Union County Mortgage Secured and Promissory Note Form

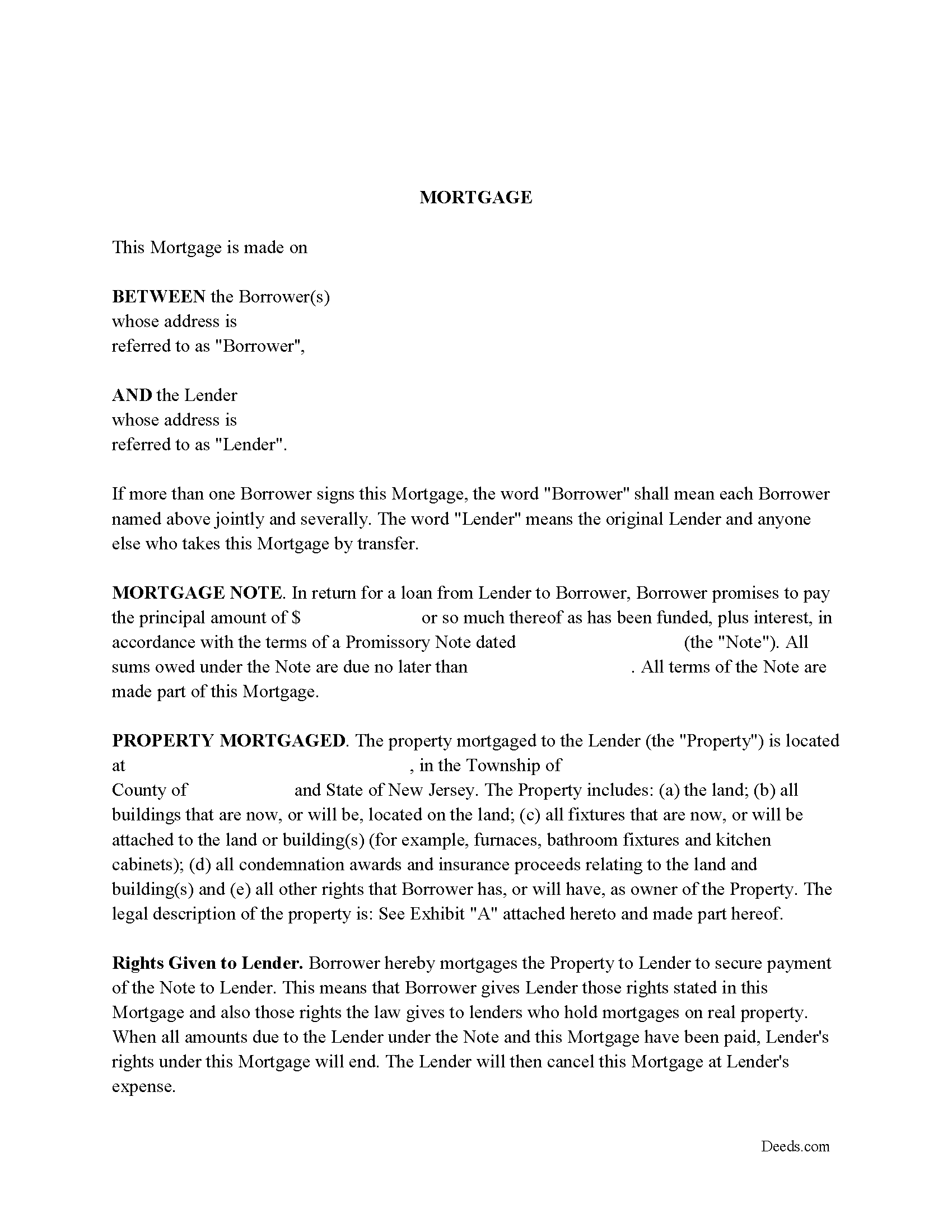

Union County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

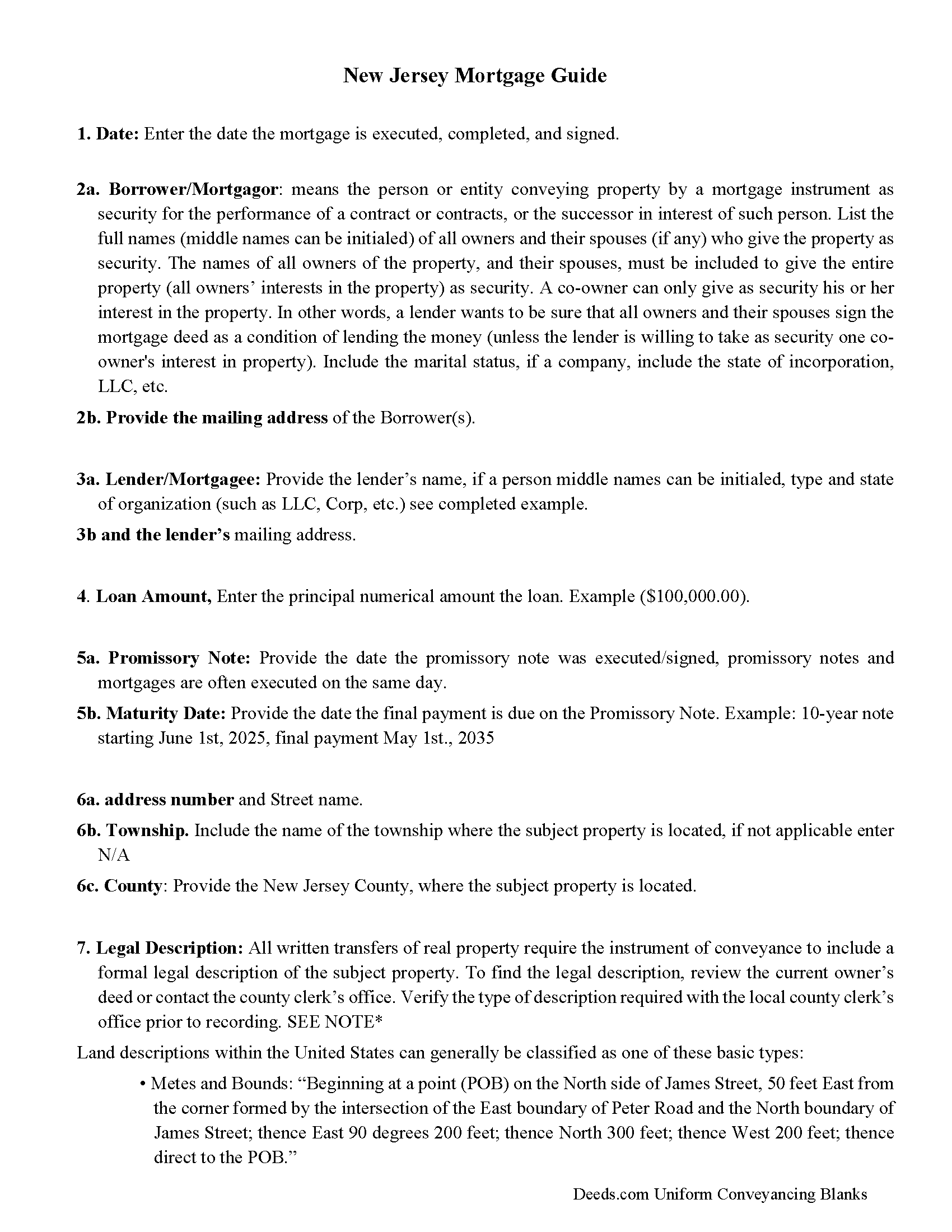

Union County Mortgage Guidelines

Line by line guide explaining every blank on the form.

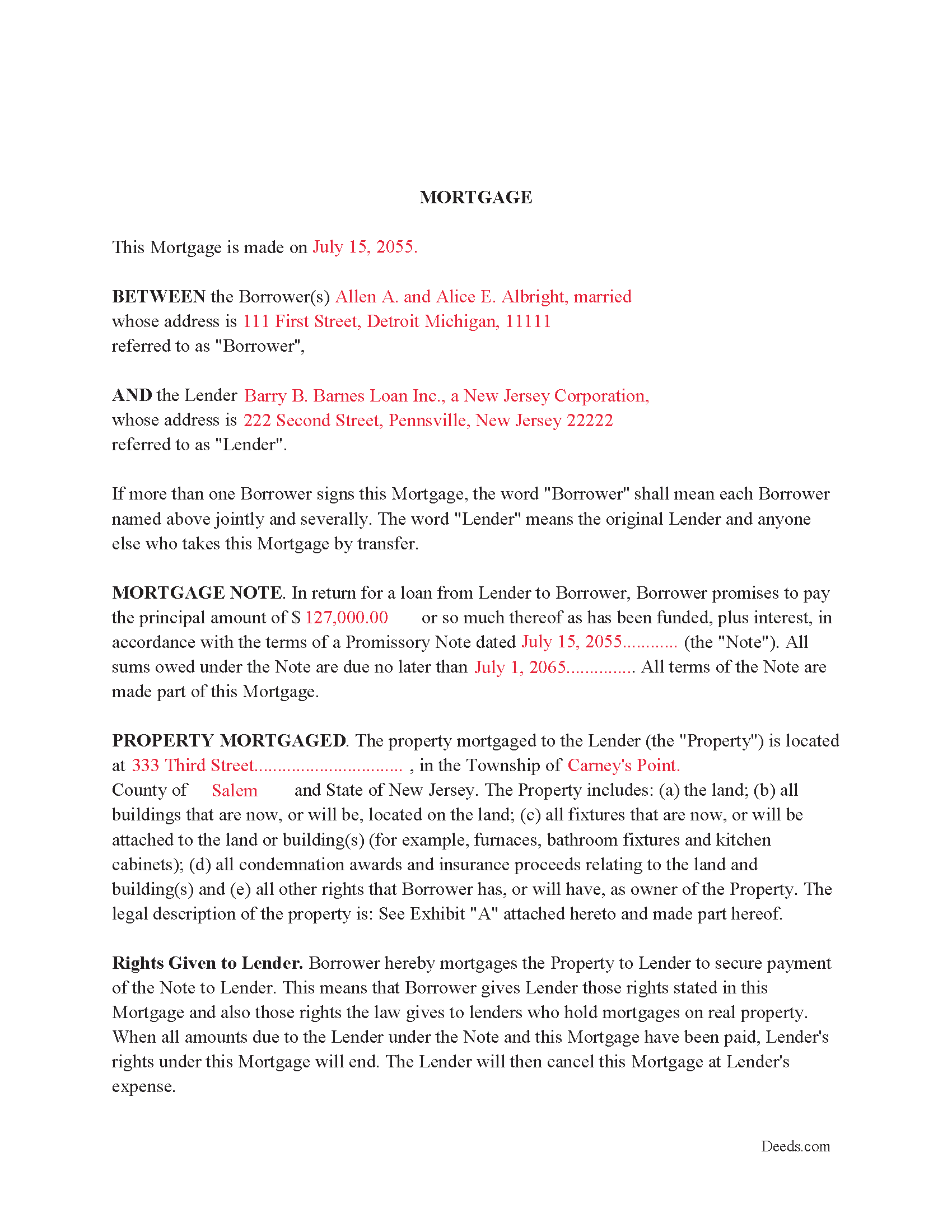

Union County Completed Example of the Morgage Document

Example of a properly completed form for reference.

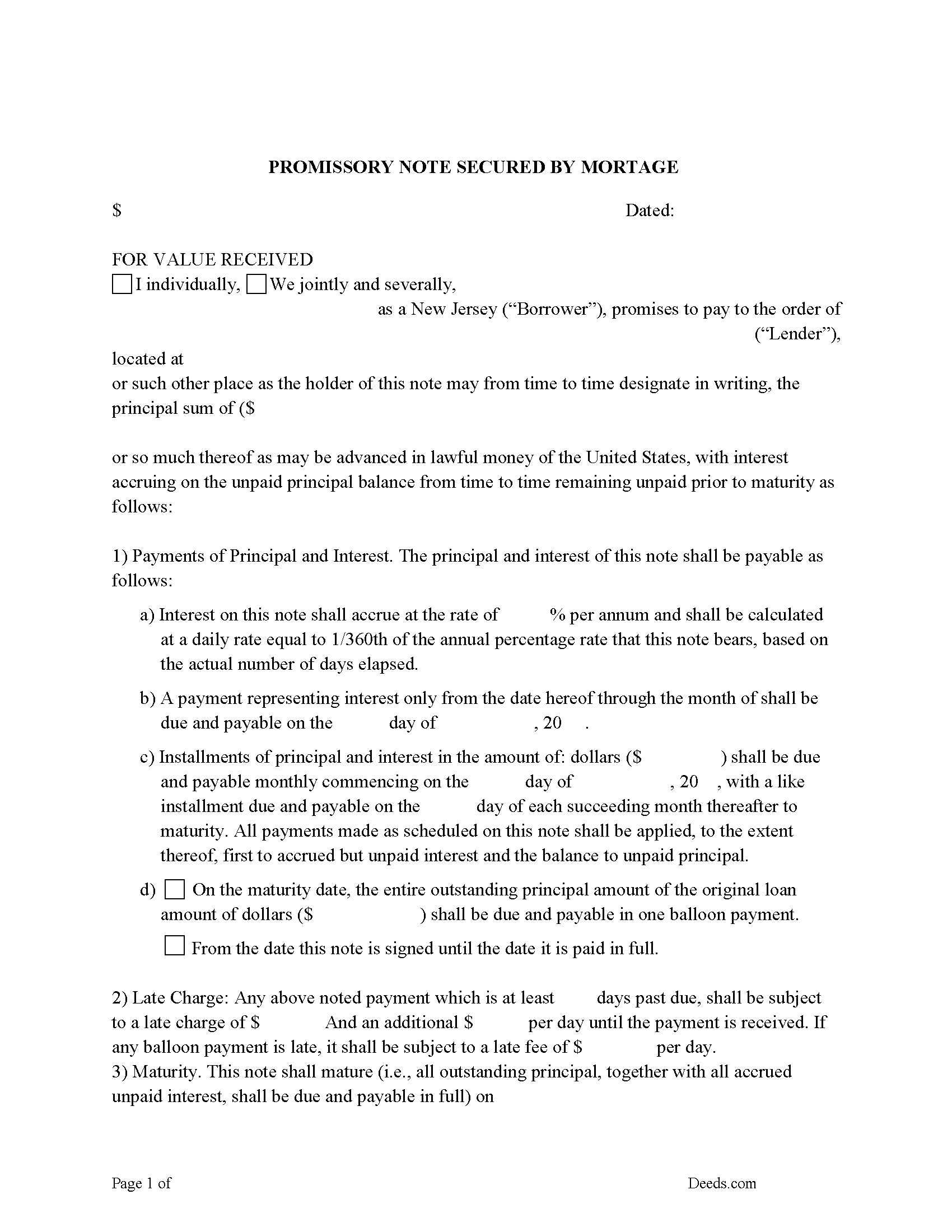

Union County Promissory Note Form

Can be used for traditional installment or balloon payment.

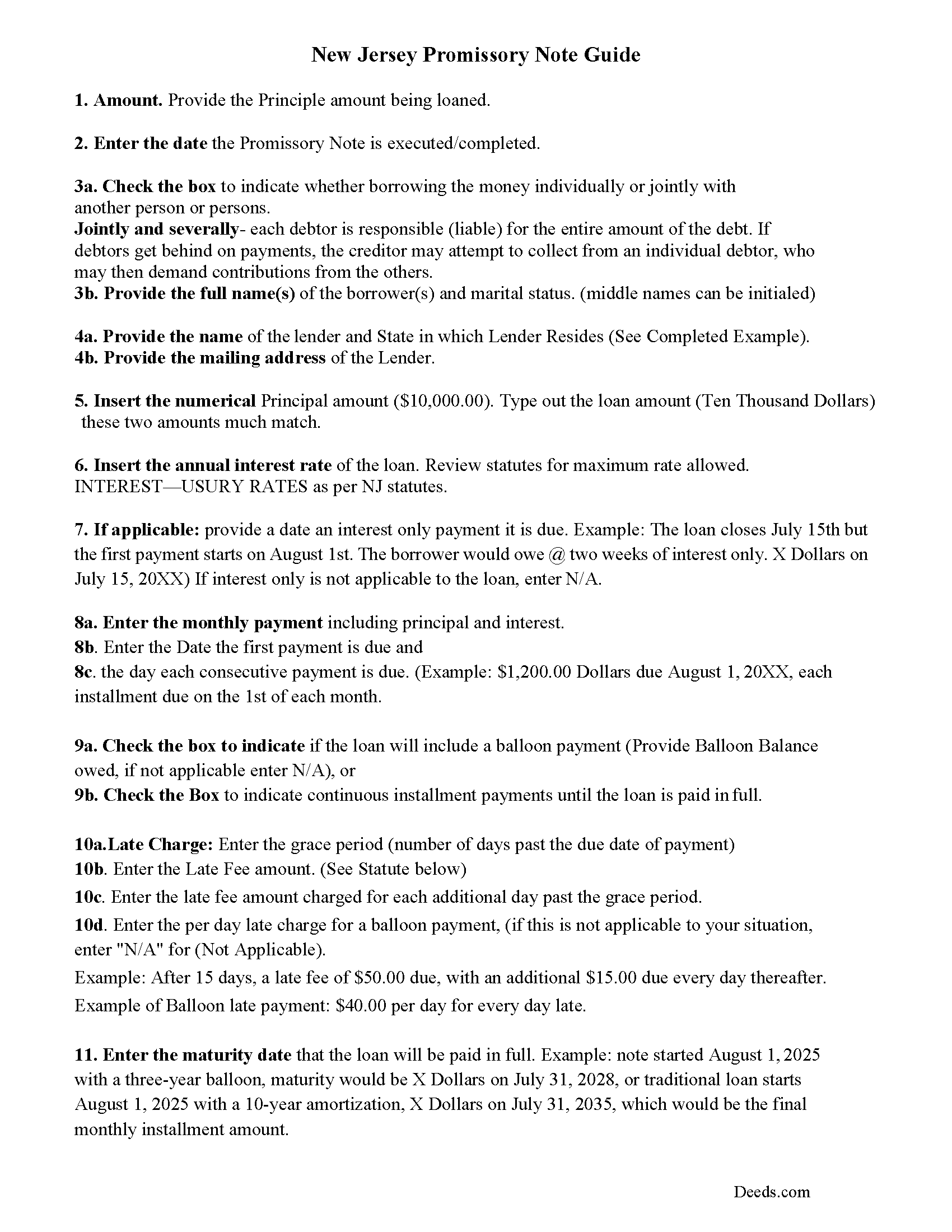

Union County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

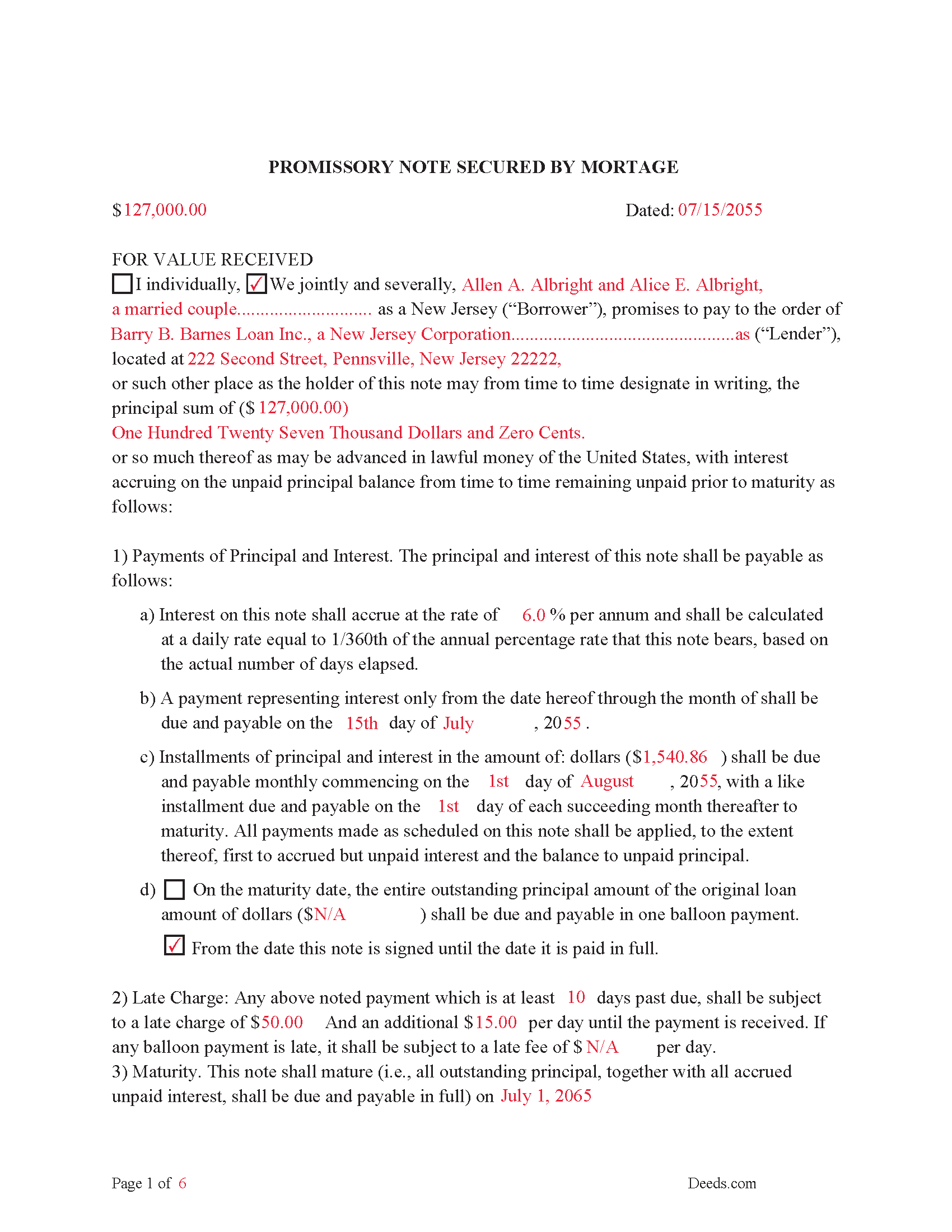

Union County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

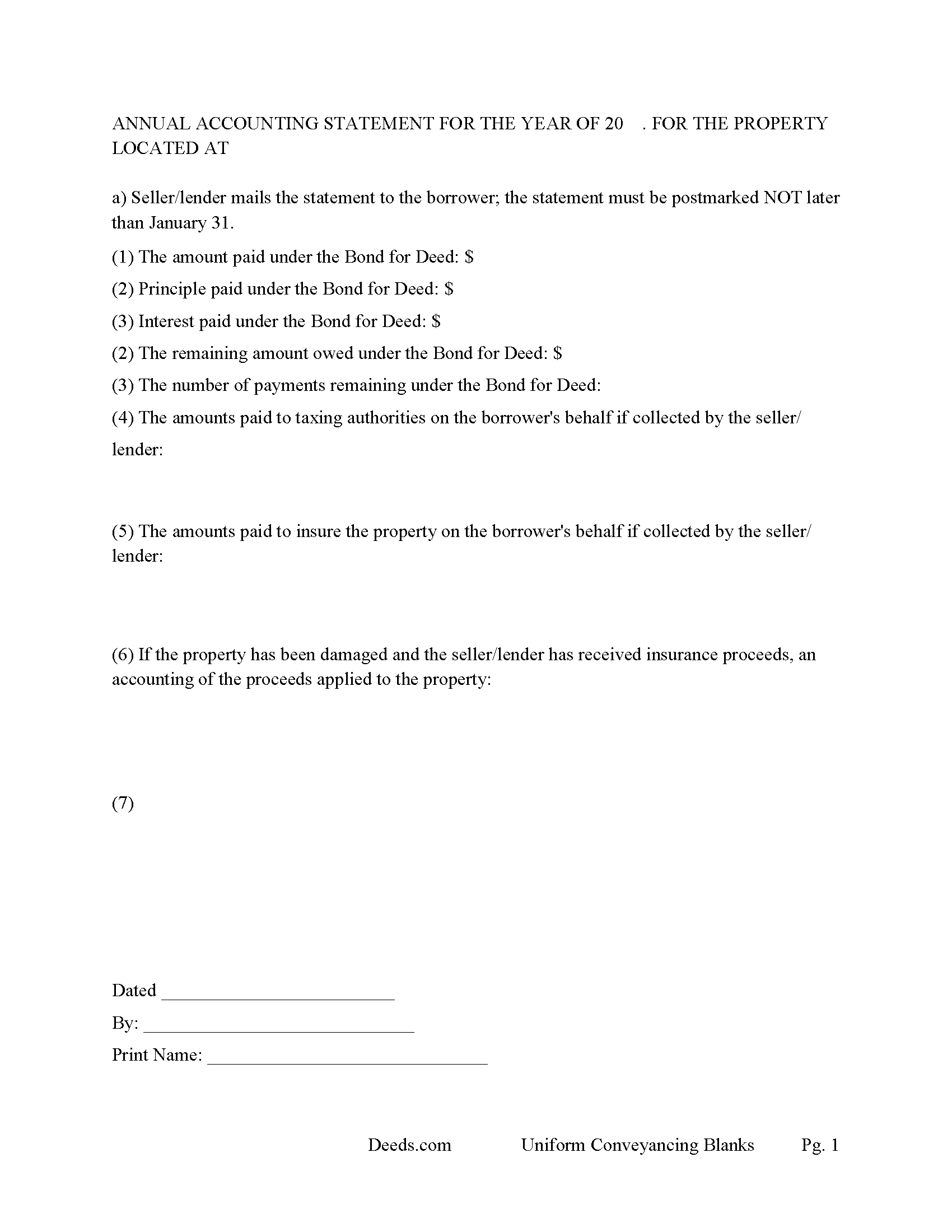

Union County Annual Accounting Statement Form

Issued to buyer for fiscal year reporting of principal, interest, etc.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Jersey and Union County documents included at no extra charge:

Where to Record Your Documents

Union County Clerk

Elizabeth, New Jersey 07207

Hours: 8:30 to 4:30 M-F

Phone: (908) 527-4787

Union County Annex

Westfield, New Jersey 07090

Hours: Mon, Wed, Fri 8:00 to 4:00; Tue & Thu until 7:30; Sat 9:00 to 1:00

Phone: (908) 654-9859

Recording Tips for Union County:

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

- Avoid the last business day of the month when possible

- Have the property address and parcel number ready

Cities and Jurisdictions in Union County

Properties in any of these areas use Union County forms:

- Berkeley Heights

- Clark

- Cranford

- Elizabeth

- Elizabethport

- Fanwood

- Garwood

- Hillside

- Kenilworth

- Linden

- Mountainside

- New Providence

- Plainfield

- Rahway

- Roselle

- Roselle Park

- Scotch Plains

- Springfield

- Summit

- Union

- Vauxhall

- Westfield

Hours, fees, requirements, and more for Union County

How do I get my forms?

Forms are available for immediate download after payment. The Union County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Union County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Union County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Union County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Union County?

Recording fees in Union County vary. Contact the recorder's office at (908) 527-4787 for current fees.

Questions answered? Let's get started!

This Mortgage and Promissory Note have stringent default provisions that are typically suited for owner financing or private lender when financing residential property, small commercial property, rental property (up to 4 units), Condominiums, planned unit developments and vacant land.

DEFAULT. The Lender may declare that Borrower is in default on the Note and this Mortgage if:

(a) Borrower fails to make any payment required by the Note and this Mortgage within fifteen (15) days after its due date;

(b) Borrower fails to keep any other promise in this Mortgage;

(c) The ownership of the Property is changed for any reason;

(d) The holder of any lien on the Property starts foreclosure proceedings;

(e) Bankruptcy, insolvency or receivership proceedings are started by or against Borrower; or

(f) Borrower defaults with respect to any other loan from Lender to an affiliate of Borrower.

PAYMENTS DUE UPON DEFAULT. If the Lender declares that Borrower is in default, Borrower must immediately pay the full amount of all unpaid principal, interest, other amounts due on the Note and this Mortgage and the Lender's costs of collection and reasonable attorney fees.

The Promissory Note can be used for installment or balloon payments. Includes default rates (interest rate that occurs when borrower is in default)

In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a)one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty(30)days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b)two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty(60)days after the Maturity Date.

Late Payment Fees. Any payment which is at least ___ days past due, shall be subject to a late charge of $___ And an additional $___ per day until the payment is received. If any balloon payment is late, it shall be subject to a late fee of $___ per day.

(New Jersey Mortgage Package includes forms, guidelines, and completed examples) For use in New Jersey only.

Important: Your property must be located in Union County to use these forms. Documents should be recorded at the office below.

This Mortgage Secured and Promissory Note meets all recording requirements specific to Union County.

Our Promise

The documents you receive here will meet, or exceed, the Union County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Union County Mortgage Secured and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Randi J.

September 8th, 2020

Everything was so easy and self explanatory and very inexpensive. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Marc T.

August 31st, 2021

Walked the document through our county offices today. the directions to fill out the document were awesome and we had no issues, We now have a TOD property. Beats paying an attorney $200.00

Thank you for your feedback. We really appreciate it. Have a great day!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debora A.

May 23rd, 2023

Website easy to use and explanations available

Thank you!

Susan S.

July 28th, 2020

The actual transfer of deed form seems to be the only one not fillable in Adobe. Seems odd.

Thank you!

Sherry F.

January 5th, 2019

Good product and service.

Thank you!

Stephen H.

December 12th, 2022

Great experience. Rapid service, no unexpected problems, and reasonable pricing. I will definitely use Deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Miguel R.

August 18th, 2019

Easy to create an account! Awesome!

Thank you!

Linda M L.

September 7th, 2023

Easy to use, documents look good, but pretty expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Maribel P.

July 14th, 2023

Thank you so much for providing simple but very significant documents one can basically do PRO SE, without any additional huge counsel expenses and yet be legitimate enough to officially file them as state law allows and extends to basic documents processing and filings. Thank you so much for the professional documents provided as they do the proper job. MP

Thank you for the kind words Maribel. Glad we were able to help!

Wanda C.

August 20th, 2020

Site is very well laid out and easy to use. My only issue is that it wouldn't allow me to change my password, so I'm stuck with the "temporary" one. Not a big deal, but I would have preferred to change it.

Thank you for your feedback. We really appreciate it. Have a great day!

Raymundo M.

November 1st, 2023

Very fast and smooth process, thank you for your quick answers and follow up.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory B.

May 30th, 2020

I believe you need more instruction on the use of the web site. I would type and nothing would appear on the form. When I tried to save a completed form I ended with a blank form with no detail.

Thank you!

Gregory G.

April 4th, 2019

Quick and Easy/Immediate Access after payment. Now seeking other forms needed ASAP! Thanks!

Thank you!

David A.

May 3rd, 2022

Forms were just what I needed. Very well explained and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!