Rock County Personal Representative Deed of Distribution Form

Rock County Personal Representative Deed of Distribution Form

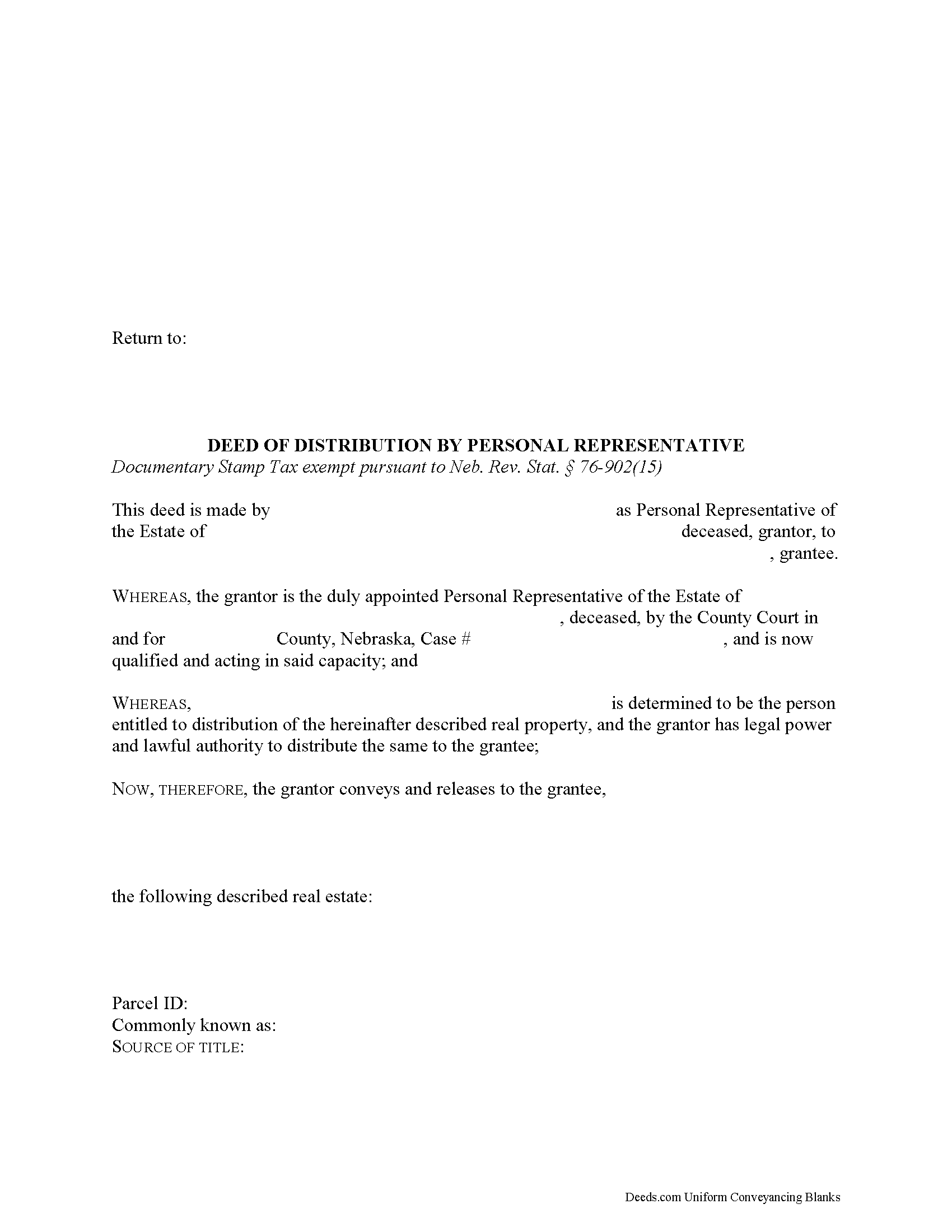

Fill in the blank form formatted to comply with all recording and content requirements.

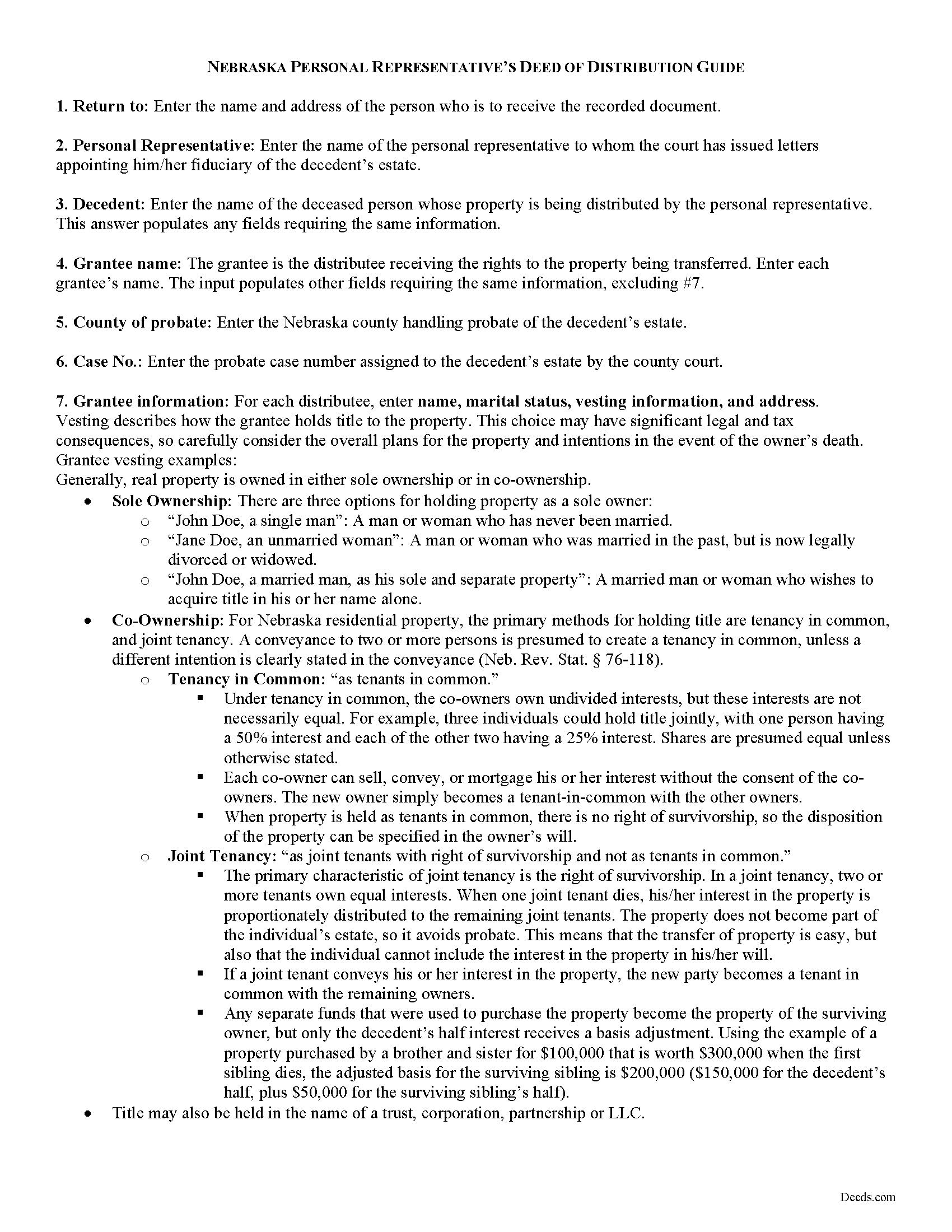

Rock County Personal Representative Deed of Distribution Guide

Line by line guide explaining every blank on the form.

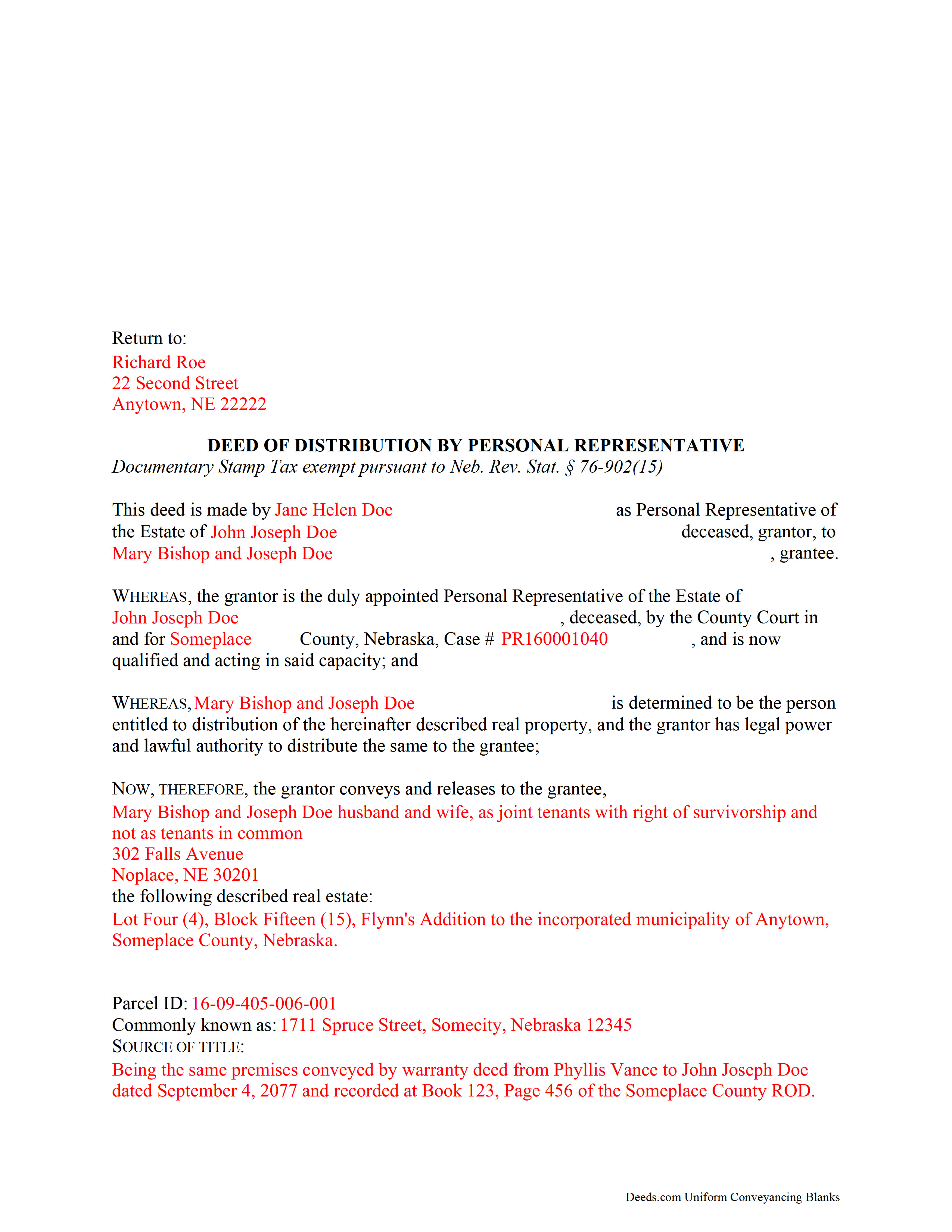

Rock County Completed Example of the Personal Representative Deed of Distribution Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Rock County documents included at no extra charge:

Where to Record Your Documents

Rock County Register of Deeds

Bassett, Nebraska 68714

Hours: 9:00am - 12:00 & 1:00 - 5:00pm Monday - Friday

Phone: (402) 684-3933

Recording Tips for Rock County:

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Rock County

Properties in any of these areas use Rock County forms:

- Bassett

Hours, fees, requirements, and more for Rock County

How do I get my forms?

Forms are available for immediate download after payment. The Rock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rock County?

Recording fees in Rock County vary. Contact the recorder's office at (402) 684-3933 for current fees.

Questions answered? Let's get started!

A personal representative is the fiduciary appointed by the County Court to administer a decedent's estate in probate. The deed transfers title to a decedent's real property to the distributee as grantee. The distributee may be a devisee under the decedent's will, or an heir with a right to succeeding interest under Nebraska's laws of intestate succession when there is no testamentary disposition.

Record a deed of distribution in the Register of Deeds office of the county where the subject property is located as proof of the distributee's succession to the decedent's interest in real property (Neb. Rev. Stat. 30-24,106). PR deeds typically recite the decedent's name and the case number assigned to the estate by the court, and expressly state that the grantor is executing the deed in a representative capacity. They must meet all requirements of form and content for documents pertaining to interest in real property in the State of Nebraska, including a complete legal description of the subject parcel. A Real Estate Transfer Form is required, but the conveyance is exempt from documentary stamp tax.

As always, consult an attorney with questions regarding personal representative's deeds and any other issues related to probate in Nebraska.

(Nebraska PRDOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Rock County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed of Distribution meets all recording requirements specific to Rock County.

Our Promise

The documents you receive here will meet, or exceed, the Rock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rock County Personal Representative Deed of Distribution form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

Patricia E.

June 8th, 2020

Easy to understand and download!

Thank you!

Larry H.

December 23rd, 2020

Nice

Thank you!

Della F.

May 30th, 2019

Always total satisfaction when information is needed. Request for information provided quickly from extremely knowledgeable and courteous personnel.

Thank you!

Rebecca H.

December 14th, 2020

Very pleased with the ease of this deed form. Completing the deed form to make sure everything was in my name took ten minutes. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert H.

January 10th, 2024

Easy to use and understand. I am glad to have found this resource.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Donald W.

December 8th, 2019

Could not have been any easier to download the quit claim forms. The provided instructions and samples look to be helpful. Only have to set aside the time to fill out. Thanks

Thank you!

Christina A G.

December 19th, 2020

It was easy to locate, purchase, and download the documents I needed on the Deeds.com website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara Y.

December 14th, 2020

I found your instructions and sample for completing a quit-claim deed in Arizona to be simple and easy to follow with one exception. The website to use in order to determine the code for the reason for exemption of fees was incorrect, as a result of which I had to contact the County Recorder to obtain that information.

Thank you for your feedback. We really appreciate it. Have a great day!

Emmy M.

August 20th, 2020

I loved using this process to record my deeds. it was fast and everytime I sent a message I received a response very quickly. I am so glad they have this option. for the extra $15 to have the convenience to do it from home and not worry about finding parking, etc. so well worth it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David C.

October 10th, 2022

I got what I expected. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Susan T.

January 21st, 2019

This was perfect for my county I will be recommending your forms to all my clients thank you.

Thank you Susan, have a great day!

Deidre E.

November 18th, 2024

Best thing since sliced bread. Do your homework. Find the documents with Deeds.com and bypass expensive and unnecessary lawyers fees.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

David L.

December 29th, 2020

It was a very easy to use application. I can only give it four stars because I have yet to receive confirmation from the county that my application was acceptable, ie., format, font, etc. I believe it will be fine.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan J.

September 12th, 2019

Simple and easy to use. I was thrilled to find deeds.com during my online search for deed forms and more pleased that I could narrow it down by state and county. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Arthur M.

February 25th, 2021

Efficient and easy to use. Thanks.

Thank you!