Mckinley County Transfer of Homestead Affidavit Form

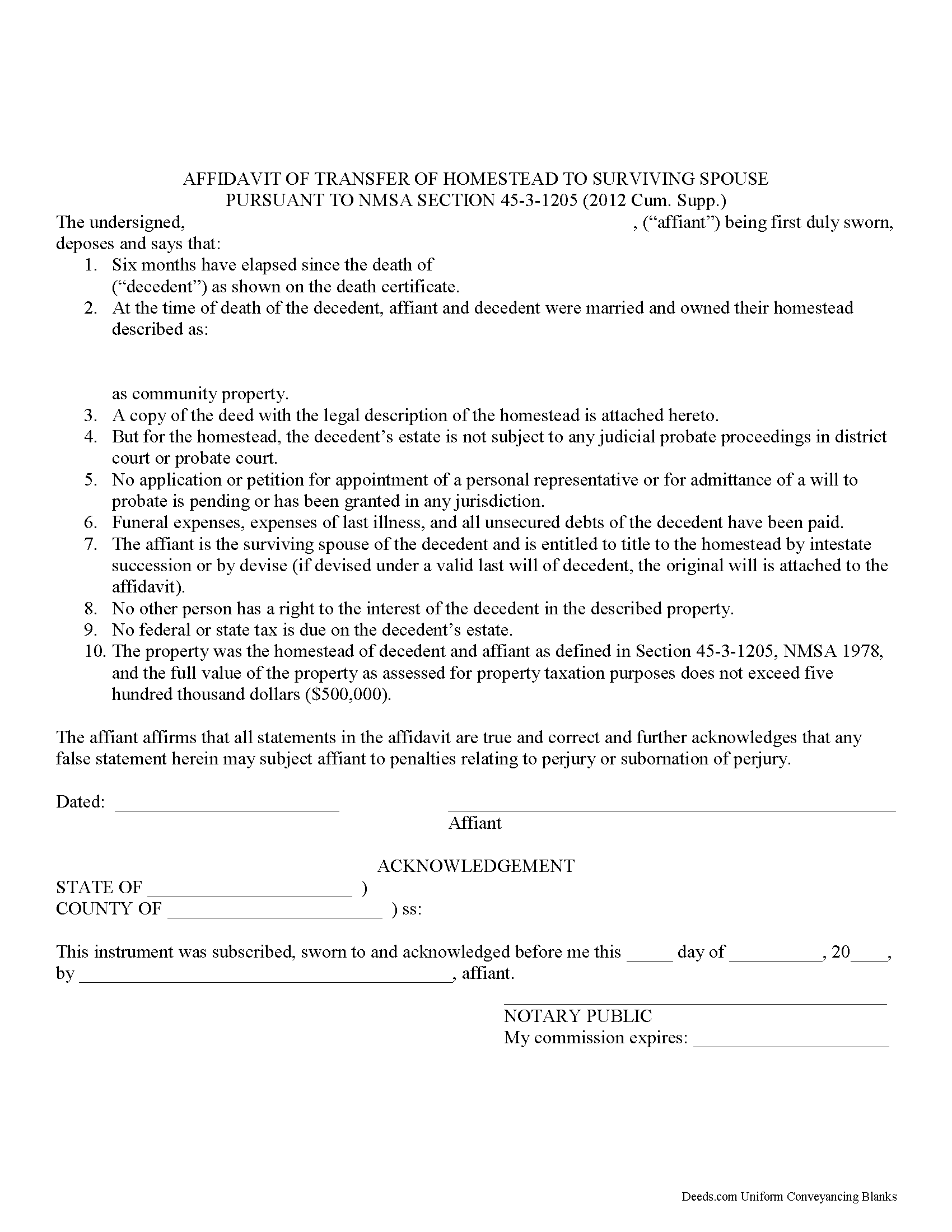

Mckinley County Transfer of Homestead Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

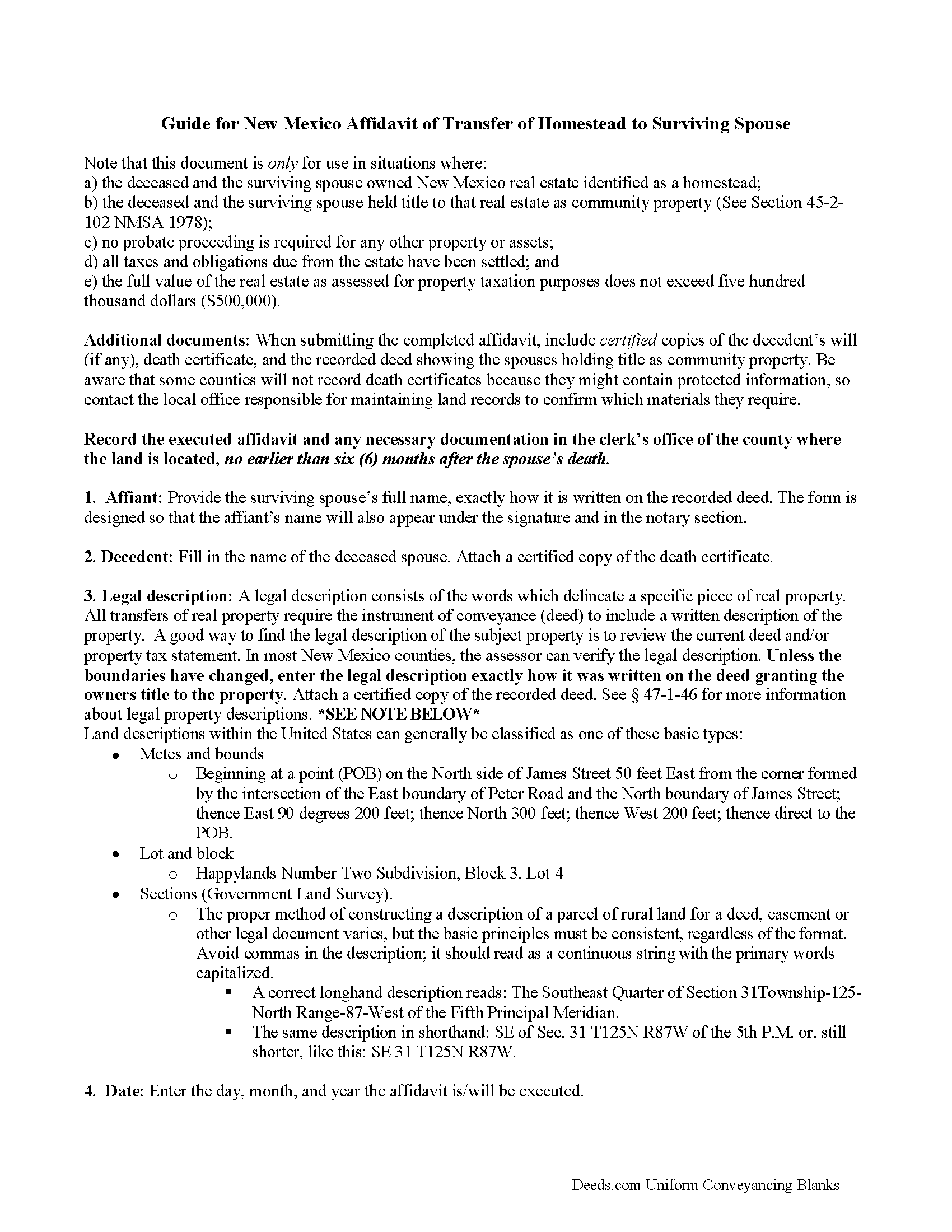

Mckinley County Transfer of Homestead Affidavit Guide

Line by line guide explaining every blank on the form.

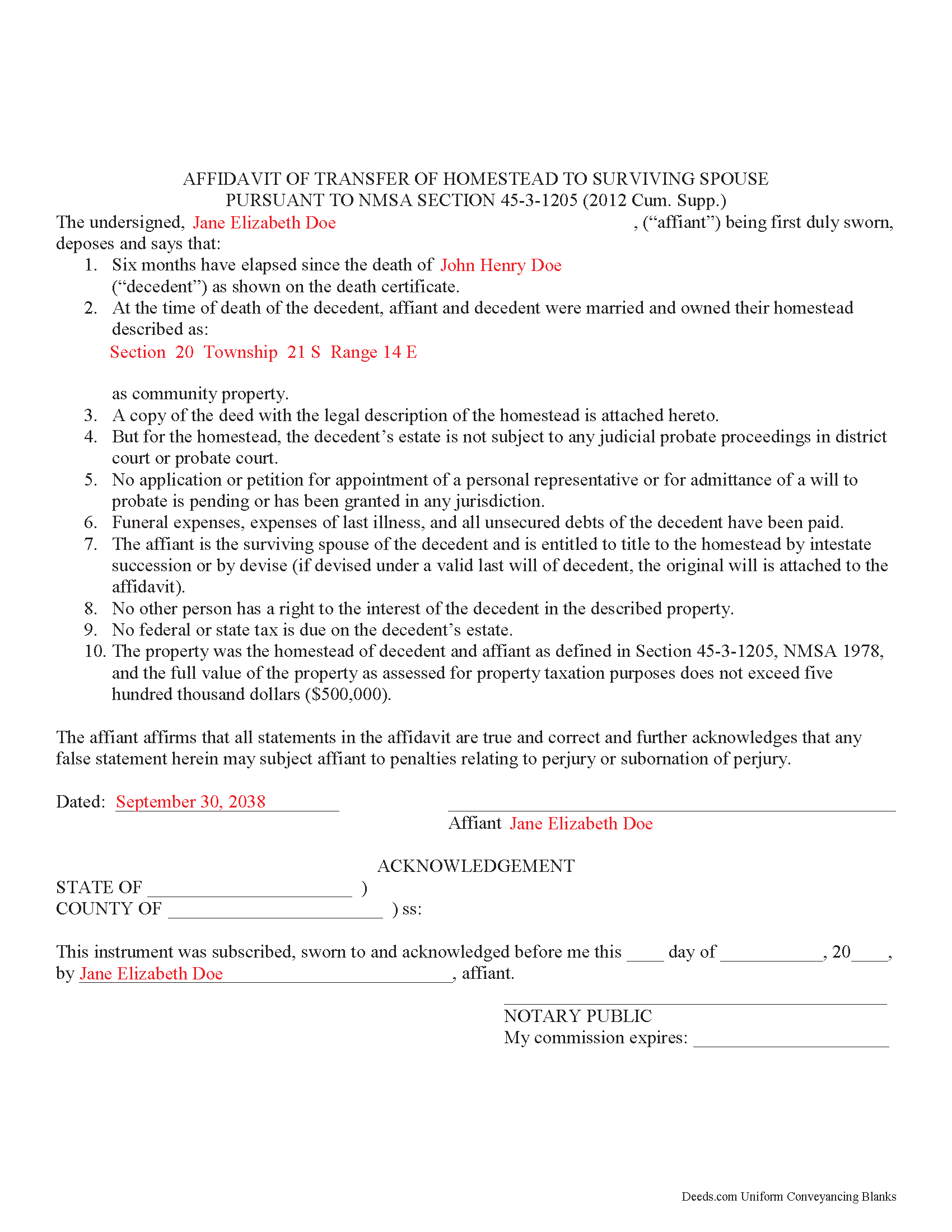

Mckinley County Completed Example of the Transfer of Homestead Affidavit Docuement

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Mckinley County documents included at no extra charge:

Where to Record Your Documents

McKinley County Clerk

Gallup, New Mexico 87301

Hours: 8:30 to 4:00 M-F

Phone: (505) 863-6866

Recording Tips for Mckinley County:

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Mckinley County

Properties in any of these areas use Mckinley County forms:

- Brimhall

- Church Rock

- Continental Divide

- Crownpoint

- Fort Wingate

- Gallup

- Gamerco

- Jamestown

- Mentmore

- Mexican Springs

- Navajo

- Prewitt

- Ramah

- Rehoboth

- Smith Lake

- Thoreau

- Tohatchi

- Vanderwagen

- Yatahey

- Zuni

Hours, fees, requirements, and more for Mckinley County

How do I get my forms?

Forms are available for immediate download after payment. The Mckinley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mckinley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mckinley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mckinley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mckinley County?

Recording fees in Mckinley County vary. Contact the recorder's office at (505) 863-6866 for current fees.

Questions answered? Let's get started!

Some married people purchase real estate in New Mexico for vacation or investment purposes and title it as the sole and separate property of one spouse. Others identify themselves as husband and wife, but do not specify how they wish to hold title. In many such situations, the death of one spouse initiates a case with the probate court to distribute the decedent's estate according to his/her will. This judicial proceeding might also include transferring ownership of real estate into the living spouse's name.

But what if the deceased spouse died intestate (without a will) or has arranged for all of his/her assets to pass to named beneficiaries using non-probate options such as joint ownership, transfer on death designations, or trusts? If the house qualifies as a <b>homestead</b> and is vested as <b>community property</b>, the remaining spouse might be able to gain full title rights more easily by using a transfer of homestead affidavit.

This affidavit is designed to transfer the entire shared interest to the surviving spouse without the need for probate. In general, the property must meet six conditions to qualify for a transfer of homestead affidavit under Section 45-3-1205:

1. The decedent and the surviving spouse owned New Mexico real estate identified as a homestead.

2. The decedent and the surviving spouse held title to that real estate as community property (See Section 45-2-102.

3. No probate proceeding is required for any other property or assets.

4. All taxes and obligations due from the estate have been settled.

5. The full value of the property as assessed for property taxation purposes does not exceed five hundred thousand dollars ($500,000).

6. At least six months have passed since the deceased spouse's death.

To complete the transfer, the surviving spouse must record the completed, notarized document at the clerk's office for the county where the property is located. In addition to the affidavit, attach certified copies of the deed granting ownership to the married couple (including a legal description of the homestead property), the decedent's will, if any, and the death certificate. Note that some counties in New Mexico refuse to record death certificates because they might contain protected information such as social security numbers, so contact the local recording office to verify their requirements.

Important terms:

A homestead, or family home, is the principal place of residence of the deceased or surviving spouse. It includes the house, associated buildings on the property, and enough land to support reasonable access and use. See Section 45-3-1205(C) NMSA 1978.

Community property as defined in Section 40-3-8 is a vesting option that is only available to married couples. Property acquired during marriage, by either or both spouses, is assumed to be community property unless specifically identified as separate property. Deeded property acquired by the couple, whether as tenants in common or as joint tenants or otherwise, is presumed to be held as community property.

This discussion is provided as general information. Please contact an attorney for assistance with specific questions or complex situations.

(New Mexico TOHA Package includes form, guidelines, and completed example)

Important: Your property must be located in Mckinley County to use these forms. Documents should be recorded at the office below.

This Transfer of Homestead Affidavit meets all recording requirements specific to Mckinley County.

Our Promise

The documents you receive here will meet, or exceed, the Mckinley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mckinley County Transfer of Homestead Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kimberly H.

April 24th, 2020

Very convenient, easy to use, and fast! I highly recommend Deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael C.

November 20th, 2022

No Search feature on the site? How do I look for forms?

Thank you for your feedback. We really appreciate it. Have a great day!

Dean L.

October 29th, 2019

The template isn't that easy to work with, with you have to type out large amounts of text. Also copy and paste doesn't seem to work. Furthermore, the code listed on the guide is out of date. However, the DQC is decent in that it has all the required fields you need.

Thank you for your feedback. We really appreciate it. Have a great day!

William S.

June 26th, 2022

The forms worked well for entering information. I have finished without much trouble. Since the forms are Adobe PDF files you need the free app to use them but you can't edit unless you have the paid Adobe program. And, it was a reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

Lorraine F.

October 9th, 2024

I followed the instructions to download the form for my Mac, typed in the legal description of the real property but the space provided for it would not expand so I just typed the form into Word as a document. While I appreciate having the form to work with it would have been a breeze if it worked properly.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Corey G.

May 24th, 2023

Very informative and helpful Thank you so much

Thank you for the kinds words Corey, glad we could help.

Julia M.

March 9th, 2019

Your PDF form Personal Representative's Deed was exceedingly helpful.

Thank you Julia. Have a fantastic day!

Ottomar H.

January 15th, 2022

Deeds site was easy to use and allowed me to print the forms I needed. No need to change anything.

Thank you!

Cyrus A.

July 18th, 2024

Easy site to work with.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Kelli B.

January 31st, 2019

Amazingly simple and fast. A great service.

Thank you!

Samantha W.

March 5th, 2022

Great place to get the forms you need. The instructions were clear and made it easy to complete. Pricing was great, especially compared to similar providers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon D.

December 29th, 2018

Very easy to understand forms...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary M.

May 7th, 2019

So easy to use. I was able to download all the forms I need, it saves a lot of time!

Thank you!

Leonard N.

January 21st, 2021

Nice and clear. Can't wait to process the completed documents at the Recorder's Office

Thank you!

Linda B.

June 15th, 2020

Very simple, fast and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!