Dakota County Disclaimer of Interest Form

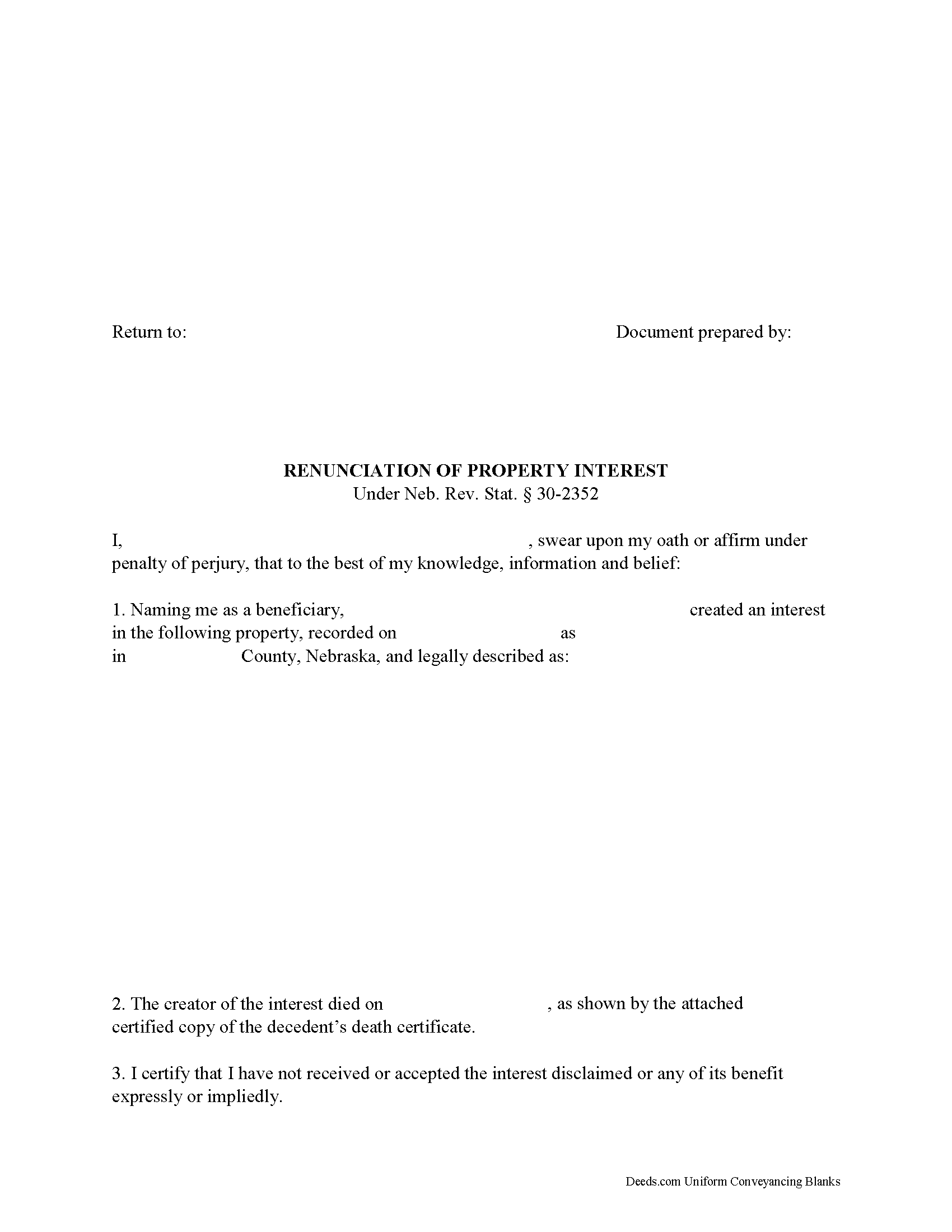

Dakota County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

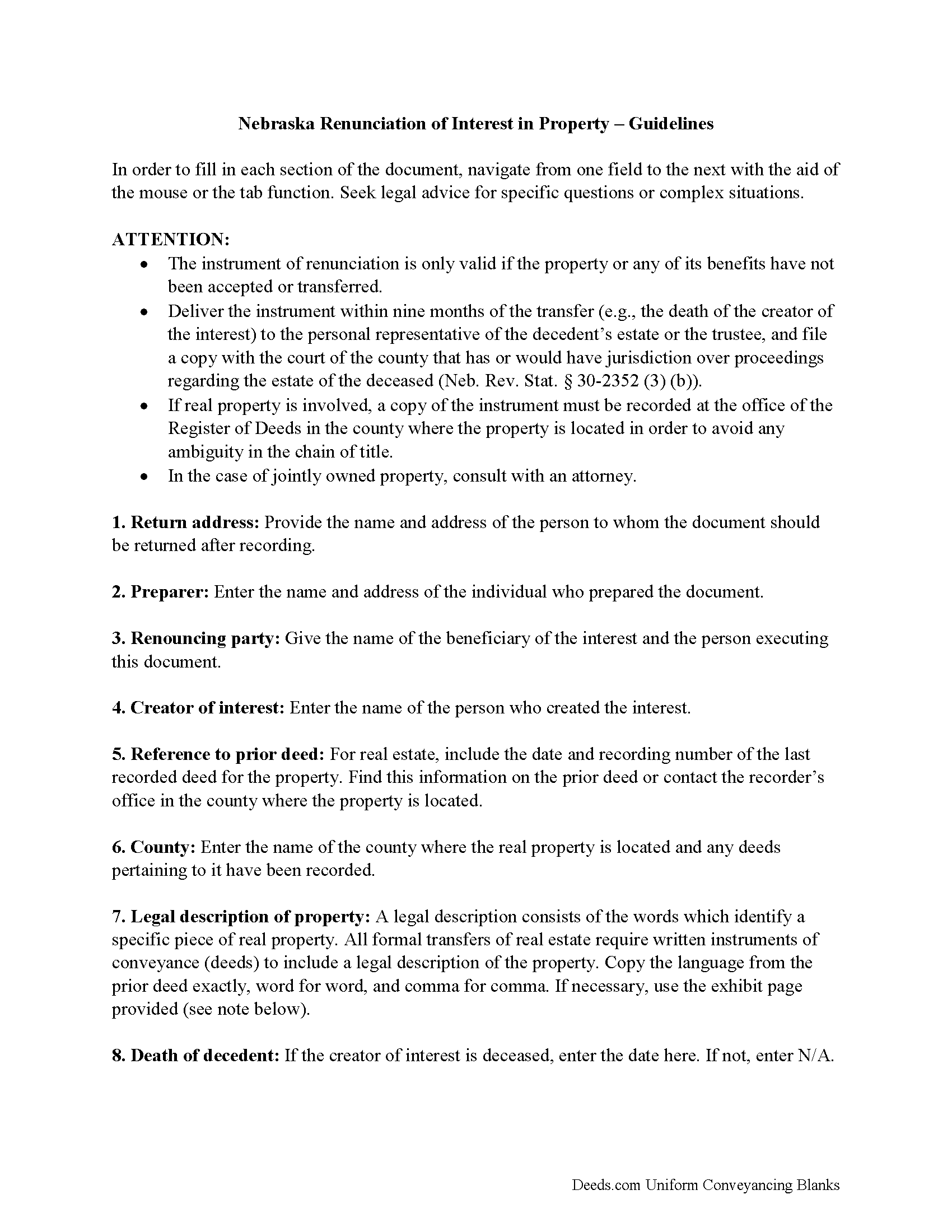

Dakota County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

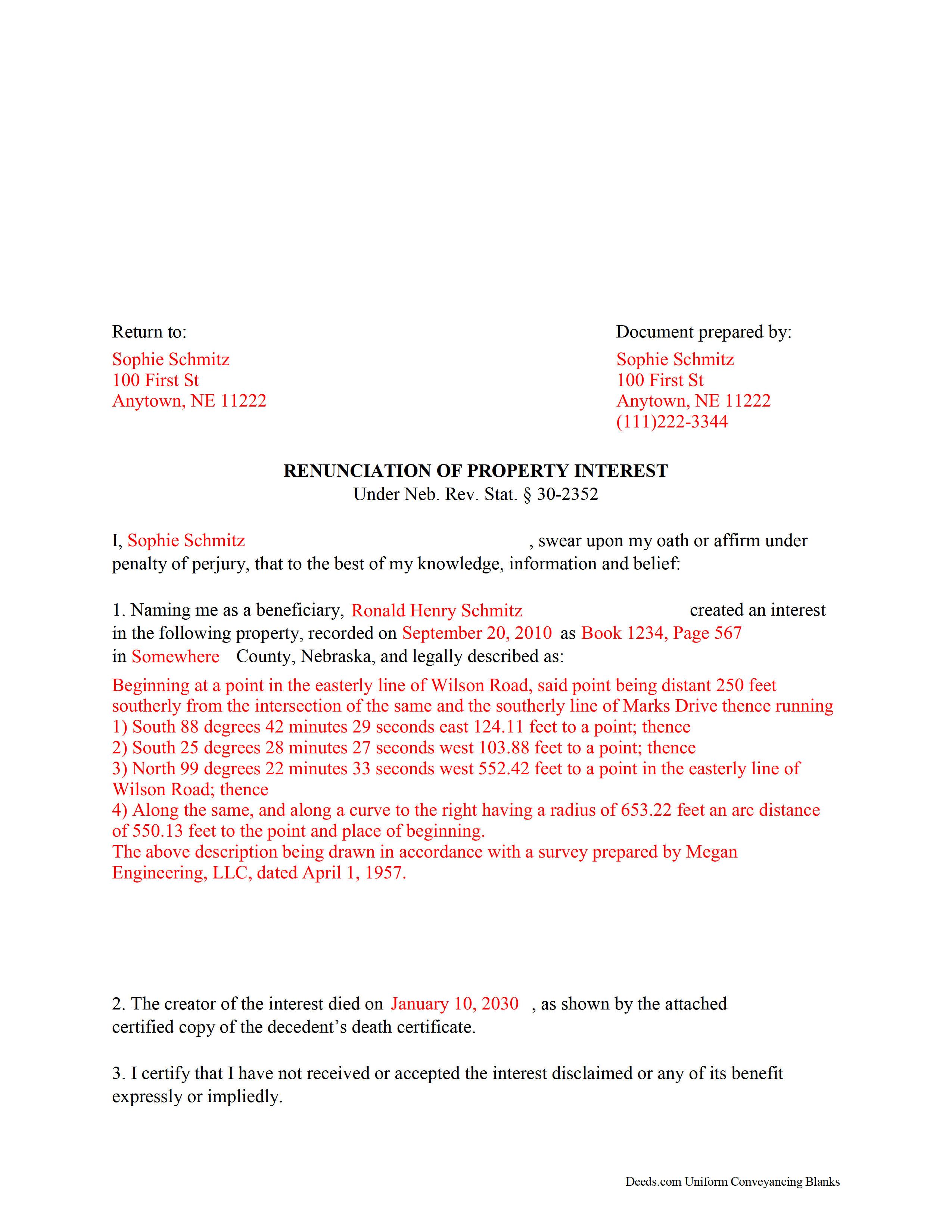

Dakota County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Dakota County documents included at no extra charge:

Where to Record Your Documents

Dakota County Register of Deeds

Dakota City, Nebraska 68731

Hours: 8:00am to 4:30pm.Monday through Friday

Phone: (402) 987-2166

Recording Tips for Dakota County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Have the property address and parcel number ready

Cities and Jurisdictions in Dakota County

Properties in any of these areas use Dakota County forms:

- Dakota City

- Emerson

- Homer

- Hubbard

- Jackson

- South Sioux City

Hours, fees, requirements, and more for Dakota County

How do I get my forms?

Forms are available for immediate download after payment. The Dakota County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dakota County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dakota County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dakota County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dakota County?

Recording fees in Dakota County vary. Contact the recorder's office at (402) 987-2166 for current fees.

Questions answered? Let's get started!

Under the Nebraska Statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (Neb. Rev. Stat. 30-2352). Note that the option to renounce is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The instrument of renunciation must be in writing and include a description of the interest, a declaration of intent to renounce all or a defined portion of the interest, and be signed by the renouncing party ( 30-2352 (2)).

Deliver the instrument within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate or the trustee, and file a copy with the court of the county that has or would have jurisdiction over proceedings regarding the estate of the deceased. If real property is involved, a copy of the instrument must be recorded at the office of the Register of Deeds in the county where the property is located in order to avoid any ambiguity in the chain of title ( 30-2352 (3) (b)).

A renunciation is irrevocable and binding for the renouncing party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited or gifted property. If the renounced interest arises out of jointly-owned property, seek legal advice as well.

(Nebraska DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Dakota County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Dakota County.

Our Promise

The documents you receive here will meet, or exceed, the Dakota County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dakota County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Joel B.

August 10th, 2022

I would have liked more room in the text fields for describing the potential claim. had to use Exhibit A. Could not delete Exhibit B. Alo would like to have a custom footer - not deeds.com. Unprofessional.

Thank you for your feedback. We really appreciate it. Have a great day!

Edward S.

March 20th, 2021

The spaces do not line up correctly with the text.

Thank you for your feedback. We really appreciate it. Have a great day!

Andre H.

June 19th, 2025

World class forms, great for someone like me that has no clue what I'm doing! Always better to let the pros do it than think one knows it all and gets themselves in trouble!

Thank you for your feedback. We really appreciate it. Have a great day!

patricia l.

February 16th, 2019

found this site very easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Aldona P.

April 9th, 2020

Awesome Job! thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judy C.

February 13th, 2019

Both sets of deeds were complete and easy to understand. Both states accepted the forms to transfer property.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

Jack B.

January 26th, 2020

All worked out well.

Thank you!

julie S.

June 24th, 2022

I love this company!! Excellent customer service and quick!! Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven N.

November 7th, 2024

I was introduced to Deeds.com from my title company. I wanted the title company to do a courtesy recording for me and they suggested Deeds.com. Best suggestion in a while. The interface to use the website was seemlessly easy. The communication with the service staff was thorough and prompt. After the initial verification process (which the photo app was a little tricky), everything was easy. Will use them again.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Richard E.

August 10th, 2021

The QuitClaim deed does not provide enough space in the Grantor block at the top of the first page. In fact, all blocks should provide more space.

Thank you for your feedback. We really appreciate it. Have a great day!

Jaimie F.

February 2nd, 2024

Very easy process and the customer service representatives are very friendly and helpful.

It was a pleasure serving you. Thank you for the positive feedback!

Eileen D.

August 5th, 2020

Very easy to use. The example form was a big help in making sure I had the forms filled out correctly.

Thank you!

Randal R.

December 20th, 2019

While disappointed that my request could not be filled, I understand the issue, and appreciate the attempt and the responsiveness. I certainly will be back if the occasion arises!

Thank you!

tom s.

May 13th, 2021

Easier than I had expected. Was looking for the 'I have to get information that I don't understand' part which never appeared. Thank you

Thank you!