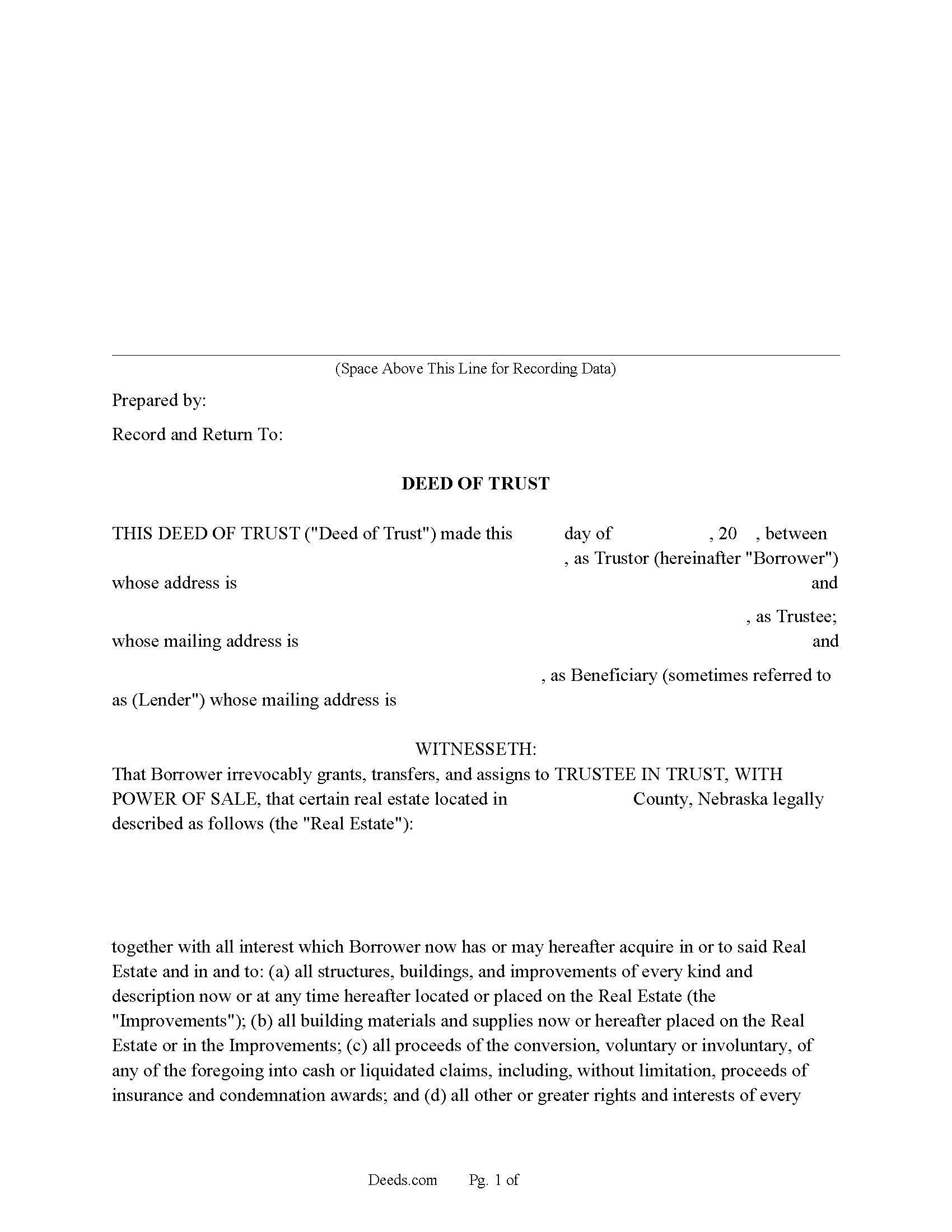

Dawson County Deed of Trust Form

Dawson County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

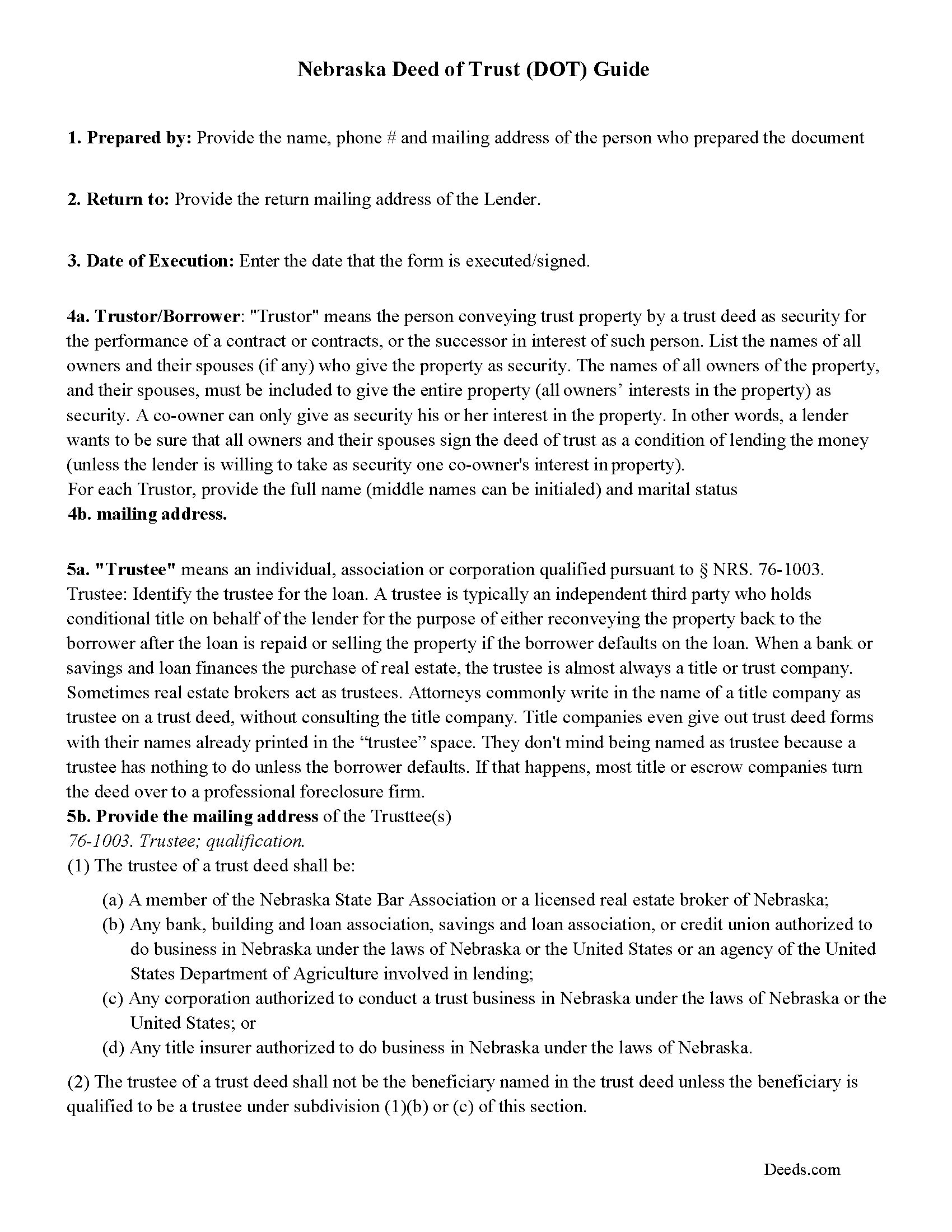

Dawson County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

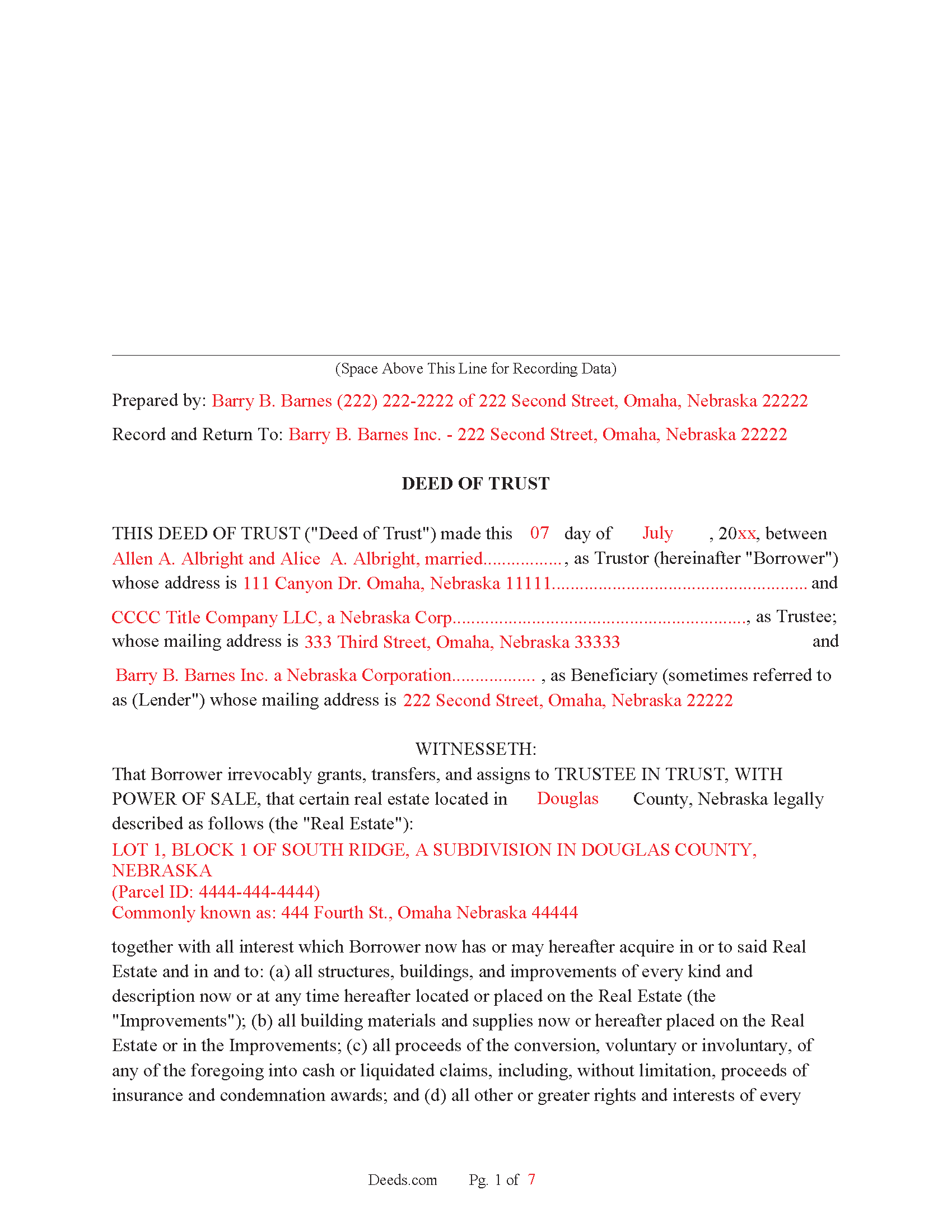

Dawson County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

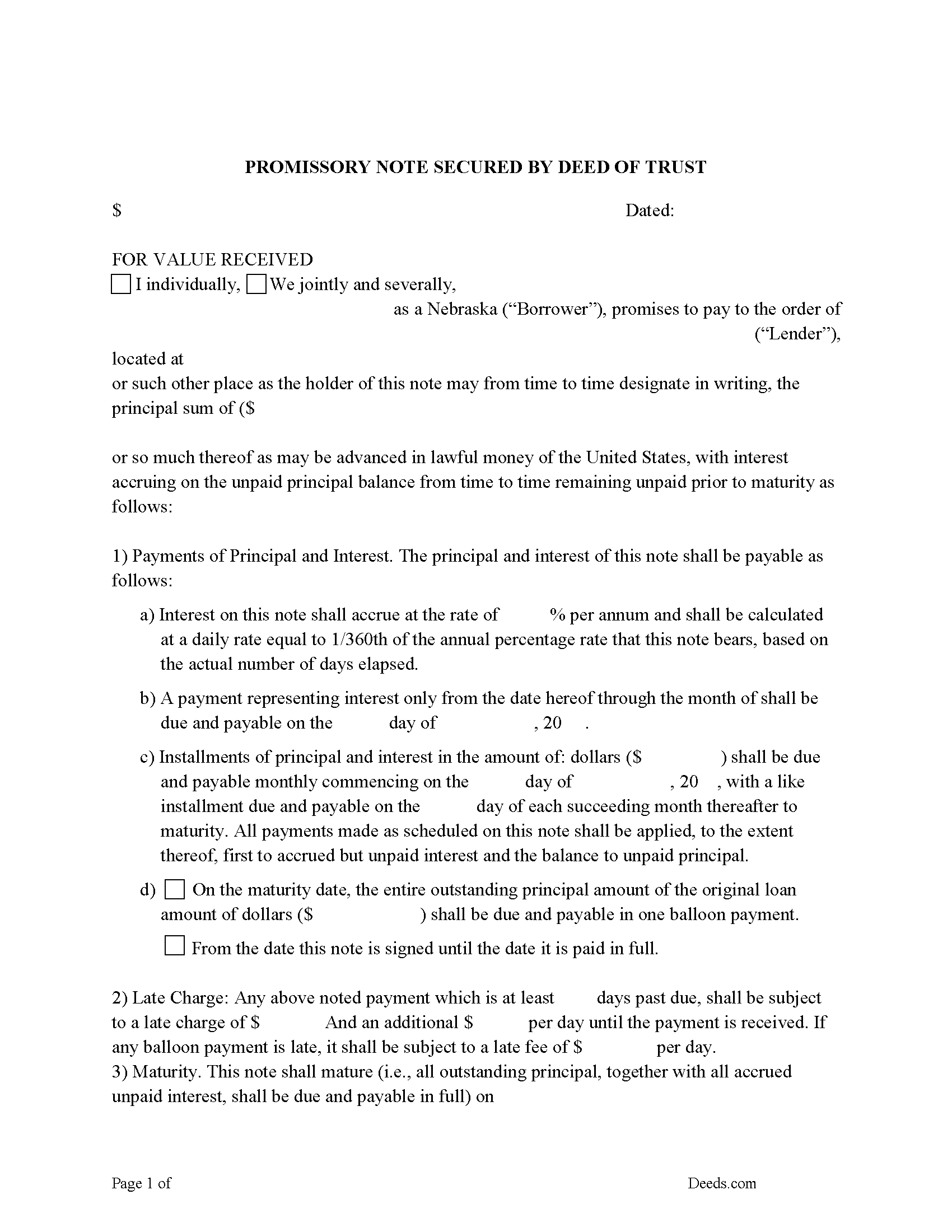

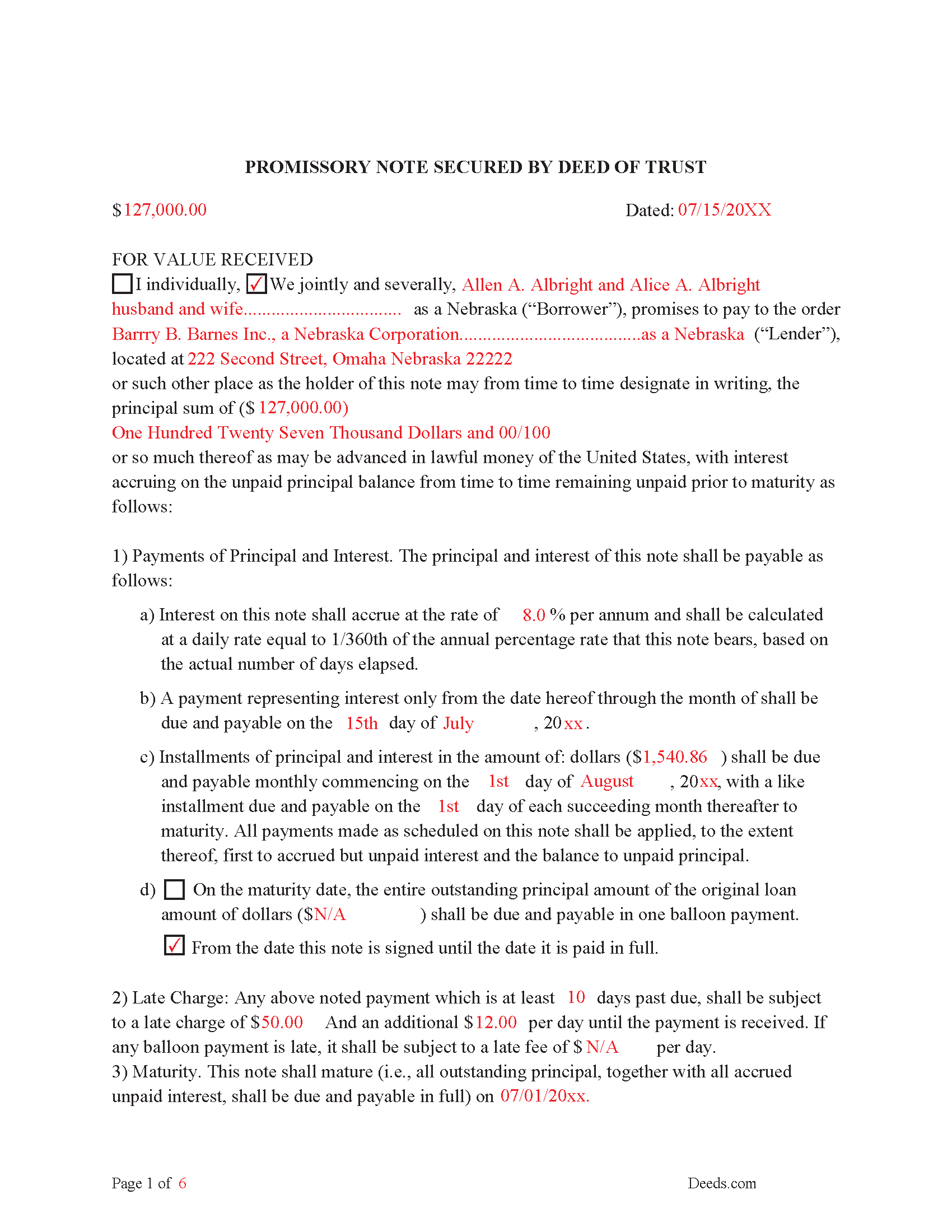

Dawson County Promissory Note Form

Note that is secured by the Deed of Trust. Can be used for traditional installments or balloon payment.

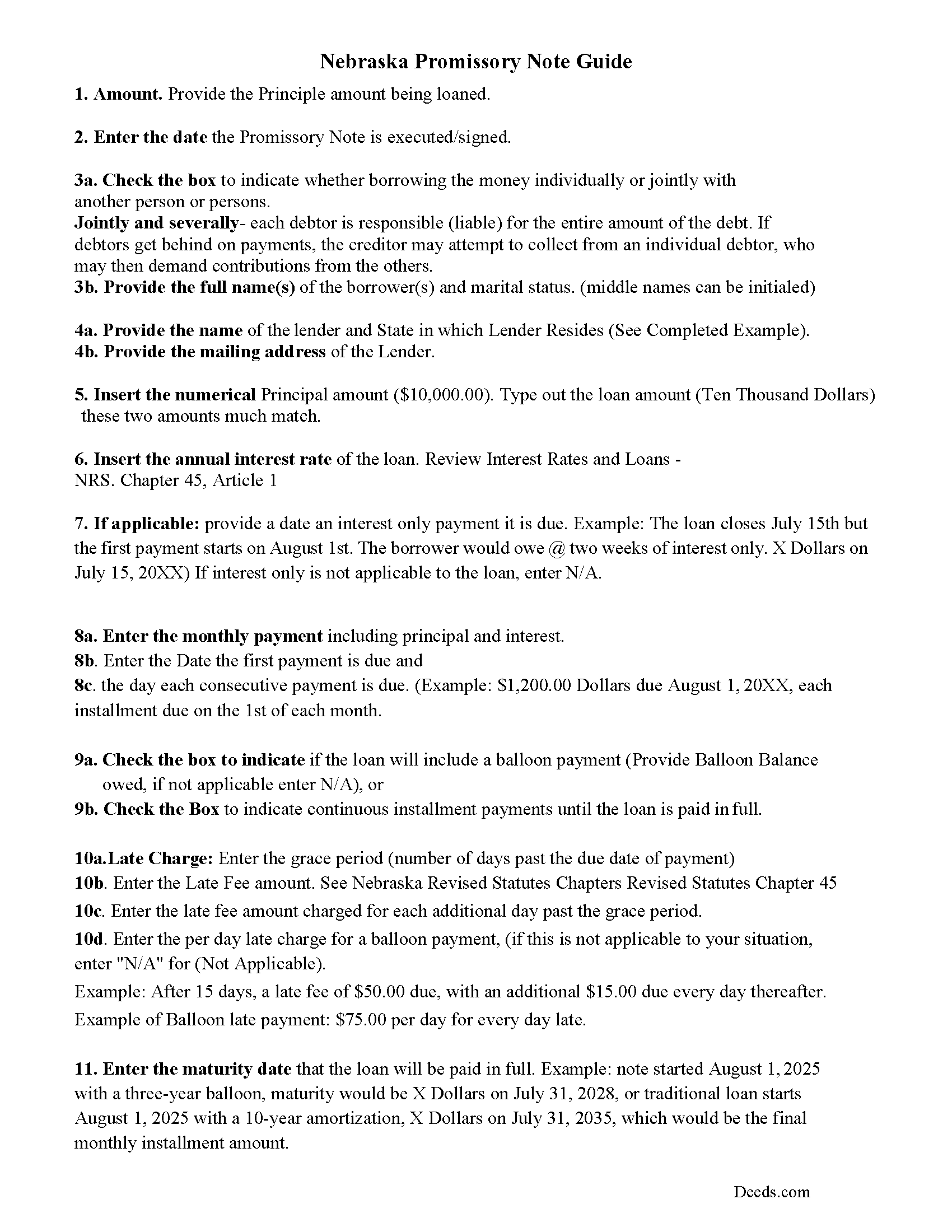

Dawson County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Dawson County Completed Example of the Promissory Note Document

This Nebraska Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

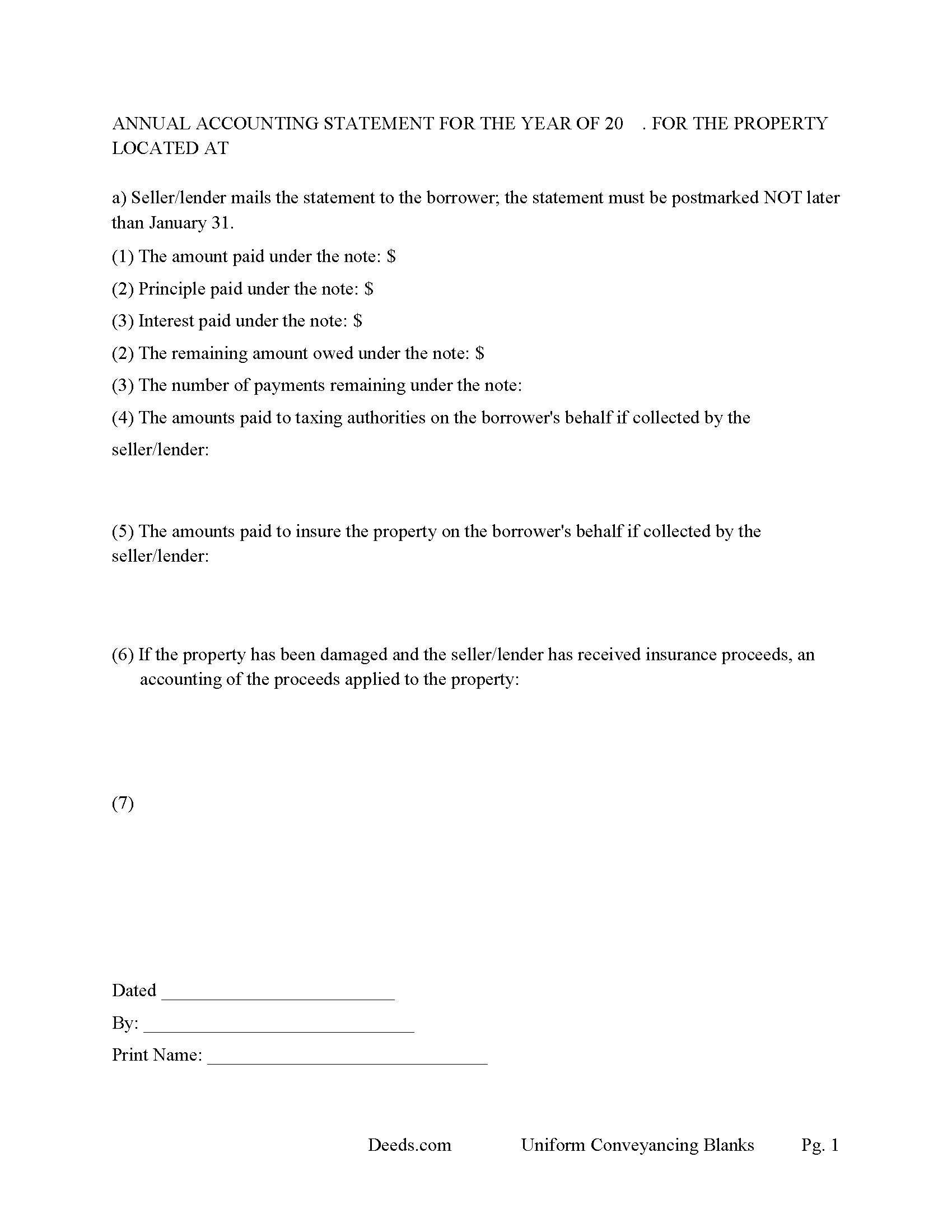

Dawson County Annual Accounting Statement Form

Mail to borrower as required for fiscal year reporting.

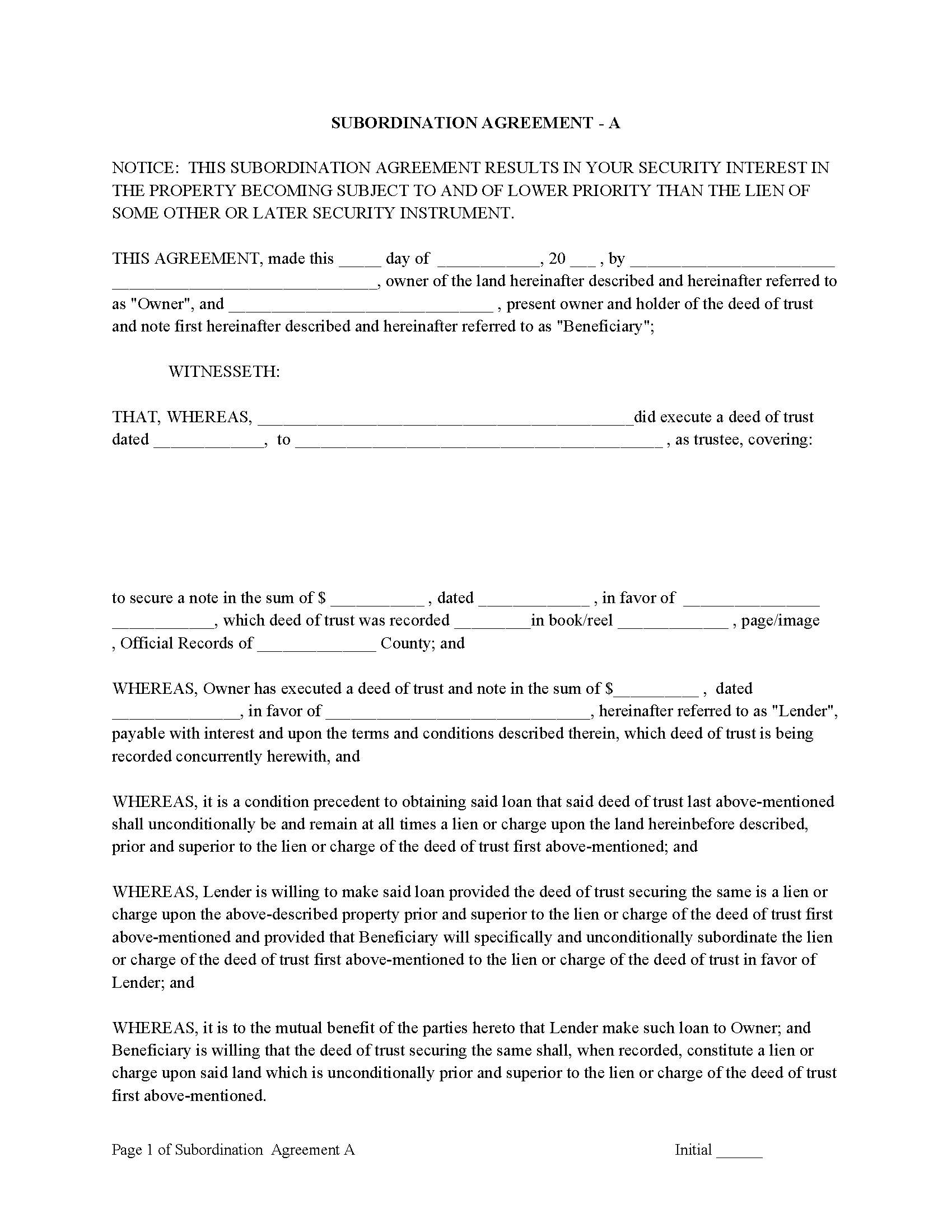

Dawson County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to D.O.T. as an addendum or rider.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Dawson County documents included at no extra charge:

Where to Record Your Documents

Dawson County Register of Deeds

Lexington, Nebraska 68850

Hours: 8:00am-5:00pm M-F

Phone: (308) 324-4271

Recording Tips for Dawson County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Dawson County

Properties in any of these areas use Dawson County forms:

- Cozad

- Eddyville

- Farnam

- Gothenburg

- Lexington

- Overton

- Sumner

- Willow Island

Hours, fees, requirements, and more for Dawson County

How do I get my forms?

Forms are available for immediate download after payment. The Dawson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dawson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dawson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dawson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dawson County?

Recording fees in Dawson County vary. Contact the recorder's office at (308) 324-4271 for current fees.

Questions answered? Let's get started!

In Nebraska, a Deed of Trust is the most commonly used instrument to secure a loan. Foreclosure can be done non-judicially, saving time and expense. This process is called a Trustee Sale. There is no automatic stay of a trustee's sale under the Nebraska Trust Deeds Act, whereas in a typical judicial foreclosure a borrower would be entitled to a stay of the sheriff's sale for anywhere from three to nine months depending upon the maturity date of the real estate mortgage

There are three parties in this Deed of Trust:

1- The Trustor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

76-1003. Trustee; qualification.

(1) The trustee of a trust deed shall be:

(a) A member of the Nebraska State Bar Association or a licensed real estate broker of Nebraska;

(b) Any bank, building and loan association, savings and loan association, or credit union authorized to do business in Nebraska under the laws of Nebraska or the United States or an agency of the United States Department of Agriculture involved in lending;

(c) Any corporation authorized to conduct a trust business in Nebraska under the laws of Nebraska or the United States; or

(d) Any title insurer authorized to do business in Nebraska under the laws of Nebraska.

(2) The trustee of a trust deed shall not be the beneficiary named in the trust deed unless the beneficiary is qualified to be a trustee under subdivision (1)(b) or (c) of this section.

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary can take an action against any person for damages. Use this Deed of Trust for financing vacant land, residential property, small commercial property, rental property (up to 4 units), condominiums and planned unit developments.

(Nebraska DOT Package includes forms, guidelines, and completed examples) For use in Nebraska only.

Important: Your property must be located in Dawson County to use these forms. Documents should be recorded at the office below.

This Deed of Trust meets all recording requirements specific to Dawson County.

Our Promise

The documents you receive here will meet, or exceed, the Dawson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dawson County Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kwaku A.

May 27th, 2021

Excellent service ! Came through in the clutch! Easy to use and understand ! Exceptional service ! 10/10

Thank you!

Barbara P.

August 13th, 2024

So easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marvita J.

September 26th, 2020

Deeds.com was fast and easy and I got everything I needed in one stop!

Thank you for your feedback. We really appreciate it. Have a great day!

James J.

October 2nd, 2021

Thank you for service. The deed process was easy to complete. My new deed was accepted by the county clerk and the tax assessors office.

Thank you for your feedback. We really appreciate it. Have a great day!

edward s.

October 1st, 2020

This is the go to place for quick work. They are awesome.

Thank you!

Sue C.

December 1st, 2023

Very helpful. Easy to use. Able to avoid the cost of having an attorney prepare the document I needed.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Cheryl B.

August 26th, 2022

I did this on a desktop using a scanned .pdf file. Simple, straight-forward, excellent instructions, easy, fast, and well documented for each step. From account creation to proof of recording: 4 hours... from the comfort of my home. I would highly recommend this service to anyone, including - and maybe especially - those who are looking for fast recording who aren't well versed in computers and on-line processes. Well done in all ways.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leslie Y.

December 10th, 2019

I had my doubts going in but was pleasantly surprised at the thoroughness of the documents and information provided. Will use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Victoria S.

March 13th, 2021

Deed.com is AMAZING! I only had about 2 weeks to get my quit claim deed recorded by my county office before my refinace due date approached. When I uploaded my quit claim to Deed.com I got it electronically recored by county register's office in "24 hours"!!! Deed.com is quick and efficient and I will dedinitely be using Deed.com again if I ever need a document recorded again.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN H.

July 20th, 2022

It was simple and fast thanks so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine S.

September 14th, 2021

One stop shopping for your Deed needs. Downloaded the forms and filled them out with ease following the step by step instructions. Saved me hundreds of dollars for not having to hire an attorney to do the exact same thing.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah H.

July 13th, 2020

Wonderful service, very fast and great customer service will be using you guys from now on. Thanks a bunch

Thank you for your feedback. We really appreciate it. Have a great day!

Phyllis B.

May 24th, 2022

I saved a ton of money doing it on my own versus through legal counsel. When I took it to the auditor/recorder today, there was absolutely no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Melanie W.

October 23rd, 2022

I used deeds.com to complete a gift deed for transferring a house to our son. Finding the correct form and completing it correctly was extremely easy due to wonderful explanations and examples provided with the purchase of the form. The registrar filing the deed told me she was impressed with the work we did. An attorney would have charged $150 so the $28.00 was well worth the money.

Thank you for your feedback. We really appreciate it. Have a great day!

JANET D.

October 19th, 2019

was good choice for me but did not realize notary had to witness all 3 signatures at the same luckily had extra copy to be signed in her presence

Thank you!