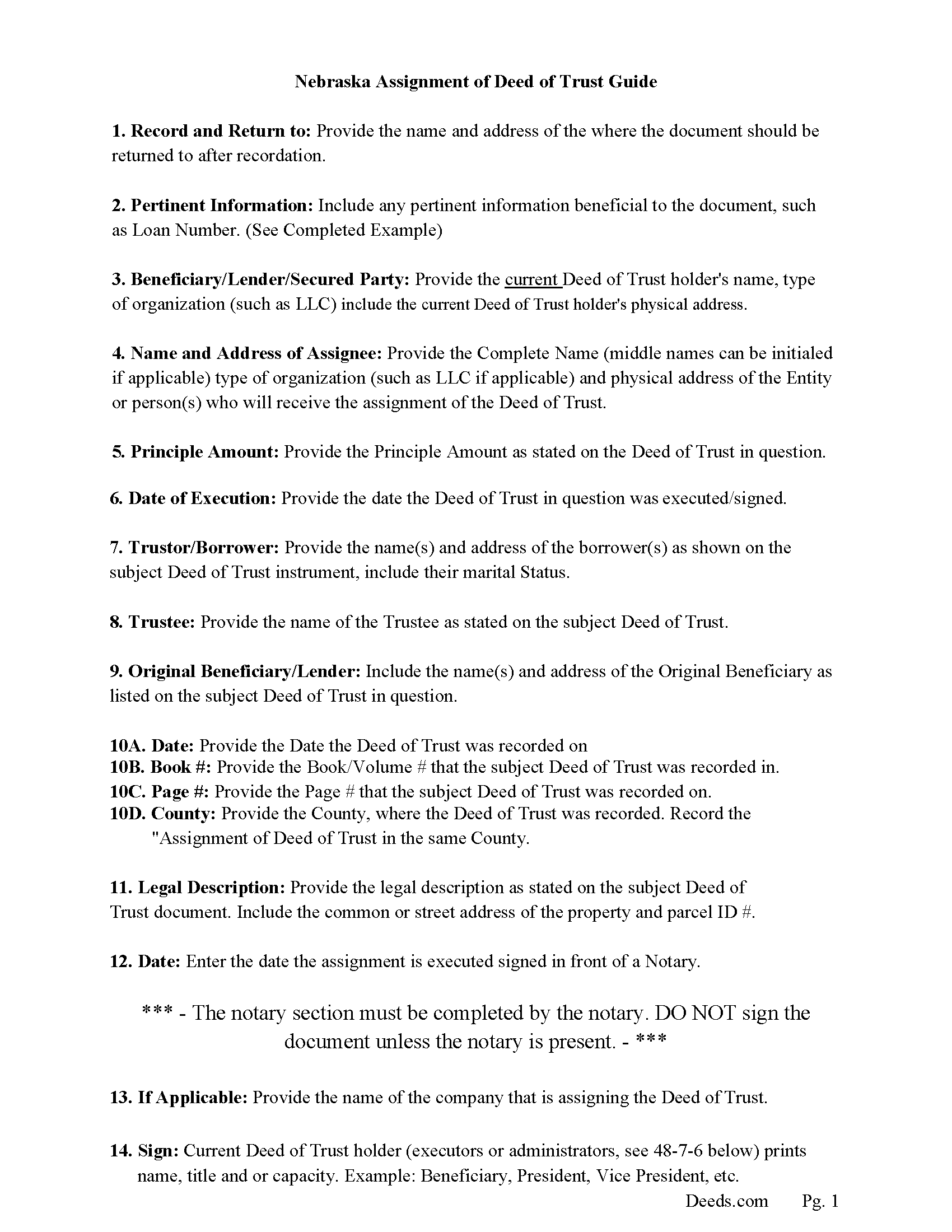

Scotts Bluff County Assignment of Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

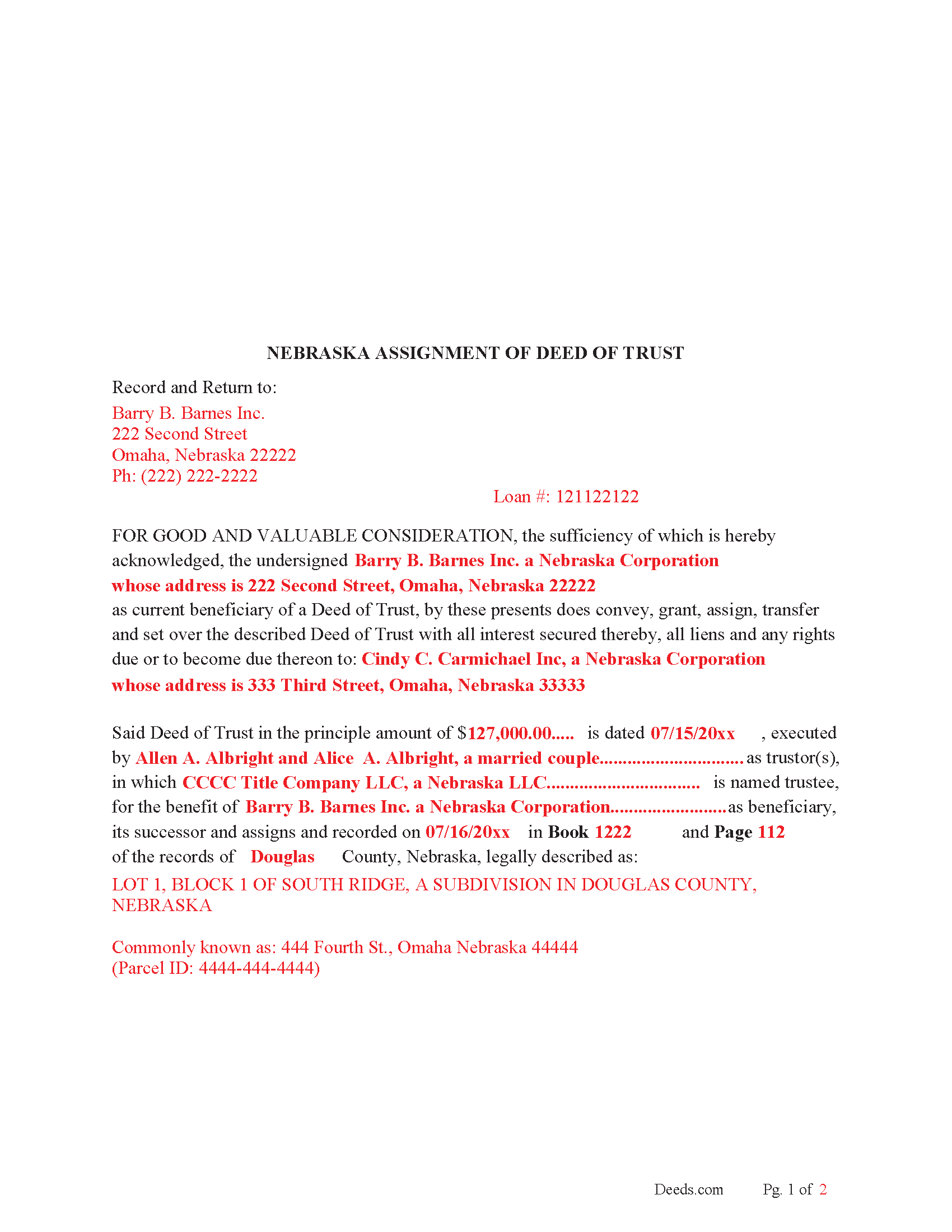

Scotts Bluff County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

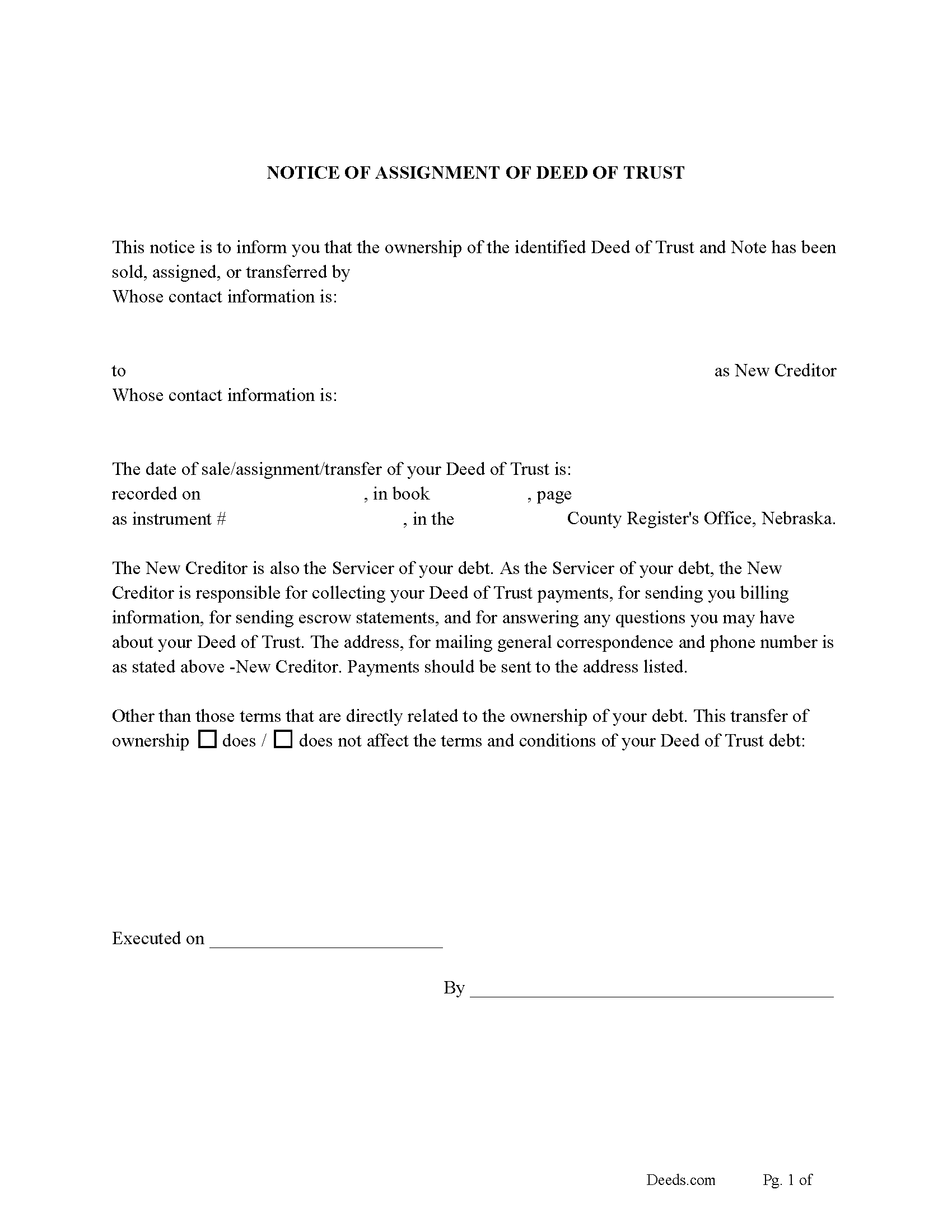

Scotts Bluff County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

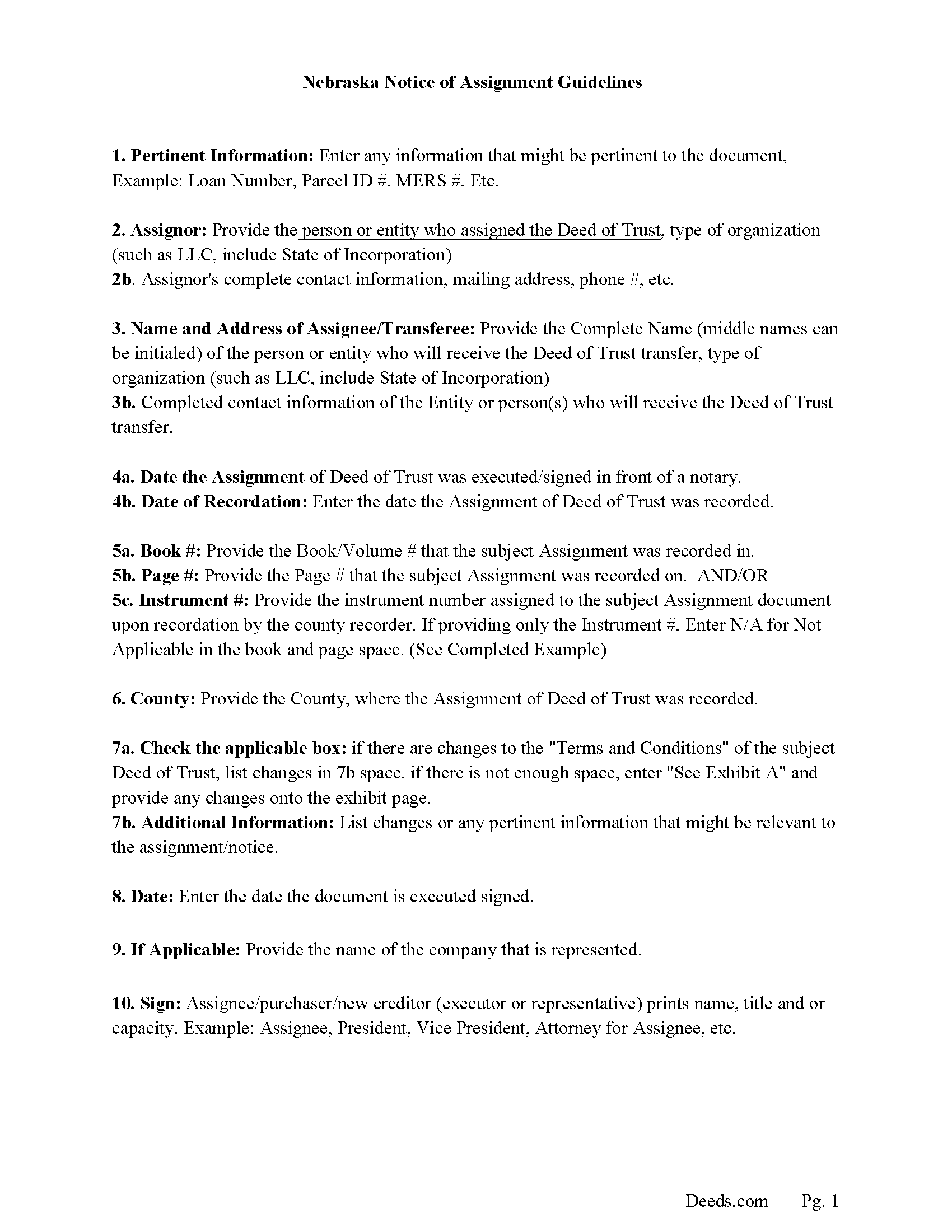

Scotts Bluff County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

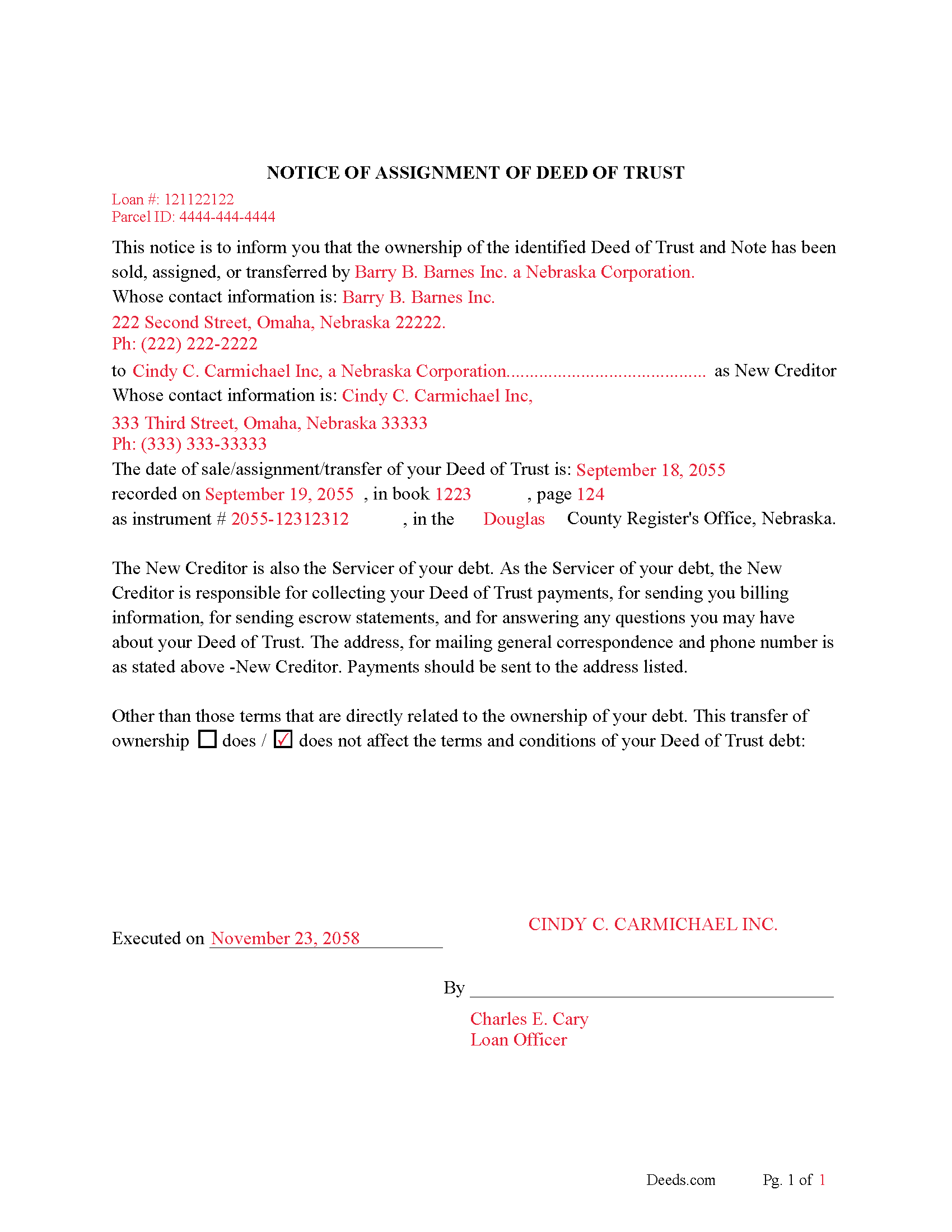

Scotts Bluff County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Scotts Bluff County documents included at no extra charge:

Where to Record Your Documents

Scotts Bluff County Register of Deeds

Gering, Nebraska 69341

Hours: 8:00am to 4:30pm M-F

Phone: 308-436-6600

Recording Tips for Scotts Bluff County:

- Ask if they accept credit cards - many offices are cash/check only

- Make copies of your documents before recording - keep originals safe

- Have the property address and parcel number ready

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Scotts Bluff County

Properties in any of these areas use Scotts Bluff County forms:

- Gering

- Lyman

- Mcgrew

- Melbeta

- Minatare

- Mitchell

- Morrill

- Scottsbluff

Hours, fees, requirements, and more for Scotts Bluff County

How do I get my forms?

Forms are available for immediate download after payment. The Scotts Bluff County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Scotts Bluff County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Scotts Bluff County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Scotts Bluff County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Scotts Bluff County?

Recording fees in Scotts Bluff County vary. Contact the recorder's office at 308-436-6600 for current fees.

Questions answered? Let's get started!

A Deed of Trust assignment, also referred to as an "Assignment of Deed of Trust", occurs when the beneficiary/lender of the loan transfers their loan obligations to a third party. The lender usually assigns a Deed of Trust by selling it to a new bank or lender. This form can be used by the current beneficiary/lender even if the Deed of Trust in question states a different beneficiary/lender.

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their Deed of Trust has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(Nebraska Assignment of DOT Package includes form, guidelines, and completed example) For use in Nebraska only.

Important: Your property must be located in Scotts Bluff County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Scotts Bluff County.

Our Promise

The documents you receive here will meet, or exceed, the Scotts Bluff County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Scotts Bluff County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Lydia E.

December 16th, 2021

Very intuitive to use and comprehensive enough for the most complex of cases.

Thank you!

tamica l.

March 31st, 2022

Excellent Service! Fast and friendly. Thank you will use again!

Thank you!

Michael D.

June 14th, 2024

Quick and easy!

Thank you!

Desiree T.

September 4th, 2020

In a world where "immediate satisfaction" takes too long, Deeds provided exceptionally satisfying service. Answered all of my questions quickly, and had my document recorded within one day. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph T.

February 6th, 2019

I downloaded the wrong form, how do I change this, or can I?

Sorry to hear that. As a one time courtesy we have canceled your order and payment for the documents you ordered in error. Have a great day.

crystal l.

January 16th, 2019

Another legal professional directed me to this site. The best advice I've received from the legal profession! Forms were instantly available, easily printed & exactly what I needed at a cost that was more than affordable!! I will definitely be back again!!

Thank you Crystal and please thank your associate for us. Have a fantastic day!

Jim H.

August 13th, 2020

Well written form, and the guidance document and example supplied were very helpful.

Thank you!

Donna R.

November 22nd, 2021

Hi! Is there a setting that I can click on that will make sure I'm notified via email when an update is made to my requests? Thank you!

Thanks for your feedback, we'll have someone look into it.

Tracey T.

July 19th, 2019

Lots of great information. Might need to view it again but found it very helpful!

Thank you!

Kimberly H.

March 27th, 2020

Very fast and easy to use!

Thank you Kimberly. Have a fantastic day.

Kimberly M.

December 5th, 2019

I love Deeds.com. I've never had any issues with the service, getting documents back, etc.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura L.

June 17th, 2025

Used a form from this service. Best part about these forms is that they don't let you get in trouble by removing or changing things that should not be changed. It's easy to look at something and think why is this margin so big, why is this field so small and want to change it only to find out it is incredibly important. That's why they are the deed document pros.

Thank you for the thoughtful review! We're so glad to hear you found our forms reliable and well-structured. It’s true—what might look like an odd margin or a small field is often there for a very specific legal or recording reason. We’ve seen how small changes can lead to big headaches, which is why we design our documents to be both user-friendly and compliant with strict recording standards. We really appreciate you recognizing the care that goes into each one. Thanks again for choosing us!

Dominick D.

October 21st, 2020

Deed.com was easy to work with, not just a website, they have real people that speak to you. They were extremely helpful with a VERY difficult Northeast county. They made the process smooth and effortless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen P.

March 19th, 2021

Very easy to use.

Thank you!

Paul N.

September 18th, 2022

Had what I needed, service was excellent.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!