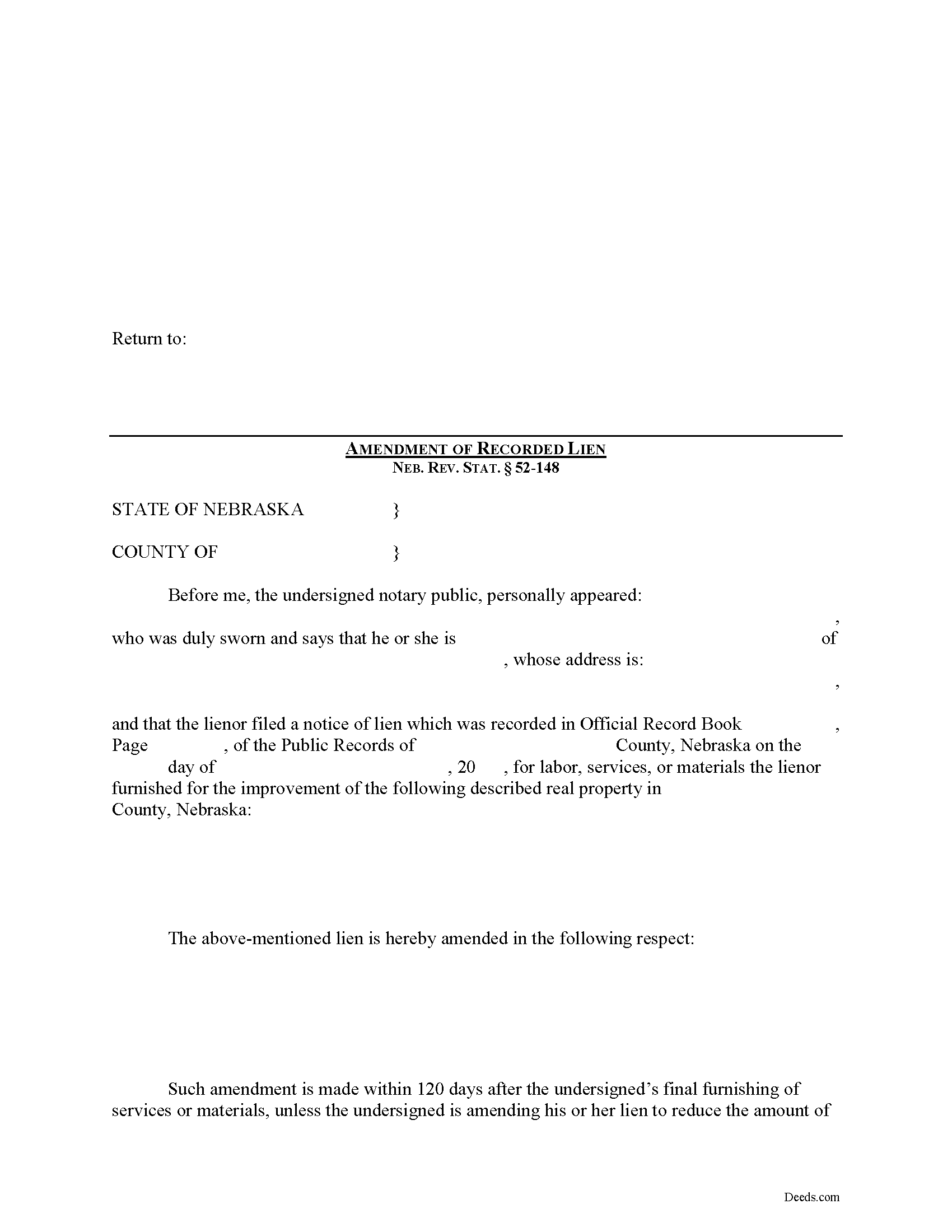

Douglas County Construction Lien Amendment Form

Douglas County Construction Lien Amendment Form

Fill in the blank Construction Lien Amendment form formatted to comply with all Nebraska recording and content requirements.

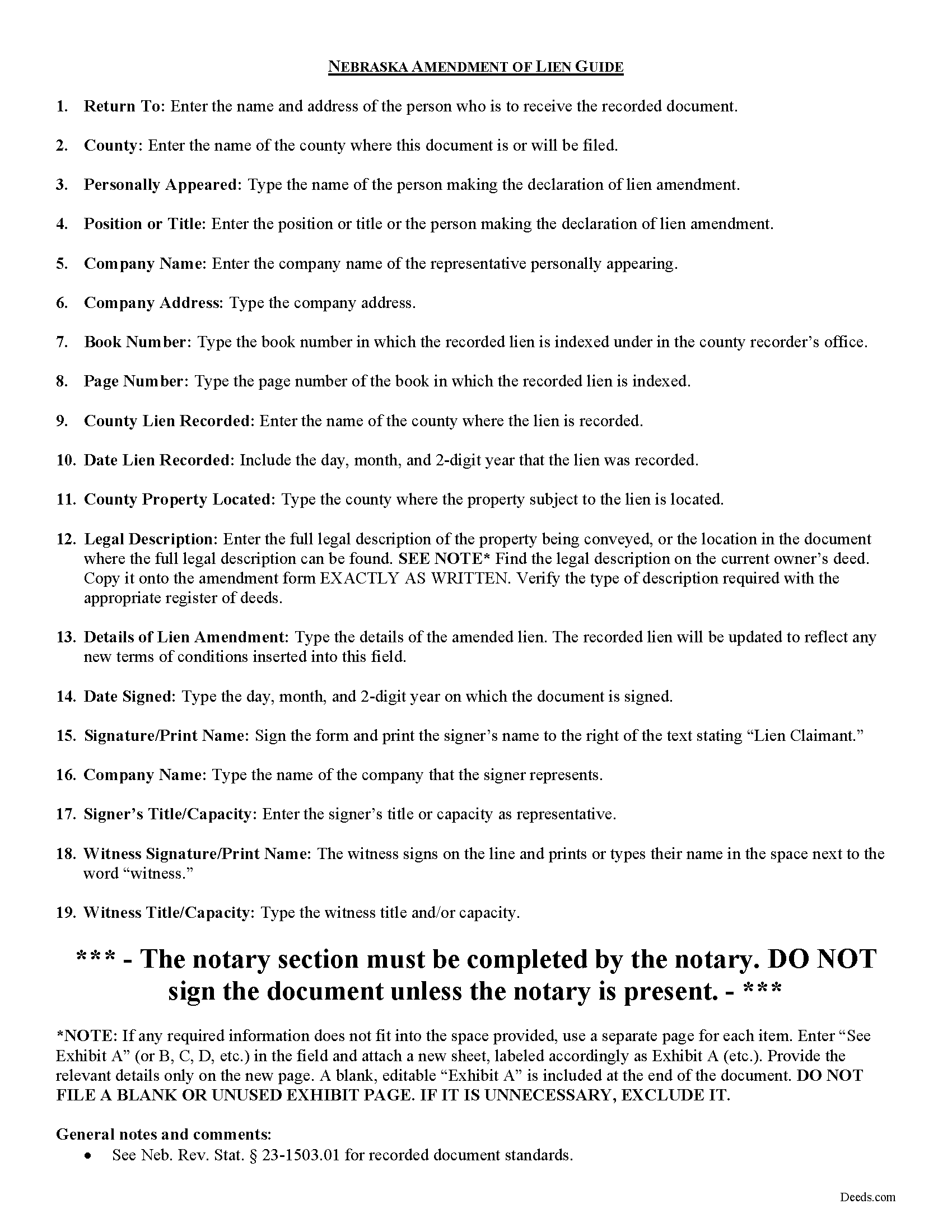

Douglas County Construction Lien Amendment Guide

Line by line guide explaining every blank on the form.

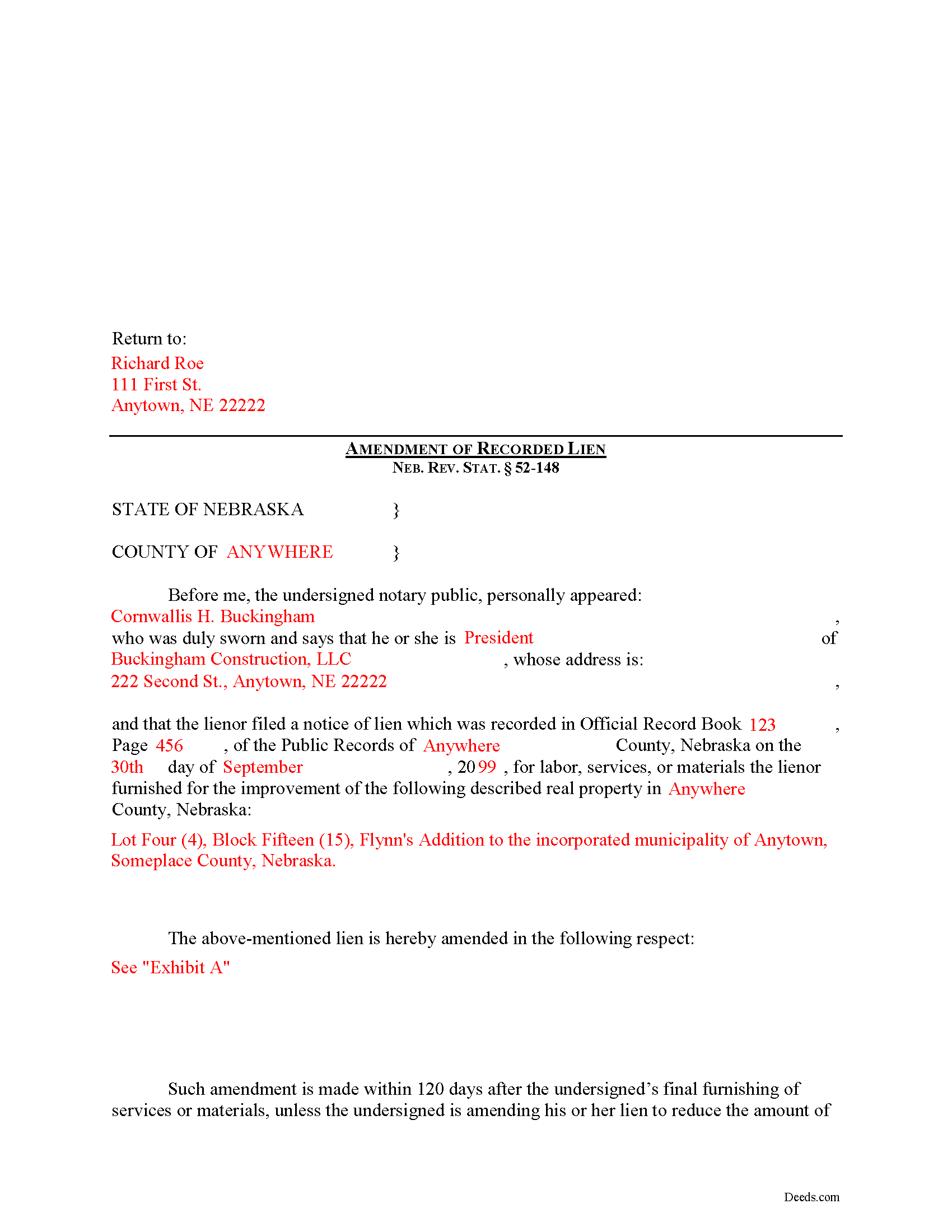

Douglas County Completed Example of the Construction Lien Amendment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Douglas County documents included at no extra charge:

Where to Record Your Documents

Douglas County Register of Deeds

Omaha, Nebraska 68183

Hours: 8:00am to 4:30pm M-F / Filing until 3:15pm

Phone: (402) 444-7159

Recording Tips for Douglas County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Douglas County

Properties in any of these areas use Douglas County forms:

- Bennington

- Boys Town

- Elkhorn

- Omaha

- Valley

- Waterloo

Hours, fees, requirements, and more for Douglas County

How do I get my forms?

Forms are available for immediate download after payment. The Douglas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Douglas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Douglas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Douglas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Douglas County?

Recording fees in Douglas County vary. Contact the recorder's office at (402) 444-7159 for current fees.

Questions answered? Let's get started!

Amending a Construction Lien in Nebraska

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

Once a lien is recorded, there may be a reason to modify it later on. Should a modification become necessary, the claimant must file an Amendment of Recorded Lien.

A recorded lien may be amended by an additional recording at any time during the period allowed for recording the original lien. Neb. Rev. Stat. 52-148(1). An amendment adding real estate or increasing the amount of lien claimed is effective as to the additional real estate or increased amount only from the time the amendment is recorded. Id.

After the period allowed for recording the original lien, it may be amended for the purpose of: (a) Reducing the amount of the lien; (b) Reducing the real estate against which the lien is claimed; or (c) Making an apportionment of the lien among lots of a platted subdivision of record. Neb. Rev. Stat. 52-148(2).

The amendment states the recording location and date of recording of the notice of lien being amended and sets out the respects in which it is being amended. Neb. Rev. Stat. 52-148(3). It identifies the parties, the location of the subject property, and must also meet state and local standards for recorded documents.

This article is offered for informational purposes only and is not legal advice. This information not be relied upon as a substitute for speaking with an attorney. Please speak with a Nebraska attorney familiar with lien laws for any questions regarding amending a construction lien.

Important: Your property must be located in Douglas County to use these forms. Documents should be recorded at the office below.

This Construction Lien Amendment meets all recording requirements specific to Douglas County.

Our Promise

The documents you receive here will meet, or exceed, the Douglas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Douglas County Construction Lien Amendment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Stephen D.

January 15th, 2019

Very good hope to use in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeff R.

December 4th, 2020

Great company. I had some issues with what I had prepared on my end but my contact at Deeds.com helped me with modifying the documents and submitted them successfully. Thanks for going the extra mile

Thank you for your feedback. We really appreciate it. Have a great day!

Billie G.

October 14th, 2021

Loved this service! It was quick, easy and effective! I'll definitely be using them again!

Thank you!

Leticia A.

January 20th, 2020

Down to the point,covers every angle with great tips:Don't forget Probate.

Thank you!

Heidi S.

August 5th, 2021

I had prompt service thank you

Thank you!

Don M.

September 9th, 2021

I find the site very difficult to nagitagte.

Sorry to hear that Don, we’ll try harder.

Mike H.

February 11th, 2021

Great

Thank you!

Frank B.

March 16th, 2023

Great website, super easy to use, user friendly to navigate. Will definitely use for future needs, and will definitely refer to other customers. F. Betancourt Texas

Thank you!

D F.

March 3rd, 2020

Find what i was looking for, and got the answers to my questions!! Thank you

Thank you!

Susan H.

September 1st, 2020

Best idea ever for completing an on-line government form. And it came with instructions!!!!! Thank you, Gadsden County.

Thank you!

John K.

September 3rd, 2021

The website was very easy to work. The documents were just what I needed and everything that my state and county required.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn N.

March 21st, 2023

It worked! It was exactly what I needed and was easily understood.

Thank you!

Todd J.

February 4th, 2021

Super Easy!

Thank you!

Tierre J.

January 3rd, 2019

I put in two orders. I did not get any results from either order and I am still waiting for my refunds.

Thank you for your feedback. Sorry we were not able to pull the information you requested. We reviewed your account and the payment voids were processed as your were notified. Sometimes, depending on your financial institution, it can take a few days for the pending charges to fall off of your statement reporting.

Kimberly W.

May 11th, 2022

Thank you for making this process so convenient.

Thank you for your feedback. We really appreciate it. Have a great day!