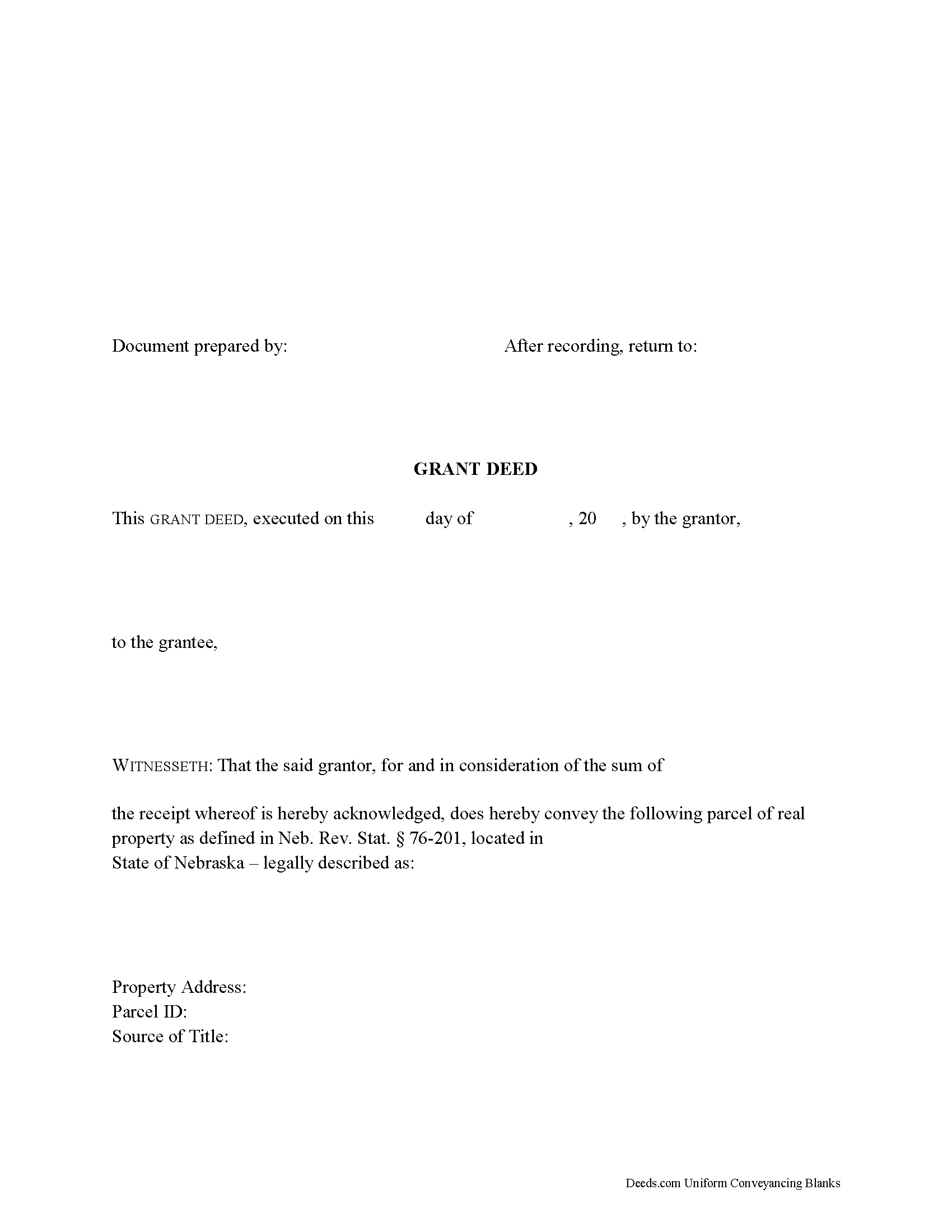

Antelope County Grant Deed Form

Antelope County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

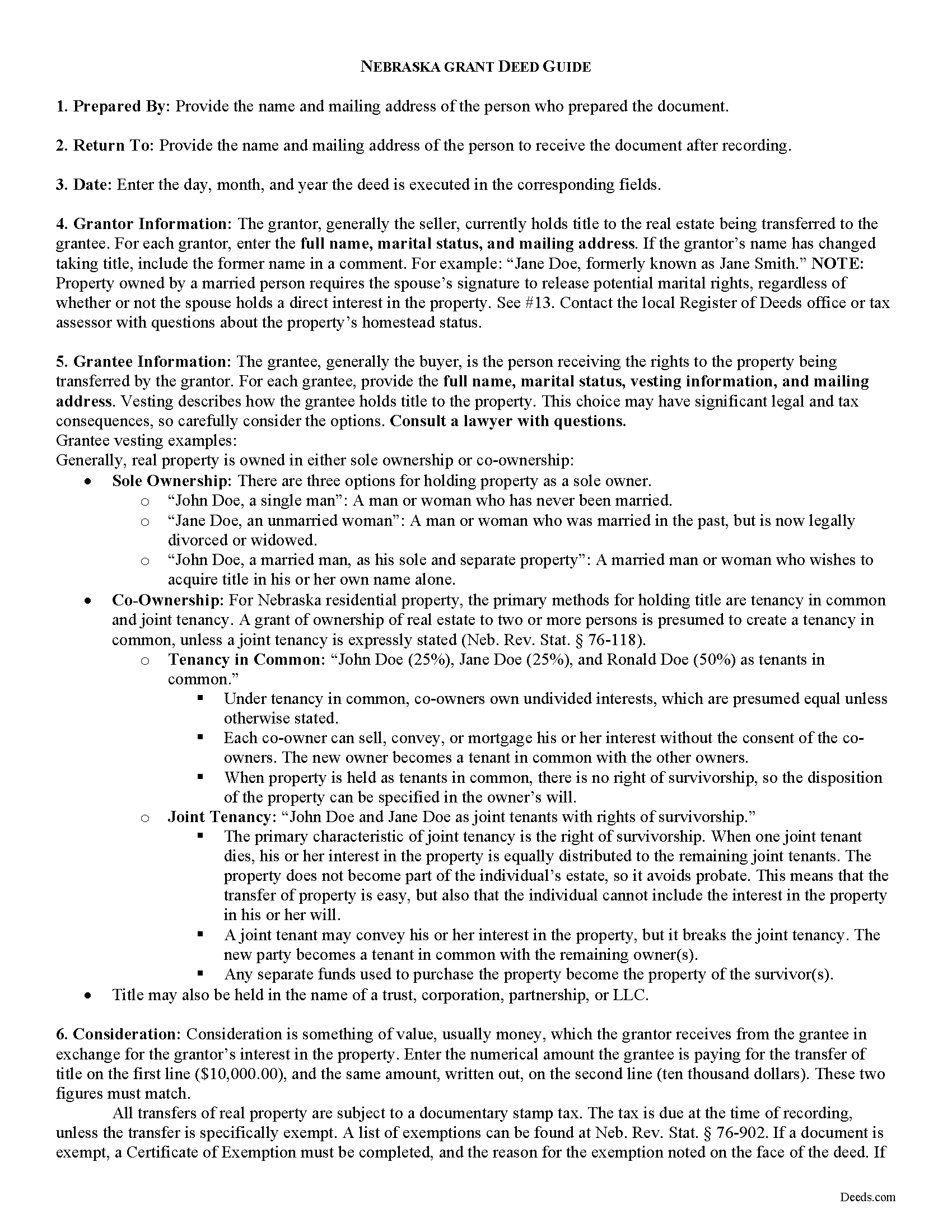

Antelope County Grant Deed Guide

Line by line guide explaining every blank on the form.

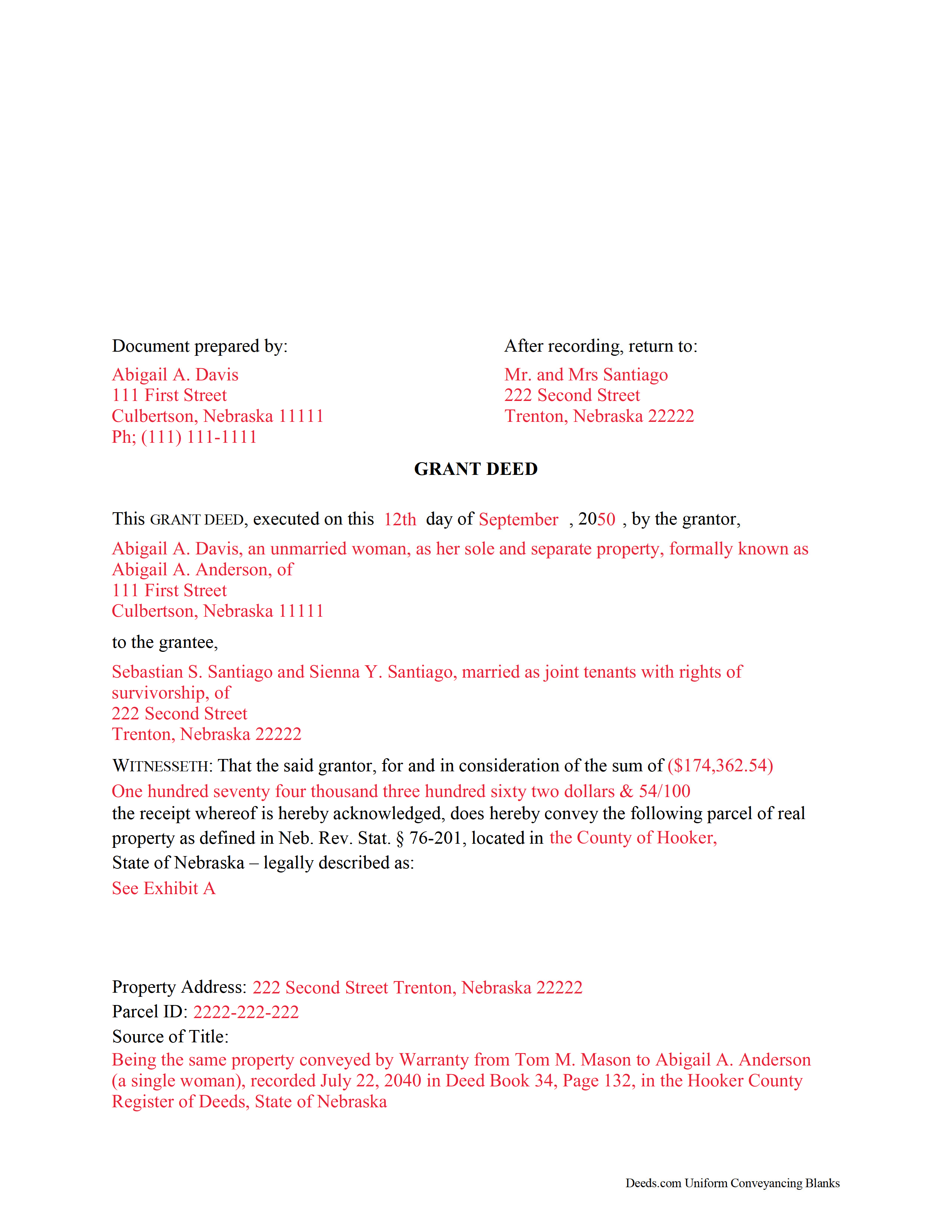

Antelope County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Antelope County documents included at no extra charge:

Where to Record Your Documents

Antelope County Register of Deeds

Neligh, Nebraska 68756

Hours: 8:00 to 4:30 M-F

Phone: (402) 887-5006

Recording Tips for Antelope County:

- Bring your driver's license or state-issued photo ID

- Leave recording info boxes blank - the office fills these

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Antelope County

Properties in any of these areas use Antelope County forms:

- Brunswick

- Clearwater

- Elgin

- Neligh

- Oakdale

- Orchard

- Royal

Hours, fees, requirements, and more for Antelope County

How do I get my forms?

Forms are available for immediate download after payment. The Antelope County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Antelope County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Antelope County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Antelope County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Antelope County?

Recording fees in Antelope County vary. Contact the recorder's office at (402) 887-5006 for current fees.

Questions answered? Let's get started!

Real property can be transferred from one party to another by executing a grant deed. Nebraska's statutory grant deed includes a covenant that the grantor has good title to the estate in quantity and quality which he purports to convey (Neb. Rev. Stat. 76-206).

A lawful grant deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For Nebraska residential property, the primary methods for holding title are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is expressly stated (Neb. Rev. Stat. 76-118).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, detail any restrictions associated with the property, and indicate whether the property is a homestead. The deed must meet all state and local standards of form and content for recorded documents.

Sign the deed in the presence of a notary public or other authorized official. Note that if the owner is married, both spouses must sign the form to release any potential marital rights to the land. For a valid transfer, file the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

All transfers of real property are subject to a documentary stamp tax. The tax is due at the time of recording. If the transfer is exempt under Neb. Rev. Stat. 76-902, note the reason on the face of the deed and fill out a certificate of exemption.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about grant deeds, or for any other issues related to transfers of real property in Nebraska.

(Nebraska Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Antelope County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Antelope County.

Our Promise

The documents you receive here will meet, or exceed, the Antelope County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Antelope County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

john g.

January 11th, 2019

no problems got what i needed.

Thanks John.

sonja E.

May 31st, 2019

It's very easy to find your way around on deeds.com, Excellent layout on this website and user friendly!

Thank you!

GARY S.

March 16th, 2021

The forms were just what i needed and for the county i needed thankyou so much

Thank you!

Deborah P.

May 14th, 2020

Great site. Official. Easy to use. Less expensive than those other sites as well. Saved me approximately $20! My records were available immediately. I highly recommend this site.

Thank you!

Peggy D.

August 26th, 2021

Very helpful in finding the information for me. Quick response. Very easy to use the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Bernadette K.

February 17th, 2021

Your system is completely unfriendly to the user. There is no clear way, unless you are a lawyer, to go through the the process without making mistakes. Very disappointed attempted user

Sorry to hear that we failed you Bernadette. We do hope that you were able to find something more suitable to your needs elsewhere.

JOHN R.

March 15th, 2023

This is an Outstanding Website for easy access in expediting my property investment needs. Thank you for this much needed online service.

Thank you!

Thomas W.

January 16th, 2019

easy to use, no problems except in beneficiary box. Need to make the box bigger because I have 4 beneficiaries to list. how do I enlarge the box.

Thanks for reaching out. All available space on the document is being used. As is noted in the guide, if you have information that does not fit in the available space the included exhibit page should be used.

Gary R.

December 17th, 2022

Very prompt response to my questions.

Thank you!

Esther R.

February 25th, 2019

Very easy to follow and complete.

Thank you for your feedback. We really appreciate it. Have a great day!

Cindy H.

October 21st, 2020

Loved it! Quick and easy, done in 24 hours.

Thank you for your feedback. We really appreciate it. Have a great day!

Elaine L.

July 21st, 2020

5 STAR, THIS WAS A GREAT EXPERIENCE, FAST VERY RESOURCEFUL TOOL TO PROVIDE FOR MY CLIENTS. Thank you

Thank you!

Pierre M.

October 13th, 2020

The form was very easy to fill out. The instructions were clear. Overall, a very user friendly product that made my job easier. Thanks you.

Thank you!

catheirne o.

January 10th, 2019

Easy to use!

Thank you!

Melody P.

January 29th, 2021

Thanks again for such expedient and excellent service!

Thank you!