Box Butte County Partial Unconditional Lien Waiver Form

Box Butte County Partial Unconditional Lien Waiver Form

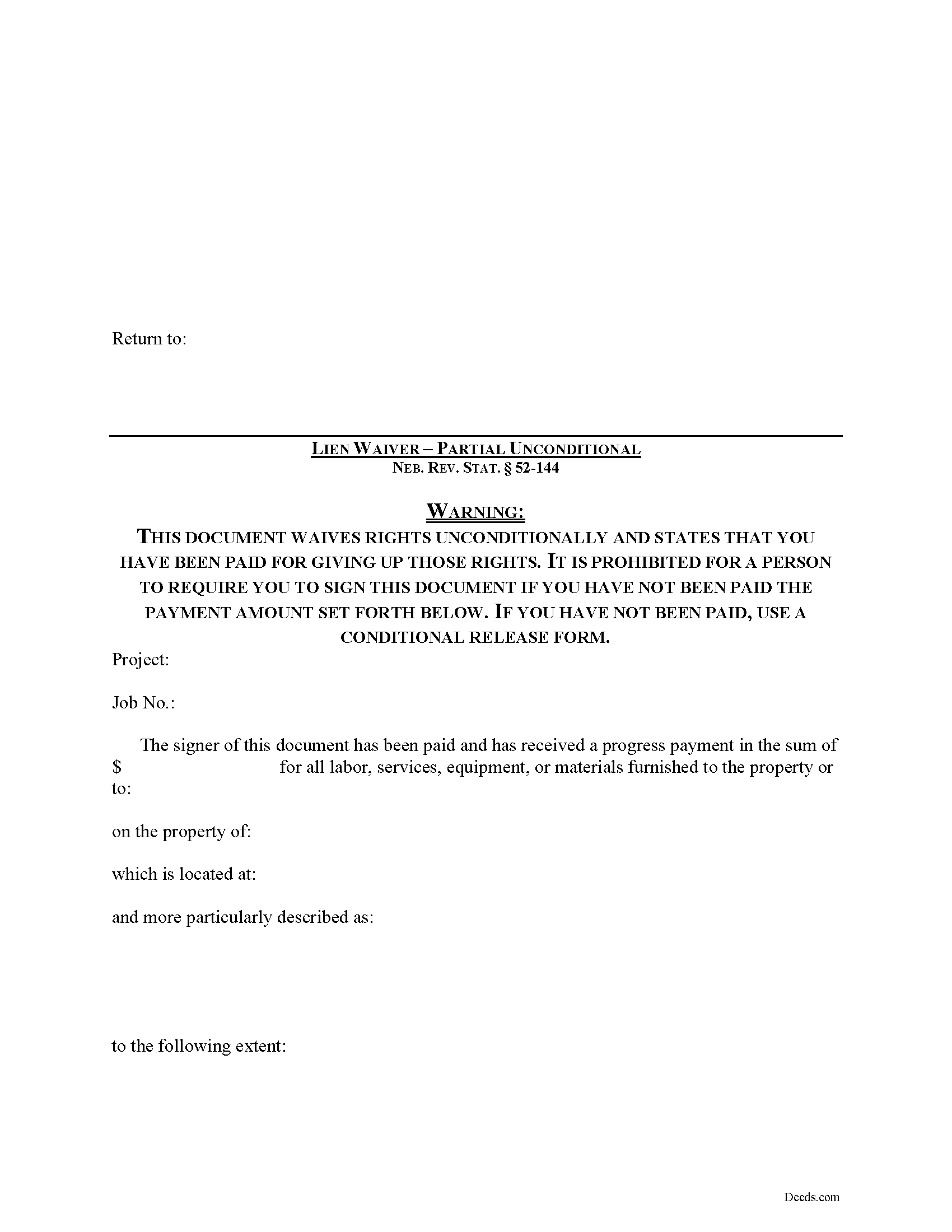

Fill in the blank Partial Unconditional Lien Waiver form formatted to comply with all Nebraska recording and content requirements.

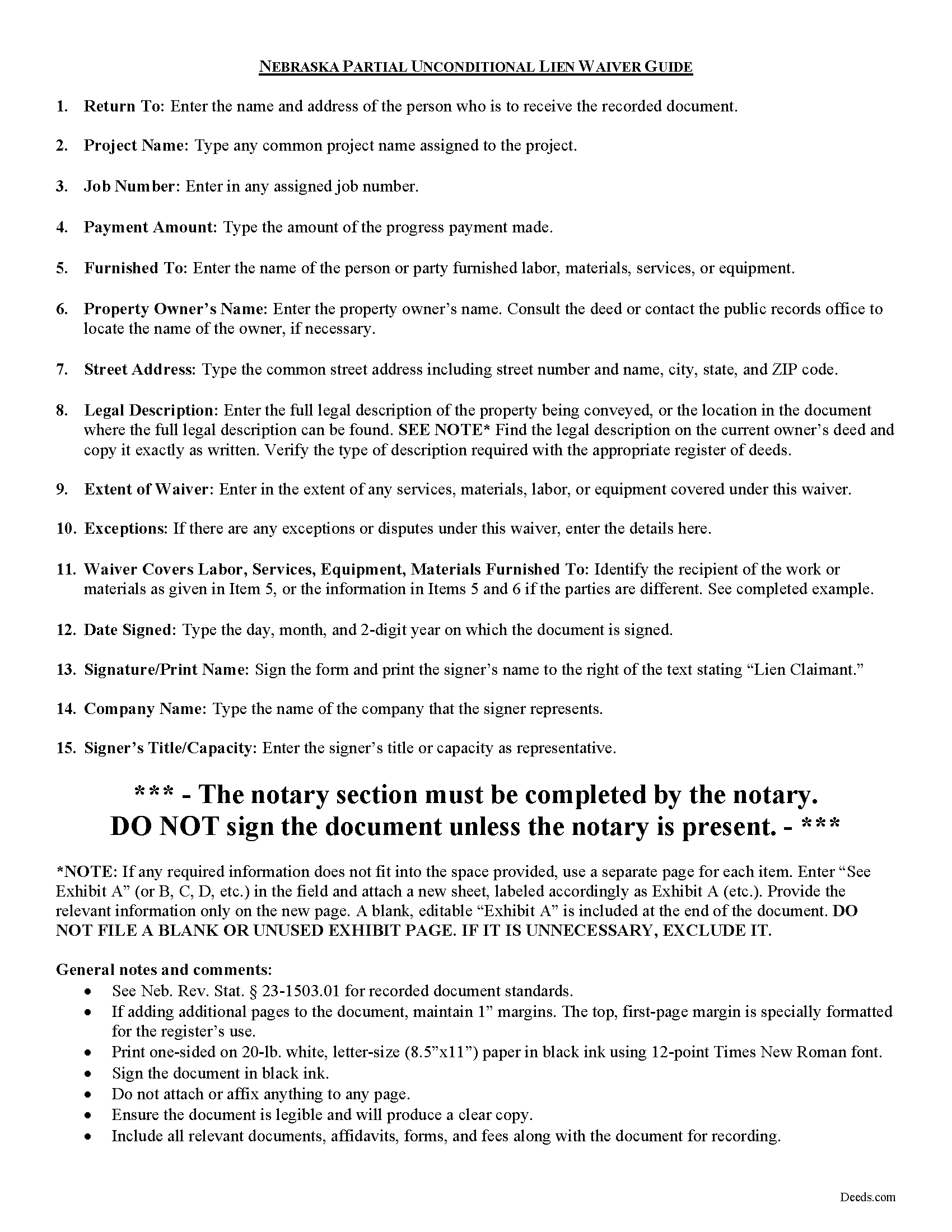

Box Butte County Partial Unconditonal Lien Waiver Guide

Line by line guide explaining every blank on the form.

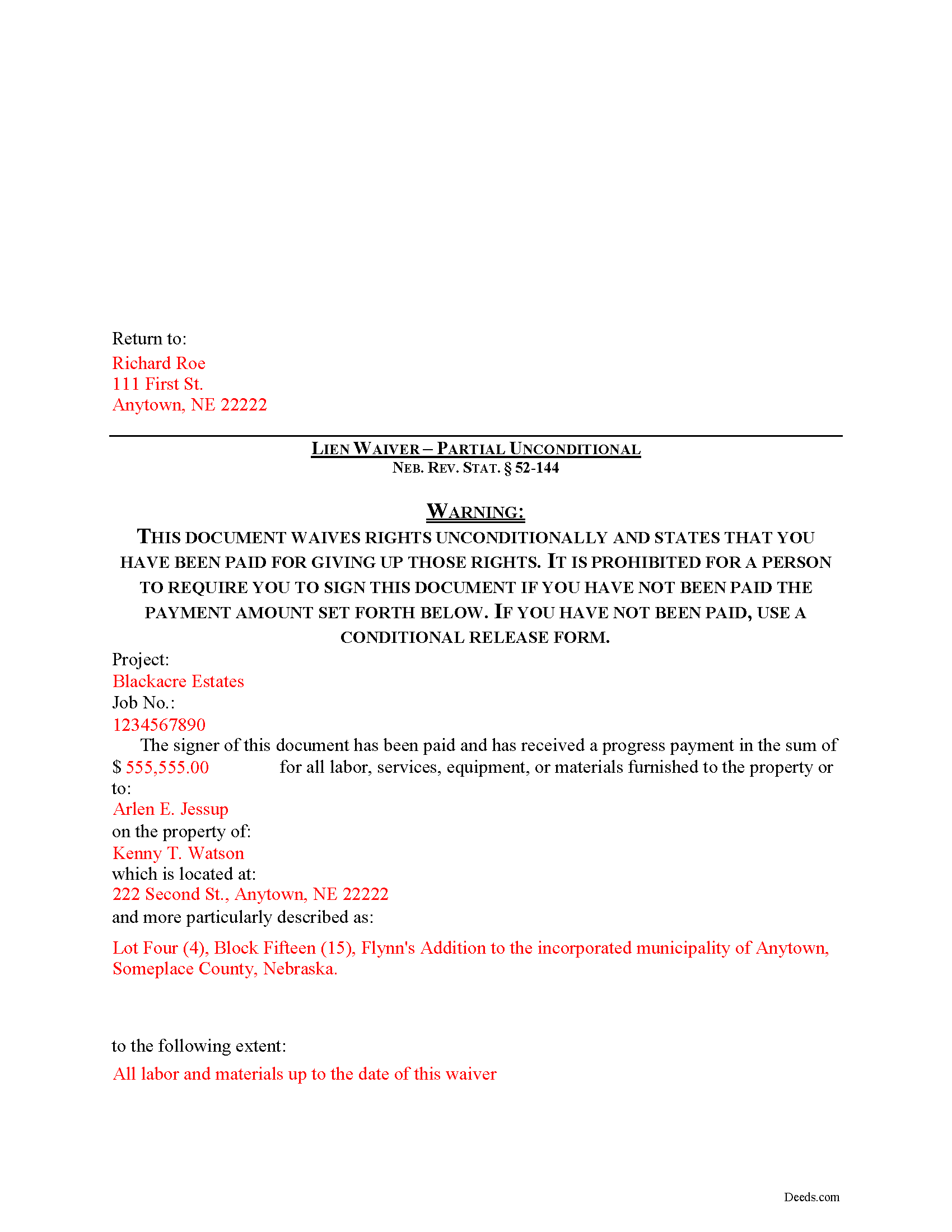

Box Butte County Completed Example of the Partial Unconditional Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Box Butte County documents included at no extra charge:

Where to Record Your Documents

Box Butte County Clerk /Register of Deeds

Alliance, Nebraska 69301

Hours: 8:00 to 4:00 M-F

Phone: (308) 762-6565

Recording Tips for Box Butte County:

- Ask if they accept credit cards - many offices are cash/check only

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Box Butte County

Properties in any of these areas use Box Butte County forms:

- Alliance

- Hemingford

Hours, fees, requirements, and more for Box Butte County

How do I get my forms?

Forms are available for immediate download after payment. The Box Butte County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Box Butte County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Box Butte County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Box Butte County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Box Butte County?

Recording fees in Box Butte County vary. Contact the recorder's office at (308) 762-6565 for current fees.

Questions answered? Let's get started!

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

The term "waiver" means a voluntary surrender of a legal right. In this case, the person granting the waiver gives up the right to seek a construction lien for all or part of the amount due on an improvement to real property. This assurance is often enough to encourage the other party to pay the outstanding debt.

As set forth by Neb. Rev. Stat. 52-144(2), a written waiver relinquishes all construction lien rights of the claimant as to the improvement to which the waiver relates unless the waiver is specifically limited to a particular lien right or a particular portion of the services or materials furnished. A waiver of lien rights does not affect any contract rights of the claimant otherwise existing. 52-144(3). Acceptance of a promissory note or other evidence of debt is not a waiver of lien rights unless the note or other instrument expressly so declares. 52-144(4).

Expanding on the statute above, Nebraska law generally recognizes four types of lien waivers. These include partial and final waivers. Each waiver can be conditional or unconditional. A partial waiver covers a progress payment and the waiver only applies to that payment amount, range of dates, or another agreed-upon point. A final waiver covers the entire balance. If the waiver is conditional, it is only valid if the payment is made or clears the bank. Unconditional waivers become effective when they are signed, regardless of payment status.

Thus, a Partial Unconditional Lien Waiver is appropriate when a partial or progress payment has been made and the claimant agrees to give up the right to claim a lien for that partial payment amount, but there is no concern about the payment clearing the bank. Note, however, that a written waiver of construction lien rights signed by a claimant requires no consideration and is valid and binding, whether signed before or after the materials or services were contracted for or furnished. Neb. Rev. Stat. 52-144(1). Ambiguities in a written waiver are construed against the claimant. Id.

A valid waiver identifies the parties, the property where the claimant performed the work or improvement, and any other information necessary for the specific situation. The claimant signs the document in front of a notary, then submits the completed waiver to the recording office for the county where the property is situated.

This article is provided for informational purposes only and is not legal advice. Please contact an attorney with questions lien waivers or any other issues related to construction liens in Nebraska.

Important: Your property must be located in Box Butte County to use these forms. Documents should be recorded at the office below.

This Partial Unconditional Lien Waiver meets all recording requirements specific to Box Butte County.

Our Promise

The documents you receive here will meet, or exceed, the Box Butte County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Box Butte County Partial Unconditional Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

ronnie y.

May 22nd, 2019

well worth the money thank you

Thank you!

Wendy C.

January 27th, 2021

I purchased a Warranty Deed "package" on Friday and found that the Main download was a working document, but the secondary document (which is required) was not. In other words, I was able to use the fill-in feature on the main document, but not on the second document. I used the portal on the website to report my issue the same day. That was Friday. This is Wednesday. I have not heard a word from them and I have to use my documents in 2 days. I will probably have to resort to pen and ink for that document, but I have already tried filling it out twice and have to keep reprinting and starting over. You can't white out or cross out. I would really prefer to have the complete service that I paid for.

Thank you for your feedback. As is noted on the site, supplemental forms are provided as a courtesy with your order. They are not our forms, we did not create them. They are created and provided by the jurisdiction/agency that requires them. Have a wonderful day.

Vicky M.

September 1st, 2022

I would give Deeds.com 10 stars if I could!! The staff were super friendly and easy to work with. They kept me constantly updated during the process of uploading and forwarding my deeds for recording. And, the price was extremely reasonable. I look forward to utilizing Deeds.com every time I need to record a deed no matter what U.S. State. I wholeheartedly recommend them!

Thank you for your feedback. We really appreciate it. Have a great day!

DEBORAH H.

January 22nd, 2024

This is my fourth try, and I hope my form is complete and acceptable.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

James R.

July 31st, 2019

Super website. Easy to use and stuff is well organized.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jim H.

August 13th, 2020

Well written form, and the guidance document and example supplied were very helpful.

Thank you!

Michael H.

November 5th, 2019

Site was easy to understand and use. Service was prompt. Good job Montgomery County!

Thank you!

Debra B.

October 1st, 2022

Easy to process and file with the courthouse.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mike H.

February 11th, 2021

Great

Thank you!

Rut P M.

November 15th, 2020

I was very pleased with the document I downloaded. I was able to edit it easily and save a copy both as a permanent copy or one that could still be edited. I also liked being able to cut and paste longer paragraphs. It cost a little more than I expected; however, it was worth it be cause I didn't have to fill it out by hand. Great job!

Thank you for your feedback. We really appreciate it. Have a great day!

Robin G.

June 2nd, 2020

Very Pleased. Was so easy and No hidden cost. Second time I have used their services. Would not use any other deed website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kelly M.

August 27th, 2021

Deeds.com made it so easy and convenient to get my homestead document recorded. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry S.

February 25th, 2023

I think it needs to be easier to enlarge print to fit an 8"x12" sheet of paper. Printing off samples is difficult to read as it is too small

Thank you for your feedback. We really appreciate it. Have a great day!

elizabeth m.

April 22nd, 2020

Wonderful service, forms were great. Completed and ready for recording. Will check back in after recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

annie m.

February 13th, 2023

recently joined Deeds.com. still exploring the site. has been very helpful in providing local information for recording, such as fees and requirements. i am working to correct mistakes made within a deed. it is amazing how these municipalities operate outside the scope of Article 1, Section 8, Clause 17; to claim land is "in" the "State of ____. when the land is actually not ceded to the United States of America as for use for needful buildings. beware of the fraud perpetrated by Attorneys in the recording of your Deeds. Registration as "RESIDENTIAL" puts your private-use land on the TAX rolls with the use of that one word. i recommend this site as it appears there is information for each state and each county office. will update my review once i place an order.

Thank you!