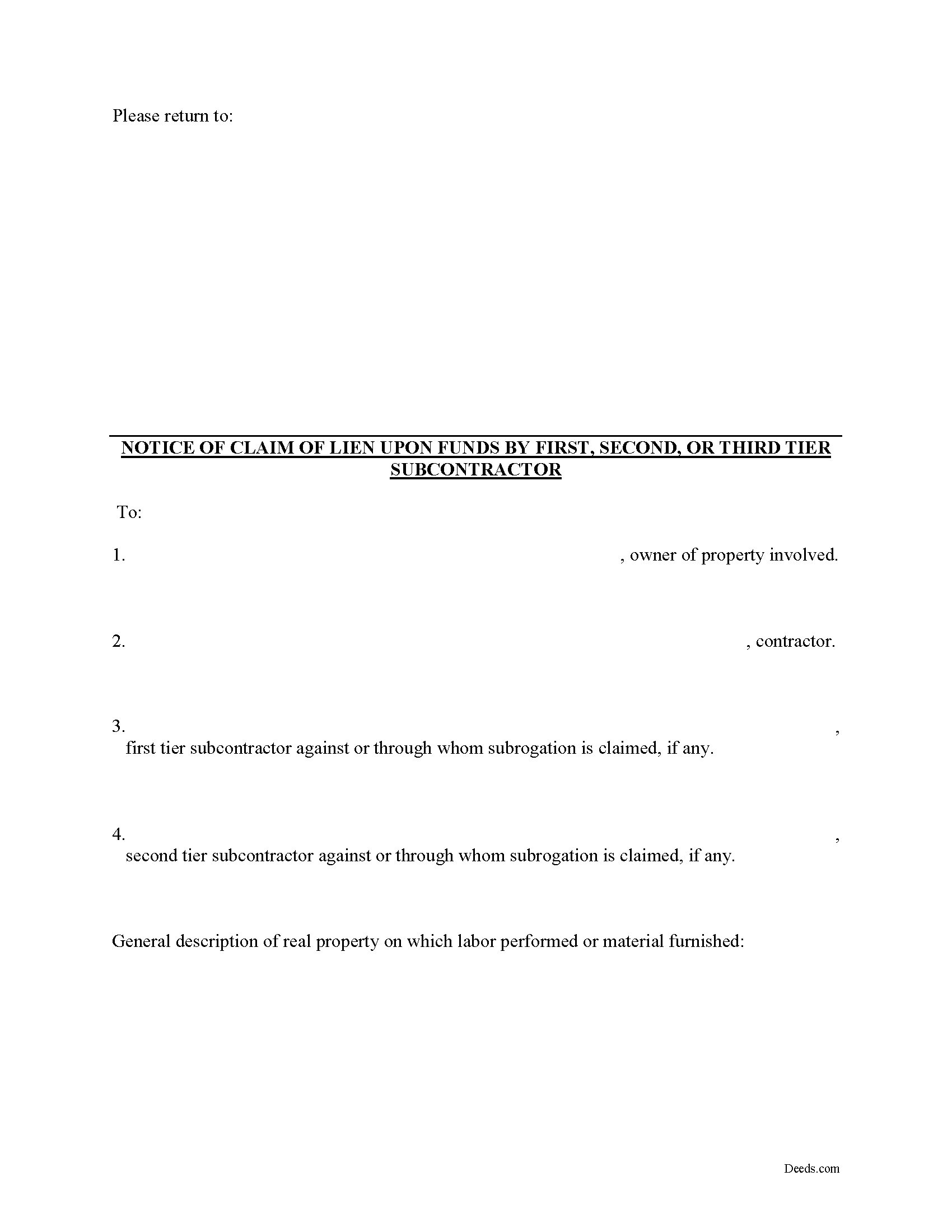

Greene County Claim of Lien Against Construction Funds Form

Greene County Claim of Lien Against Construction Funds Form

Fill in the blank Claim of Lien Against Construction Funds form formatted to comply with all North Carolina recording and content requirements.

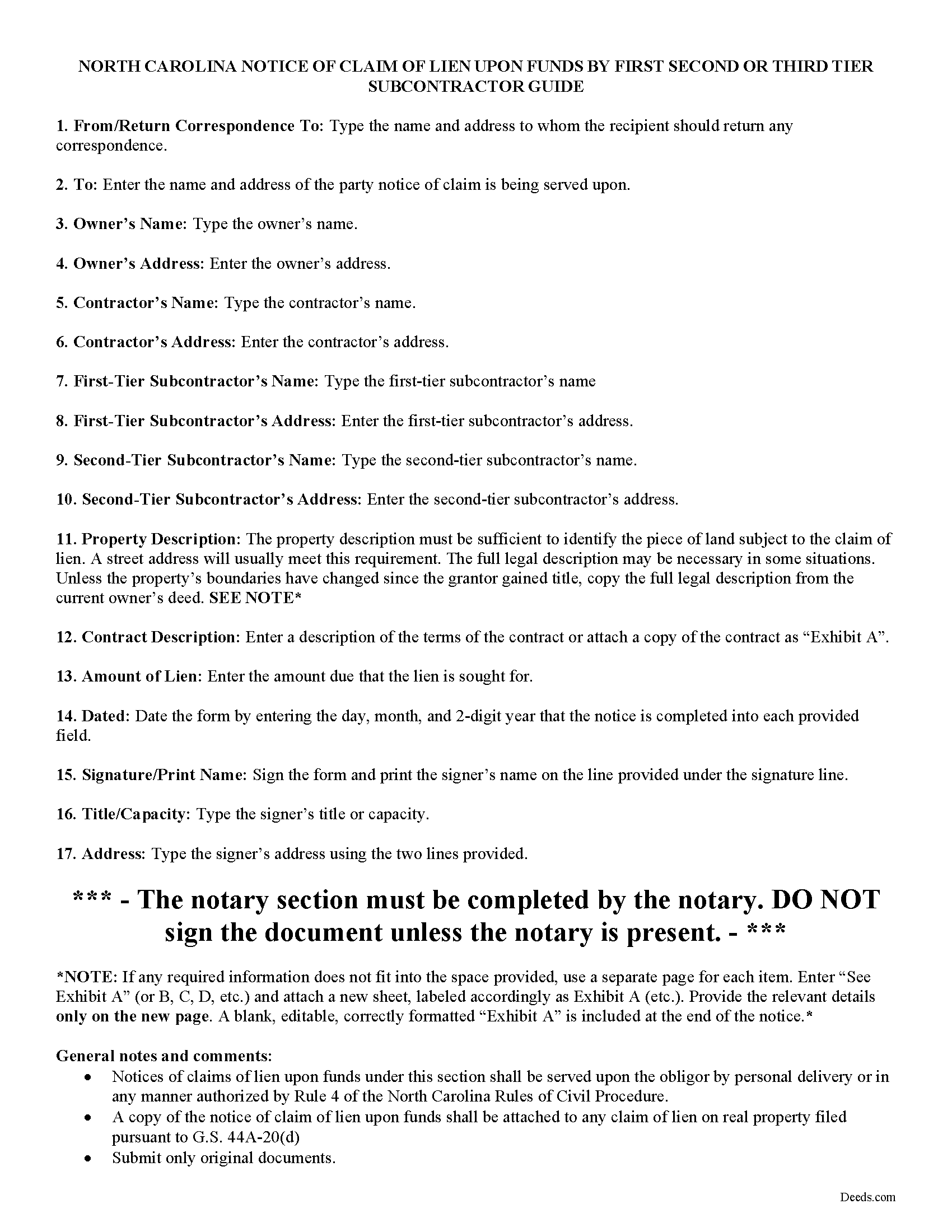

Greene County Claim of Lien Against Construction Funds Guide

Line by line guide explaining every blank on the form.

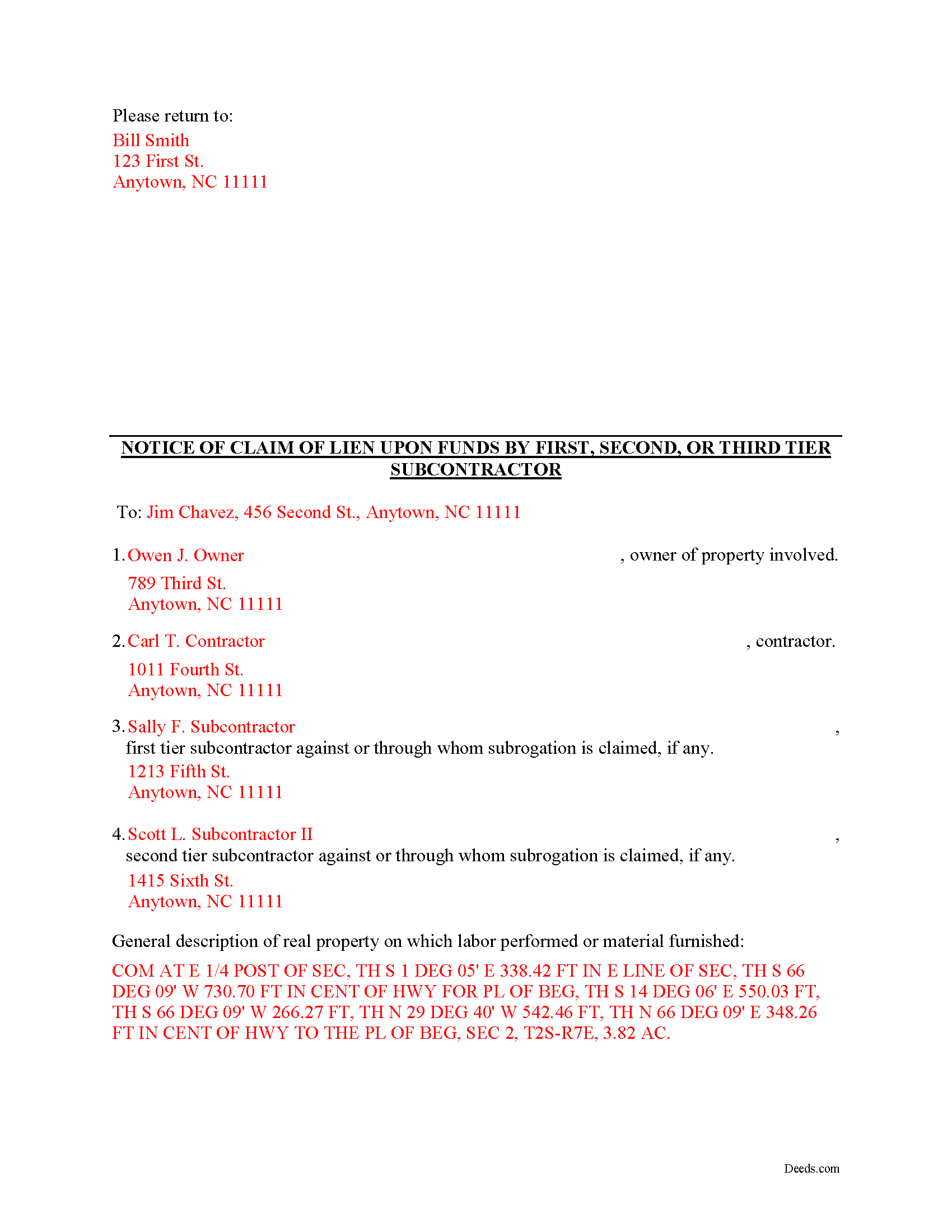

Greene County Completed Example of the Claim of Lien Against Construction Funds Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Greene County documents included at no extra charge:

Where to Record Your Documents

Greene County Register of Deeds

Snow Hill, North Carolina 28580

Hours: 8:00 to 5:00 Monday through Friday

Phone: (252) 747-3620

Recording Tips for Greene County:

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Greene County

Properties in any of these areas use Greene County forms:

- Hookerton

- Maury

- Snow Hill

- Walstonburg

Hours, fees, requirements, and more for Greene County

How do I get my forms?

Forms are available for immediate download after payment. The Greene County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Greene County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Greene County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Greene County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Greene County?

Recording fees in Greene County vary. Contact the recorder's office at (252) 747-3620 for current fees.

Questions answered? Let's get started!

Claiming a Lien Against Construction Funds in North Carolina

In addition to claiming a lien against a real property, contractors can also lien on construction funds regardless of tier. Therefore, a subcontractor has lien rights against any funds that are owed to the party that hired the subcontractor. A lien can be claimed to the extent money is owed to the party occupying the position in the chain above the subcontractor. N.C.G.S. 44A-18.

The subcontractor's right to a lien becomes ripe as soon as labor or materials are first furnished on the job and relates back to the date the contractor or supplier first furnished labor, services, or materials on the project.

The notice of a claim of lien upon funds must set forth all of the following information: (1) the name and address of the person claiming the lien upon funds; (2) a general description of the real property improved; (3) the name and address of the person with whom the lien claimant contracted to improve real property; (4) the name and address of each person against or through whom subrogation rights are claimed; (5) a general description of the contract and the person against whose interest the lien upon funds is claimed; and (6) the amount of the lien upon funds claimed by the lien claimant under the contract. N.C.G.S. 44A-19(a).

The notice must also be served on the obligor (debtor) by personal delivery or in any manner authorized by Rule 4 of the North Carolina Rules of Civil Procedure. N.C.G.S. 44A-19(d). A copy of the notice of claim of lien upon funds shall be attached to any claim of lien on real property filed pursuant to G.S. 44A-20(d). Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of a legal professional. Please contact an attorney with questions about claiming a lien on funds, or any other issues related to liens in North Carolina.

Important: Your property must be located in Greene County to use these forms. Documents should be recorded at the office below.

This Claim of Lien Against Construction Funds meets all recording requirements specific to Greene County.

Our Promise

The documents you receive here will meet, or exceed, the Greene County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Greene County Claim of Lien Against Construction Funds form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Lee C.

February 10th, 2021

Quick, easy and reasonably priced.

Thank you!

charles g.

December 2nd, 2019

very good forms. they covered everything i needed.

Thanks Charles, we really appreciate your feedback. Have a great day!

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn R.

May 21st, 2020

Definitely 5 stars. Everything was taken care of well within 24 hours. If our law firm needs to record a single document in a different county again, we will use your service. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Bryan A.

April 9th, 2020

Very easy thank you for this quick process.

Thank you for the kind words Bryan.

David C.

January 17th, 2020

Very fast service

Thank you!

Amanda W.

August 18th, 2020

Very helpful.

Thank you!

Daniel D.

June 3rd, 2019

Easier than I expected. I followed the downloaded examples step by step, and before I knew it, the form was completed correctly and good to go. Thank you, Daniel D.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Glenda R.

June 16th, 2020

My experience with deeds.com during this pandemic that has us inconvenienced has made it easy for personal business to continue as usual. I will recommend deeds.com to anyone I learn of needing the assistance.

Thank you for your feedback. We really appreciate it. Have a great day!

Amanda S.

April 3rd, 2019

Thank you! My husband and I went in the get notary stamps for a Special Warranty Deed and a Post Nuptial Agreement. The representative was very knowledgeable and thorough with the notary process. She made sure we read and understood all documents that we were signing and they required us to recite in sworn statements that everything there was true and understood! I will be using the notary service again at Bank of America! The representative was very respectful and had a nice smile the entire time to make our visit great!

Thank you!

terrance G.

February 11th, 2025

Excellent Service, with quick turnaround times.

Thank you for your positive words! We’re thrilled to hear about your experience.

Felincia L.

September 28th, 2024

The process was fast and efficient. I did get a bit confused after entering info for my package but soon realized I had completed this part of the process and only needed to leave the page and wait for review of the document and then the invoice. It was pretty simple. After payment of the invoice I was notified that the document had been submitted. A few hours later I received notice that the document was recorded by the city. It was fast!

We are motivated by your feedback to continue delivering excellence. Thank you!

Kimberly M.

January 8th, 2020

Love Deeds.com. Fast turnaround and easy to work with.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darryl S.

April 16th, 2020

These guys saved the day! Very good at what they do and deliver AS ADVERTISED!! My county's recorder's office was closed to the public due to the COVID-19 pandemic, and the recorder's office did not offer the service I needed online. Attempting to close on a home the following day, I was in immediate need of a deed for property that I previously owned to provide to the underwriters for my pending loan. I thought I was dead in the water and would miss my next day closing date. Strolling the internet for options, I came upon DEEDS.COM. After reading the posted reviews, I thought I would give them a try. Within 10 minutes of placing my order, I received ALL the information I requested about the property I previously owned. Thank you DEEDS.COM for the prompt, courteous, and professional service. You guys are ROCK STARS!!! I closed on my new home.

Thank you so much for your kinds words Darryl, glad we were able to help.

Kathryn G.

December 21st, 2023

This was extremely helpful!

We are motivated by your feedback to continue delivering excellence. Thank you!