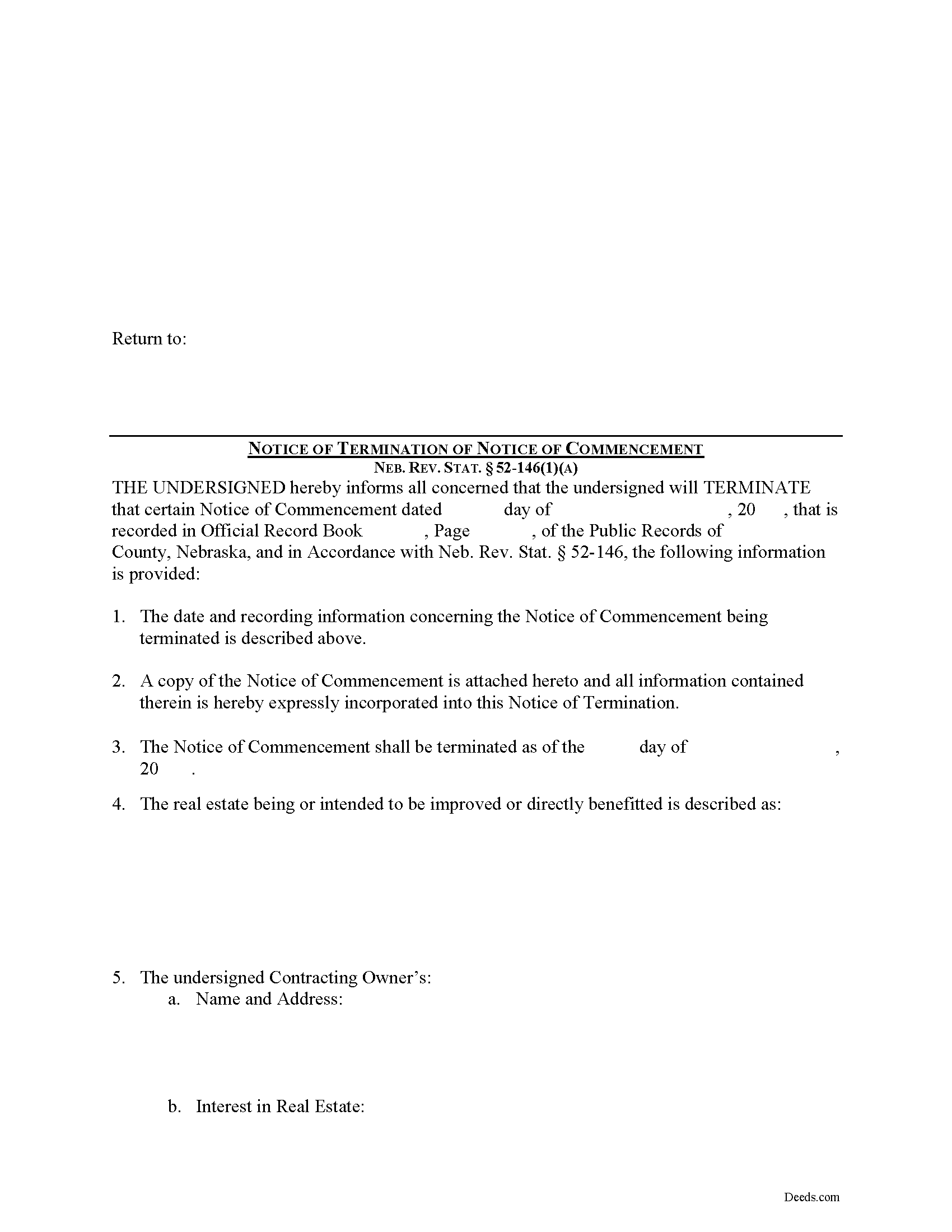

Rock County Notice of Termination Form

Rock County Notice of Termination Form

Fill in the blank Notice of Termination form formatted to comply with all Nebraska recording and content requirements.

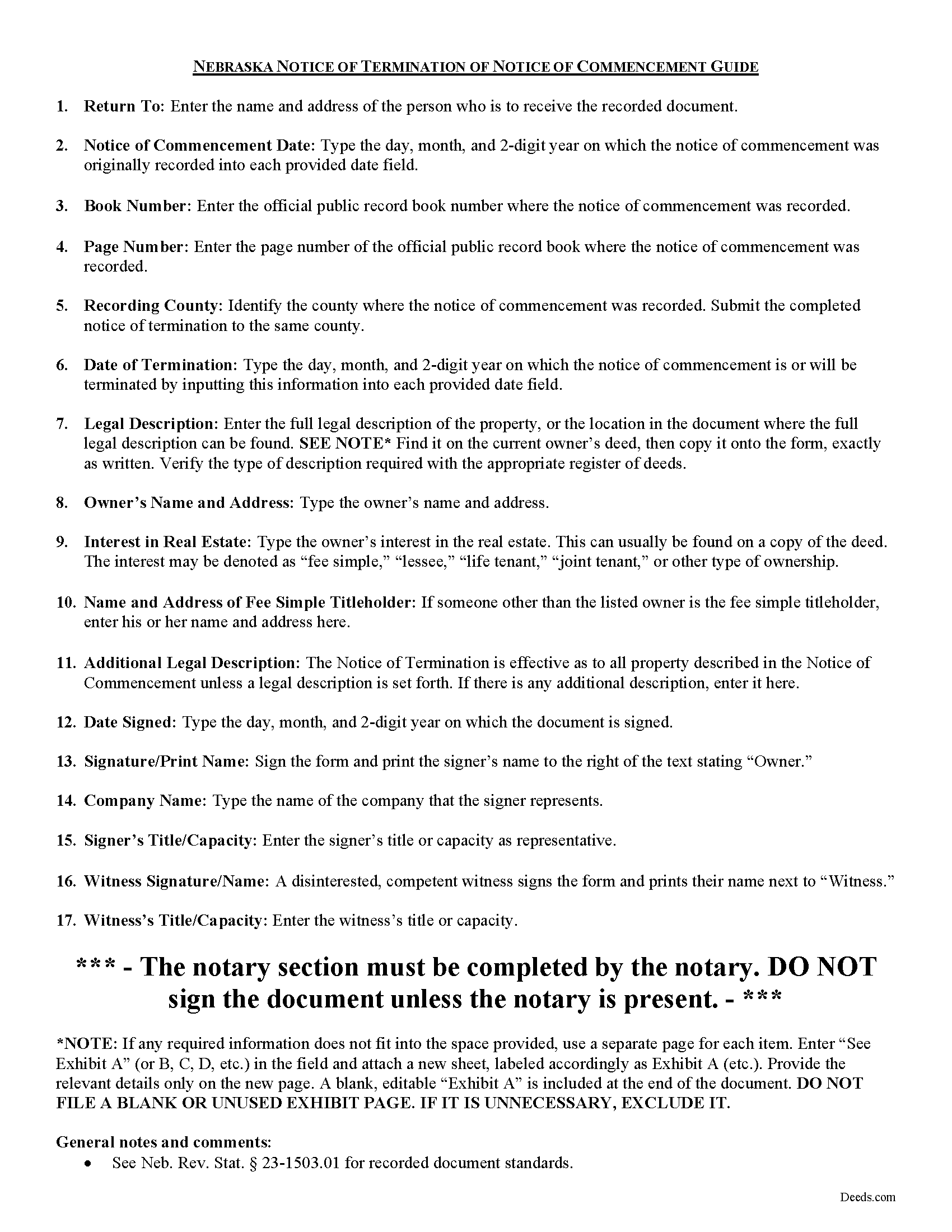

Rock County Notice of Termination Guide

Line by line guide explaining every blank on the form.

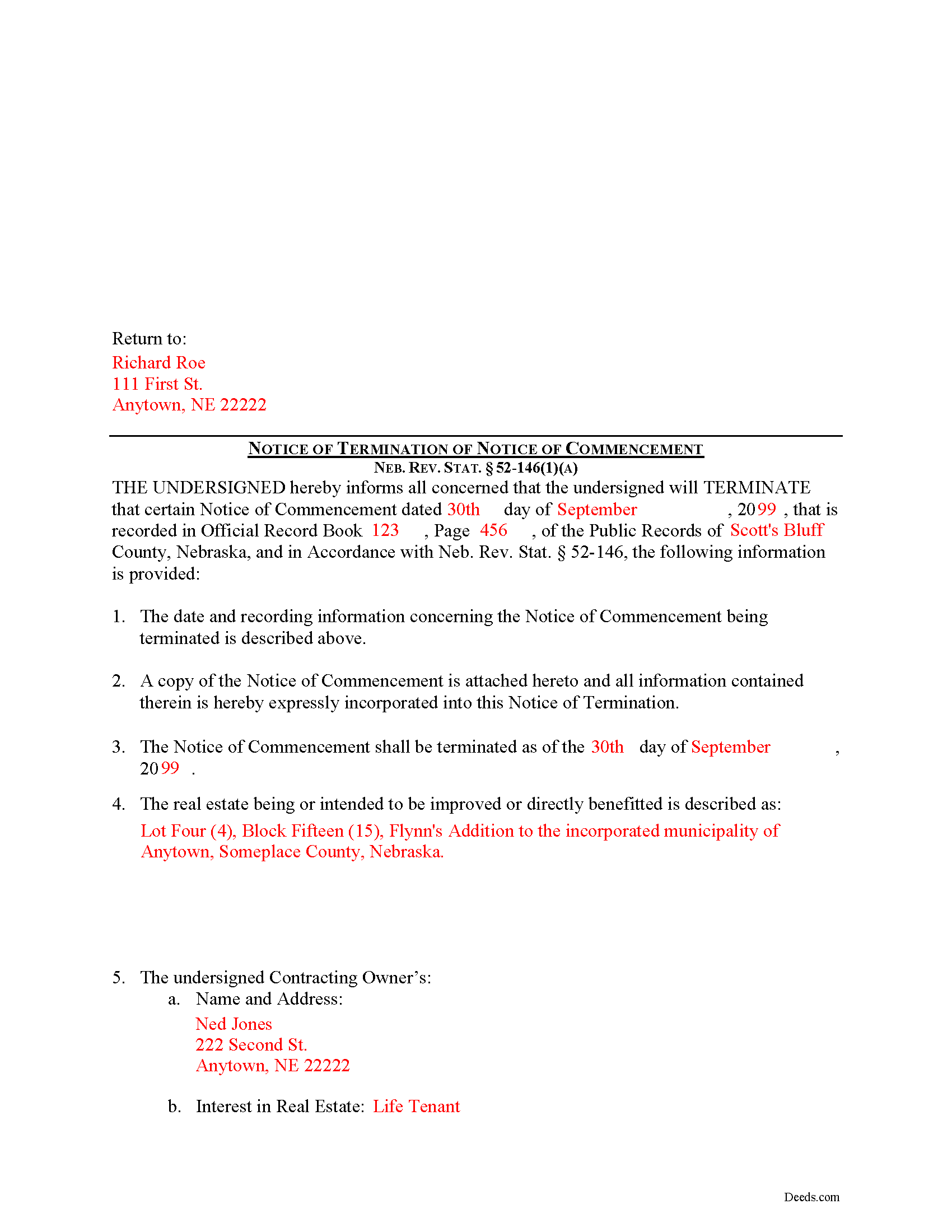

Rock County Completed Example of the Notice of Termination Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Rock County documents included at no extra charge:

Where to Record Your Documents

Rock County Register of Deeds

Bassett, Nebraska 68714

Hours: 9:00am - 12:00 & 1:00 - 5:00pm Monday - Friday

Phone: (402) 684-3933

Recording Tips for Rock County:

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Have the property address and parcel number ready

Cities and Jurisdictions in Rock County

Properties in any of these areas use Rock County forms:

- Bassett

Hours, fees, requirements, and more for Rock County

How do I get my forms?

Forms are available for immediate download after payment. The Rock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rock County?

Recording fees in Rock County vary. Contact the recorder's office at (402) 684-3933 for current fees.

Questions answered? Let's get started!

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

In Nebraska, a contracting owner may terminate a notice of commencement as to all or any identified portion of the real estate subject to the notice of commencement by recording a notice of termination. Neb. Rev. Stat. 52-146(1).

The notice of termination must contain the following:

1) The information required for a notice of commencement (See Neb. Rev. Stat. 52-145);

2) A reference to the recorded notice of commencement by its record location and a statement of its date of recording;

3) A statement of the date as of which the notice of commencement is terminated which date may not be earlier than thirty (30) days after the notice of termination is recorded; and

4) If the notice of termination is to apply only to a portion of the real estate subject to the notice of commencement, a statement of that fact and a description of the portion of the real estate to which the notice of termination applies. Id.

Note that, in addition to the content requirements, the form must meet all state and local standards for recorded documents. File the completed notice with the county recorder's office within the bounds of the county where the property is located.

To fully end the recorded notice of commencement, the owner must also complete and publish or record the following in addition to recording the notice of termination:

1) Send, at least three weeks before the effective date of the notice of termination, a copy of the notice of termination, showing the date it was recorded, to all claimants who have requested that the owner notify them of the recording of a notice of termination;

2) Publish a notice of the recording of the notice of termination, at least once a week for three consecutive weeks in a newspaper having general circulation in the county where the recording occurs, the last publication of which must be at least five days before the stated termination date; and

3) Record an affidavit stating that notice of the recorded notice of termination has been sent to all claimants who have requested notice and that publication has been made. The affidavit must state the newspaper and dates of publication and include a copy of the published notice. Id.

This article is offered for informational purposes only and is not legal advice. This information not be relied upon as a substitute for speaking with an attorney. Please speak with an attorney familiar with construction lien laws for any questions regarding the Notice of Termination or any other issues related to liens in Nebraska.

Important: Your property must be located in Rock County to use these forms. Documents should be recorded at the office below.

This Notice of Termination meets all recording requirements specific to Rock County.

Our Promise

The documents you receive here will meet, or exceed, the Rock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rock County Notice of Termination form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John W.

February 10th, 2021

Wow, I wish that I would have found Deeds.com before! Great service!

Thank you!

Karina C.

March 27th, 2020

The process was very convenient, fast, and efficient. I appreciated the messaging feature which provided real-time communication. I would certainly recommended this service to anyone needing it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wava B.

January 8th, 2021

Obtaining the form was quick and easy. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen M.

May 31st, 2022

Great way to get the forms you need. Quick, easy and affordable

Thank you!

Jennifer K.

February 12th, 2022

Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Leonard H.

November 21st, 2019

Just perfect for what I needed. Made the property transfer very easy.

Thank you!

Shonda S.

April 5th, 2023

This is my first time using the site for business and I must say this site made it so easy for me. I was so lost, thank you so much.

Thank you!

Janice W.

October 10th, 2020

So easy to follow the directions and get what you need. Simple Quick and Easy.' I am very pleased with the outcome.

Thank you!

Suzanne A.

February 25th, 2024

The purchase and download from Deeds.com were pleasantly straightforward. The actual of filing not so obvious in our case.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Alan M.

December 3rd, 2021

The packet I downloaded was complete and useful, and process was not unduly opaque. However, I would have liked to download the whole packet, about 6 files, all at one go. Still, the forms provided the complete solution to my situation.

Thank you for your feedback. We really appreciate it. Have a great day!

George R.

July 28th, 2020

One of the most satisfactory and easy to use websites I have come across. Being able to record documents in the court records without having to pay an atty $500 per hour and accomplish the recording in about 24 hours instead of days and even weeks i s invaluable. Worked perfectly.

Thank you!

Jacquelyn W.

February 4th, 2022

Great site with great info. Almost made the job seamless but form would not adjust to my longer than usual legal description -- I ended up having to recreate the form in word processing software (Libre). But could not have done it without the guidelines.

Thank you!

Kim H.

October 17th, 2020

Great site. quick turnaround and communication. I needed an exception that they told me I needed and where to get the info within hours. I returned warranty deed with exception and the deed was recorded the same day! Great turnaround!

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret P.

May 15th, 2025

EXCELLENT WEBSITE AND SERVICE, HIGHLY RECOMMENDED.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

crystal l.

January 16th, 2019

Another legal professional directed me to this site. The best advice I've received from the legal profession! Forms were instantly available, easily printed & exactly what I needed at a cost that was more than affordable!! I will definitely be back again!!

Thank you Crystal and please thank your associate for us. Have a fantastic day!