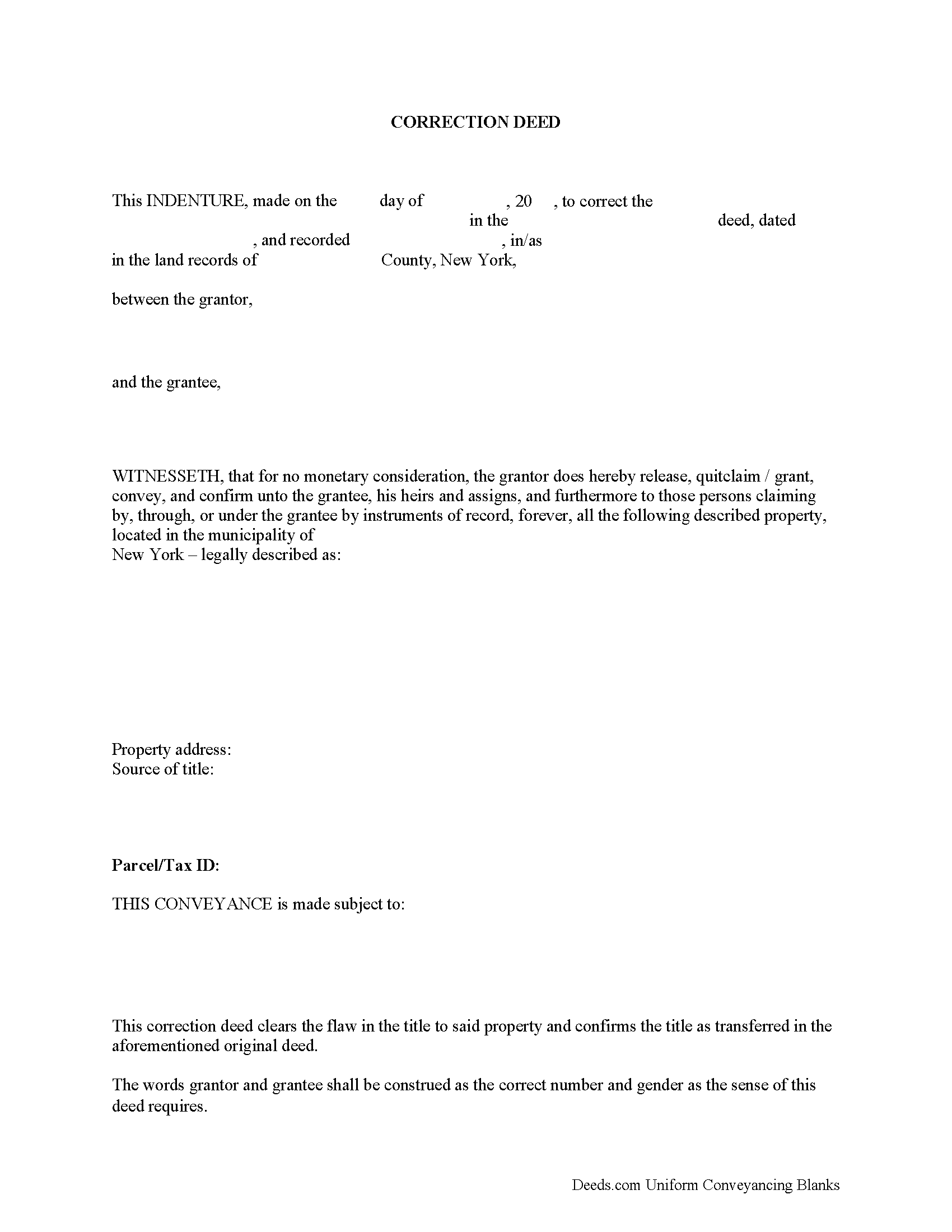

Wayne County Correction Deed Form

Wayne County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

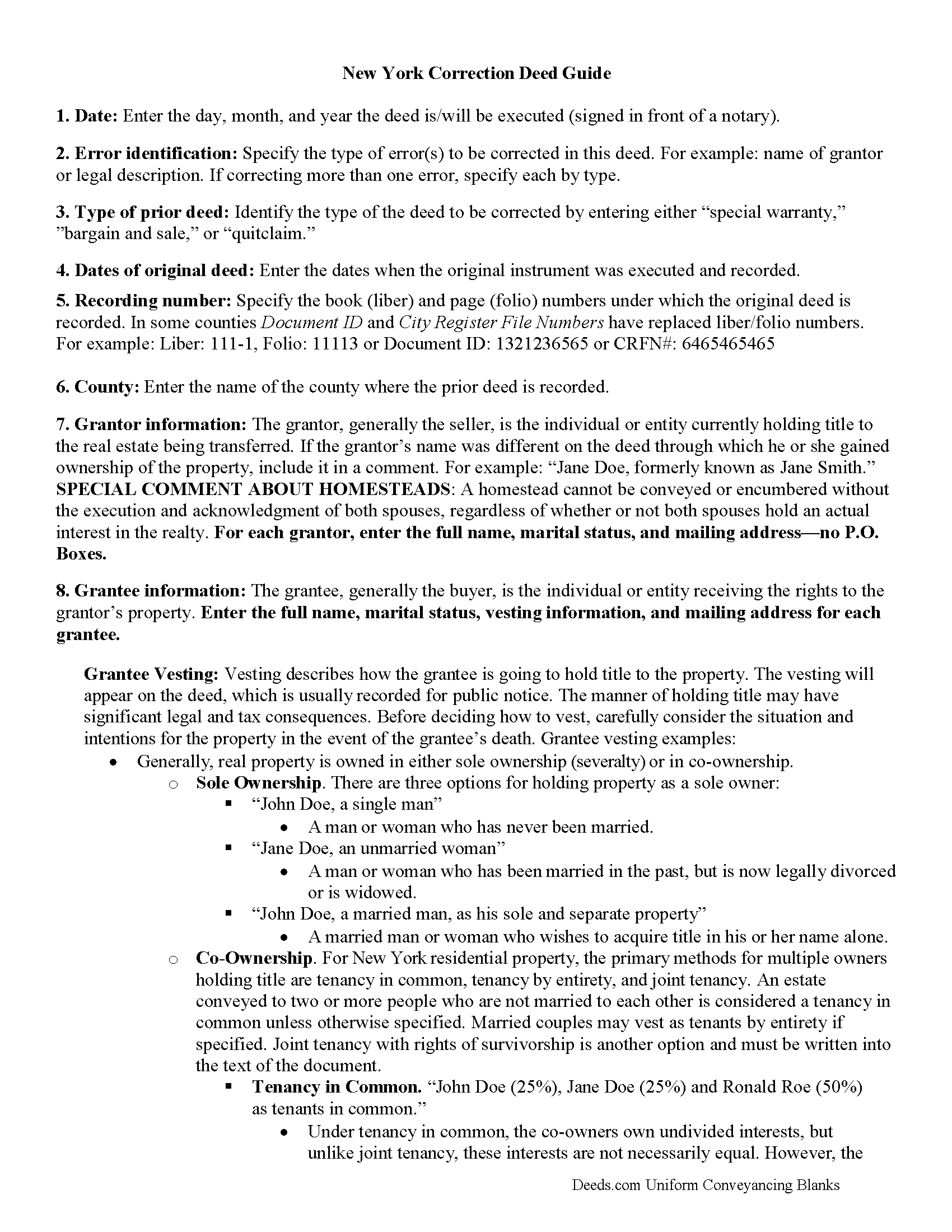

Wayne County Correction Deed Guide

Line by line guide explaining every blank on the form.

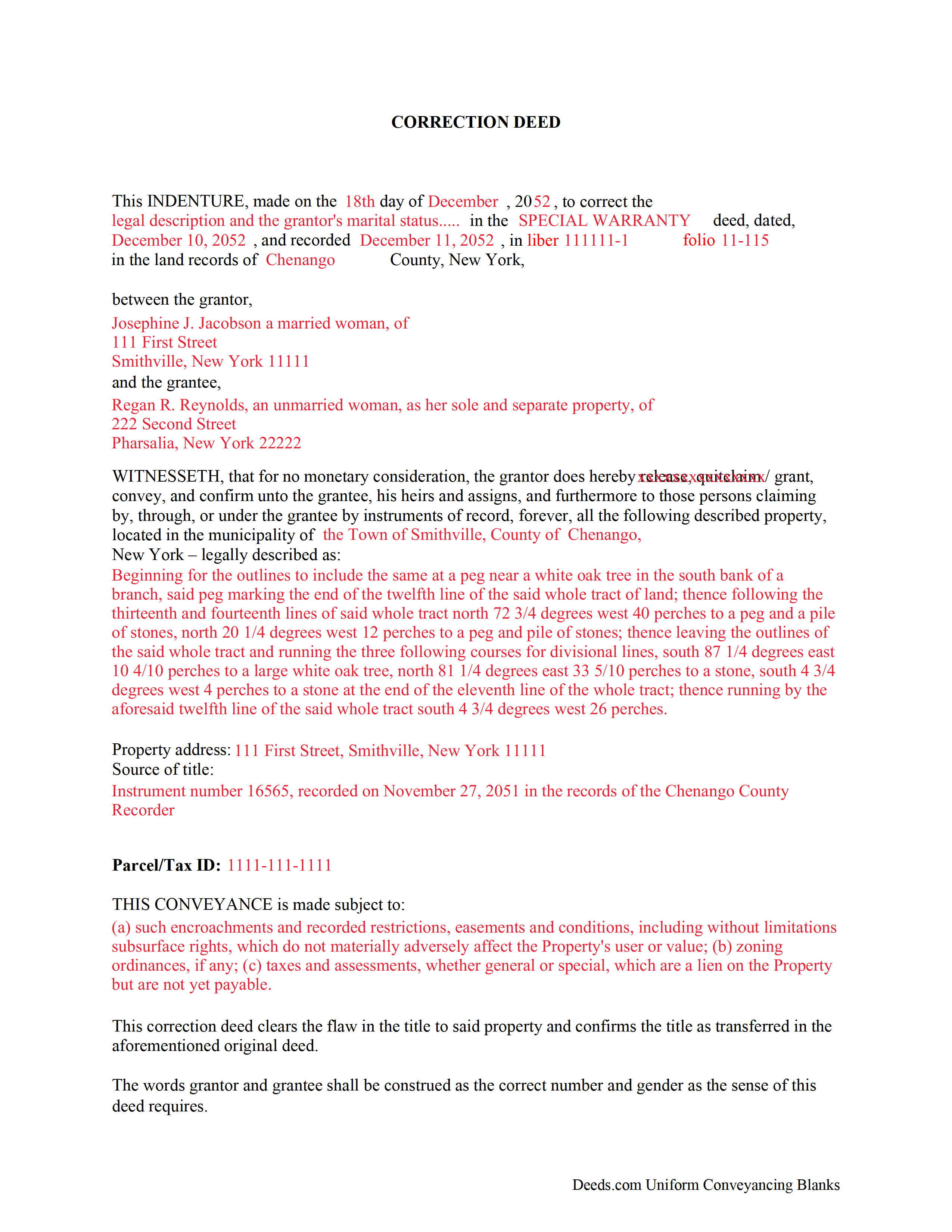

Wayne County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Wayne County documents included at no extra charge:

Where to Record Your Documents

Wayne County Clerk

Lyons, New York 14489

Hours: 9:00 - 5:00 Monday - Friday (Recording until 4:30pm)

Phone: (315) 946-7470

Recording Tips for Wayne County:

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Alton

- Clyde

- East Williamson

- Lyons

- Macedon

- Marion

- Newark

- North Rose

- Ontario

- Ontario Center

- Palmyra

- Pultneyville

- Red Creek

- Rose

- Savannah

- Sodus

- Sodus Point

- South Butler

- Union Hill

- Walworth

- Williamson

- Wolcott

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (315) 946-7470 for current fees.

Questions answered? Let's get started!

Correction deeds are sometimes called confirmatory instruments. As such, they confirm and perfect an existing title created earlier and remove any defects from it, but they do not pass title on their own. They make explicit reference to the instrument that is being corrected by indicating its execution and recording date, the place of recording and the number under which the document is filed. They also need to identify the error or errors by type before supplying the correction in the subsequent body of the deed.

A new real property transfer report, RP-5217-pdf (or RP-5217NYC), with original signatures must accompany all deeds in New York, including correction deeds; the same goes for the tax affidavit TP-584, which both seller and buyer must sign. Forms are available at the county recording office or can be ordered online (but not downloaded). As a correction, the transaction may be exempt from transfer tax. Be sure to include proof that the transfer tax was paid, either by including the original cover page of the prior deed, or by providing an affidavit stating that transfer tax was paid with the prior document.

Furthermore, counties often require a cover page, which may be specific to the county or city and provided on their websites. It serves to identify the document more easily and may be called "recording and endorsement (cover) page." New recording fees per page must be paid for a correction instrument.

(New York CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4601 Reviews )

Greg S.

August 19th, 2022

The Beneficiary Deed is easy to fill out, expecially with the examples/explanations provided. The only recommendation I would make is to state that the Parcel ID and the Assessor's ID are one in the same. I looked everywhere for something that mentions "Assessor's ID" in my paperwork to no avail. Upon calling the Maricopa Assessor's number in Maricopa I was told that they are the same.

Thank you for your feedback. We really appreciate it. Have a great day!

Diane W.

December 12th, 2019

Easy to download and print. Came with good instructions. Would use deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe S.

May 7th, 2021

My first experience with deeds.com was excellent. My task was handled promptly and efficiently. Count on me as a repeat customer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brian J.

September 4th, 2025

make filing doc so simple and fast saves time and money

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margie H.

June 9th, 2021

Great

Thank you!

Jenine E.

April 4th, 2021

The information seems complete and accurate. The form was easy to use and save. I'll let you know if we encounter problems getting the deed processed.

Thank you for your feedback. We really appreciate it. Have a great day!

Melody M.

March 27th, 2023

Thank you Deeds.com for making our Quit Deed process easy and efficient. The instructions and example forms are a must! Excellent value for the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert H.

January 16th, 2019

I have used the quit claim form and seem is very easy.

Thank you Robert, have an awesome day!

Ramona C.

October 28th, 2020

Easy to use and the sample really helped.

Thank you!

KAREN S.

July 22nd, 2020

Easy to use this app and I was able to print my forms immediately! Great service and I would use it again.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara Y.

December 14th, 2020

I found your instructions and sample for completing a quit-claim deed in Arizona to be simple and easy to follow with one exception. The website to use in order to determine the code for the reason for exemption of fees was incorrect, as a result of which I had to contact the County Recorder to obtain that information.

Thank you for your feedback. We really appreciate it. Have a great day!

DONALD S.

March 11th, 2020

Using the Administrators Deed, pay attention to "Exhibit A". The blank will allow you to type a full legal description BUT it will not save it. Use "Exhibit A" to type the legal description. The form was great and I filed it this morning with no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel A.

April 25th, 2022

First time using Deeds.com. Downloaded the PDF forms for creating an Illinois Mortgage and Promissory Note. Filled them out, saved them, and printed them out. Going to send them to my Title Company for closing on a property. Save a bunch of money on not have to pay lawyer fees for creating the same legal documents that Deeds.com provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark W.

May 9th, 2019

Easy, simple and fast. I am familiar with deeds in my state and these looked correct. The common missed document of TRANSFER OF REAL ESTATE VALUE document was also included. Kudos on being complete.

Thanks Mark, we really appreciate your feedback.

Catherine O.

February 23rd, 2021

Love the fact that you can buy a form instead of a subscription. I would highly recommend this site.

Thank you for your feedback. We really appreciate it. Have a great day!