Harlan County Grant Deed Form (Nebraska)

All Harlan County specific forms and documents listed below are included in your immediate download package:

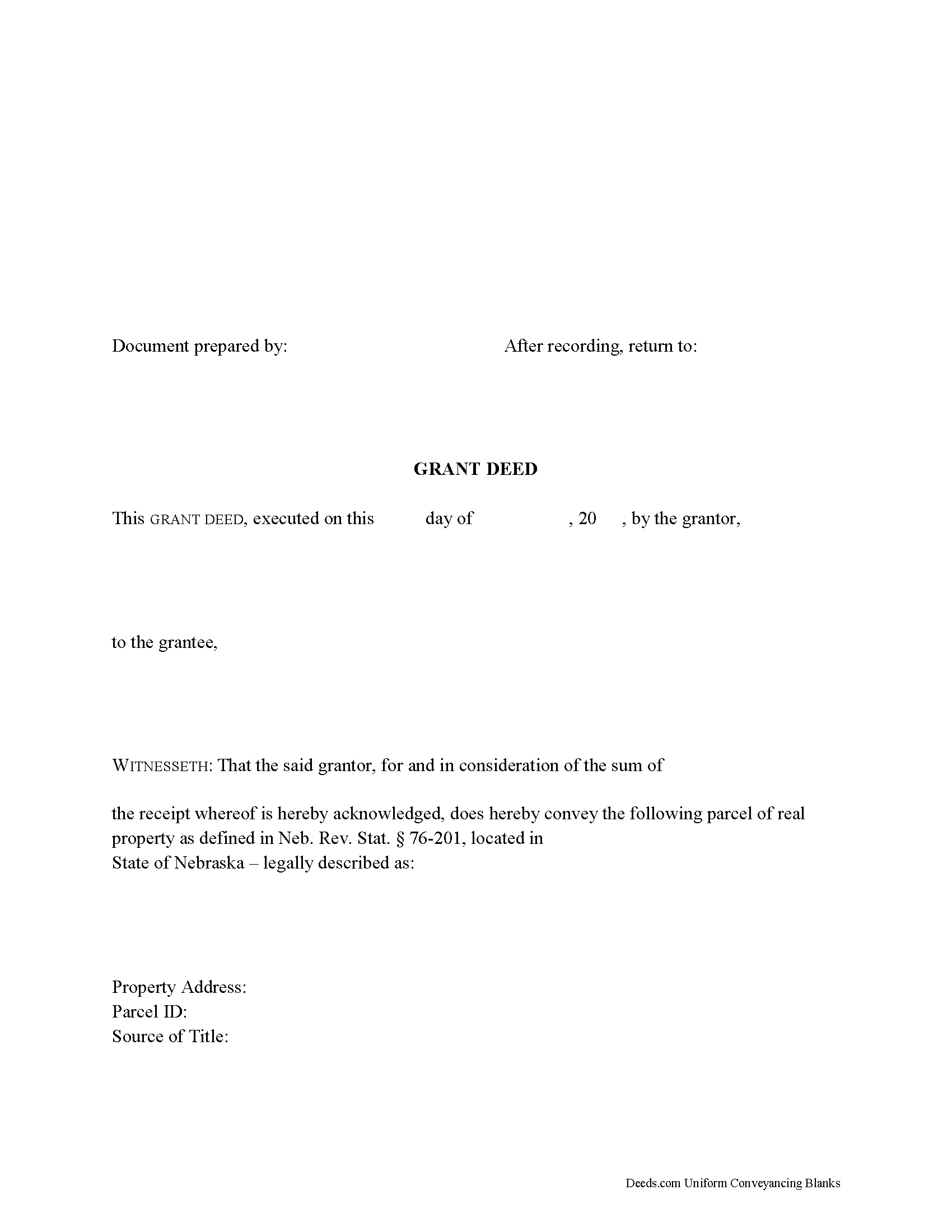

Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Harlan County compliant document last validated/updated 6/4/2025

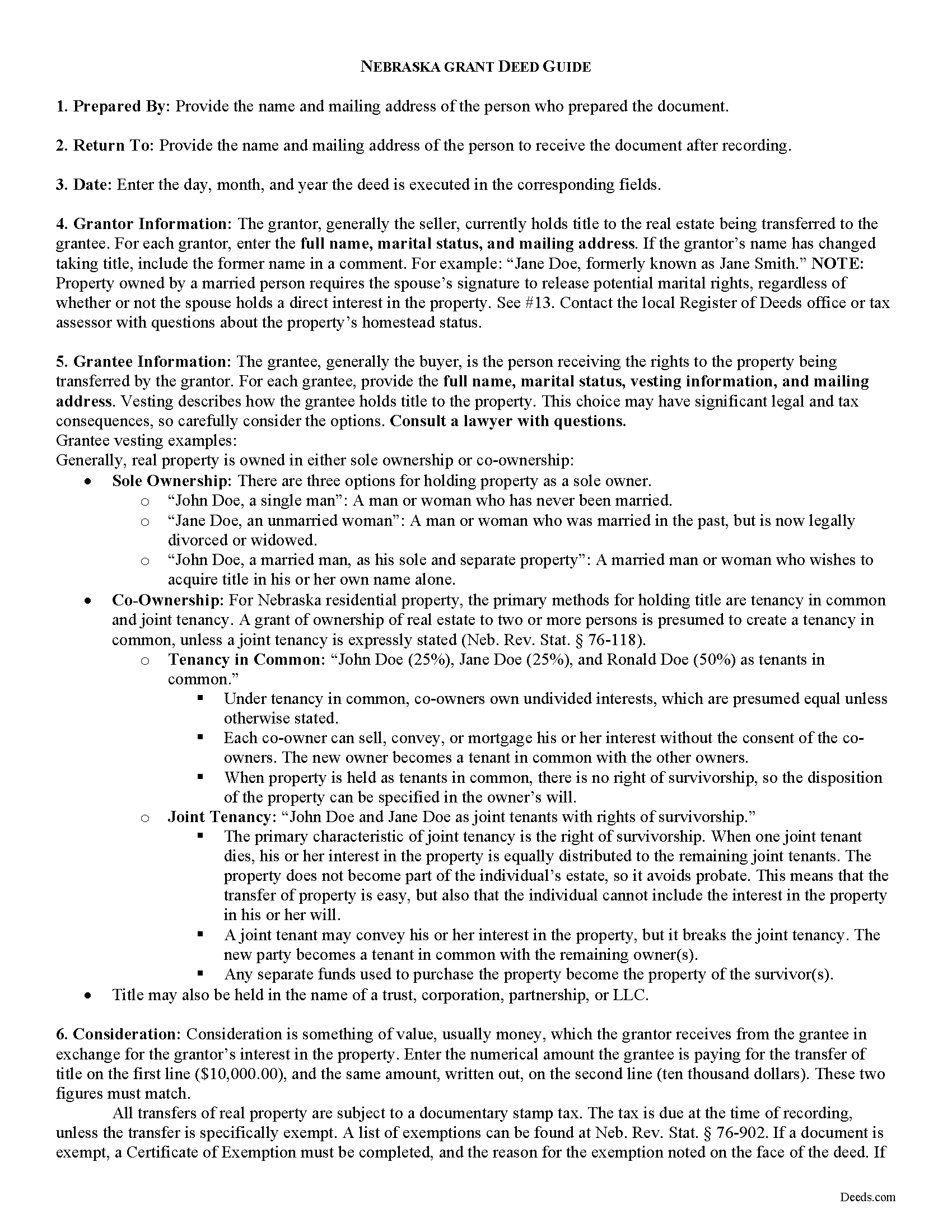

Grant Deed Guide

Line by line guide explaining every blank on the form.

Included Harlan County compliant document last validated/updated 3/14/2025

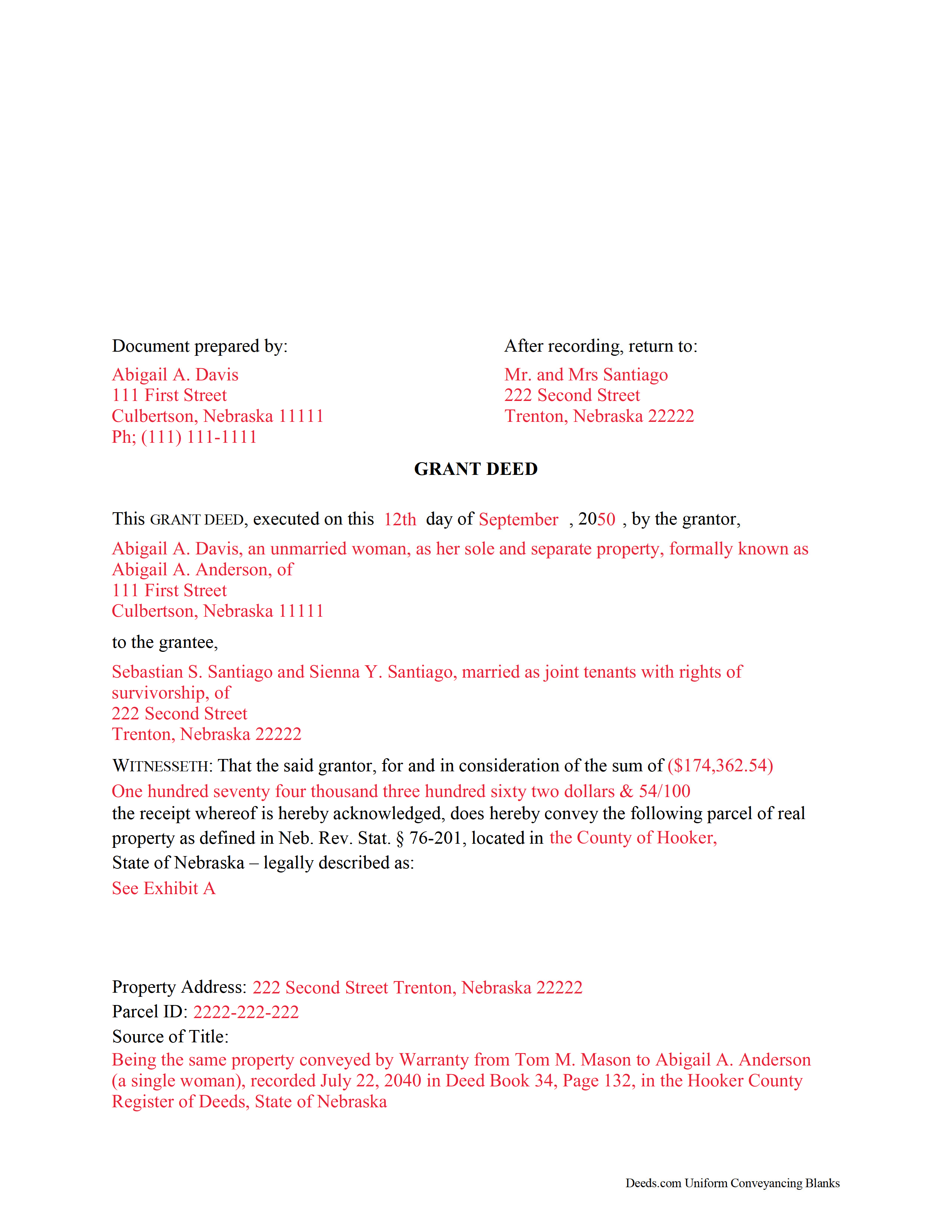

Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

Included Harlan County compliant document last validated/updated 6/30/2025

The following Nebraska and Harlan County supplemental forms are included as a courtesy with your order:

When using these Grant Deed forms, the subject real estate must be physically located in Harlan County. The executed documents should then be recorded in the following office:

Harlan County Register of Deeds/Clerk

706 W Second Ave, Alma, Nebraska 68920

Hours: 8:30 to 4:30 M-F

Phone: (308) 928-2173

Local jurisdictions located in Harlan County include:

- Alma

- Orleans

- Ragan

- Republican City

- Stamford

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Harlan County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Harlan County using our eRecording service.

Are these forms guaranteed to be recordable in Harlan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harlan County including margin requirements, content requirements, font and font size requirements.

Can the Grant Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Harlan County that you need to transfer you would only need to order our forms once for all of your properties in Harlan County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nebraska or Harlan County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Harlan County Grant Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Real property can be transferred from one party to another by executing a grant deed. Nebraska's statutory grant deed includes a covenant that the grantor has good title to the estate in quantity and quality which he purports to convey (Neb. Rev. Stat. 76-206).

A lawful grant deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For Nebraska residential property, the primary methods for holding title are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is expressly stated (Neb. Rev. Stat. 76-118).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, detail any restrictions associated with the property, and indicate whether the property is a homestead. The deed must meet all state and local standards of form and content for recorded documents.

Sign the deed in the presence of a notary public or other authorized official. Note that if the owner is married, both spouses must sign the form to release any potential marital rights to the land. For a valid transfer, file the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

All transfers of real property are subject to a documentary stamp tax. The tax is due at the time of recording. If the transfer is exempt under Neb. Rev. Stat. 76-902, note the reason on the face of the deed and fill out a certificate of exemption.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about grant deeds, or for any other issues related to transfers of real property in Nebraska.

(Nebraska Grant Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Harlan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harlan County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Danna F.

May 29th, 2020

VERY INFORMATIVE

Thank you!

Beverly R.

February 2nd, 2022

This was a wonderful experience, easy fast and convenient.

Thank you for all your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Khadija K.

March 2nd, 2023

Great Service. Not only the required form, but also the state guidelines. Thank you for making it easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

ronald d.

February 19th, 2021

I found that the website was laid out well and referenced documents were professionally created.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jay B.

July 3rd, 2020

Fantastic!

Thank you!

Jean S.

July 2nd, 2019

Service was outstanding. I had the results very quickly. Definitely will use this service again

Thank you!

Timothy N.

September 21st, 2020

Extremely easy and fast recording of real estate records. I was impressed that it was less than 6 hours from the time I uploaded the document to Deeds.com to receiving confirmation that it was recorded by the county clerk. I would highly recommend this service to save you time and quickly get documents recorded!

Thank you for your feedback. We really appreciate it. Have a great day!

Beverly J. A.

November 27th, 2022

The forms where easy to follow with the directions showing how to fill out the forms that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Biagio V.

July 16th, 2022

Process was quick , through and completed with no problems. Excellent service for the price involved.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rahul P.

July 19th, 2023

Excellent Site for recording documents to respective county Recorder Office.rnExcellent customer service, very well informed and experienced staff who responds promptly and guide customers throughout recording process.rnMy recording was suspended But KVH (Staff) gave me proper timely advise and guided me for the procedure till recording was done by county office.rnI would like to give 6 stars or more to the site as per my experience with this site. Highly recommended site

Thank you for your feedback. We really appreciate it. Have a great day!

Quenette S.

September 12th, 2020

Deeds.com is a very Good company. They helped me when I needed the

Thank you!