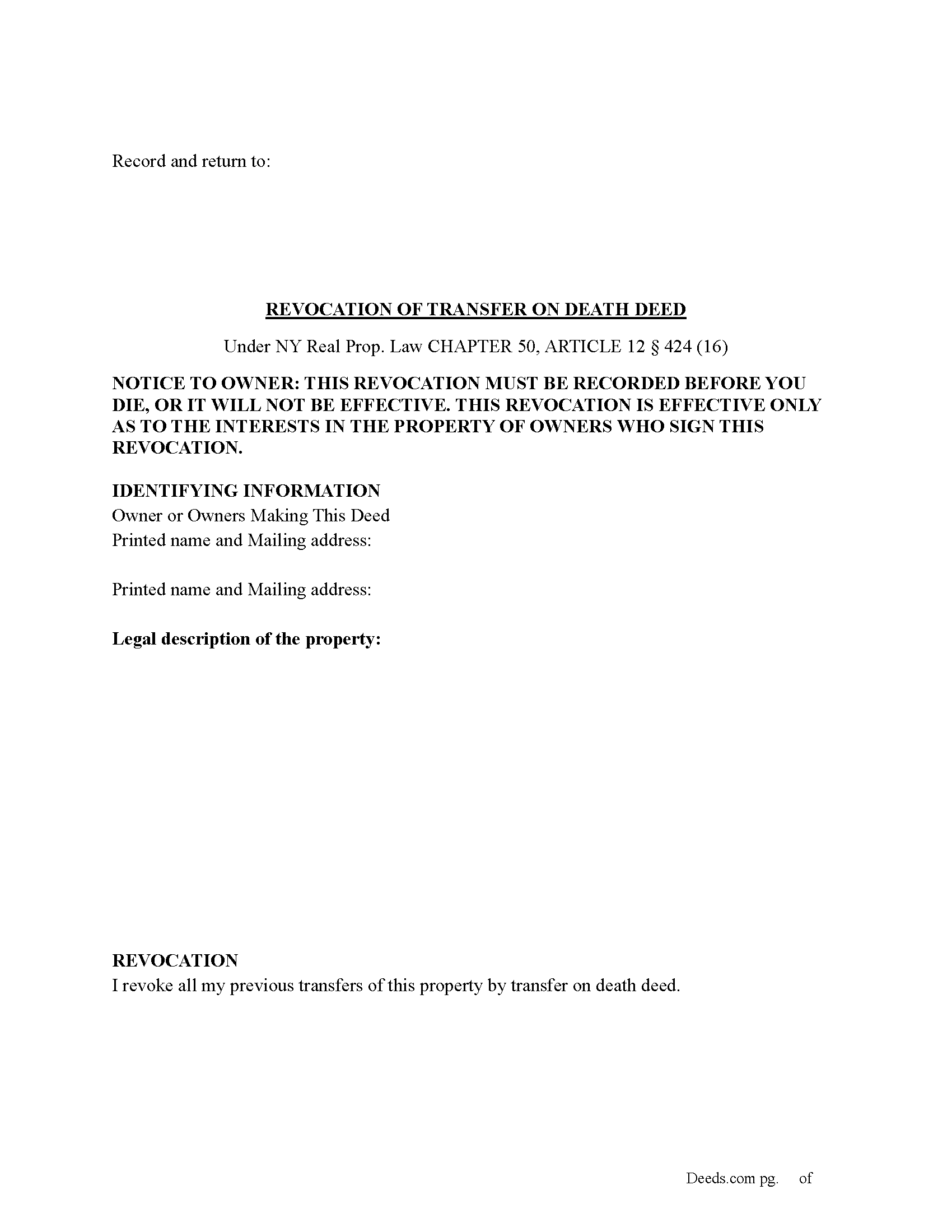

Erie County Revocation of Transfer on Death Deed Form

Erie County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

Erie County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

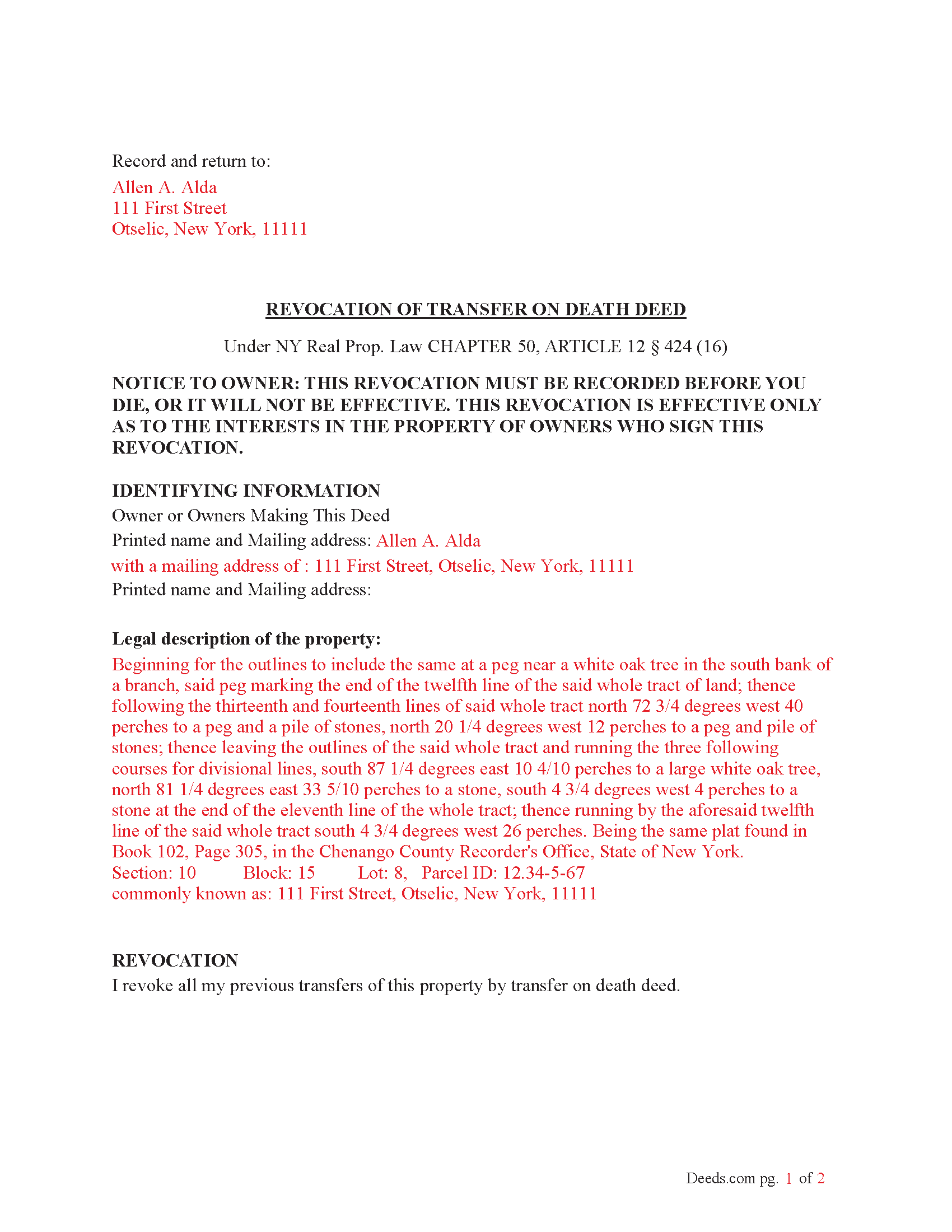

Erie County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed New York Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Erie County documents included at no extra charge:

Where to Record Your Documents

Erie County Clerk's Office

Buffalo, New York 14202

Hours: 9:00am to 5:00pm M-F (be in line by 4:15pm)

Phone: (716) 858-8785

Recording Tips for Erie County:

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Erie County

Properties in any of these areas use Erie County forms:

- Akron

- Alden

- Angola

- Athol Springs

- Boston

- Bowmansville

- Brant

- Buffalo

- Chaffee

- Clarence

- Clarence Center

- Colden

- Collins

- Collins Center

- Crittenden

- Depew

- Derby

- East Amherst

- East Aurora

- East Concord

- Eden

- Elma

- Farnham

- Getzville

- Glenwood

- Grand Island

- Hamburg

- Holland

- Lake View

- Lancaster

- Lawtons

- Marilla

- North Boston

- North Collins

- North Evans

- Orchard Park

- Sardinia

- South Wales

- Spring Brook

- Springville

- Tonawanda

- Wales Center

- West Falls

Hours, fees, requirements, and more for Erie County

How do I get my forms?

Forms are available for immediate download after payment. The Erie County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Erie County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Erie County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Erie County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Erie County?

Recording fees in Erie County vary. Contact the recorder's office at (716) 858-8785 for current fees.

Questions answered? Let's get started!

(How do I revoke the TOD deed after it is recorded?

There are three ways to revoke a recorded TOD deed:

(1) Complete and acknowledge a revocation form and record it in each county where the property is located.

(2) Complete and acknowledge a new TOD deed that disposes of the same property and record it in each county where the property is located.

(3) Transfer the property to someone else during your lifetime by a recorded deed that expressly revokes the TOD deed. You may not revoke the TOD deed by will.) (Real Property (RPP) CHAPTER 50, ARTICLE 12 § 424(15))

Execution of Revocation: The revocation must be executed (signed) by the property owner in the presence of two witnesses and a Notary Public, similar to how the original TOD deed was executed.

Recording the Revocation: The revocation (whether via a new TOD deed or a revocation form) must be recorded in the County Clerk's office where the property is located, just like the original TOD deed. If the revocation is not recorded, it will not be valid.

Retain Control Until Revoked: The property owner retains full control over the property and can revoke the TOD deed at any time during their lifetime. However, after the owner's death, the TOD deed takes effect and cannot be revoked.

Important Considerations: Beneficiary Consent- The property owner does not need the consent of the beneficiary to revoke the TOD deed.

Automatic Revocation by Sale: If the property owner sells or transfers the property during their lifetime, this will also effectively revoke the TOD deed.

Important: Your property must be located in Erie County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Erie County.

Our Promise

The documents you receive here will meet, or exceed, the Erie County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Erie County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Qingqiu H.

May 14th, 2022

I ordered the wrong forms at first because I'm an idiot and didn't do my research. When I told the customer service about my error they were understanding.

Thank you for your feedback. We really appreciate it. Have a great day!

Tony R.

July 23rd, 2021

As advertised. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monica D. N.

April 8th, 2019

The Web site is very intuitive, organized well and forms are easily found. The instructions provided are very helpful. Value in terms of price is very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly J. A.

April 24th, 2022

Thank you for the paperwork. It was so much easier to do at home than go out and have to have people miss work.

Thank you!

Kurt P.

November 20th, 2020

I like the basics. The one thing I would recommend changing would be, something that tells me I have actually have submitted my package, or that I can leave at any time without needing to click on a "Submit" button.

Thank you for your feedback. We really appreciate it. Have a great day!

Rysta W.

June 29th, 2021

Very easy to use and great price.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

January 10th, 2019

Documents available immediately as advertised. Was easy to understand the guide and complete the deed form for notarization and filing for recording.

Thank you!

Daniel S.

July 6th, 2020

So far, so good. Waiting for the County Recorder to accept and record my document, but use of the Deeds.com system has been easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Gertrude M.

January 31st, 2023

Rating 5 stars

Thank you!

Rene S.

December 23rd, 2022

Amazing forms and great value. That may sound like hyperbole talking about legal forms but it's not, you really are getting way more than you pay for here.

Thank you for your feedback. We really appreciate it. Have a great day!

JAMES V.

August 5th, 2020

I initiated an order at 8:30PM on a Tuesday. I already had a response waiting for me when I opened my email the next morning. Very responsive. I'm very happy with this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steve R.

June 17th, 2023

Hopefully filling out and filing the paperwork is as easy as this was.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary S.

January 25th, 2019

I am so excited to find this site. Thank you

Thank you Mary. We appreciate your enthusiasm, have a great day!

Rhoads H.

December 3rd, 2020

Excellent, thank you.

Thank you!

harriet l.

June 21st, 2019

Worked very smoothly and got the job done

Thank you for your feedback. We really appreciate it. Have a great day!