Douglas County Discharge of Lien Form

Douglas County Discharge of Lien Form

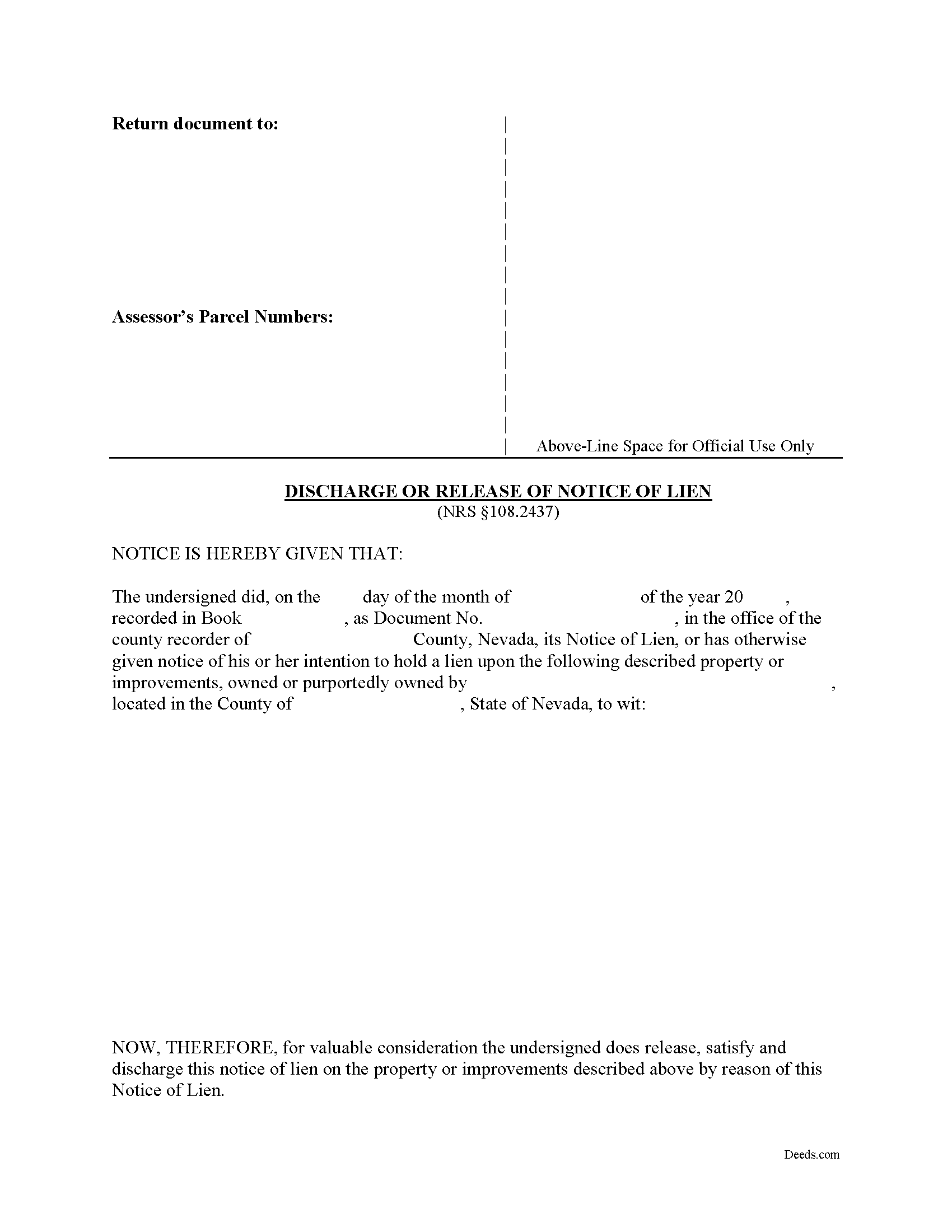

Fill in the blank form formatted to comply with all recording and content requirements.

Douglas County Discharge of Lien Guide

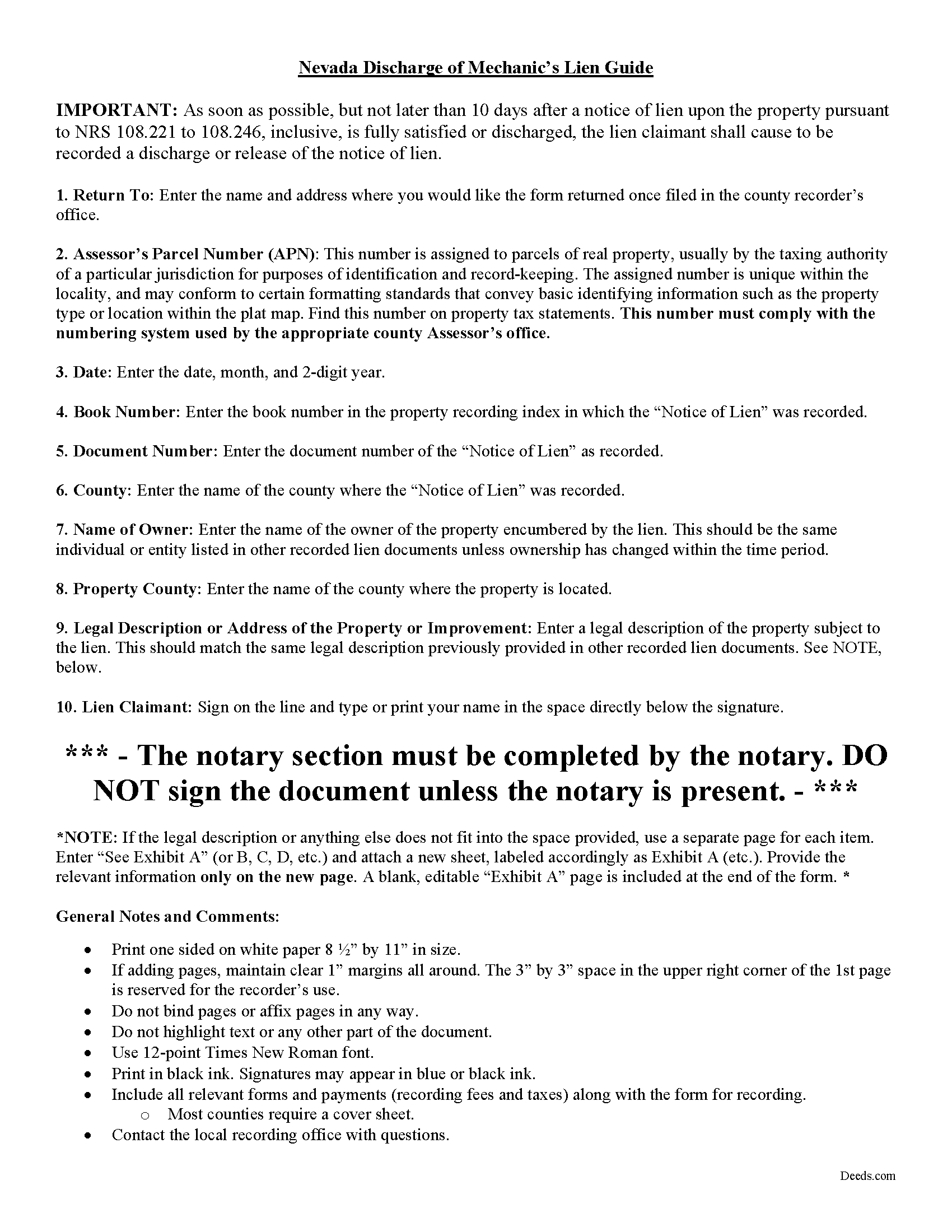

Line by line guide explaining every blank on the form.

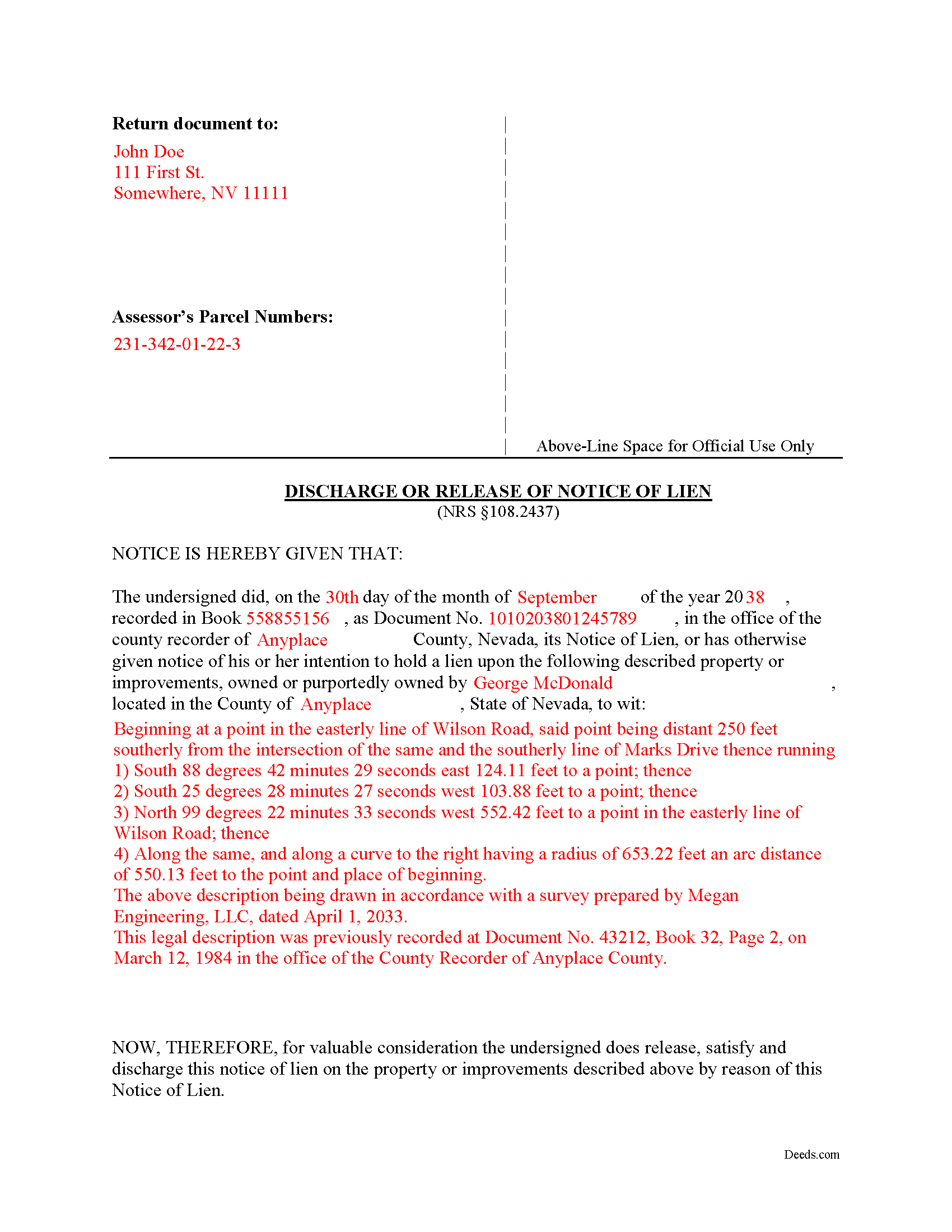

Douglas County Completed Example of the Discharge of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Douglas County documents included at no extra charge:

Where to Record Your Documents

Douglas County Recorder

Minden, Nevada 89423

Hours: 8:00am - 5:00pm M-F

Phone: (775) 782-9025

Recording Tips for Douglas County:

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Douglas County

Properties in any of these areas use Douglas County forms:

- Carson City

- Gardnerville

- Genoa

- Glenbrook

- Minden

- Stateline

- Zephyr Cove

Hours, fees, requirements, and more for Douglas County

How do I get my forms?

Forms are available for immediate download after payment. The Douglas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Douglas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Douglas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Douglas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Douglas County?

Recording fees in Douglas County vary. Contact the recorder's office at (775) 782-9025 for current fees.

Questions answered? Let's get started!

Discharging a Lien in Nevada

So at this point you've filed your mechanic's lien against a client's property after the client never paid the invoice for a completed project. Now the client has finally paid off the lien or maybe you've come to some agreement with the client to accept a lesser amount. You're free to forget about the ordeal and move on to prepare for your next job, right?

Not quite; Nevada lien law requires you to perform one additional step of filing a notice of discharge to provide public notice that you are no longer claiming a lien against the title. It is essential to properly file and record this notice because you can face potential consequences by skipping this step. By this time, you've already complied with statutory lien law to the letter in order to obtain your lien, so don't be sloppy now.

The discharge of lien form gives notice to the owner, other lien claimants, and anyone else with a potential interest in the subject property that the lien has been paid in full or has otherwise terminated. If you obtained a mechanic's lien and the debtor or other person responsible for the lien pays the debt or you discharge the lien for any other reason, you must file a discharge of lien notice. As soon as possible, but not later than 10 days after a notice of lien upon the property (pursuant to NRS 108.221 to 108.246) is fully satisfied or discharged, the lien claimant must record a discharge or release of the notice of lien drafted in substantial compliance as required by Nevada lien law. Serve the discharge notice on the owner personally or by certified mail.

Failure to file this notice in time exposes you to potential liability in a civil action (pursuant to NRS 108.2437). Because a lien is a burden on the property (and the owner) and can discourage or prevent a sale, transfer, or refinancing, neglecting to discharge the lien can cause the owner damages, thus entitling her to a legal remedy. For instance, you may be liable for the costs of a lost sale or damages caused by a lender's refusal to extend credit due to the mechanic's lien on the collateral property. Even if the failure to discharge the lien did not cause any actual damages, Nevada lien law allows for a statutory penalty award of $100 to the owner. The owner or heirs are also entitled to reasonable attorney's fee and the costs of bringing the action. Again, it is essential to properly discharge any lien recorded against a property once the underlying debt has been satisfied or discharged for any other reason.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Important: Your property must be located in Douglas County to use these forms. Documents should be recorded at the office below.

This Discharge of Lien meets all recording requirements specific to Douglas County.

Our Promise

The documents you receive here will meet, or exceed, the Douglas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Douglas County Discharge of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Tim R.

May 9th, 2019

Quick and efficient

Thank you Tim, we appreciate your feedback.

Francis L.

February 8th, 2023

You have duplicate documents in your listing of documents. please clean up.

Thank you!

Rebecca M.

December 28th, 2023

Great service! fast turnaround! I’ve used Deeds.com multiple times, and the software interface is easy to use. I was able to get Deeds for Nevada re-recorded (errors on my lawyers part), quickly with Deeds.com support. Thanks Deeds.com!!

It was a pleasure serving you. Thank you for the positive feedback!

William G.

August 10th, 2023

So far so good. I will be taking the report to the Marion County Clerks office this week to see if it meets their requirements. If so, I will definitely be able to recommend Deeds.com to others.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin M.

December 3rd, 2021

My first time using Deeds.com and I am impressed how much you offer and how easy it is to use this site. Had the real-estate forms I needed plus a bonus of how to fill them out. Best value on the internet for real-estate forms and information.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brian H.

May 1st, 2019

Forms are good. But need to be able to fill in information and blanks so these can be filed. Disappointed.

Thank you for your feedback. The forms are fill in the blank, Adobe PDFs. As is noted on the site, make sure you download the documents to your computer and open them with Adobe. Sounds like you may be trying to complete them online in your browser.

Lawrence N.

August 31st, 2020

Very easy and convenient to use. Low cost and saves a trip to the courthouse and/or having to do mailing(s)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heidi G.

August 19th, 2020

Very happy with the service that you offer. My office will use you again.

Great to hear Heidi, glad we could help. Have an amazing day!

Ronald C.

January 31st, 2019

My goal was to find the Covenant, Conditions, and Restrictions for my HOA. From what I can read, these documents should be attached to our Deed (single family, patio home in New Hanover County). I am not sure if I have a copy of my Deed. I would need to check my Safe Deposit Box. Unfortunately, I was not successful at finding these documents from your Website. If you can help me find them, I would appreciate that.

It is most common to obtain a copy of CC&Rs directly from the HOA. Alternatively, they are also usually a matter of public record recorded with the local recorder and you can obtain a copy there.

Richard B.

April 27th, 2023

Excellent! I was able to complete the documents especially using the instructions as a guide. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erica W.

July 21st, 2020

Very easy and convenient. I will use this service again!

Thank you!

Michael C.

November 20th, 2022

No Search feature on the site? How do I look for forms?

Thank you for your feedback. We really appreciate it. Have a great day!

Christin A.

July 7th, 2020

Super Quick! and Easy!

Thank you!

LAWRENCE S.

January 9th, 2022

I am mostly satisfied with my Deeds.Com experience. Not sure if you can do anything about this, but since it is fairly common, I thought the Quit Claim Form would have a section specifically for adding spouse to a deed.

Thank you for your feedback. We really appreciate it. Have a great day!

David S.

April 6th, 2024

This site was recommended by my County's Clerks office website. Let me tell you when I received my specific State and County's Quit Claim Deed forms from Deeds.com, every conceivable form that could be needed in addition to the full instructions, and a sample filled out form, I was impressed (five stars) and made things so easy for me to feel confident in my legal activity on a land transaction.

Thank you for your positive words! We’re thrilled to hear about your experience.