Lancaster County Transfer on Death Deed Form

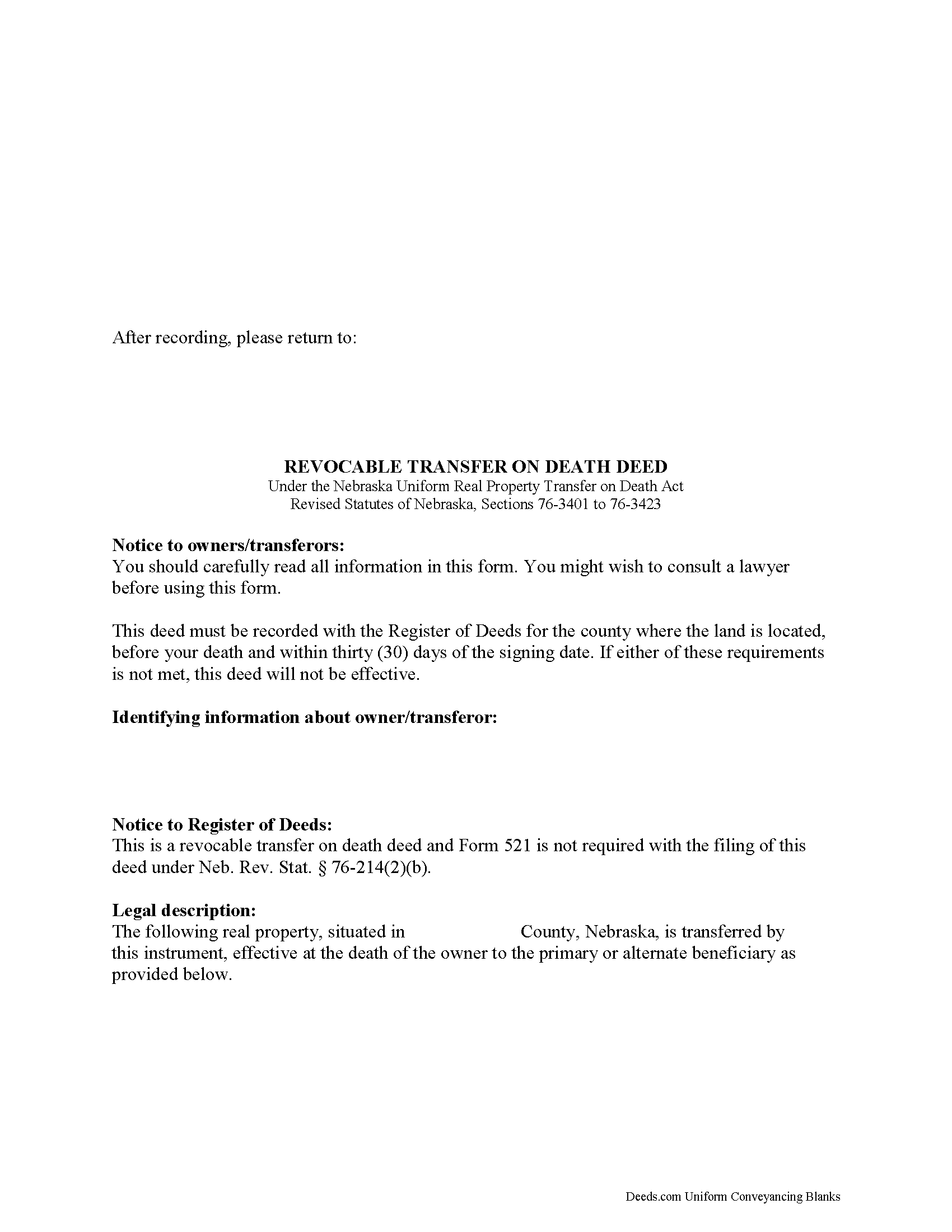

Lancaster County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

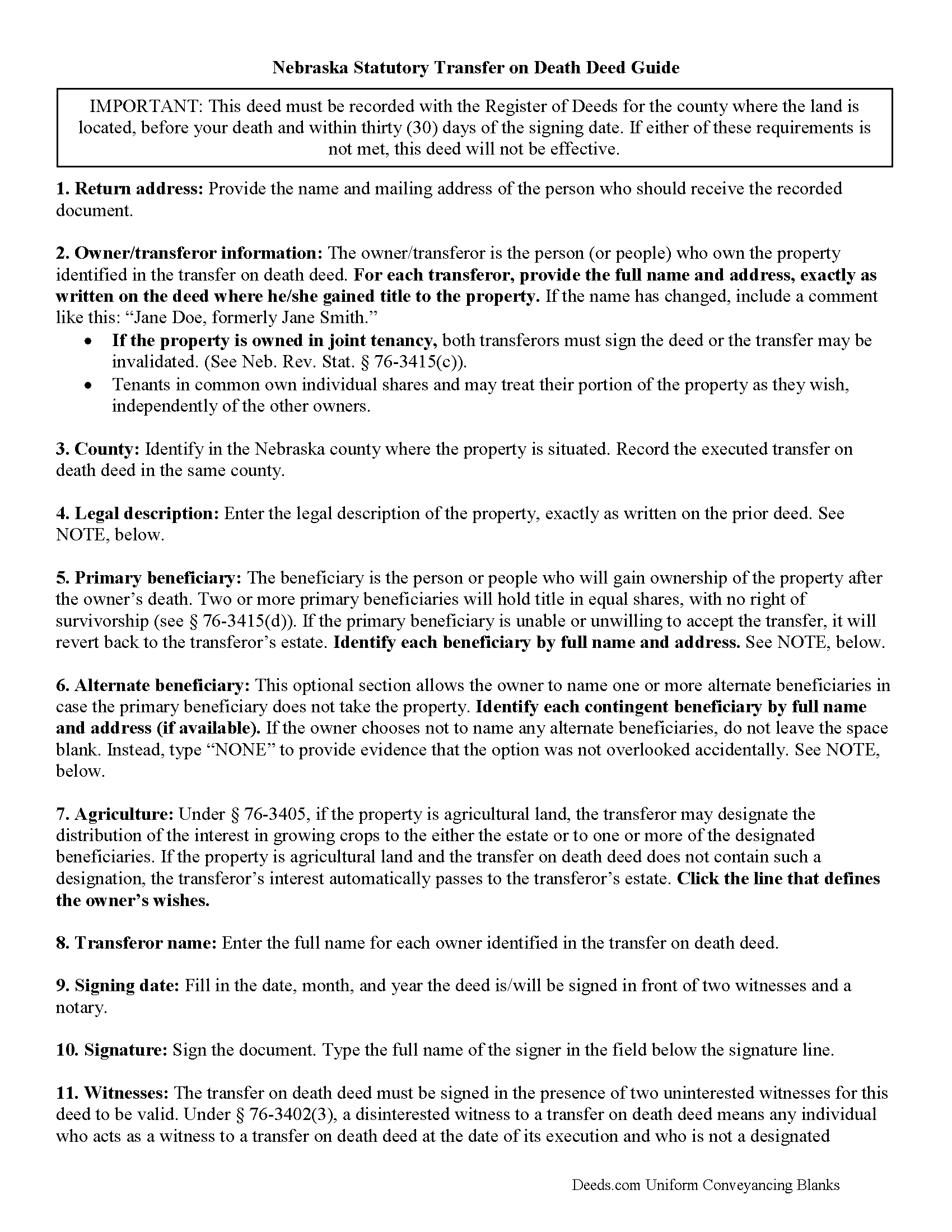

Lancaster County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

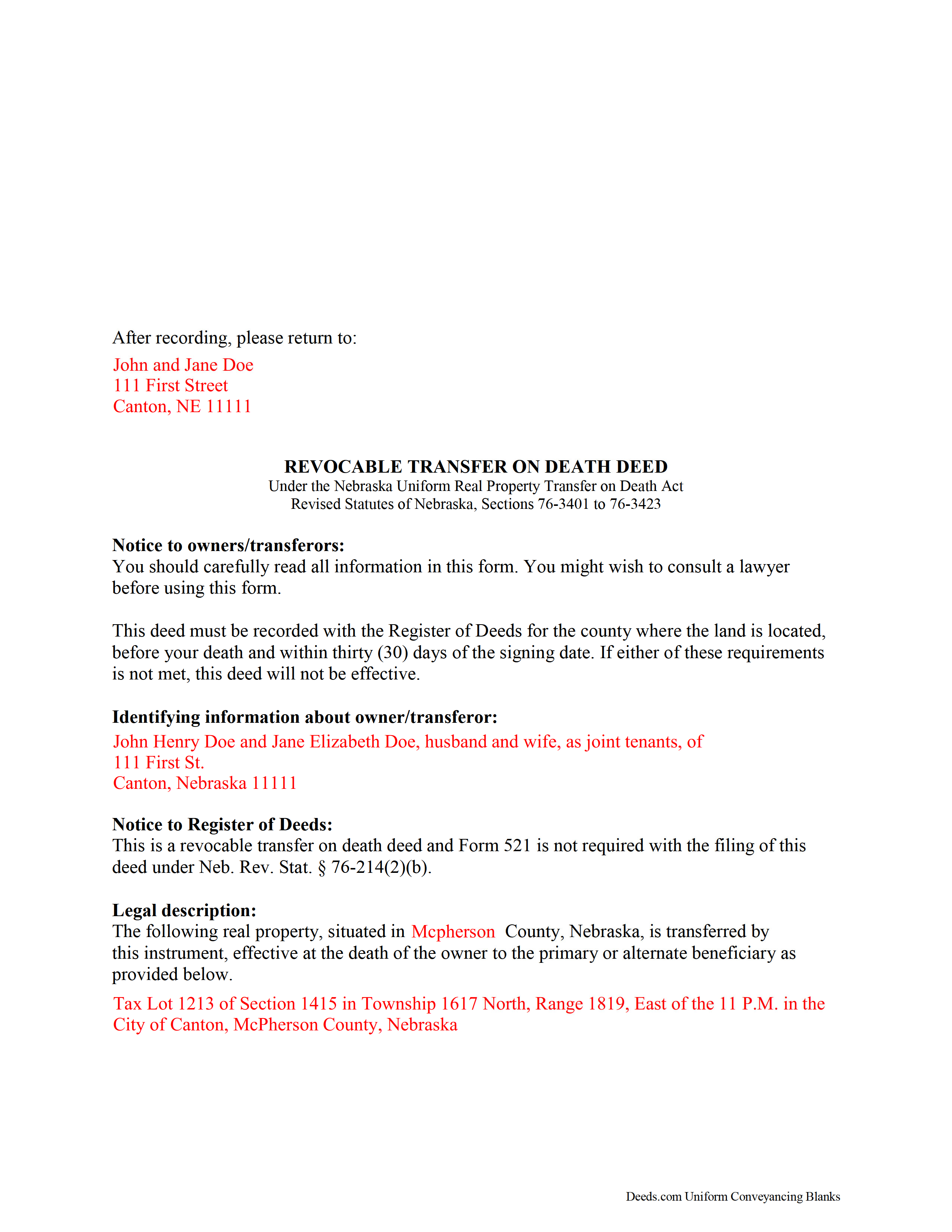

Lancaster County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Lancaster County documents included at no extra charge:

Where to Record Your Documents

Lancaster County Register of Deeds

Lincoln, Nebraska 68508

Hours: 7:30 to 4:30 M-F

Phone: (402) 441-7463

Recording Tips for Lancaster County:

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Lancaster County

Properties in any of these areas use Lancaster County forms:

- Bennet

- Davey

- Denton

- Firth

- Hallam

- Hickman

- Lincoln

- Malcolm

- Martell

- Panama

- Raymond

- Roca

- Sprague

- Walton

- Waverly

Hours, fees, requirements, and more for Lancaster County

How do I get my forms?

Forms are available for immediate download after payment. The Lancaster County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lancaster County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lancaster County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lancaster County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lancaster County?

Recording fees in Lancaster County vary. Contact the recorder's office at (402) 441-7463 for current fees.

Questions answered? Let's get started!

The Nebraska Uniform Real Property Transfer on Death Act is found at Sections 76-3401 to 76-3423 of the Nebraska Revised Statutes. This useful law provides an option for land owners to convey their real estate after their death, but without the need to include it in a will.

A transfer on death deed (TODD), when lawfully executed, allows property owners to retain absolute title to and control over their land during their lives ( 76-3414). The deeds are also revocable (76-3413). In part, these features are possible because unlike traditional deeds (warranty deeds, quitclaim deeds, etc.), TODDs do not require consideration from or notice to the beneficiary ( 76-3411).

In addition to meeting the content requirements of traditional deeds, people who use or revoke TODDs must meet the same competency standards as for creating a will (76-3408). The statute also demands the signatures of two disinterested witnesses (76-3409). Further, the document must contain specific warnings and must be recorded before the owner's death and within thirty days of signing ( 76-3410).

The rules for revoking a recorded TODD are set out at 76-3413. They include executing and recording a document that specifically revokes the TODD ( 76-3413(1)(B)); a new TODD that revokes the previous deed and changes the beneficiary or details about the transfer (76-3413(1)(A)); or transferring the real estate with a traditional deed (76-3413 (1)(C)).

When the owner dies, the beneficiary may accept the transfer by recording the appropriate documentation (76-3412, 76-3415) or disclaim the interest as provided by section 30-2352 (76-3416).

Overall, transfer on death deeds are flexible tools to consider as part of a comprehensive estate plan, but each circumstance is unique. Please contact an attorney for complex situations or with specific questions.

(Nebraska TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lancaster County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Lancaster County.

Our Promise

The documents you receive here will meet, or exceed, the Lancaster County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lancaster County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

anthony r.

November 19th, 2020

Fast and easy

Thank you!

Claude F.

February 8th, 2021

quick and easy to use, thank you

Thank you!

Tamara H.

August 7th, 2021

Absolutely awesome, all the information and forms I needed Thanks Tamie Hamilton

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia M.

August 19th, 2019

Very easy site to navigate and very helpful information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David M.

April 24th, 2019

Why is Dade County not listed for the Lady Bird Deed?

Because on November 13, 1997, voters changed the name of the county from Dade to Miami-Dade.

Jon W.

September 16th, 2021

Useless for me. My deed could not be pulled. After investigation, I got a copy online directly from WV for $3. No one but editors of this will ever see this. Shame.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine A.

September 25th, 2022

Very good site, easy to get around, very thourough, easy to use. Definately will use again. I give you 5 stars

Thank you for your feedback. We really appreciate it. Have a great day!

Robert K.

June 13th, 2021

Very user friendly - I found the affidavit I needed right away together with the guide to filling it out.

Thank you!

Susan B.

August 8th, 2023

I guess I got what I paid for. The site said I would be able to download blank PDF forms that I could fill out on my computer. I expected fillable forms, like I download for taxes. Instead the forms I got could only be completed by using Adobe Sign and Fill tools. These are much harder to use than fillable forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy E.

May 4th, 2025

Took me awhile to figure out and get the information printed so I can use it later. Thank you.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

ALICIA G.

January 16th, 2022

To set the service was incredibly easy and the results came back very fast. Very reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy C.

February 13th, 2019

Both sets of deeds were complete and easy to understand. Both states accepted the forms to transfer property.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

candy h.

June 18th, 2020

service was great!

Thank you!

Janice S.

August 31st, 2022

All instructions and forms are very easy to read and fill-out. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

JoAnn T.

October 7th, 2022

Very happy! This was a very easy to use web site, the form came with directions and an example, both were very helpful. I will absolutely use Deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!