Mclean County Mineral Deed Form

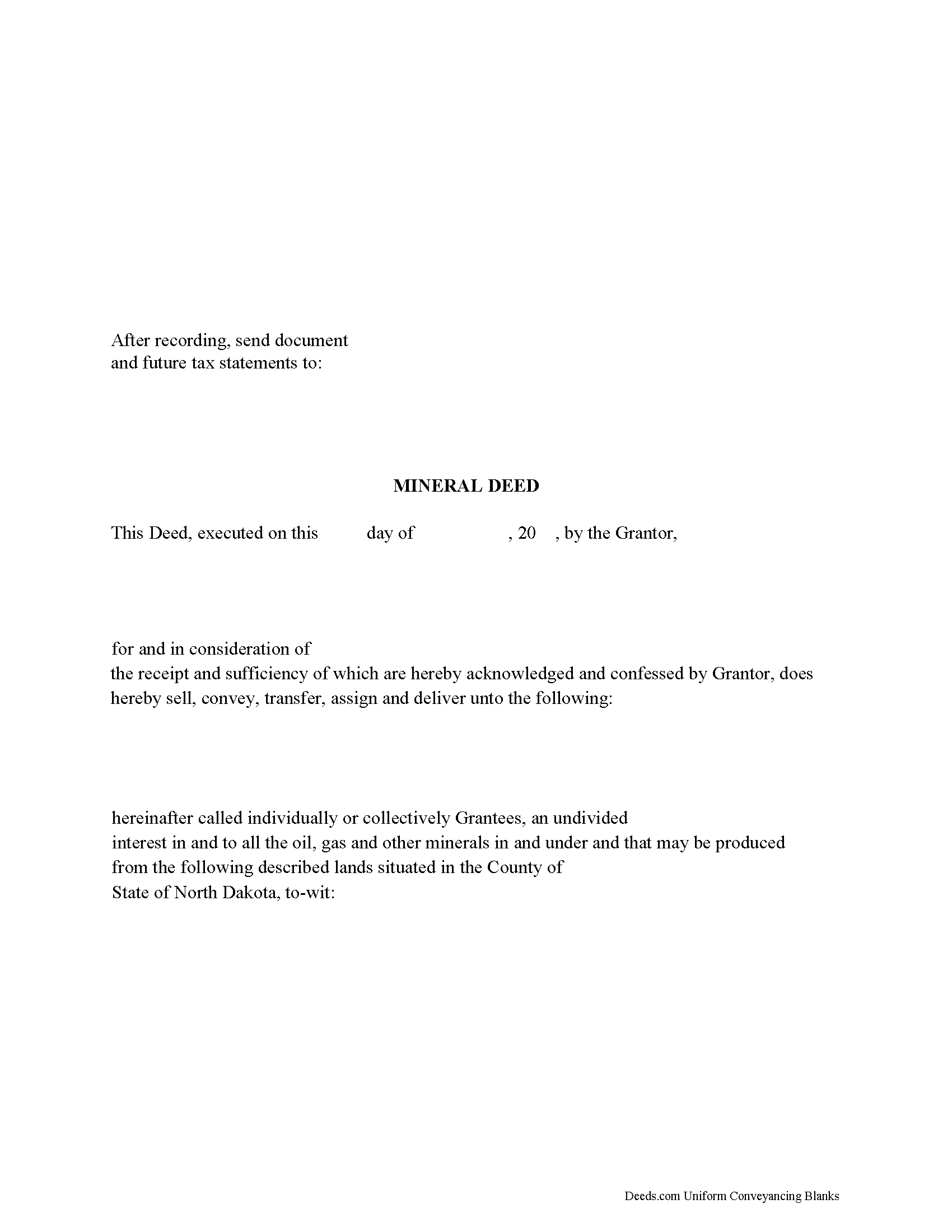

Mclean County Mineral Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Mclean County Mineral Deed Guide

Line by line guide explaining every blank on the form.

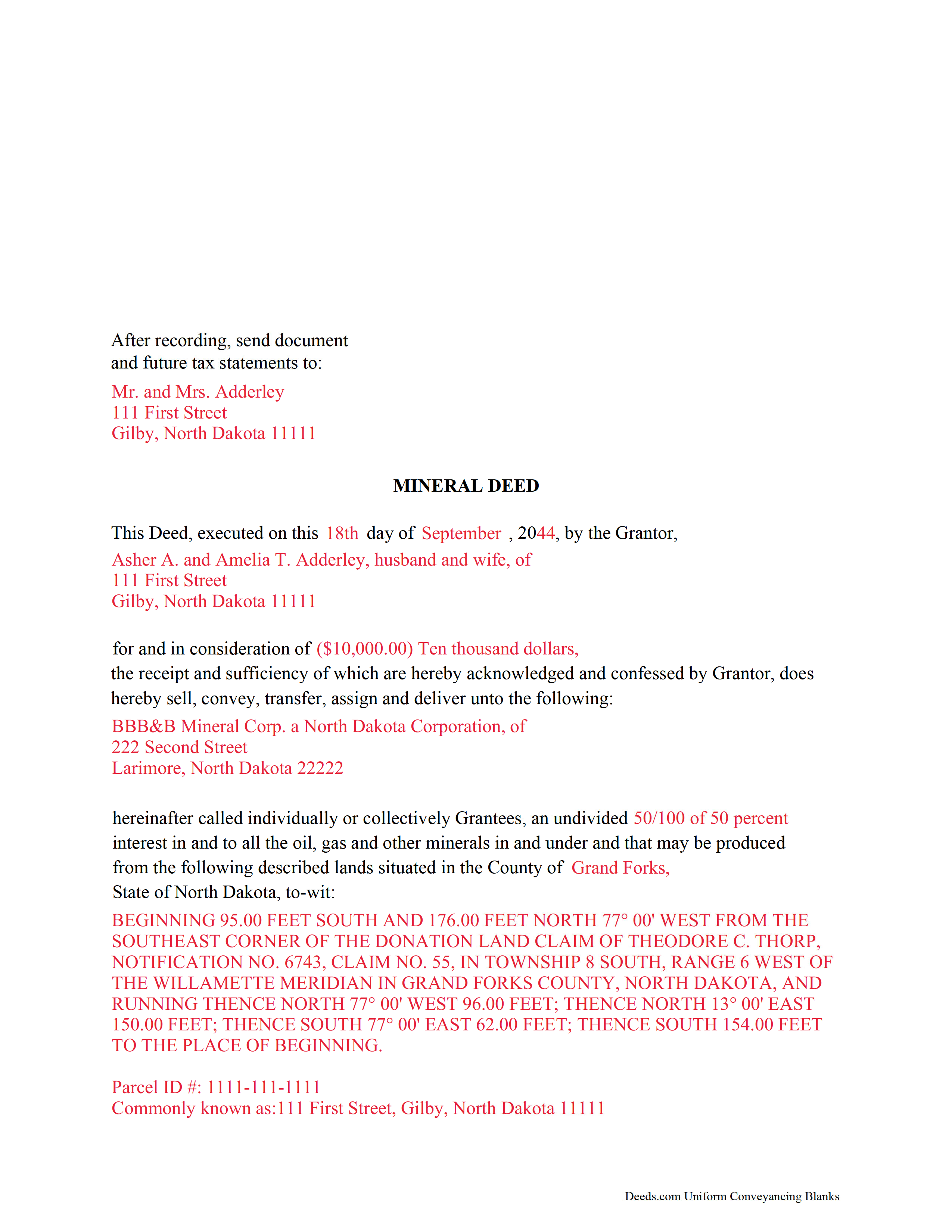

Mclean County Completed Example of a Mineral Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Mclean County documents included at no extra charge:

Where to Record Your Documents

McLean County Recorder

Washburn, North Dakota 58577

Hours: 8:00 to 12:00 & 12:30 to 4:30 Mon-Fri

Phone: (701) 462-8541

Recording Tips for Mclean County:

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Mclean County

Properties in any of these areas use Mclean County forms:

- Benedict

- Butte

- Coleharbor

- Garrison

- Max

- Mercer

- Riverdale

- Roseglen

- Ruso

- Turtle Lake

- Underwood

- Washburn

- Wilton

Hours, fees, requirements, and more for Mclean County

How do I get my forms?

Forms are available for immediate download after payment. The Mclean County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mclean County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mclean County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mclean County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mclean County?

Recording fees in Mclean County vary. Contact the recorder's office at (701) 462-8541 for current fees.

Questions answered? Let's get started!

The General Mineral Deed in North Dakota transfers oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. It also transfers any and all rights to receive royalties, overriding royalties, net profits interests or other payments out of or with respect to those oil, gas and other minerals. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive and is made subject to any rights existing under any valid and subsisting oil and gas lease or leases of record.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

In this document the Grantor Warrants and will defend said Title to Grantee. Use of this document has a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(North Dakota MD Package includes form, guidelines, and completed example)

Important: Your property must be located in Mclean County to use these forms. Documents should be recorded at the office below.

This Mineral Deed meets all recording requirements specific to Mclean County.

Our Promise

The documents you receive here will meet, or exceed, the Mclean County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mclean County Mineral Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William N.

July 16th, 2019

Every thing worked perfectly.

Thank you!

Charles R.

August 10th, 2021

Pleased with the forms and their ease of use. No complaints.

Thank you Charles, we appreciate you.

Jennifer D.

March 9th, 2022

I was skeptical; but, so thankful I went with them. They were beyond helpful through the entire process and very patient with me. I could not have done my quit deed form without them. Thank you for all of your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARC G.

June 26th, 2020

Very easy. Very helpful.

Thank you!

Michael H.

April 8th, 2022

another exact match with what i needed, thank you! the recorded of deeds accepted it with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy H.

October 20th, 2023

great response to my question.

We are delighted to have been of service. Thank you for the positive review!

Lara C.

September 14th, 2022

Love it! It was super easy. Will be back!

Thank you for your feedback. We really appreciate it. Have a great day!

henry p v.

March 18th, 2020

The deed easily downloaded. Form fill was smooth. I thought the service was a good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan G.

January 7th, 2023

I was pleased with the example of a completed beneficiary deed and instructions. It made filling out the deed very easy.

Thank you!

Jeff C.

May 28th, 2020

Had the paperwork that I needed. Was a quick and easy transaction.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia D.

May 22nd, 2021

It turned out I didn't need the information was taken care of by my husband. Thank you.

Thank you!

Cathern S.

January 23rd, 2020

Thanks much for your good help. Was a pleasure to use your help and was simple to use. Thanks much.

Thank you!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

Cheryl C.

February 23rd, 2023

my only problem is the cost of the form I downloaded. A bit cheaper would be nice

Thank you for your feedback. We really appreciate it. Have a great day!