Monroe County Correction Deed Form

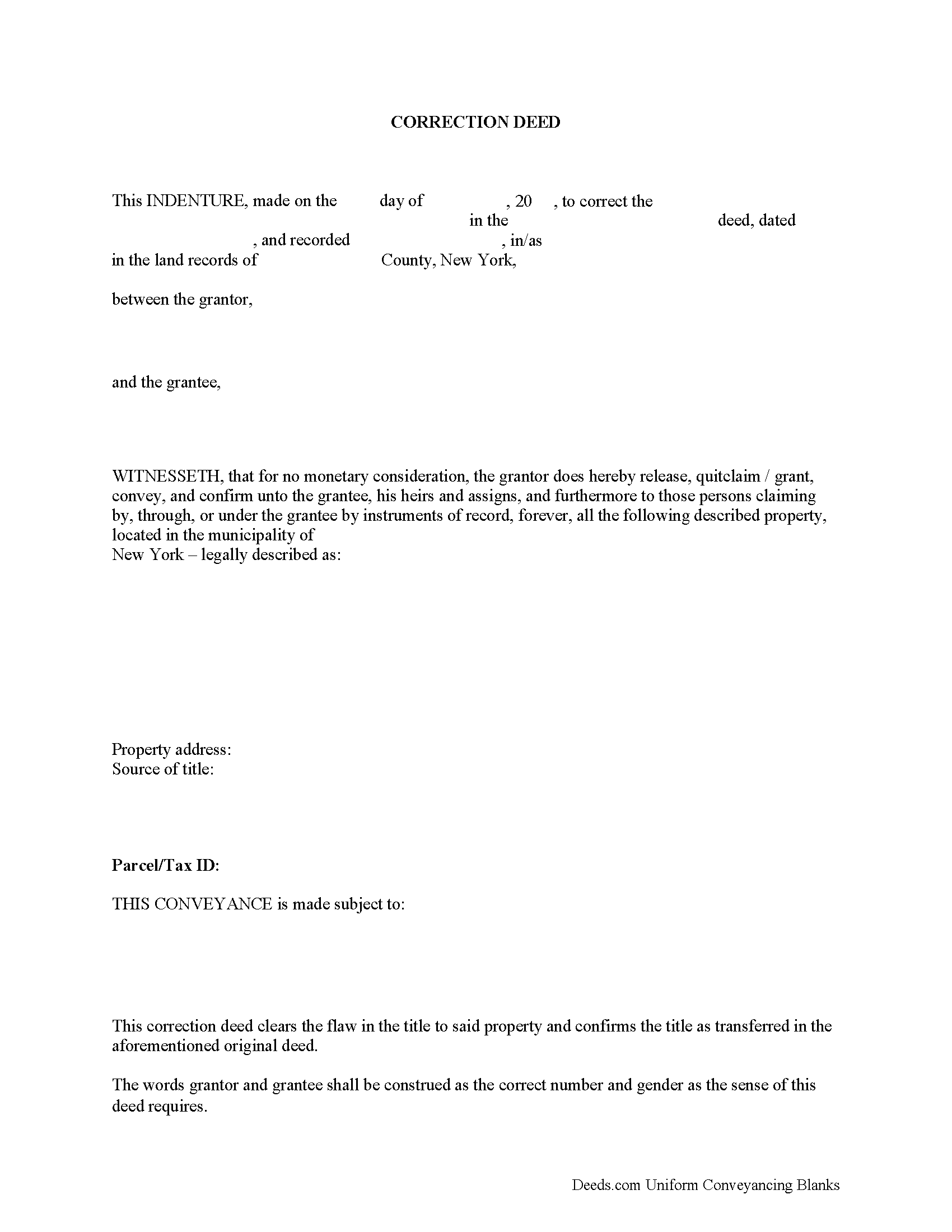

Monroe County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

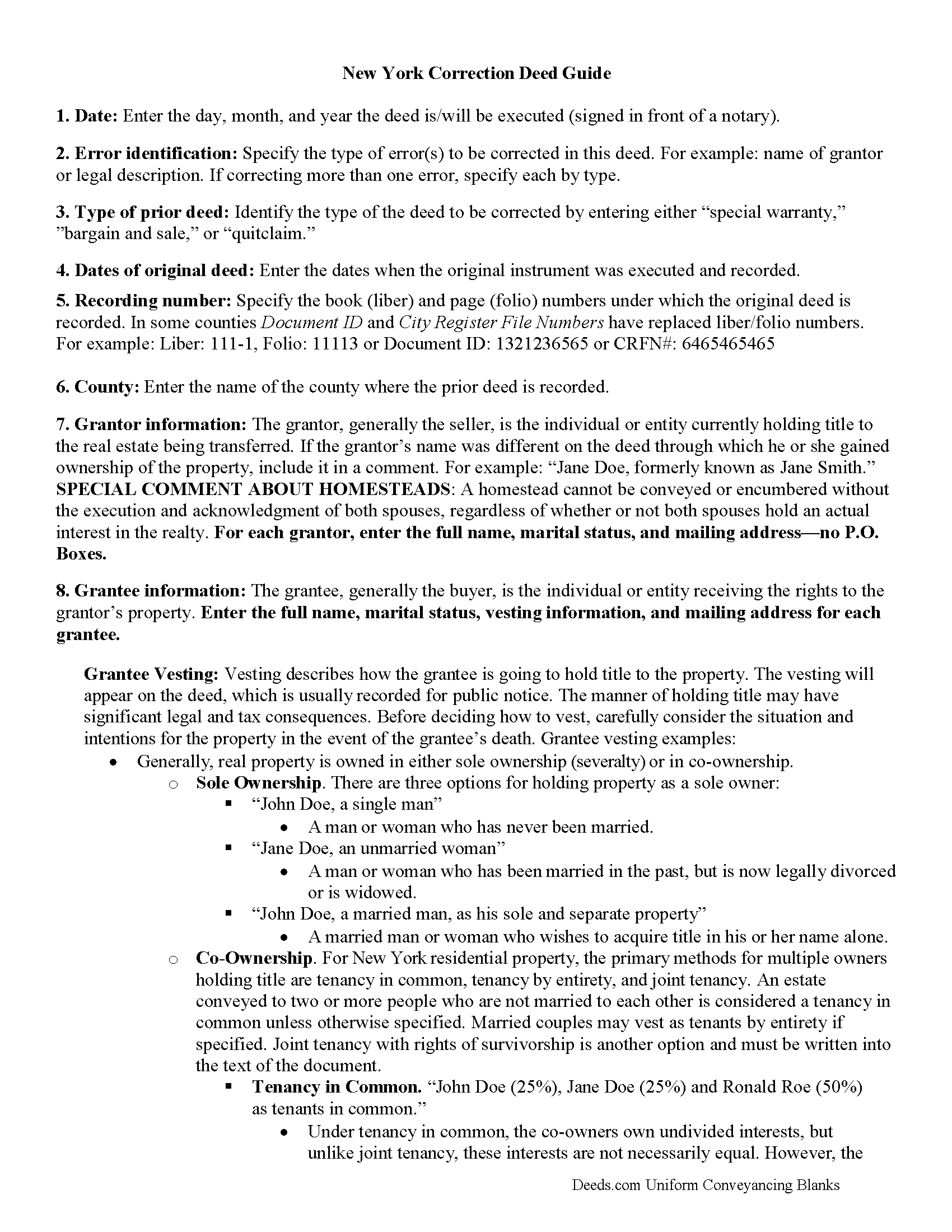

Monroe County Correction Deed Guide

Line by line guide explaining every blank on the form.

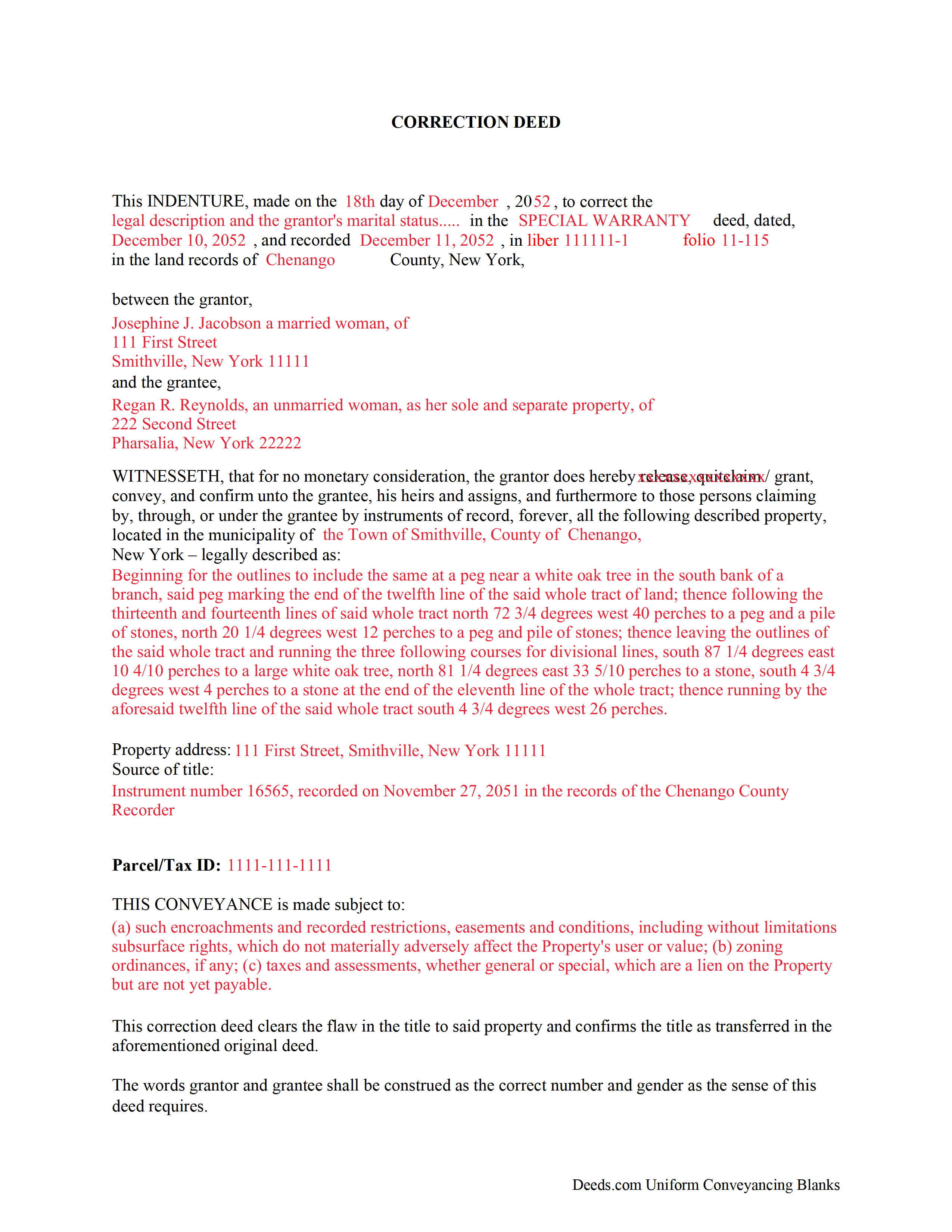

Monroe County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Monroe County documents included at no extra charge:

Where to Record Your Documents

Monroe County Clerk - County Office Building

Rochester, New York 14614

Hours: 9:00am to 5:00pm M-F

Phone: 585-753-1600

Recording Tips for Monroe County:

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Monroe County

Properties in any of these areas use Monroe County forms:

- Adams Basin

- Brockport

- Churchville

- Clarkson

- East Rochester

- Fairport

- Hamlin

- Henrietta

- Hilton

- Honeoye Falls

- Mendon

- Morton

- Mumford

- North Chili

- North Greece

- Penfield

- Pittsford

- Rochester

- Rush

- Scottsville

- Spencerport

- Webster

- West Henrietta

Hours, fees, requirements, and more for Monroe County

How do I get my forms?

Forms are available for immediate download after payment. The Monroe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Monroe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Monroe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Monroe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Monroe County?

Recording fees in Monroe County vary. Contact the recorder's office at 585-753-1600 for current fees.

Questions answered? Let's get started!

Correction deeds are sometimes called confirmatory instruments. As such, they confirm and perfect an existing title created earlier and remove any defects from it, but they do not pass title on their own. They make explicit reference to the instrument that is being corrected by indicating its execution and recording date, the place of recording and the number under which the document is filed. They also need to identify the error or errors by type before supplying the correction in the subsequent body of the deed.

A new real property transfer report, RP-5217-pdf (or RP-5217NYC), with original signatures must accompany all deeds in New York, including correction deeds; the same goes for the tax affidavit TP-584, which both seller and buyer must sign. Forms are available at the county recording office or can be ordered online (but not downloaded). As a correction, the transaction may be exempt from transfer tax. Be sure to include proof that the transfer tax was paid, either by including the original cover page of the prior deed, or by providing an affidavit stating that transfer tax was paid with the prior document.

Furthermore, counties often require a cover page, which may be specific to the county or city and provided on their websites. It serves to identify the document more easily and may be called "recording and endorsement (cover) page." New recording fees per page must be paid for a correction instrument.

(New York CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Monroe County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Monroe County.

Our Promise

The documents you receive here will meet, or exceed, the Monroe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Monroe County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4601 Reviews )

Jo G.

November 8th, 2021

The form was easy enough to purchase but I ended up not needing it. No fault of Deeds.com, but it was of no value to me.

Thank you for your feedback. We really appreciate it. Have a great day!

Jerome R.

July 22nd, 2021

great service clean and accurate

Thank you for your feedback. We really appreciate it. Have a great day!

Iva R.

August 20th, 2020

Great service. Fast, got everything done (form, recording) done in a couple of hours, lightning speed in the real estate world. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!

Jaimie F.

February 2nd, 2024

Very easy process and the customer service representatives are very friendly and helpful.

It was a pleasure serving you. Thank you for the positive feedback!

Ernest K.

July 27th, 2020

Im an out of state realtor, but couldnt believe how quick and easy the process was. Recieved my deed within 15 min of submission. I will be referring clients to this service.

Thank you!

Ron B.

September 16th, 2020

Most complete and affordable documents that I was able to locate online. Excellent printed out presentation. Very professional. More than happy with results.

Thank you!

Judie G.

February 2nd, 2022

Review: Forms are on point, to the point, and cover the vast majority of situations. Would not suggest if your deal is overly complicated but most situations are not complicated at all.

Thank you!

Ralph H.

May 13th, 2019

It had all the info I was looking for!

Thank you Ralph, we appreciate your feedback.

Kathryn G.

December 21st, 2023

This was extremely helpful!

We are motivated by your feedback to continue delivering excellence. Thank you!

Melissa H.

August 10th, 2021

Amazing forms! Order the quitclaim deed forms, got the form and lots of extra forms which is good because I needed a few of them and didn't even know it. Very happy, will be back if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David G.

September 2nd, 2020

Fill in the blanks portions are so limited, it makes it almost impossible to use.

Sorry to hear that David. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere.

Carol K.

October 8th, 2020

Amazing! That's all I can say. From the time I started the process to the time the deed was recorded was less than two hours! What a great, streamlined, seamless process

Thank you!

Michael L.

March 3rd, 2019

Perfect timely service! Will use again!

Thank you!

DONNA P.

July 21st, 2020

Deeds.com was quick, efficient, and cost effective. Deeds.com works with individuals where I found other companies only offer services to title companies, settlement companies, etc. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!