Mineral County Discharge of Lien Forms (Nevada)

Express Checkout

Form Package

Discharge of Lien

State

Nevada

Area

Mineral County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Mineral County specific forms and documents listed below are included in your immediate download package:

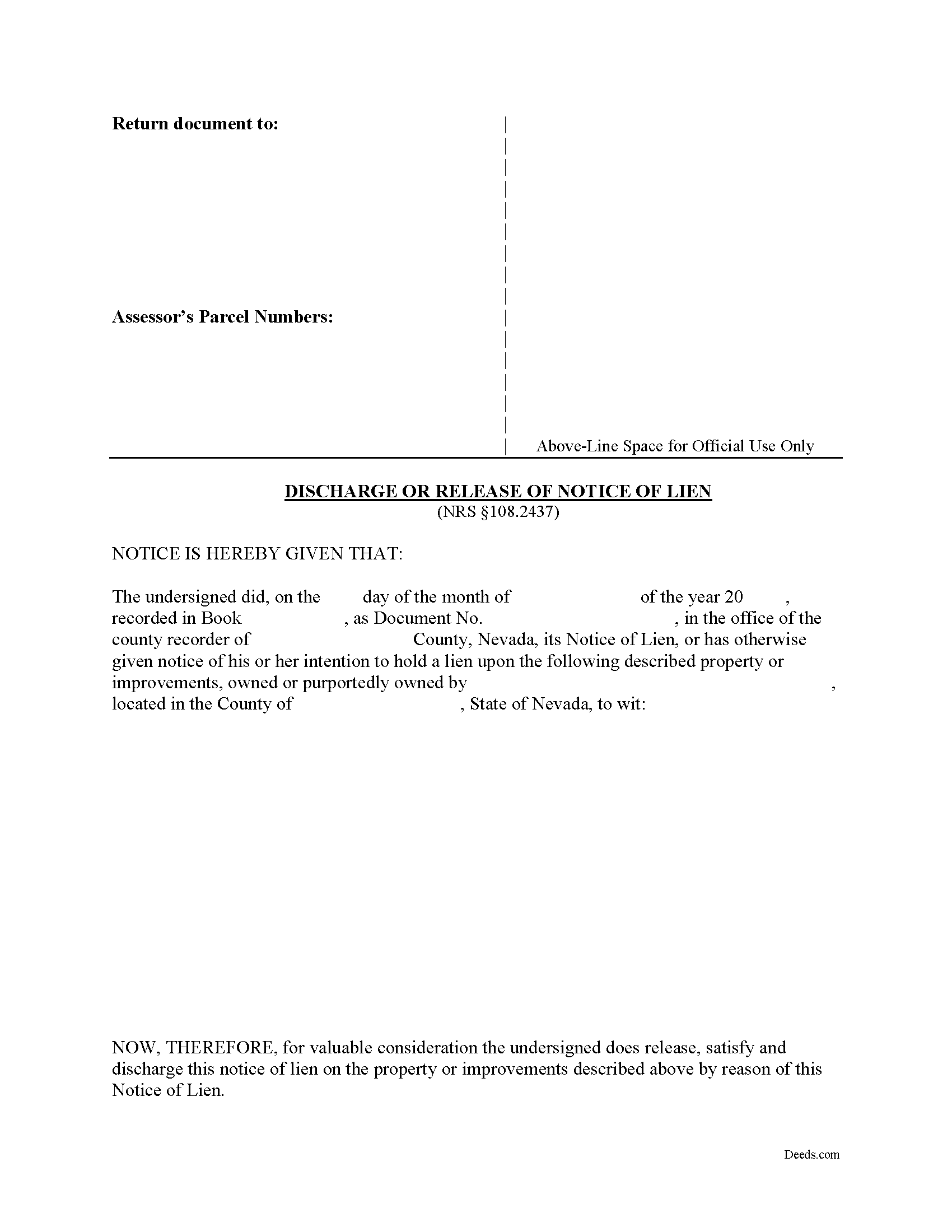

Discharge of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 2/16/2024

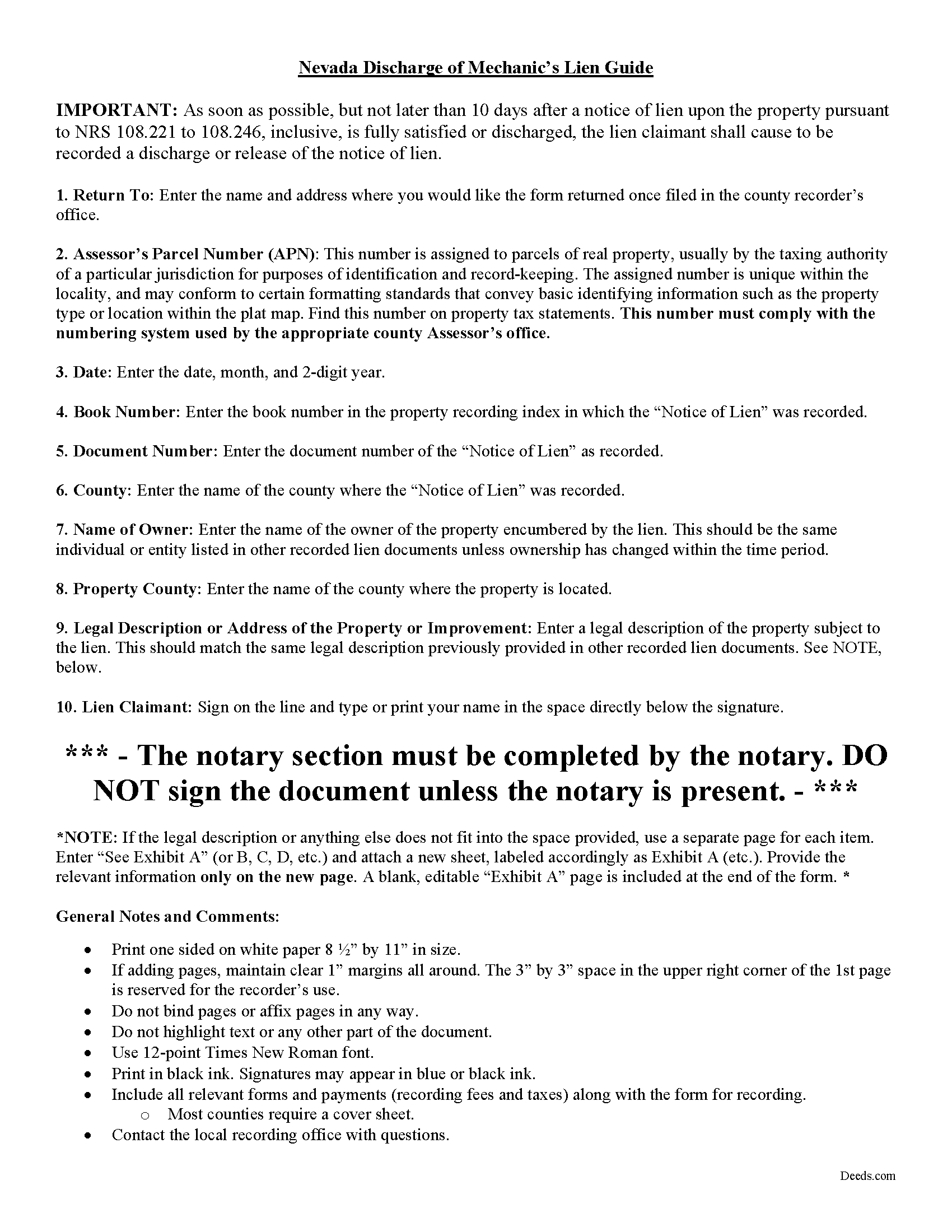

Discharge of Lien Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 2/22/2024

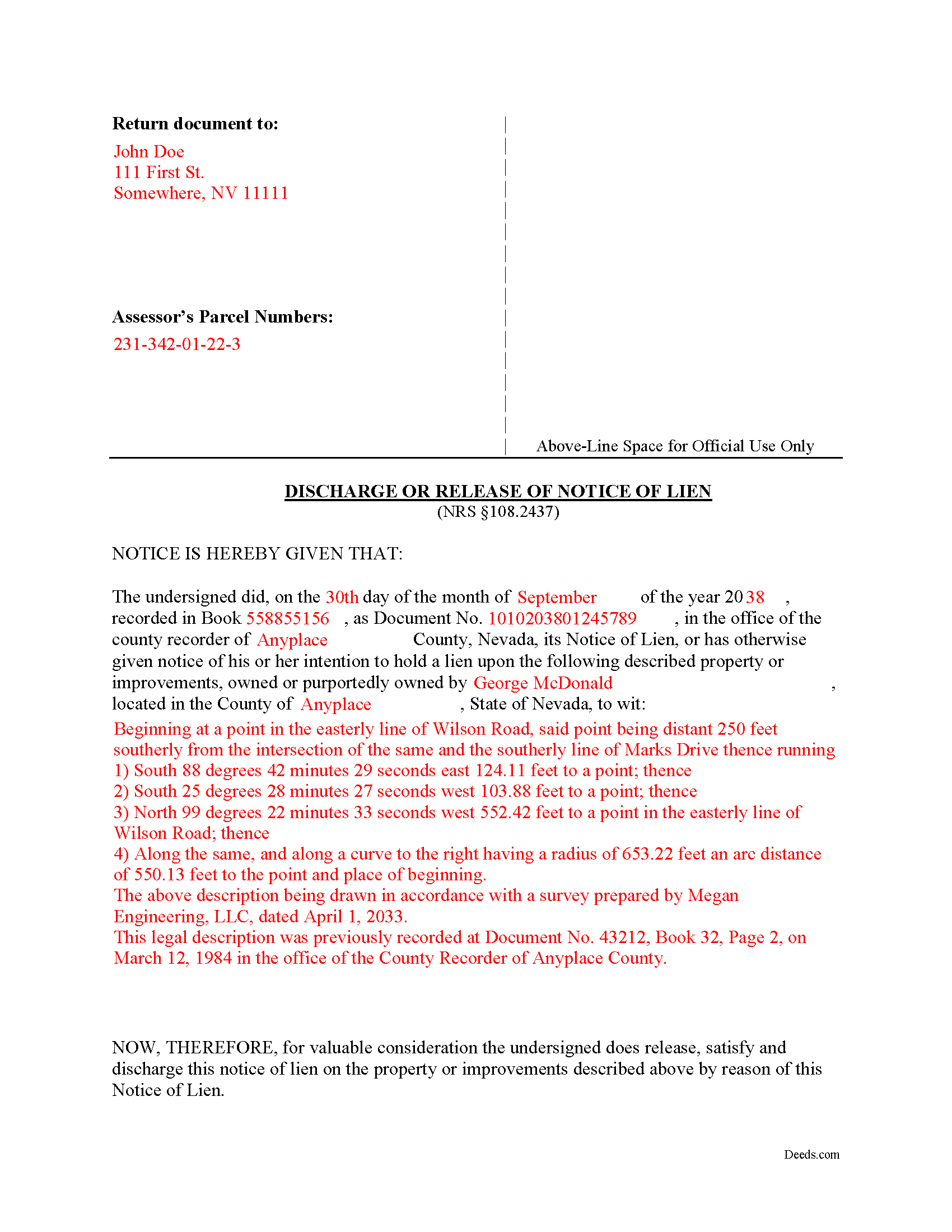

Completed Example of the Discharge of Lien Document

Example of a properly completed form for reference.

Included document last reviewed/updated 4/11/2024

Included Supplemental Documents

The following Nevada and Mineral County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nevada or Mineral County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Mineral County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Mineral County Discharge of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Discharge of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Mineral County that you need to transfer you would only need to order our forms once for all of your properties in Mineral County.

Are these forms guaranteed to be recordable in Mineral County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mineral County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Discharge of Lien Forms:

- Mineral County

Including:

- Hawthorne

- Luning

- Mina

- Schurz

What is the Nevada Discharge of Lien

Discharging a Lien in Nevada

So at this point you've filed your mechanic's lien against a client's property after the client never paid the invoice for a completed project. Now the client has finally paid off the lien or maybe you've come to some agreement with the client to accept a lesser amount. You're free to forget about the ordeal and move on to prepare for your next job, right?

Not quite; Nevada lien law requires you to perform one additional step of filing a notice of discharge to provide public notice that you are no longer claiming a lien against the title. It is essential to properly file and record this notice because you can face potential consequences by skipping this step. By this time, you've already complied with statutory lien law to the letter in order to obtain your lien, so don't be sloppy now.

The discharge of lien form gives notice to the owner, other lien claimants, and anyone else with a potential interest in the subject property that the lien has been paid in full or has otherwise terminated. If you obtained a mechanic's lien and the debtor or other person responsible for the lien pays the debt or you discharge the lien for any other reason, you must file a discharge of lien notice. As soon as possible, but not later than 10 days after a notice of lien upon the property (pursuant to NRS 108.221 to 108.246) is fully satisfied or discharged, the lien claimant must record a discharge or release of the notice of lien drafted in substantial compliance as required by Nevada lien law. Serve the discharge notice on the owner personally or by certified mail.

Failure to file this notice in time exposes you to potential liability in a civil action (pursuant to NRS 108.2437). Because a lien is a burden on the property (and the owner) and can discourage or prevent a sale, transfer, or refinancing, neglecting to discharge the lien can cause the owner damages, thus entitling her to a legal remedy. For instance, you may be liable for the costs of a lost sale or damages caused by a lender's refusal to extend credit due to the mechanic's lien on the collateral property. Even if the failure to discharge the lien did not cause any actual damages, Nevada lien law allows for a statutory penalty award of $100 to the owner. The owner or heirs are also entitled to reasonable attorney's fee and the costs of bringing the action. Again, it is essential to properly discharge any lien recorded against a property once the underlying debt has been satisfied or discharged for any other reason.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Our Promise

The documents you receive here will meet, or exceed, the Mineral County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mineral County Discharge of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4320 Reviews)

Lorie S.

April 24th, 2024

It was available to download immediately

Thank you!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Nancy A.

April 24th, 2024

This is an excellent resource. I was surprised because the price is so low I thought the products might be inferior. Not only were were the requested documents high quality, additional unrequested documents were added to my order that I didn\'t realize I would need until I read them. I especially appreciate that all the documents were specific to my county. I highly recommend using deeds.com.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Linda T.

July 11th, 2020

The application was extremely easy to use with good instructions. Will definitely use a again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LINDA C.

June 29th, 2020

EASY, FAST, AND CONVENIENT.

Thank you!

Anita W.

June 18th, 2020

Love this site. It has been truly helpful and easy to navigate.

Thank you Anita, glad we could help.

Buster T.

April 19th, 2022

Very comprehensive - lots of additional forms and instructions.

Top-notch!

Thank you!

Christina H.

April 15th, 2021

The process was straightforward, quick and reasonably priced.

The agents provided updates every step of the way.

Thank you!

Jay B.

March 17th, 2021

I've never had a problem locating the records I need. I can't imagine what can be done to improve the service.

Thank you!

Daren R.

March 4th, 2023

I believe that you should wait until a pending file is completed before asking for feedback.

Thank you.

Daren

Thank you!

Martin M.

November 14th, 2020

This site is great. Simple to use with excellent instructions. Will recommend to others.

Thank you!

Maurice M.

January 29th, 2019

It was very convenient to be able to purchase the forms that I needed and save an extra trip downtown. I really appreciated the instructions that came with the forms.

Thank you Maurice. Have a great day!

L B W.

January 22nd, 2021

Bottom line - it was certainly worth the $21 (+-?) I paid for the form and instructions, etc.

Admittedly the form is a little inflexible in terms of editing for readability but I understand that offering greater flexibility would likely make theft more likely. So I'm happy with what I got. One suggestion - add more info about what's required in the "Source of Title" section.

Thank you for your feedback. We really appreciate it. Have a great day!

edward m.

February 27th, 2019

I would rate it 5 stars also. Eddie M.

Thank you!

raymond w.

February 24th, 2022

answeed many questions I had.

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.