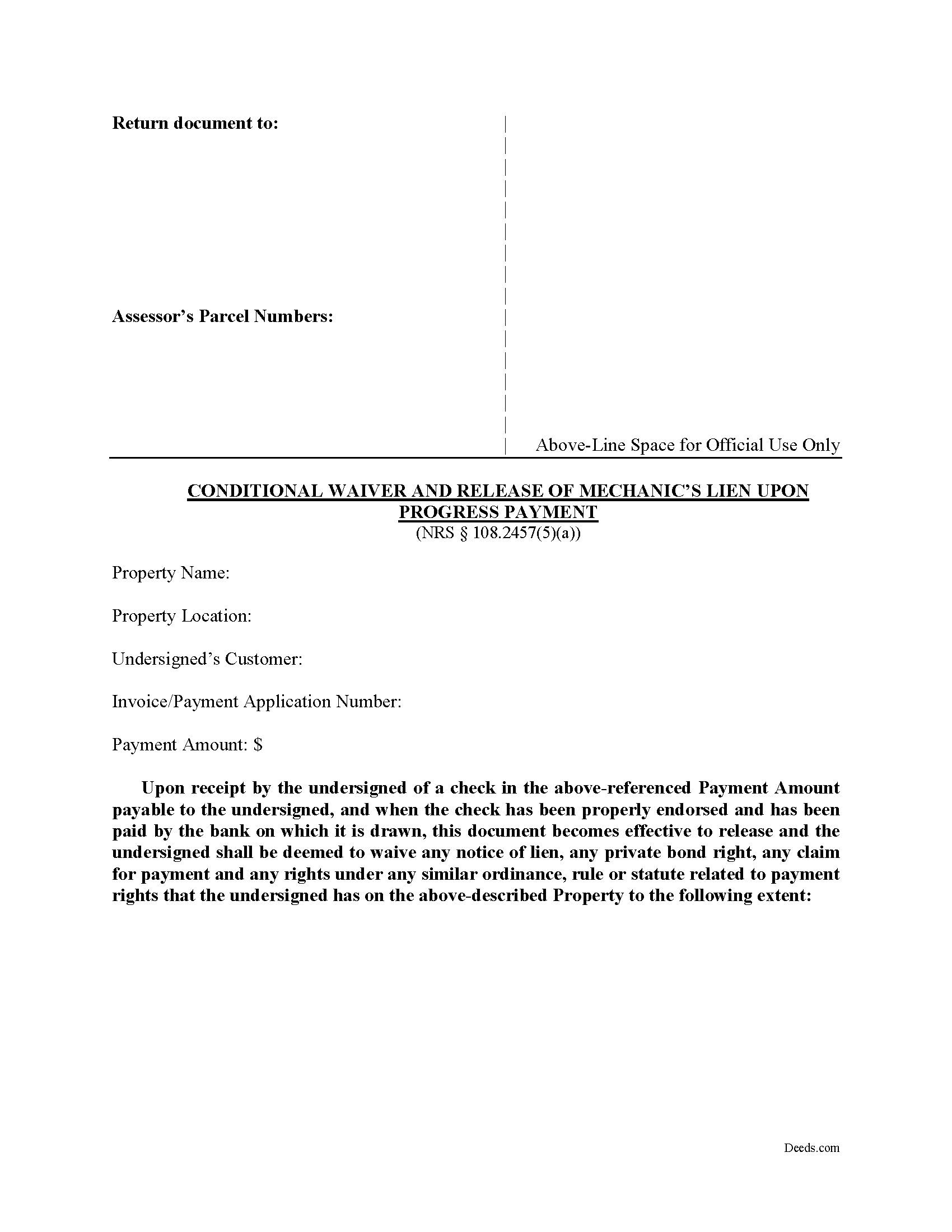

Douglas County Conditional Waiver upon Progress Form

Douglas County Conditional Waiver upon Progress Form

Fill in the blank Conditional Waiver upon Progress form formatted to comply with all Nevada recording and content requirements.

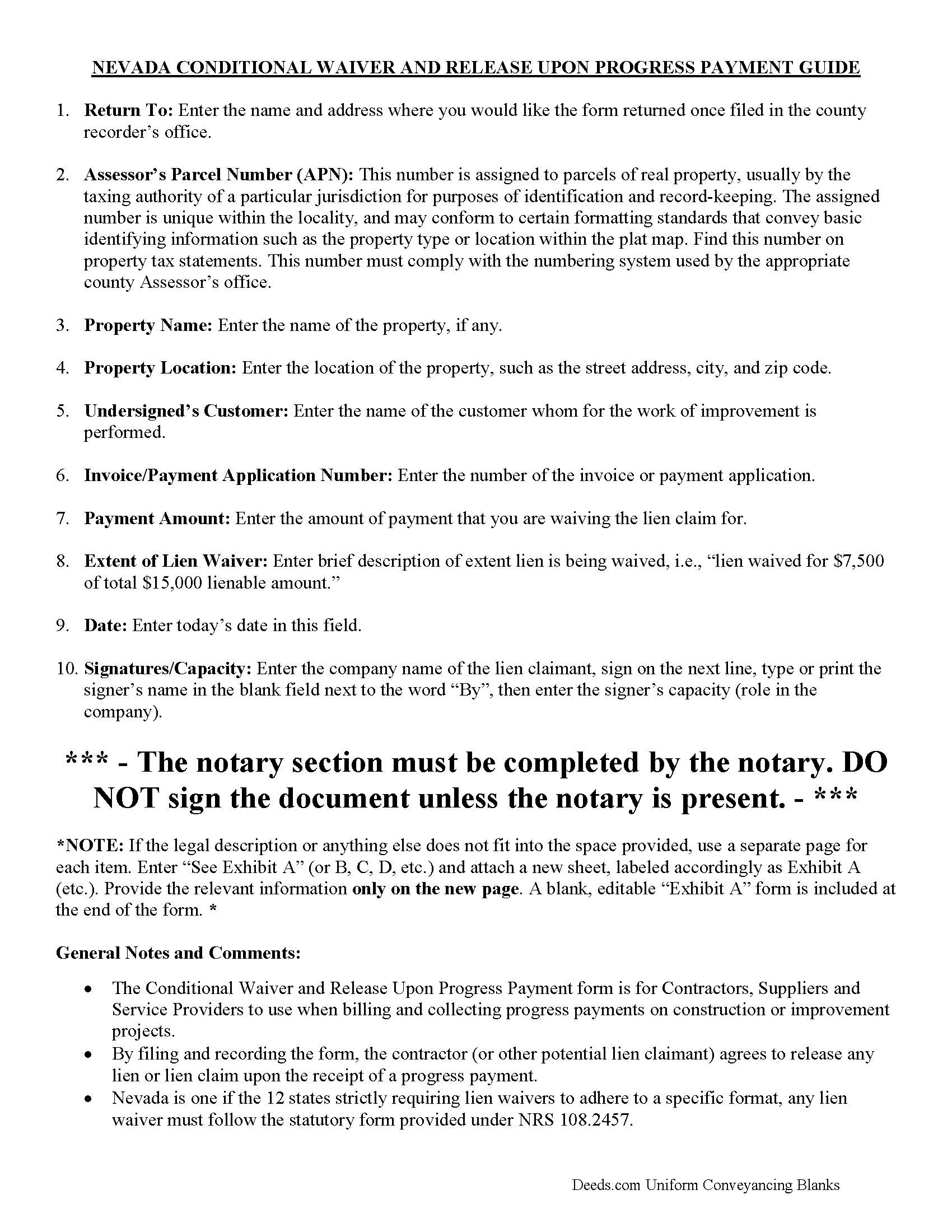

Douglas County Conditional Waiver upon Progress Guide

Line by line guide explaining every blank on the form.

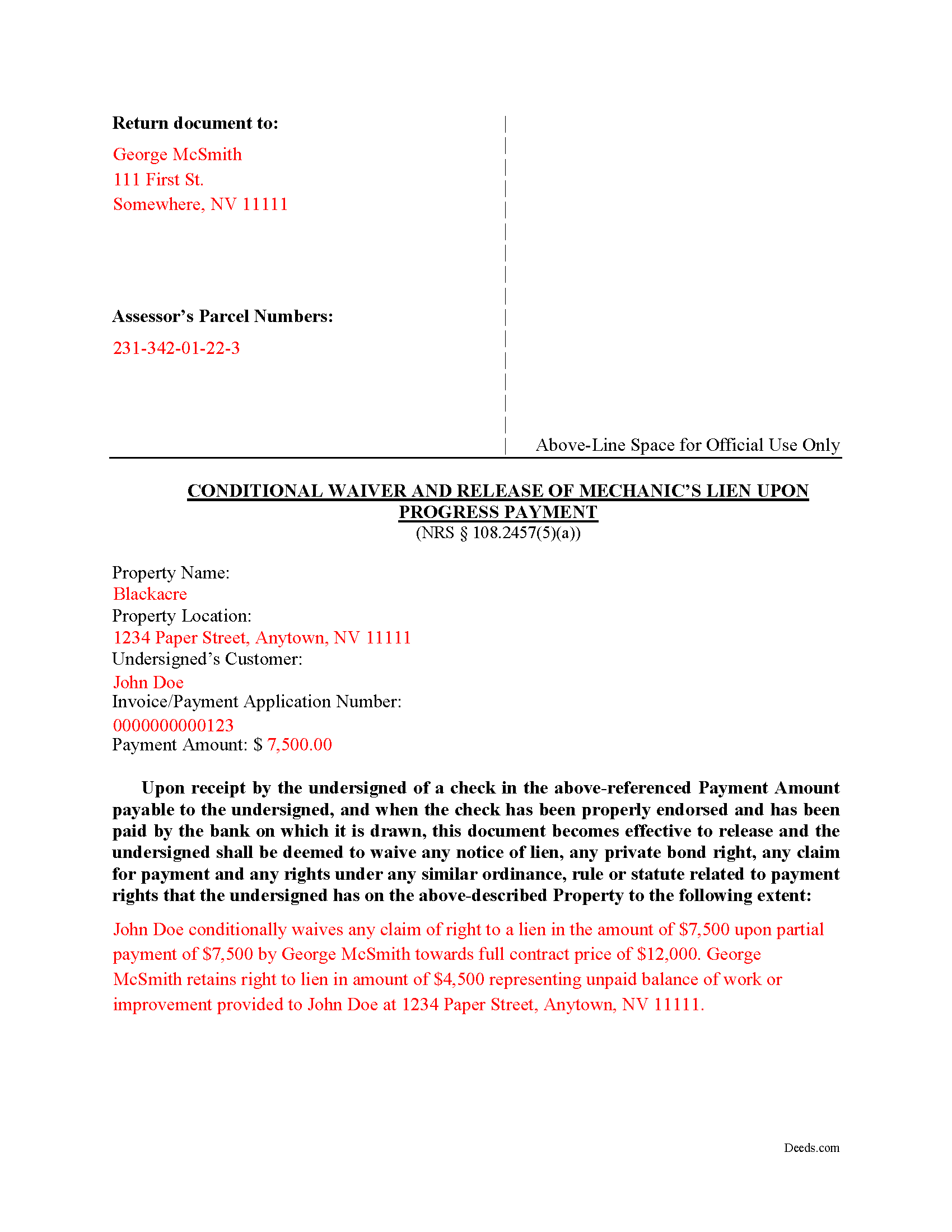

Douglas County Completed Example of the Conditional Waiver upon Progress Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Douglas County documents included at no extra charge:

Where to Record Your Documents

Douglas County Recorder

Minden, Nevada 89423

Hours: 8:00am - 5:00pm M-F

Phone: (775) 782-9025

Recording Tips for Douglas County:

- Ensure all signatures are in blue or black ink

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Douglas County

Properties in any of these areas use Douglas County forms:

- Carson City

- Gardnerville

- Genoa

- Glenbrook

- Minden

- Stateline

- Zephyr Cove

Hours, fees, requirements, and more for Douglas County

How do I get my forms?

Forms are available for immediate download after payment. The Douglas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Douglas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Douglas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Douglas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Douglas County?

Recording fees in Douglas County vary. Contact the recorder's office at (775) 782-9025 for current fees.

Questions answered? Let's get started!

Nevada Conditional Waiver and Release upon Progress Payment

Provided under NRS 108.2457(5)(a), this waiver offers the most protection for lien claimants, because it states that if the claimant(s) have actually been paid to date (including no returned or stopped payment checks) the waiver serves as effective proof against any lien claim on the property. The lien is "conditioned" on receiving payment and is only waived if the claimant actually receives the payment.

By filing the form, the lien claimant represents that he or she either has already paid or will use the money he or she receives from this progress payment in order to make prompt payment in full all his or her laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

Getting a lien waiver also allows property owners to shield the title to their property from the general contractor, material supplier and every subcontractor involved with a project. By releasing the lien upon a progress payment, the property owner once again has clear title and can obtain financing or sell the property.

The property owner should require lien and labor waivers to be submitted with the contractor's invoices and no payment of any invoice should be made unless properly signed lien and labor waivers are provided. Proper lien waivers can protect the property owner from liens filed by the contractor's subcontractors, suppliers and laborers who might record a lien if they are not paid by the contractor.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Important: Your property must be located in Douglas County to use these forms. Documents should be recorded at the office below.

This Conditional Waiver upon Progress meets all recording requirements specific to Douglas County.

Our Promise

The documents you receive here will meet, or exceed, the Douglas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Douglas County Conditional Waiver upon Progress form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Edward L.

March 6th, 2019

Excellent web site with just the right documents. Filled a very important need in less tha 2 minutes time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

April 13th, 2021

Thank you for always providing great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan M.

May 12th, 2022

Simple and straightforward

Thank you for your feedback. We really appreciate it. Have a great day!

David O.

March 19th, 2022

Service was top-notch....fast, accurate, cost-effective.

Thank you!

frederic m.

January 1st, 2021

surprisingly good, gave me all the info I needed to prepare a deed and necessary attachments for recording.

Thank you!

srikanth n.

January 14th, 2020

why not word format??

Good question. There are many reasons, we'll touch on a few. For the end user (you) Adobe Reader is free, Word is not. PDF is the portable document standard, Word is a decent word processor. A portable document format (PDF) maintains document formatting such as margins and font size which is very important to legal documents, Word does not. Have a wonderful day.

Judy C.

February 13th, 2019

Both sets of deeds were complete and easy to understand. Both states accepted the forms to transfer property.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CARMEN R J.

August 7th, 2019

Thank you intensly

Thank you!

Thomas E.

December 18th, 2018

Great, immediate access to everything I needed to assist my client! This is truly a great resource for a Notary Public! I will surely keep my account open, and will refer others as well!

Thank you for the Kind words Thomas. We really appreciate you! Have a great day.

Liliana H.

July 21st, 2025

I had a great experience using Deeds.com to file my legal document. The whole process was simple and easy to follow. The website walks you through each step, and everything is explained clearly. At one point, I had to resubmit my documents, but even that was quick and easy. There were clear instructions, and I had no trouble making the changes and sending them again. The communication was great too. I was kept updated the whole time, and any questions I had were answered fast. If you need to file legal documents and want a stress-free way to do it, I definitely recommend Deeds.com. They made the whole process smooth from start to finish.

Thank you, Liliana! We really appreciate you taking the time to share your experience. We're glad everything went smoothly and that our team could support you when needed. It means a lot to know you'd recommend us!

RUSSELL E.

August 5th, 2020

The process sure was easy and fast. Not sure why a rep would question why I am requesting an exhibit page on the Deed when that's a common practice here in AZ. They recorded it the way I sent it so all good.

Thank you!

Daniel S.

November 7th, 2022

Easy to access documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Roxanne G.

April 16th, 2023

That was easy(I think). Hopefully they saved to my computer intact so I don't have to come back begging for a repeat. Great service!

Thank you!

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacquelyn W.

February 4th, 2022

Great site with great info. Almost made the job seamless but form would not adjust to my longer than usual legal description -- I ended up having to recreate the form in word processing software (Libre). But could not have done it without the guidelines.

Thank you!