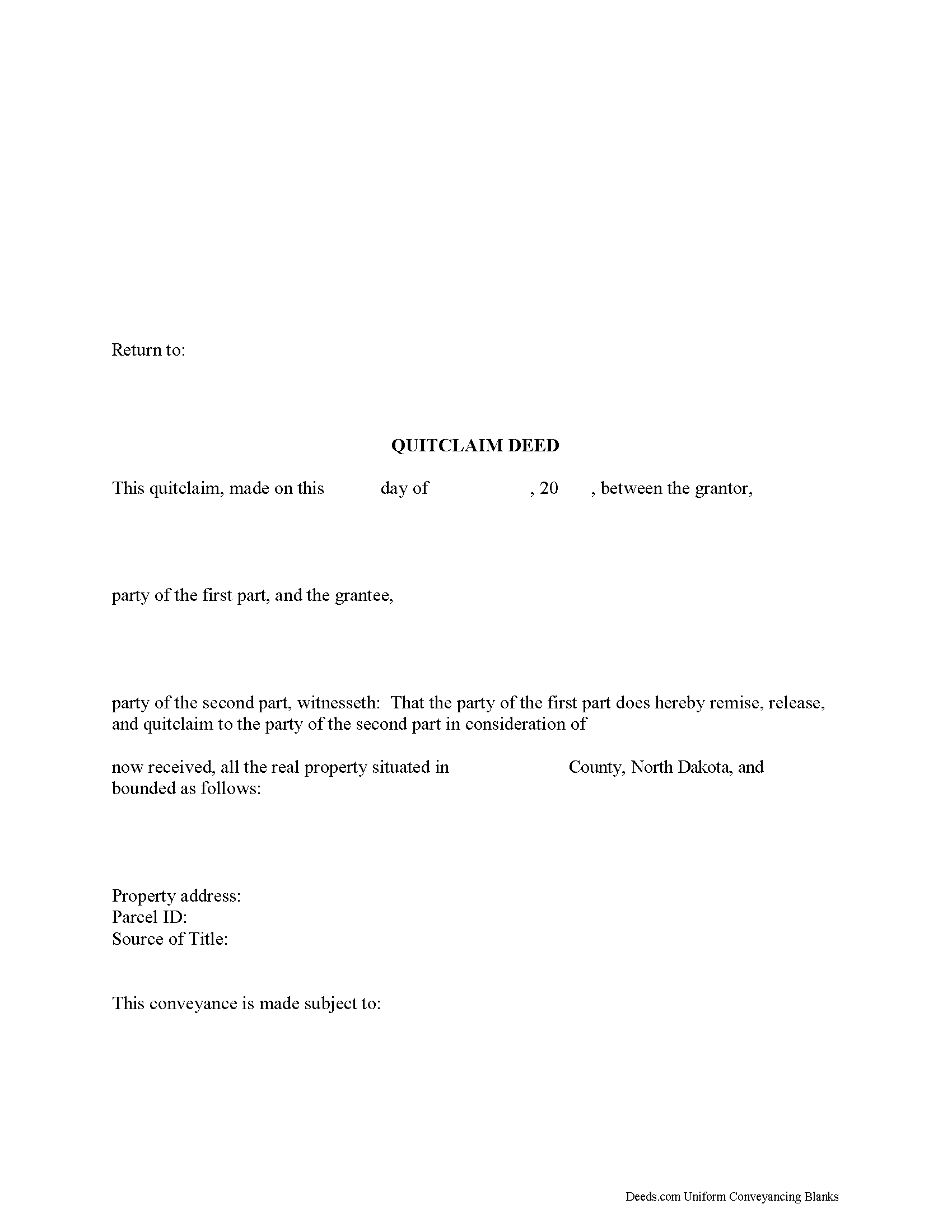

Mclean County Quitclaim Deed Form

Mclean County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all North Dakota recording and content requirements.

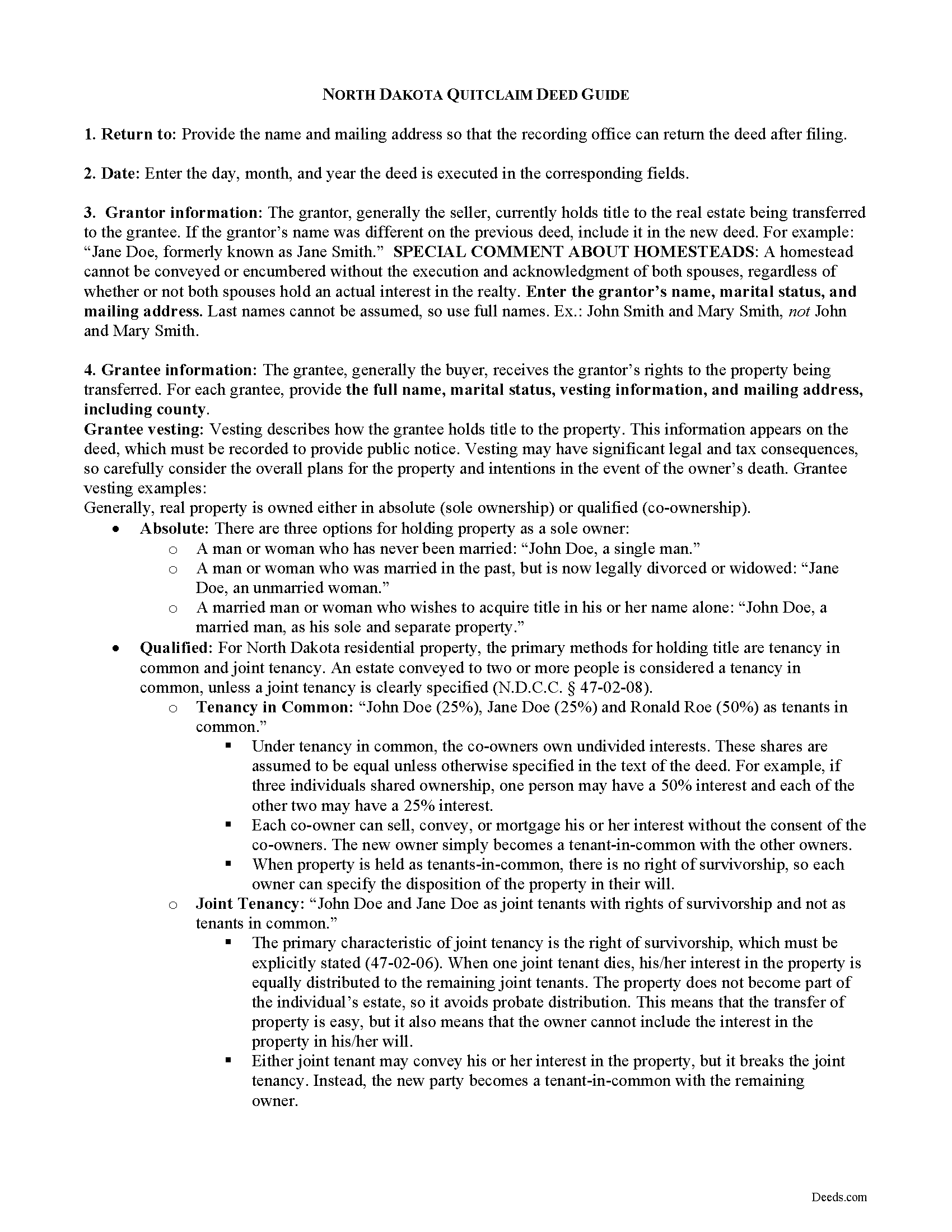

Mclean County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

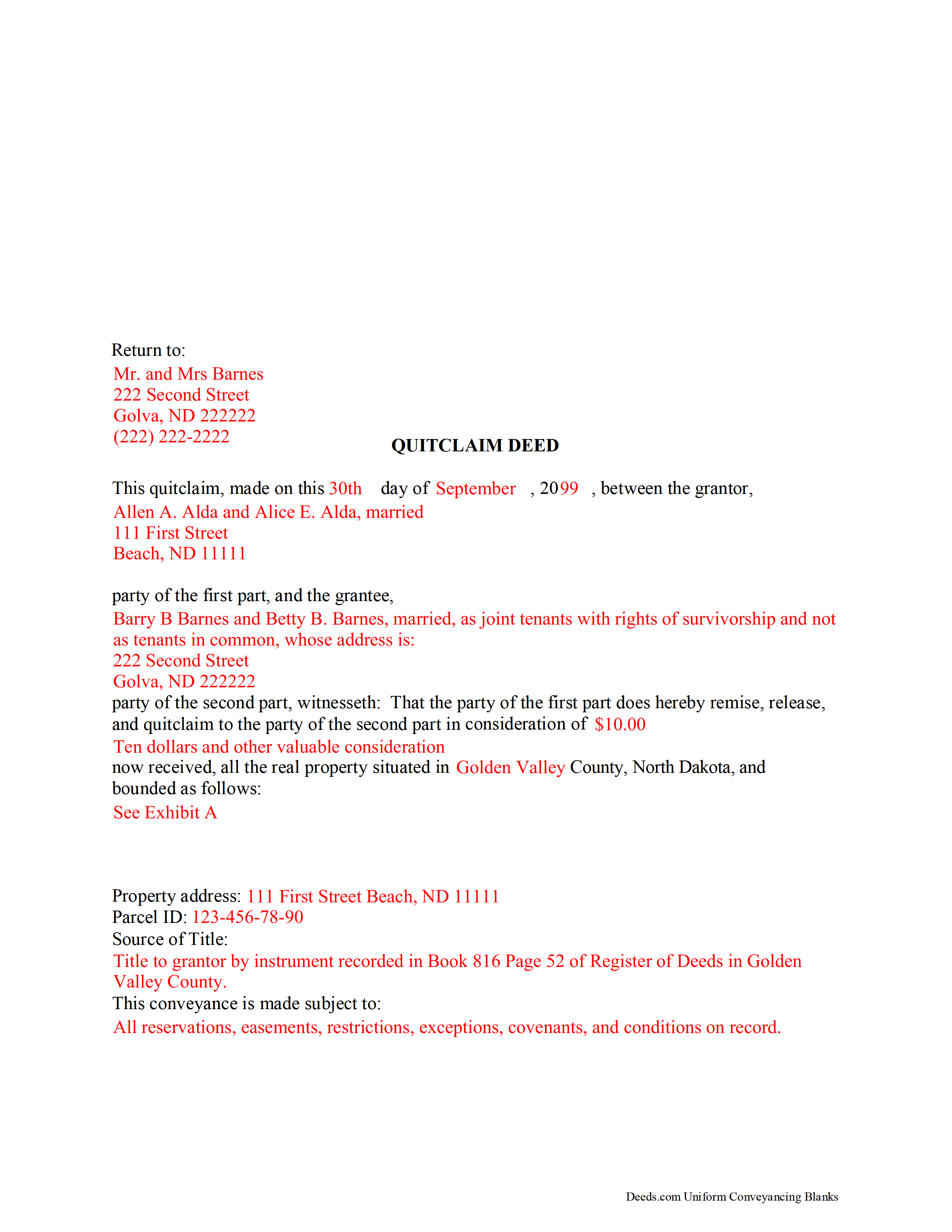

Mclean County Completed Example of the Quitclaim Deed Document

Example of a properly completed North Dakota Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Mclean County documents included at no extra charge:

Where to Record Your Documents

McLean County Recorder

Washburn, North Dakota 58577

Hours: 8:00 to 12:00 & 12:30 to 4:30 Mon-Fri

Phone: (701) 462-8541

Recording Tips for Mclean County:

- Bring your driver's license or state-issued photo ID

- Make copies of your documents before recording - keep originals safe

- Request a receipt showing your recording numbers

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Mclean County

Properties in any of these areas use Mclean County forms:

- Benedict

- Butte

- Coleharbor

- Garrison

- Max

- Mercer

- Riverdale

- Roseglen

- Ruso

- Turtle Lake

- Underwood

- Washburn

- Wilton

Hours, fees, requirements, and more for Mclean County

How do I get my forms?

Forms are available for immediate download after payment. The Mclean County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mclean County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mclean County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mclean County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mclean County?

Recording fees in Mclean County vary. Contact the recorder's office at (701) 462-8541 for current fees.

Questions answered? Let's get started!

A quitclaim deed in North Dakota will take effect and will vest the interest intended to be transferred by the grantor to the grantee upon its delivery (47-09-06). The post office address of the grantee is a prerequisite to recording (47-10-07). Additional requirements, such as a Certificate of Real Estate Value, signature of the grantor, and an acknowledgment, can be found in the North Dakota information section.

Every grant of an estate in real property in North Dakota is conclusive against the grantor and everyone subsequently claiming under the grantor, except a good faith purchaser or encumbrancer who acquires a title or lien for valuable consideration by an instrument that first is duly recorded (47-10-08). Recording a North Dakota quitclaim deed provides notice of the contents to all persons (47-19-19). If a quitclaim deed is not recorded, it is void as against a subsequent good faith purchaser who purchases the same real estate for valuable consideration (or portion of it) whose conveyance, whether it is entitled to be recorded or not, is first duly recorded in the proper county in North Dakota. If a quitclaim deed is recorded first, this does not affect the question of the good faith of the subsequent purchaser (47-19-41). An unrecorded quitclaim deed is valid between the parties to it and those who have notice of it (47-19-46). However, having knowledge of a quitclaim deed that is outside the chain of title does not constitute notice (47-19-41).

(North Dakota QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Mclean County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Mclean County.

Our Promise

The documents you receive here will meet, or exceed, the Mclean County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mclean County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

diana c.

February 24th, 2022

quick and easy, thankyou

Thank you!

Kerianne B.

June 25th, 2021

I would definitely recommend Deeds.com. It was so easy! I wish we knew about them a long time ago.

Thank you for your feedback. We really appreciate it. Have a great day!

Ann C.

October 18th, 2023

Very responsive and helpful. Made a big task quite easy and effecient. I would highly recommend. Reasonable fees as well

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Robert R.

September 1st, 2019

Just joined. Recommended by a strong source. Looking forward to doing business.

Thank you!

Jacqueline C.

August 15th, 2019

Was relieved to see your site actually delivered what I paid for.

Thank you!

chris m.

March 10th, 2022

Was warned by attorney that forms from internet have lots of mistakes. But after looking all over, took a chance on here. So far, I am satisfied, and actually happy that I got something that (I believe) meets my state and local requirements. Haven't filed the deed yet, or had to put it into effect, but being able to pick the local area, and have the relevant state law listed on the deed, gives me confidence. Also, got the whole package of possibly relevant forms, and a very good guide how to prep the deed with a sample completed deed - greatly appreciated!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jing H.

March 8th, 2019

Excellent work. I have recommended some friends to your website and will continue. Thanks.

Thank you Jing. Have a fantastic day!

Saul N.

June 13th, 2023

Great and fast service. Would have been grate to have seen a little more detail or a pre-filled sample in the fields. Had a little confussion in some of the lines to fill out since the guide only explains a few of the lines not all of them. Otherwise, is really great to have this service with low cost. Thank you.

Thank you for taking the time to provide us with your feedback Saul, we appreciate you.

Michael M.

July 30th, 2019

Received the documents as ordered in a timely fashion. Can't ask for much better than that!

Thank you!

Lillian B.

October 27th, 2022

Easy peasy

Thank you!

Brian T.

June 16th, 2022

Great to find this makes for easy work when you need to secure your ownership of a property!!Thanks guys Brian the Mann

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen N.

February 11th, 2021

Excellent service.

Thank you!

Elango R.

November 9th, 2020

It was so easy to use the site and got recording done in a day. Very happy with experience.

Thank you!

tao a.

June 23rd, 2021

excellent. I will this service again.

Thank you!

Sharon C.

October 29th, 2022

Easy process considering not too technical savvy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!