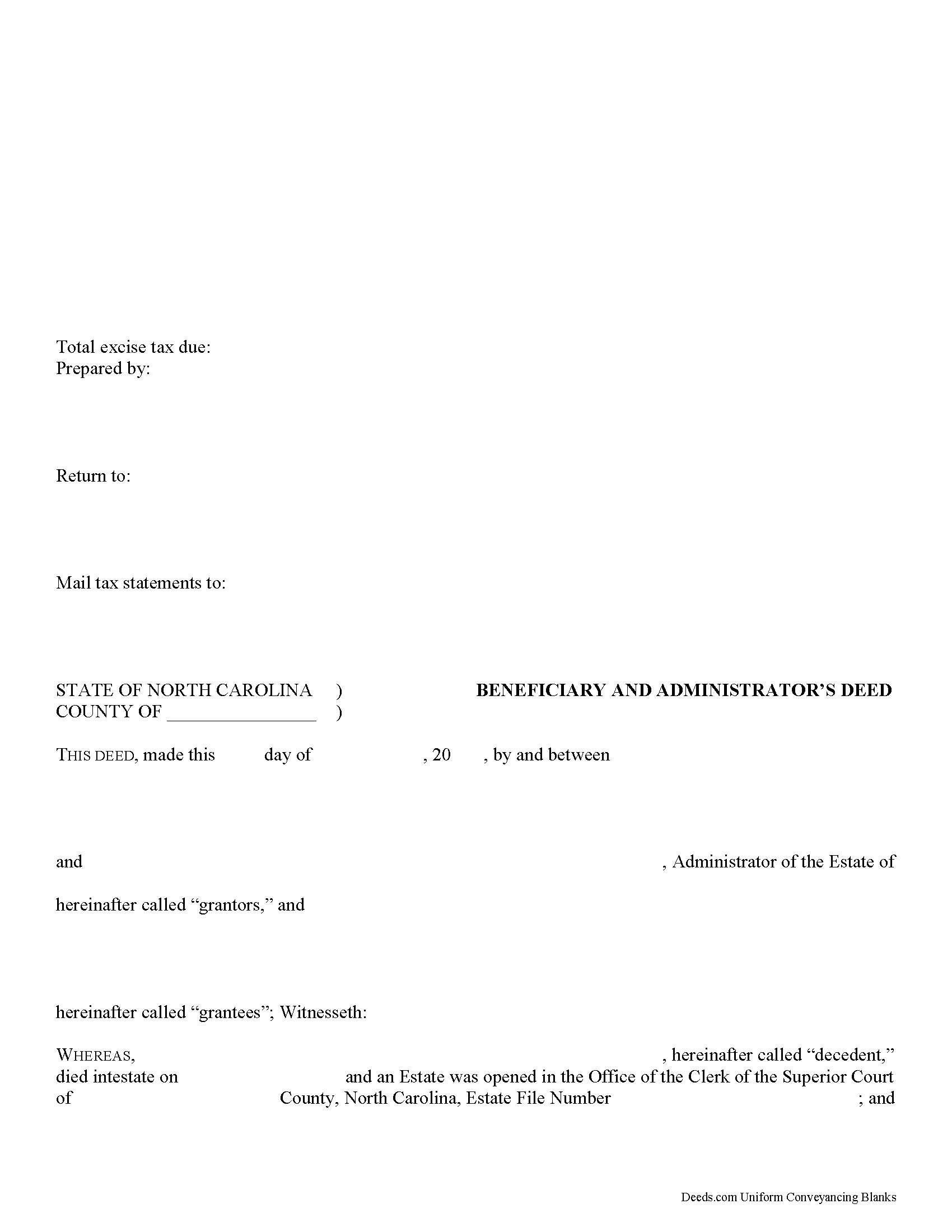

Download North Carolina Beneficiary and Administrator Deed Legal Forms

North Carolina Beneficiary and Administrator Deed Overview

Probate is the legal process of settling a decedent's (deceased person's) estate. An administrator is the personal representative appointed by the clerk of superior court to administer a decedent's estate.

When the estate's assets are not sufficient to pay debts, the administrator may need to petition the superior court where the estate is open to obtain an order to sell the decedent's real property. In North Carolina, title to real property vests in the decedent's heirs upon death, and a special proceeding is required to bring the property into the estate. An administrator may not sell realty without the court's permission.

The beneficiary and administrator's deed is an instrument executed by a decedent's heirs and joined by the administrator of the estate to convey an interest in real property from an intestate estate (so called when the decedent dies without a will, or does not name an executor of the estate) to a purchaser.

When the estate is still open in probate, the administrator joins in the deed consenting to the sale of the real property described within as required by N.C.G.S. 28A-17-12. By signing the deed, the administrator waives the possibility of opening a special proceeding to bring the property back into the estate later.

Heirs must execute the deed for a valid transfer. The deed lists all heirs and their marital status; spouses of heirs must join in signing the deed to release homestead rights under North Carolina law. Because title is legally vested in them, the executing heirs may make warranties of title, but the administrator typically does not. Any warranty language included in the deed is binding on the heirs.

Recitals of a beneficiary and administrator's deed include a statement that the decedent died intestate and information regarding the opened estate, including the decedent's date of death, the county of probate, and the file number assigned to the estate by the clerk of superior court. In addition, the deed states that the administrator named within is qualified to administer the estate and joins to evidence consent to the sale, and includes the date of first notice to creditors.

A lawful deed in North Carolina states the consideration made for the transfer of title, contains an accurate legal description of the subject parcel and recites the grantor's source of title. When properly executed and recorded, the beneficiary and administrator's deed vests title to the within-described property in the named grantee(s). Any restrictions to the transfer should be noted in the body of the deed.

Both the heirs' signatures and the administrator's signature must be acknowledged in the presence of a notarial official before the deed can be recorded in the county where the subject property is located. For a valid deed, the signatures of heirs and their spouses, when applicable, must be present. An affidavit of consideration or value may be required.

Consult an attorney licensed in the State of North Carolina with questions regarding beneficiary and administrator's deeds, as each situation is unique.

(North Carolina B&AD Package includes form, guidelines, and completed example)