Oswego County Revocation of Transfer on Death Deed Form

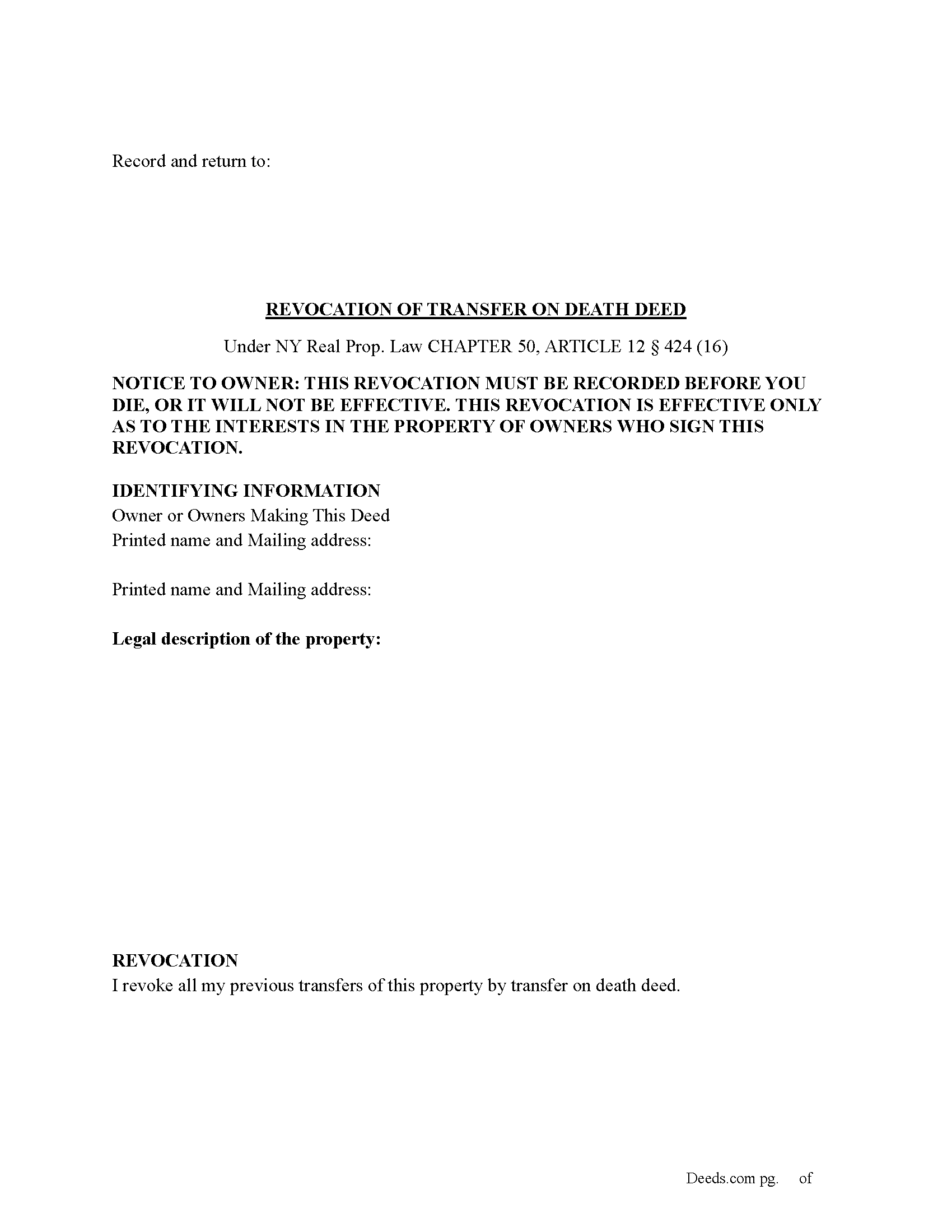

Oswego County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

Oswego County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

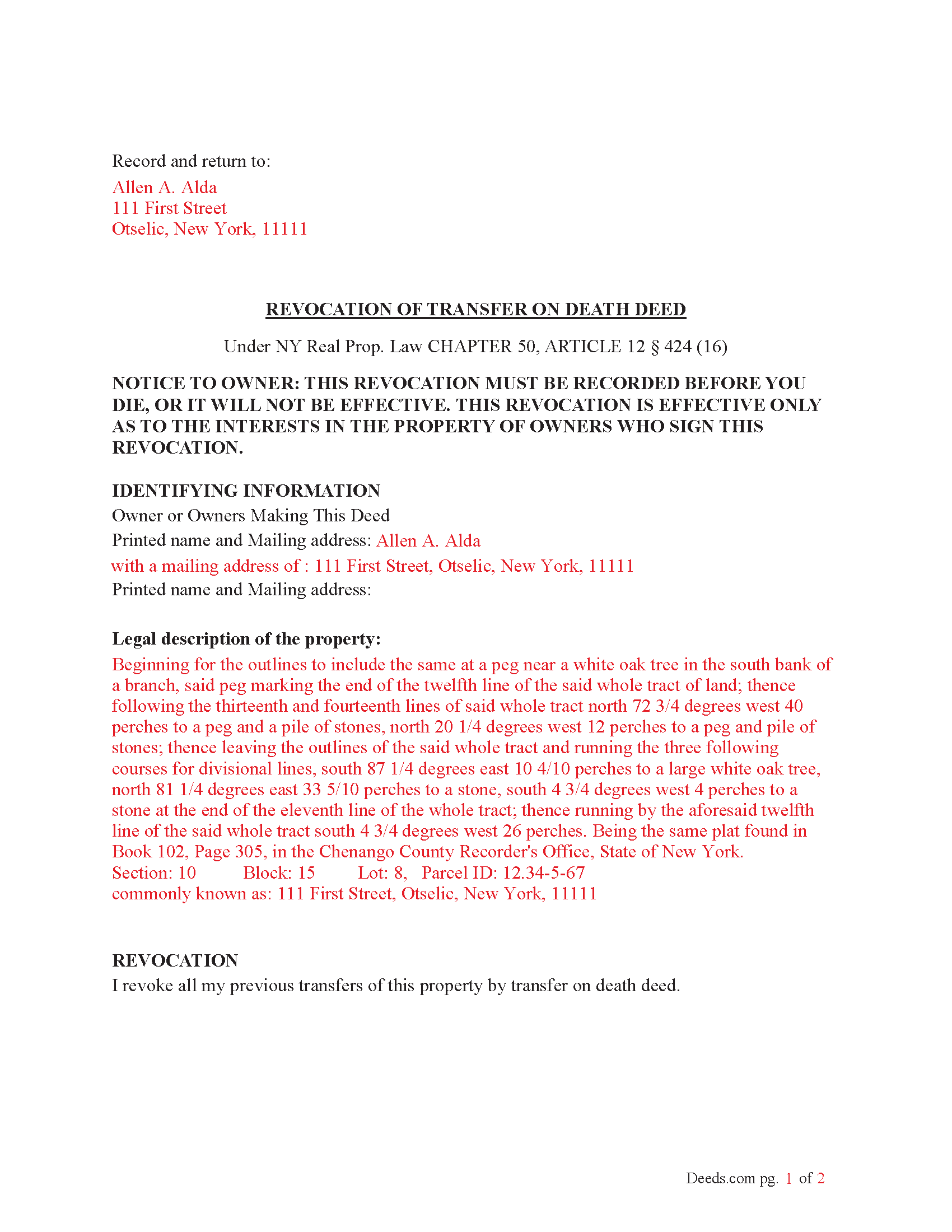

Oswego County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed New York Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Oswego County documents included at no extra charge:

Where to Record Your Documents

Oswego County Clerk's Office

Oswego, New York 13126

Hours: 9:00am to 5:00pm / July-August 8:30am to 4:00pm

Phone: (315) 349-8621

Recording Tips for Oswego County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Oswego County

Properties in any of these areas use Oswego County forms:

- Altmar

- Bernhards Bay

- Central Square

- Cleveland

- Constantia

- Fulton

- Hannibal

- Hastings

- Lacona

- Lycoming

- Mallory

- Maple View

- Mexico

- Minetto

- New Haven

- Orwell

- Oswego

- Parish

- Pennellville

- Phoenix

- Pulaski

- Redfield

- Richland

- Sandy Creek

- West Monroe

- Williamstown

Hours, fees, requirements, and more for Oswego County

How do I get my forms?

Forms are available for immediate download after payment. The Oswego County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Oswego County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Oswego County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Oswego County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Oswego County?

Recording fees in Oswego County vary. Contact the recorder's office at (315) 349-8621 for current fees.

Questions answered? Let's get started!

(How do I revoke the TOD deed after it is recorded?

There are three ways to revoke a recorded TOD deed:

(1) Complete and acknowledge a revocation form and record it in each county where the property is located.

(2) Complete and acknowledge a new TOD deed that disposes of the same property and record it in each county where the property is located.

(3) Transfer the property to someone else during your lifetime by a recorded deed that expressly revokes the TOD deed. You may not revoke the TOD deed by will.) (Real Property (RPP) CHAPTER 50, ARTICLE 12 § 424(15))

Execution of Revocation: The revocation must be executed (signed) by the property owner in the presence of two witnesses and a Notary Public, similar to how the original TOD deed was executed.

Recording the Revocation: The revocation (whether via a new TOD deed or a revocation form) must be recorded in the County Clerk's office where the property is located, just like the original TOD deed. If the revocation is not recorded, it will not be valid.

Retain Control Until Revoked: The property owner retains full control over the property and can revoke the TOD deed at any time during their lifetime. However, after the owner's death, the TOD deed takes effect and cannot be revoked.

Important Considerations: Beneficiary Consent- The property owner does not need the consent of the beneficiary to revoke the TOD deed.

Automatic Revocation by Sale: If the property owner sells or transfers the property during their lifetime, this will also effectively revoke the TOD deed.

Important: Your property must be located in Oswego County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Oswego County.

Our Promise

The documents you receive here will meet, or exceed, the Oswego County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Oswego County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Scotty A.

October 2nd, 2021

A great time and money saver that also has a money back guarantee. I received all the pertinent forms and instructions for less than a family eating a fast food dinner.

Thank you!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Lawrence N.

August 31st, 2020

Very easy and convenient to use. Low cost and saves a trip to the courthouse and/or having to do mailing(s)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon M.

February 23rd, 2021

I will be going through title, so didn't order deed, but I think your website is wonderful. It's great to offer online services, such a great time saving for me with my work. Thank you, Sharon M.

Thank you for taking the time to leave your feedback Sharon, we really appreciate it. Have a fantastic day!

Dennis B.

June 19th, 2019

It was easy to download the necessary "Death of Joint Tenant" forms. These easy to use interactive forms are made to comply with the laws specific to your state.

Thank you!

Yvonne W.

December 30th, 2018

I'm not certain yet that this is all I need to do what I need to do. Marion Co. Clerk's office has not been helpful. I found this site from that site & hopefully it will help.

Thanks for the feedback Yvonne. We hope you found what you needed. Have a wonderful day!

Gerald G.

September 16th, 2020

I am researching forms required to change deed from joint owners to individual. Subsequently, forms required when/after a trust is established for real property.

Thank you!

Hideo K.

September 12th, 2023

Very prompt and satisfied with the service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Grace V.

February 29th, 2020

Easy to use

Thank you!

Nicolette C.

March 3rd, 2025

Deeds.com was a wealth of information and easy to navigate through the myriad of forms to choose from. During a time of family tragedy, this site was a valuable resource to complete necessary paperwork and ensure assets were in proper names and titles.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Russell B.

March 15th, 2023

complete package as promised at a very reasonable cost. Easy forms to complete. Thank you. Definitely 5 stars!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara P.

March 18th, 2025

Easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James D.

March 31st, 2023

I had a satisfying experience very informative and easy to navigate.

Thank you!

Mark M.

October 1st, 2020

So nice to find the forms I was looking for. Great site!! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Donald H.

November 5th, 2019

EXCELLENT,,super good. Quick & easy

Thank you!