Saline County Disclaimer of Interest Form

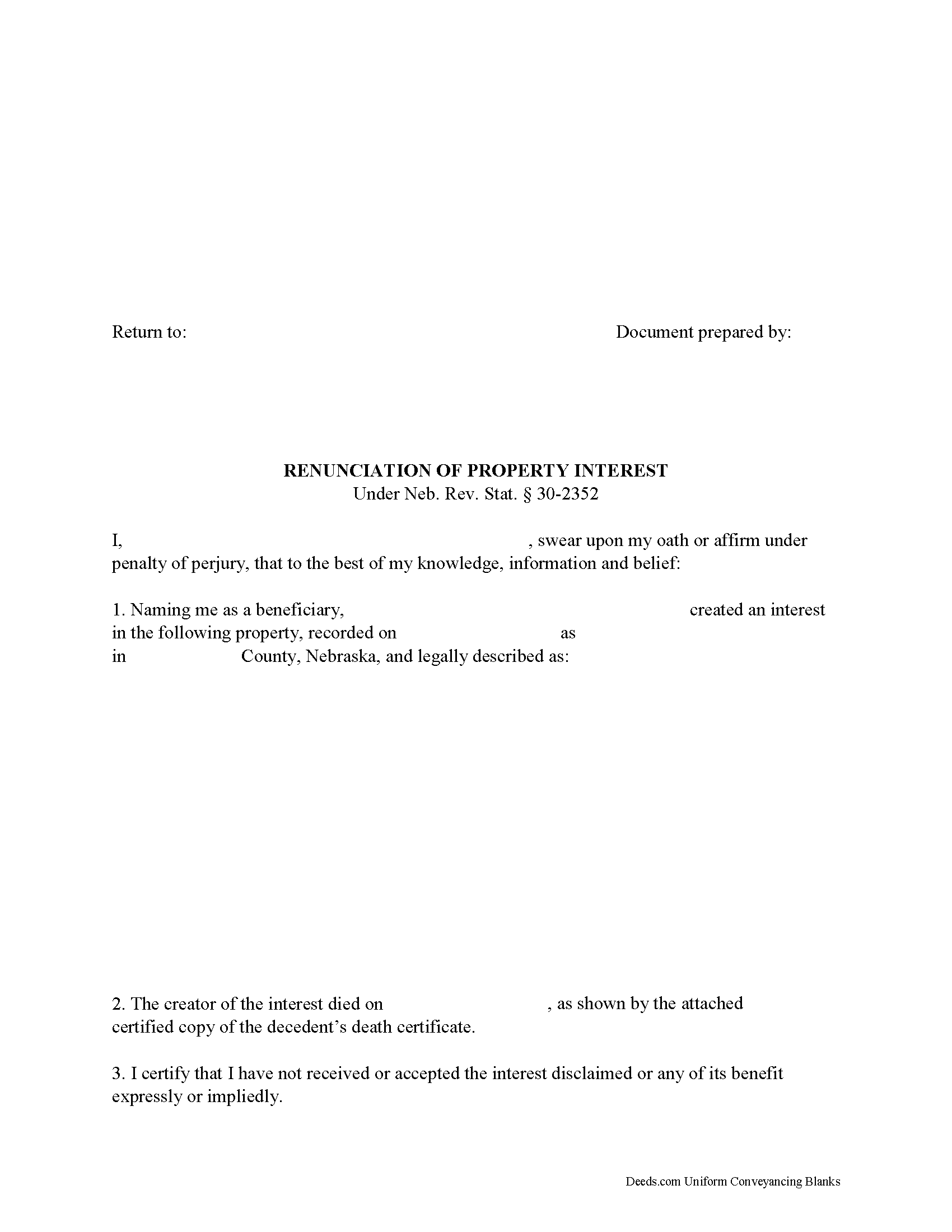

Saline County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

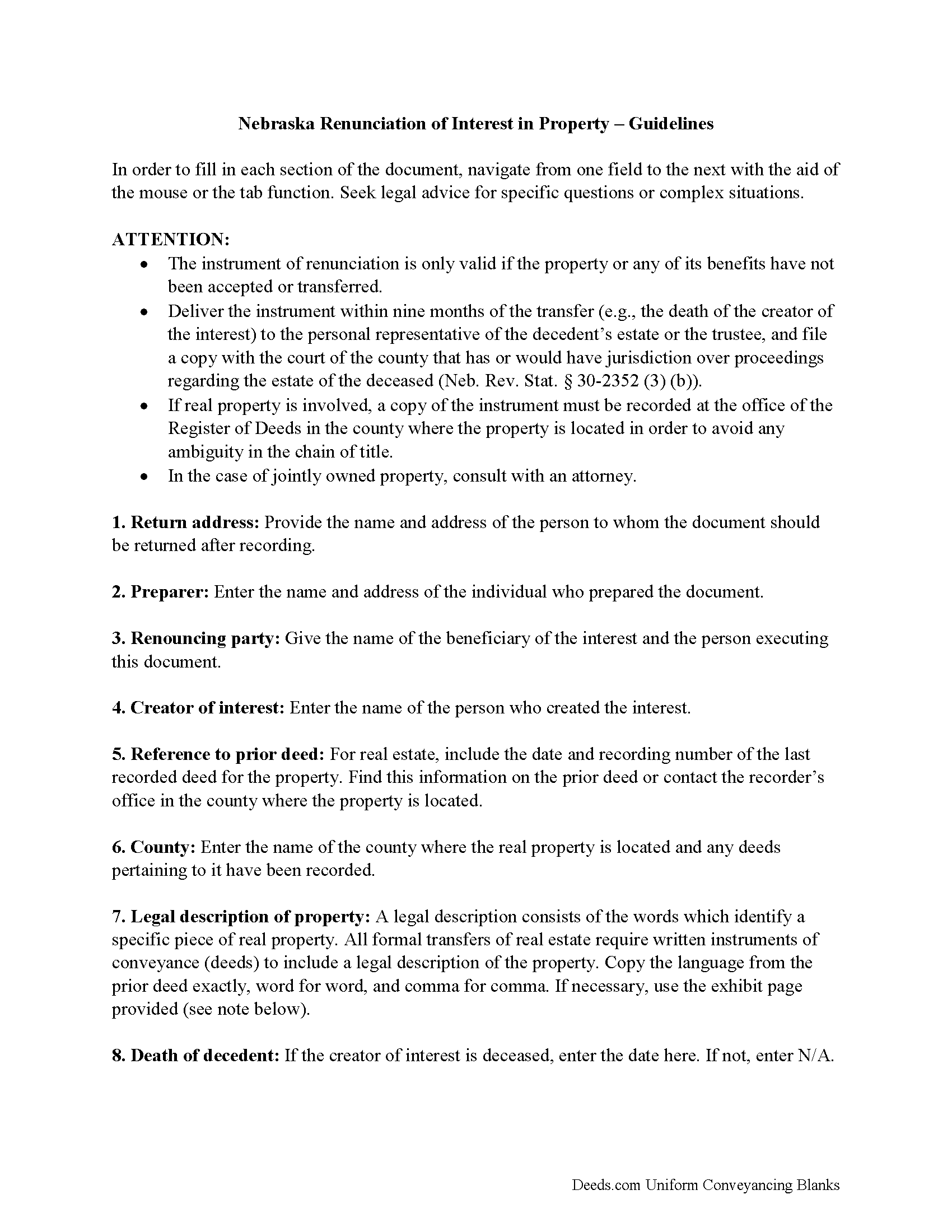

Saline County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

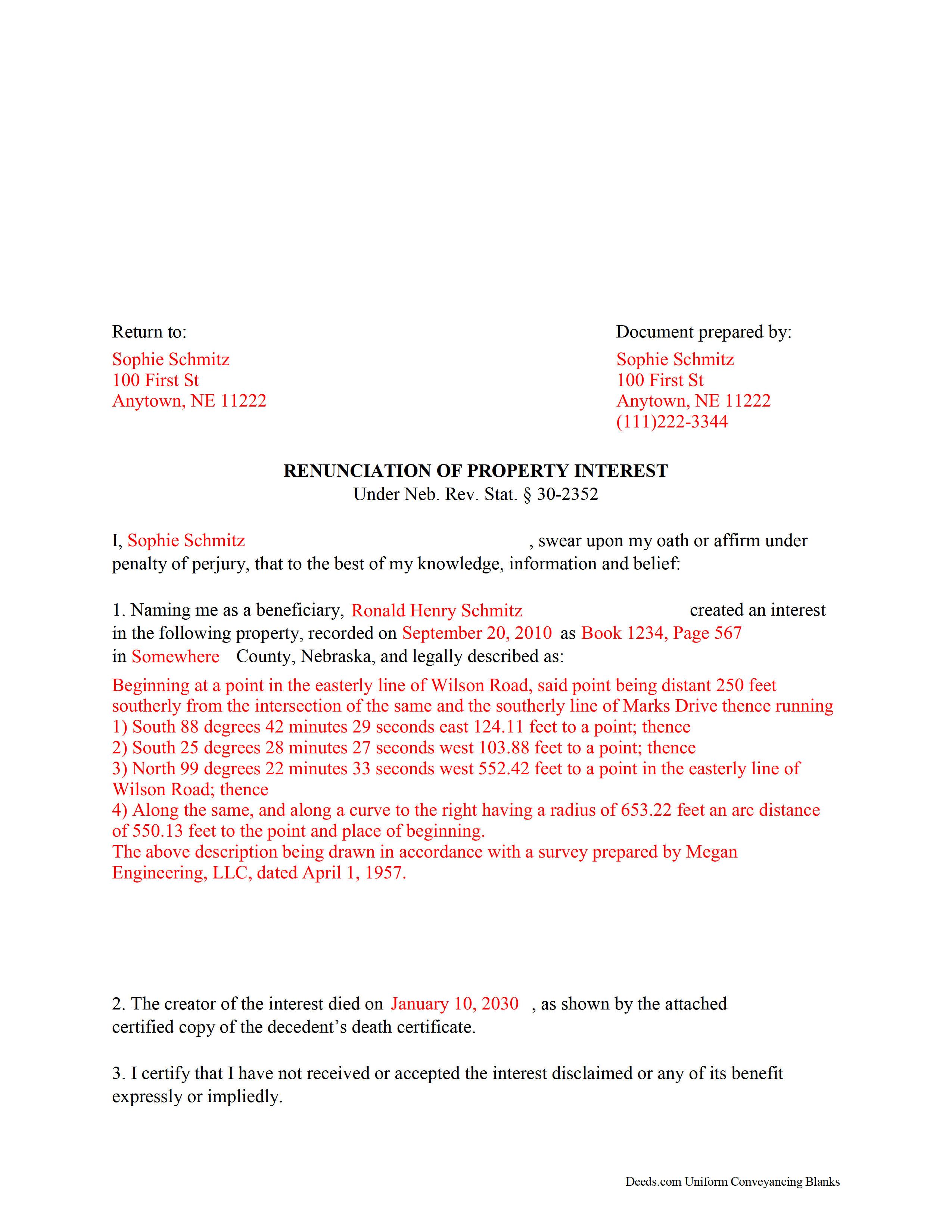

Saline County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Saline County documents included at no extra charge:

Where to Record Your Documents

Saline County Register of Deeds/Clerk

Wilber, Nebraska 68465

Hours: 8:00am to 5:00pm M-F

Phone: (402) 821-2374

Recording Tips for Saline County:

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Saline County

Properties in any of these areas use Saline County forms:

- Crete

- De Witt

- Dorchester

- Friend

- Swanton

- Tobias

- Western

- Wilber

Hours, fees, requirements, and more for Saline County

How do I get my forms?

Forms are available for immediate download after payment. The Saline County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saline County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saline County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saline County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saline County?

Recording fees in Saline County vary. Contact the recorder's office at (402) 821-2374 for current fees.

Questions answered? Let's get started!

Under the Nebraska Statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (Neb. Rev. Stat. 30-2352). Note that the option to renounce is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The instrument of renunciation must be in writing and include a description of the interest, a declaration of intent to renounce all or a defined portion of the interest, and be signed by the renouncing party ( 30-2352 (2)).

Deliver the instrument within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate or the trustee, and file a copy with the court of the county that has or would have jurisdiction over proceedings regarding the estate of the deceased. If real property is involved, a copy of the instrument must be recorded at the office of the Register of Deeds in the county where the property is located in order to avoid any ambiguity in the chain of title ( 30-2352 (3) (b)).

A renunciation is irrevocable and binding for the renouncing party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited or gifted property. If the renounced interest arises out of jointly-owned property, seek legal advice as well.

(Nebraska DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Saline County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Saline County.

Our Promise

The documents you receive here will meet, or exceed, the Saline County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saline County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Peter W.

February 28th, 2019

Thanks worked out great

Thank you for the follow up Peter. Have a great day!

Dianne C.

July 13th, 2023

Love it

Thank you!

Corey G.

May 24th, 2023

Very informative and helpful Thank you so much

Thank you for the kinds words Corey, glad we could help.

Timmy S.

December 18th, 2019

The form gave me a perfect place to start. I was looking for something regarding time-shares, so the form was not perfect, but the register of deeds worked with me to get it right. I would not have even been able to start without the form from deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie S.

May 24th, 2023

This was amazingly easy to access.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith H.

May 22nd, 2023

This site was so easy. Got my documents in minutes. downloaded and they work perfectly and accurately. I LOVE THIS SITE AND COMPANY!!!

Thank you for your feedback. We really appreciate it. Have a great day!

AJ H.

April 30th, 2019

What a wonderful service to offer! Very impressed, and grateful for the forms and instructions!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth H.

December 17th, 2020

You had just what I was looking for. It was explained well and easy to find. Will recommend you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karina C.

March 27th, 2020

The process was very convenient, fast, and efficient. I appreciated the messaging feature which provided real-time communication. I would certainly recommended this service to anyone needing it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Albert j.

June 3rd, 2020

Very easy site to use for a simple minded happy howmowner. Very reasonable fee Quick turn around Good communication

Thank you!

Carol T.

April 26th, 2019

It was very difficult to maneuver through your website the wording on certain things are very difficult to figure out. I can't seem to get through to one place that I want versus what I don't want. I think it needs to be a little more explanatory and I am a college graduate so it's not like I'm stupid or anything. Thank you

Thank you for your feedback. Very sorry to hear that we failed you with our navigation. We will certainly address it to see how we can approve. Have a wonderful day.

Linda L.

July 7th, 2021

The service was excellent. The fee to use Deeds was more than I expected however, but the service was excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jina N.

January 29th, 2019

Awesome site!! You guys really make it simple to understand and access any Deeds that I need. I know you keep very up to date forms, as my county is hard core when it comes to the smallest of details, even compared to every other county across the state. Yet you made it simple and quick, and I never had to redo anything. Even the clerk was impressed that I had it filled out correctly the first time, as that usually never happened. Even the size of type/font and the margins were perfect. That saved a lot of time, money and most of all, frustration. I've recommended you to relatives, friends and co-workers. Thanks to the staff at deeds dot com !! I truly appreciate you. j

Thank you!

Peter V.

November 1st, 2021

Great set of forms. Downloaded in a min and Used immediately. Good sample as it easy to read And fill out yours. Overall good experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cedric W.

January 2nd, 2021

This process was very easy to go through, from beginning to end. It was fast, precise and got the job done without me having to leave my computer. If opportunities arise, I will definitely use deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!