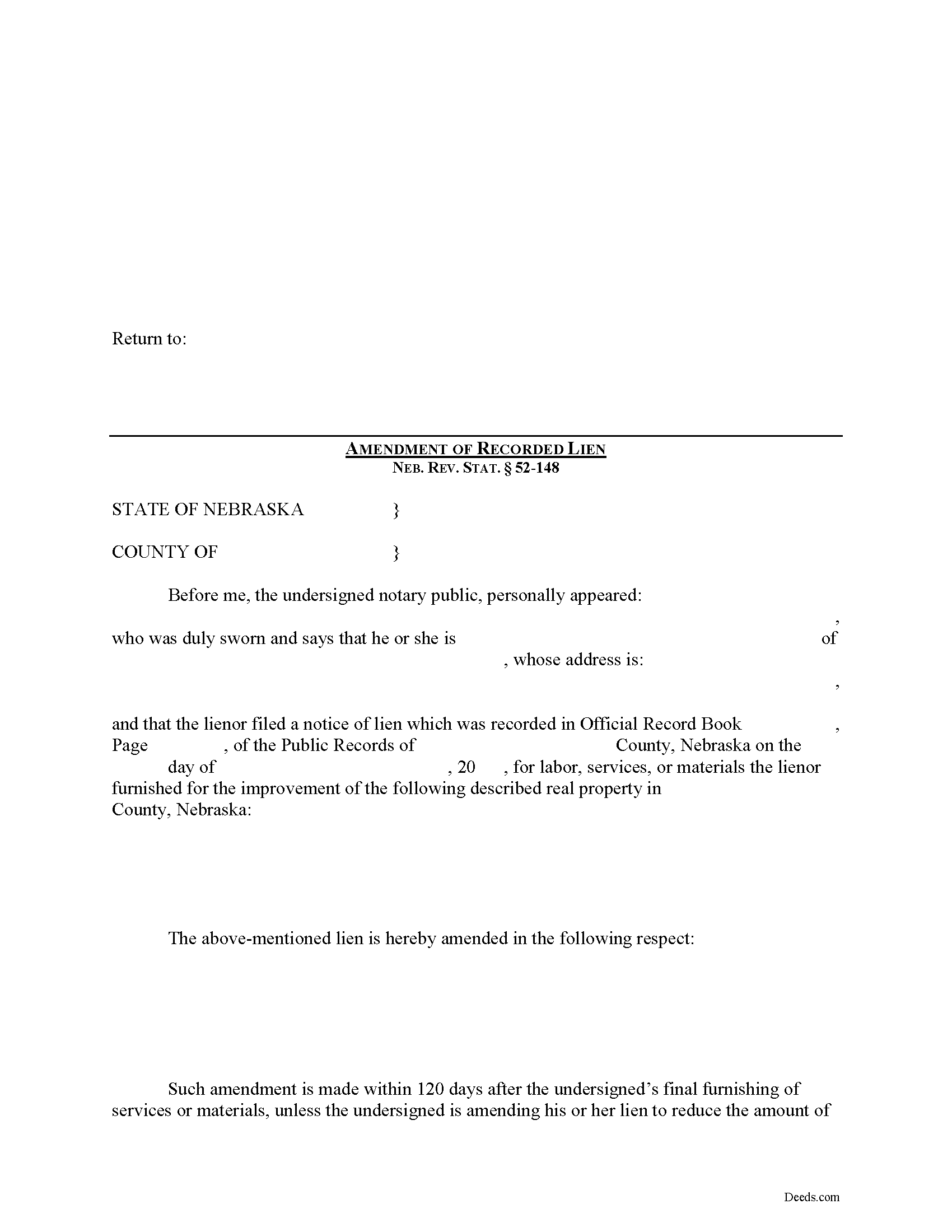

Gage County Construction Lien Amendment Form

Gage County Construction Lien Amendment Form

Fill in the blank Construction Lien Amendment form formatted to comply with all Nebraska recording and content requirements.

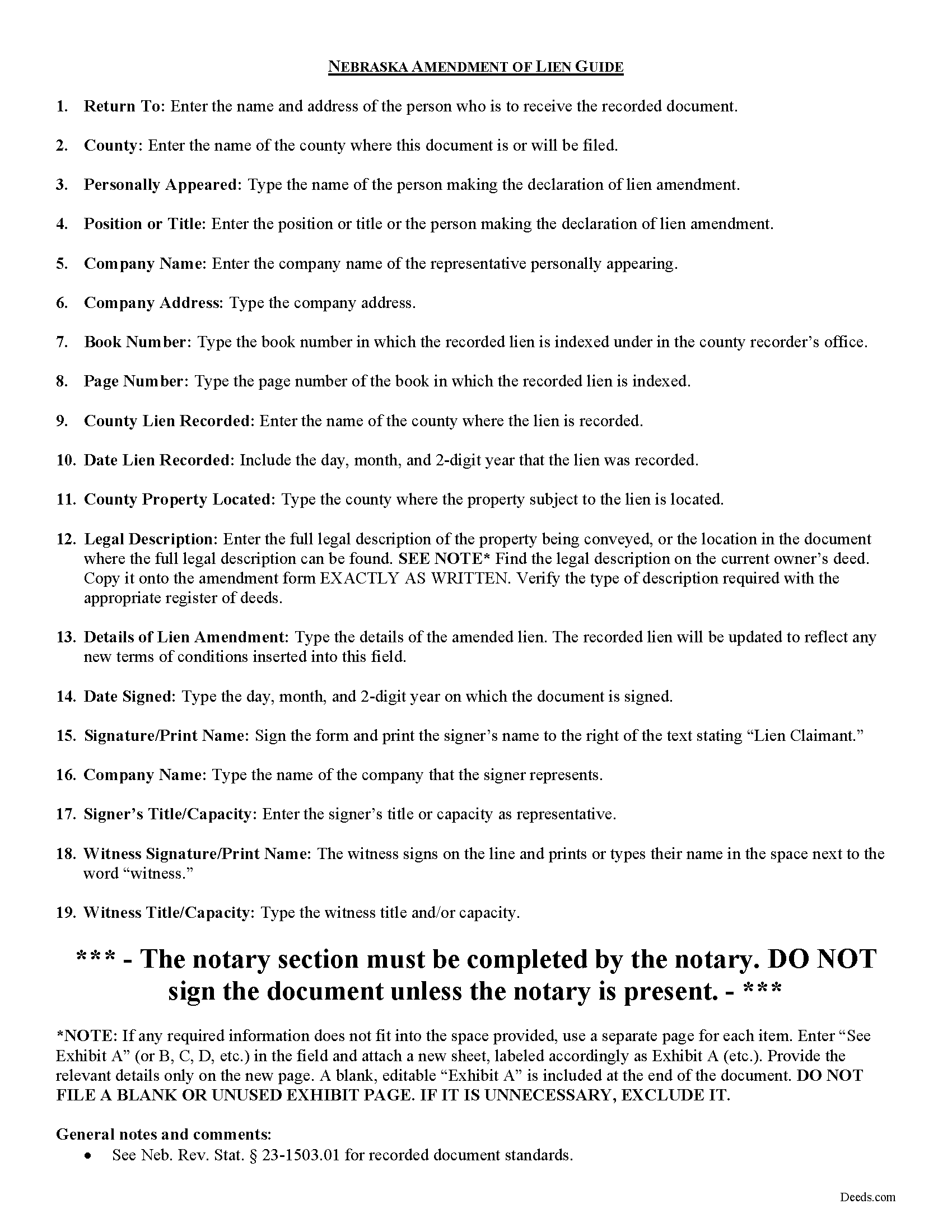

Gage County Construction Lien Amendment Guide

Line by line guide explaining every blank on the form.

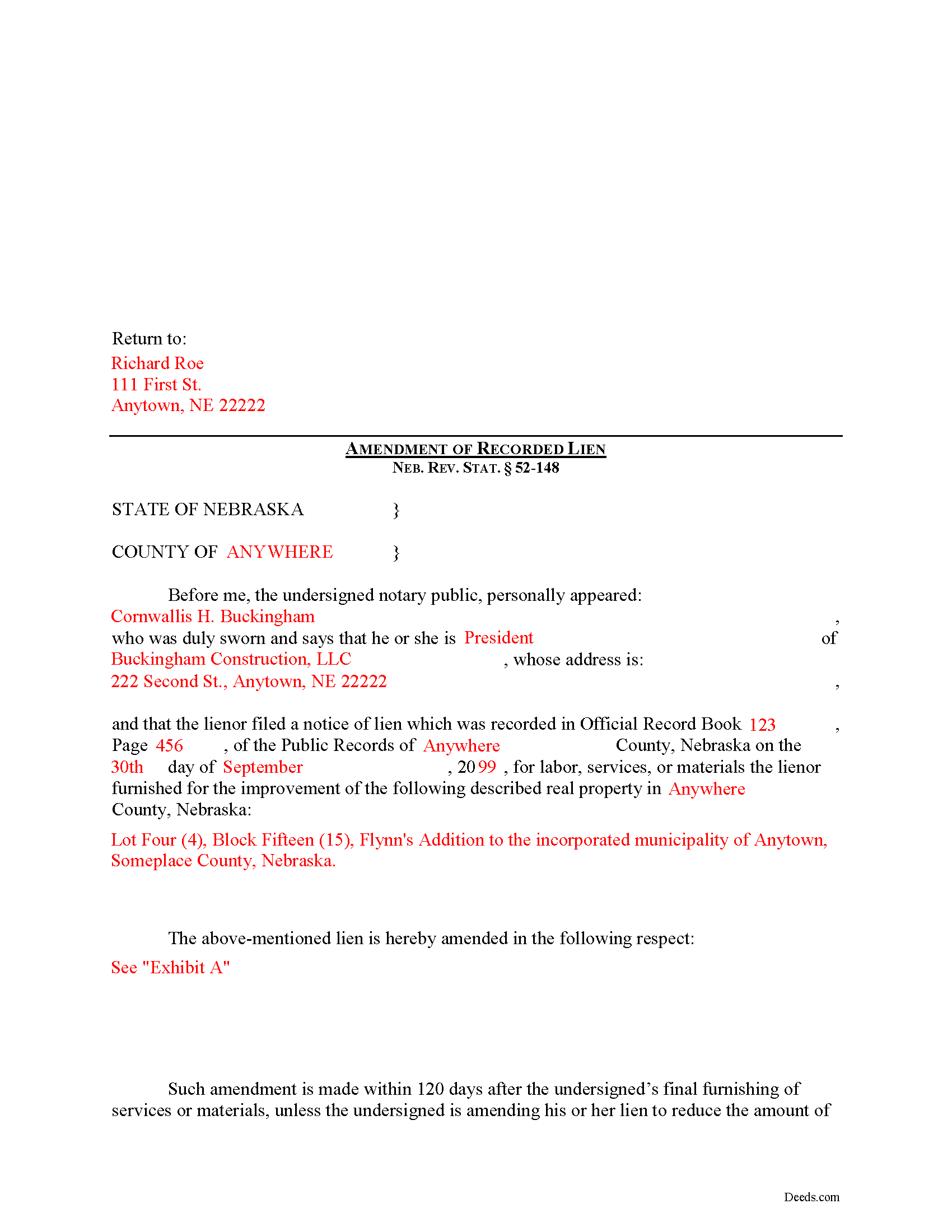

Gage County Completed Example of the Construction Lien Amendment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Gage County documents included at no extra charge:

Where to Record Your Documents

Gage County Register of Deeds

Beatrice, Nebraska 68310

Hours: 8:00am-5:00pm M-F

Phone: (402) 223-1361

Recording Tips for Gage County:

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Recorded documents become public record - avoid including SSNs

- Verify the recording date if timing is critical for your transaction

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Gage County

Properties in any of these areas use Gage County forms:

- Adams

- Barneston

- Beatrice

- Blue Springs

- Clatonia

- Cortland

- Filley

- Liberty

- Odell

- Pickrell

- Virginia

- Wymore

Hours, fees, requirements, and more for Gage County

How do I get my forms?

Forms are available for immediate download after payment. The Gage County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gage County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gage County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gage County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gage County?

Recording fees in Gage County vary. Contact the recorder's office at (402) 223-1361 for current fees.

Questions answered? Let's get started!

Amending a Construction Lien in Nebraska

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

Once a lien is recorded, there may be a reason to modify it later on. Should a modification become necessary, the claimant must file an Amendment of Recorded Lien.

A recorded lien may be amended by an additional recording at any time during the period allowed for recording the original lien. Neb. Rev. Stat. 52-148(1). An amendment adding real estate or increasing the amount of lien claimed is effective as to the additional real estate or increased amount only from the time the amendment is recorded. Id.

After the period allowed for recording the original lien, it may be amended for the purpose of: (a) Reducing the amount of the lien; (b) Reducing the real estate against which the lien is claimed; or (c) Making an apportionment of the lien among lots of a platted subdivision of record. Neb. Rev. Stat. 52-148(2).

The amendment states the recording location and date of recording of the notice of lien being amended and sets out the respects in which it is being amended. Neb. Rev. Stat. 52-148(3). It identifies the parties, the location of the subject property, and must also meet state and local standards for recorded documents.

This article is offered for informational purposes only and is not legal advice. This information not be relied upon as a substitute for speaking with an attorney. Please speak with a Nebraska attorney familiar with lien laws for any questions regarding amending a construction lien.

Important: Your property must be located in Gage County to use these forms. Documents should be recorded at the office below.

This Construction Lien Amendment meets all recording requirements specific to Gage County.

Our Promise

The documents you receive here will meet, or exceed, the Gage County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gage County Construction Lien Amendment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John E.

November 14th, 2020

This process exceeded my expectations. A great customer experience!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott A.

August 3rd, 2019

The information and instructions provided is thorough and great. But, the fill-in-the-blanks form does not work well and is very frustrating. The font size of the information I was adding on each individual line varies and is determined by the number of characters entered on that individual line. So the font size is different on each line. And the number of lines is fixed making it impossible to fill in the full legal name of the trust I needed to fill out the form for. My needs are somewhat unusual, but the form should have been designed to be flexible enough to handle it. A blank paper form would have been more useful.

Thank you for your feedback. We really appreciate it. Have a great day!

Lori S.

April 19th, 2022

The documents I created on deeds com turned out beautiful and very professional looking. The example they gave along with the instruction booklet made it very easy t create a professional looking document for our land Sale. I was very pleased with how easy it was and would recommend it to anyone needing professional documents without having to go thru an attorney or title company. I was very impressed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen S.

March 18th, 2021

This is awesome. Making sure not only that everything is worded correctly but also formatted correctly is great. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph E.

March 24th, 2019

I wish I had found this site earlier!!! Not only was it helpful and just what I needed but I got my information so fast AND on the weekend. I would recommend this site to everyone. I plan on using it more. Its cheap and I can get my information while sitting at home. Very impressed!

Thank you for the kinds words Ralph. Have a great day!

Elijah H.

December 24th, 2018

Deeds.com worked very well for me. Very Simple packet. And my County uses the same website

Thanks for the kinds words Elijah, we really appreciate it.

Lillian F.

May 2nd, 2019

I LOVE THE EASE OF GETTING THE INFORMATION I REQUESTED. YOUR SERVICE IS MORE THAN WHAT I EXPECTED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patsy H.

January 10th, 2022

I had trouble at first printing out the forms but once I figured out what to do, all went well. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul S.

October 23rd, 2020

Directions were good. It was an easy process. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pat K.

December 31st, 2018

It has been very easy. Like that the recording is so fast.

Thank you for your feedback. We really appreciate it. Have a great day!

RUTH A.

November 8th, 2024

I truly appreciate the service that you have for the customers. This very convenient and easy to follow. Thank you very much for this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard S.

August 13th, 2020

Not user friendly, and not an Adobe fan. The first page of Quitclaim Deed form cuts off the Parcel Identification line on the bottom. Also quite a few forms showed up to be downloaded , after I paid, so I was unsure if all the forms were part of the quitclaim package. I have adobe but was unable to locate the forms in adobe on my computer after I downloaded them. Just wanted to print out one quitclaim deed form, which would have taken less that 3 minutes. instead it took 97 minutes. Thank you, though, for having the form there.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa m.

April 25th, 2020

Very fast and easy! Thanks!!

Glad we could help. Thank you!

John N.

July 19th, 2020

Very easy to navigate.

Thank you!

Rene S.

December 23rd, 2022

Amazing forms and great value. That may sound like hyperbole talking about legal forms but it's not, you really are getting way more than you pay for here.

Thank you for your feedback. We really appreciate it. Have a great day!