Otero County Quitclaim Deed Form

Otero County Quitclaim Deed Form

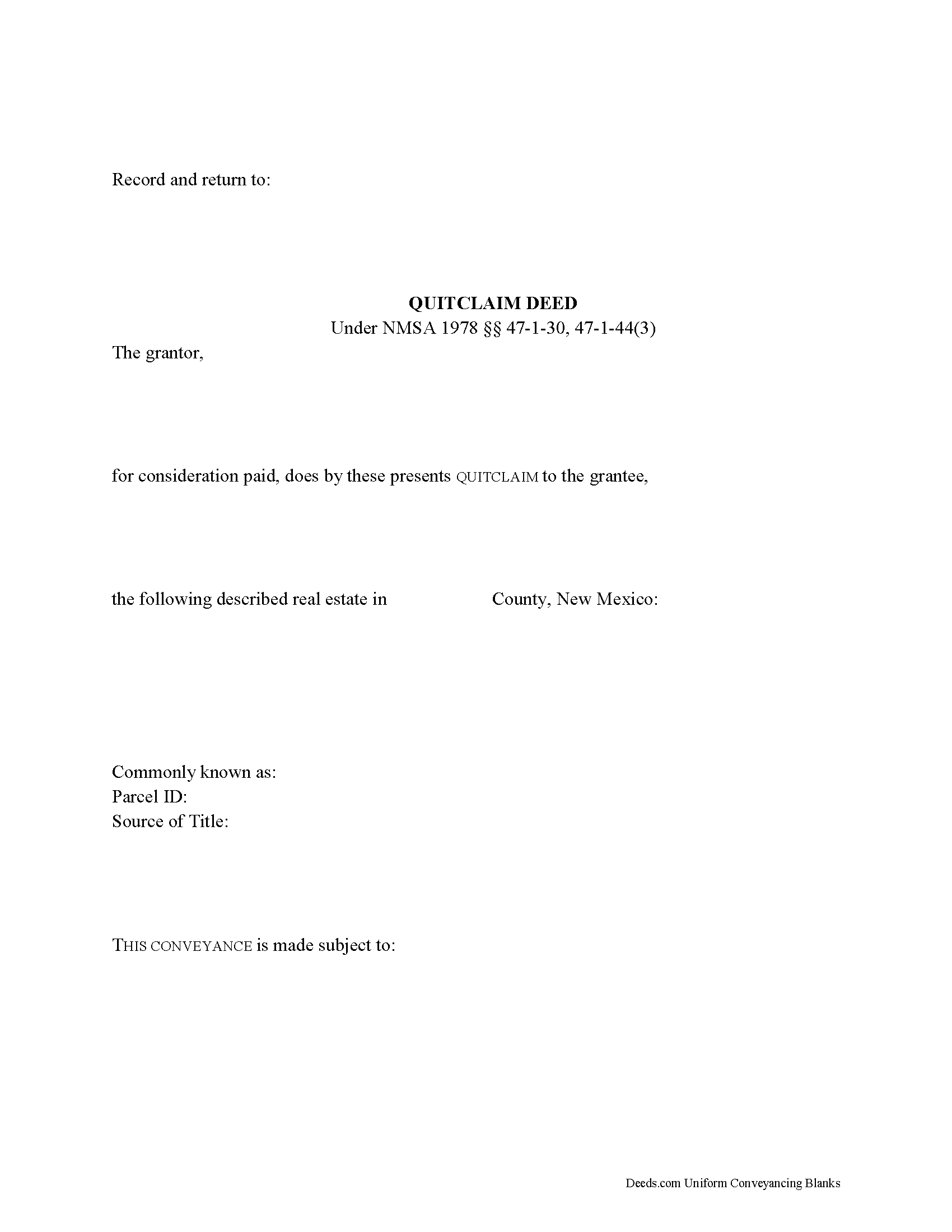

Fill in the blank Quitclaim Deed form formatted to comply with all New Mexico recording and content requirements.

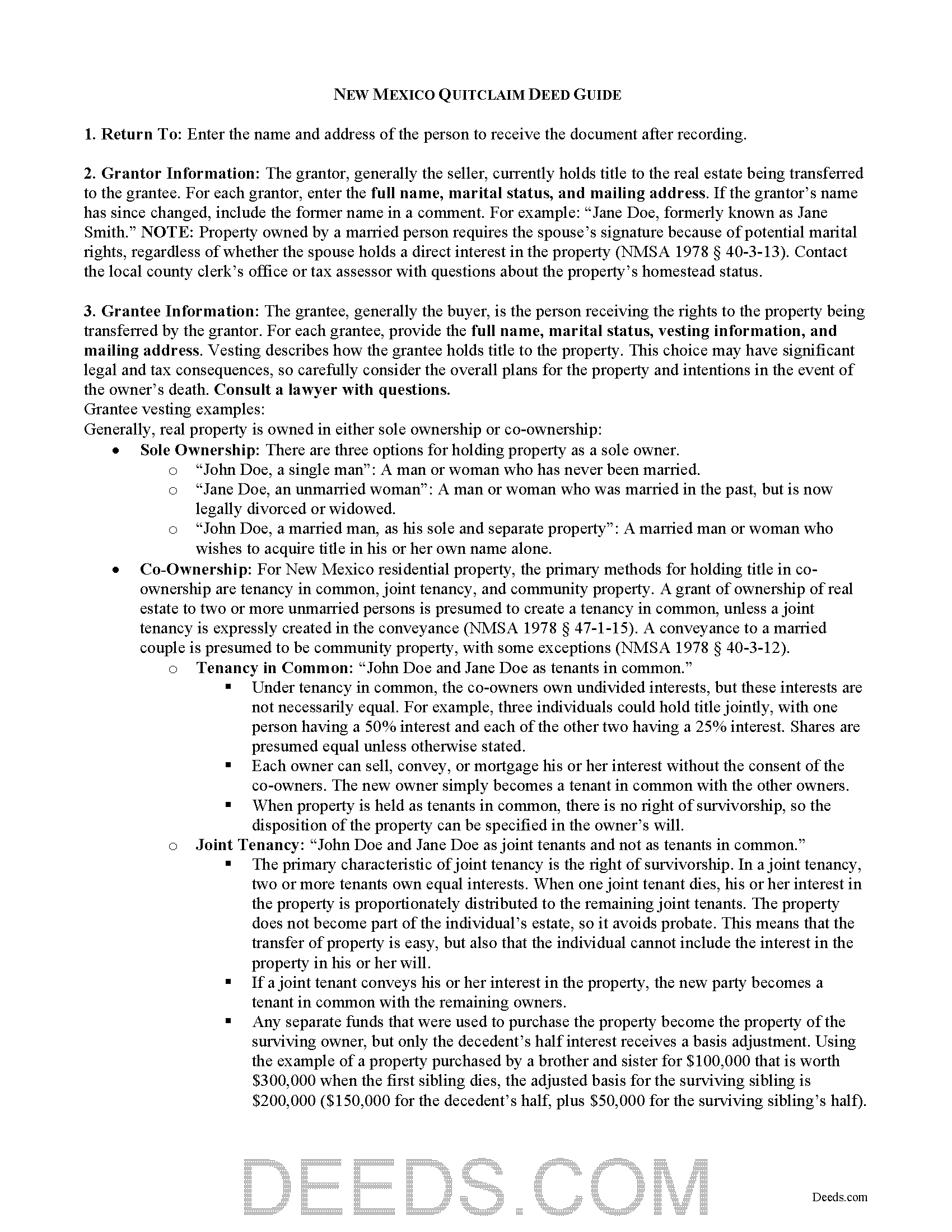

Otero County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

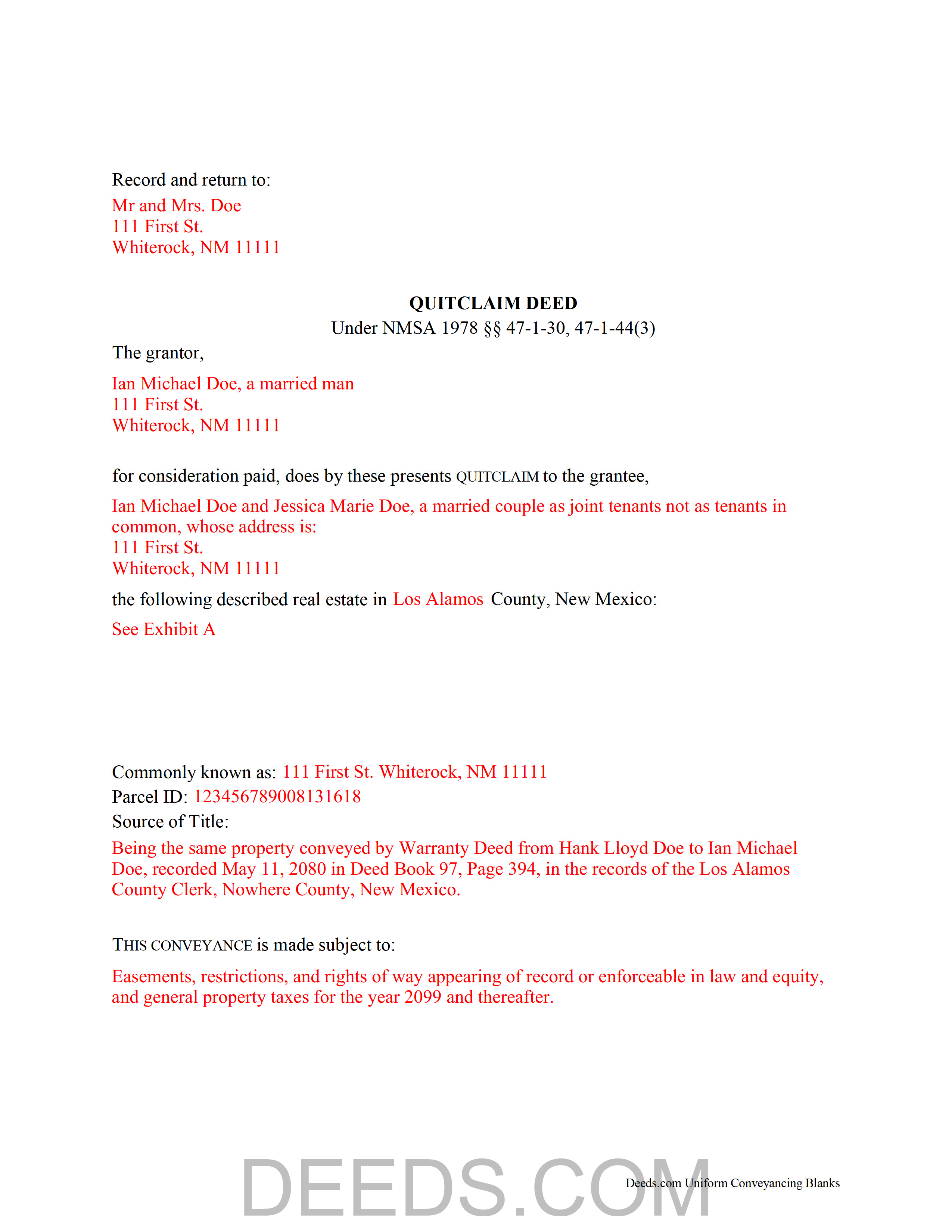

Otero County Completed Example of the Quitclaim Deed Document

Example of a properly completed New Mexico Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Otero County documents included at no extra charge:

Where to Record Your Documents

Otero County Clerk

Alamogordo, New Mexico 88310

Hours: 7:30 to 6:00 M-F

Phone: (575) 437-4942

Recording Tips for Otero County:

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Otero County

Properties in any of these areas use Otero County forms:

- Alamogordo

- Bent

- Cloudcroft

- High Rolls Mountain Park

- Holloman Air Force Base

- La Luz

- Mayhill

- Mescalero

- Orogrande

- Pinon

- Sacramento

- Sunspot

- Timberon

- Tularosa

- Weed

Hours, fees, requirements, and more for Otero County

How do I get my forms?

Forms are available for immediate download after payment. The Otero County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Otero County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Otero County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Otero County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Otero County?

Recording fees in Otero County vary. Contact the recorder's office at (575) 437-4942 for current fees.

Questions answered? Let's get started!

In New Mexico, real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are statutory under NMSA 1978 Section 47-1-44(3).

Quitclaim deeds offer no warranties of title and provide the least amount of protection to the grantee. They do not guarantee that the grantor has good title or ownership of the property and only transfer whatever interest the grantor may have in the property at the time of execution. They are typically used in divorce proceedings or other transfers of property pursuant to court order, or to clear title.

A lawful quitclaim deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New Mexico residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and community property. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is expressly created in the conveyance (NMSA 1978 47-1-15). A conveyance to a married couple is presumed to be community property, with some exceptions (NMSA 1978 40-3-12).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Finally, the document must meet all state and local recording standards. Note that because New Mexico is a nondisclosure state, certain types of personal information, including the consideration exchanged in a transfer of property, are withheld from public record

Sign the deed in the presence of a notary public or other authorized official. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment.

All transfers require a Real Property Transfer Declaration Affidavit, which details the sales information for the transfer. There are certain exceptions, such as an instrument delivered to establish a gift or a distribution, or an instrument pursuant to a court-ordered partition. If the transfer is exempt from the affidavit requirement, detail the reason why on the face of the deed. See NMSA 1978 7-38-12.1(D) for a list of exemptions. This affidavit must be filed with the assessor's office within 30 days of the deed's recordation.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with any questions related to quitclaim deeds or transfers of real property in New Mexico.

(New Mexico QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Otero County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Otero County.

Our Promise

The documents you receive here will meet, or exceed, the Otero County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Otero County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Claudia S.

May 23rd, 2024

Website is very easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mike F.

April 15th, 2023

The explanation sheet and example was very handy.

Thank you!

Susan J.

June 6th, 2023

I was pleased that I could send the documents this way rather than having to mail it or take time out of my day to go down to the records office.

Thank you for taking the time to leave your feedback Susan, we really appreciate you. Have an amazing day.

Monty H.

November 6th, 2019

Perfection. The filled-out form was especially helpful and I appreciate not having to share personal/financial information over the Internet, as required by so many other legal form service providers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Aaron H.

April 3rd, 2023

Excellent service! Easy to use interface and quick response post-recording.

Thank you for your feedback. We really appreciate it. Have a great day!

Valerie I.

November 19th, 2020

Quick and easy! Had my document submitted to the county and back in one day. Good rates as well!

Thank you!

Billie W.

April 23rd, 2021

Excellent way to do this kind of transaction.

Thank you!

Carnell G.

September 26th, 2020

The basic setup was fine but, I need to review the document in its entirety for accuracy which I have yet to do so. So far so good. The monthly fee is more than I need for right now.

Thank you!

wendy w.

October 19th, 2022

Excellent

Thank you!

Earnestine C.

September 4th, 2019

Informative and instruction clear and concise, which made it easy for a person without real estate knowledge to acquire needed information. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

John C.

May 30th, 2023

So far it's OK but have not filed it with the the county so can't say if it will be what they want

Thank you for your feedback. We really appreciate it. Have a great day!

Jenine E.

April 4th, 2021

The information seems complete and accurate. The form was easy to use and save. I'll let you know if we encounter problems getting the deed processed.

Thank you for your feedback. We really appreciate it. Have a great day!

A Rod P.

May 25th, 2019

The website was short and to the point. And I receive three responses quite quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelyn R.

June 21st, 2020

Responses to my needs were prompt and professional. I found the service easy to use and clearly outlined for processing. Thank you.

Thank you!

Christina P.

July 28th, 2023

Fantastic!! The gals at Deeds really seem to have their stuff together! Great Forms, easy, exhaustive, and most importantly... accepted at the recorder the FIRST TIME!

Thank you so much for your review! Your feedback is highly appreciated, and we look forward to assisting you again in the future!