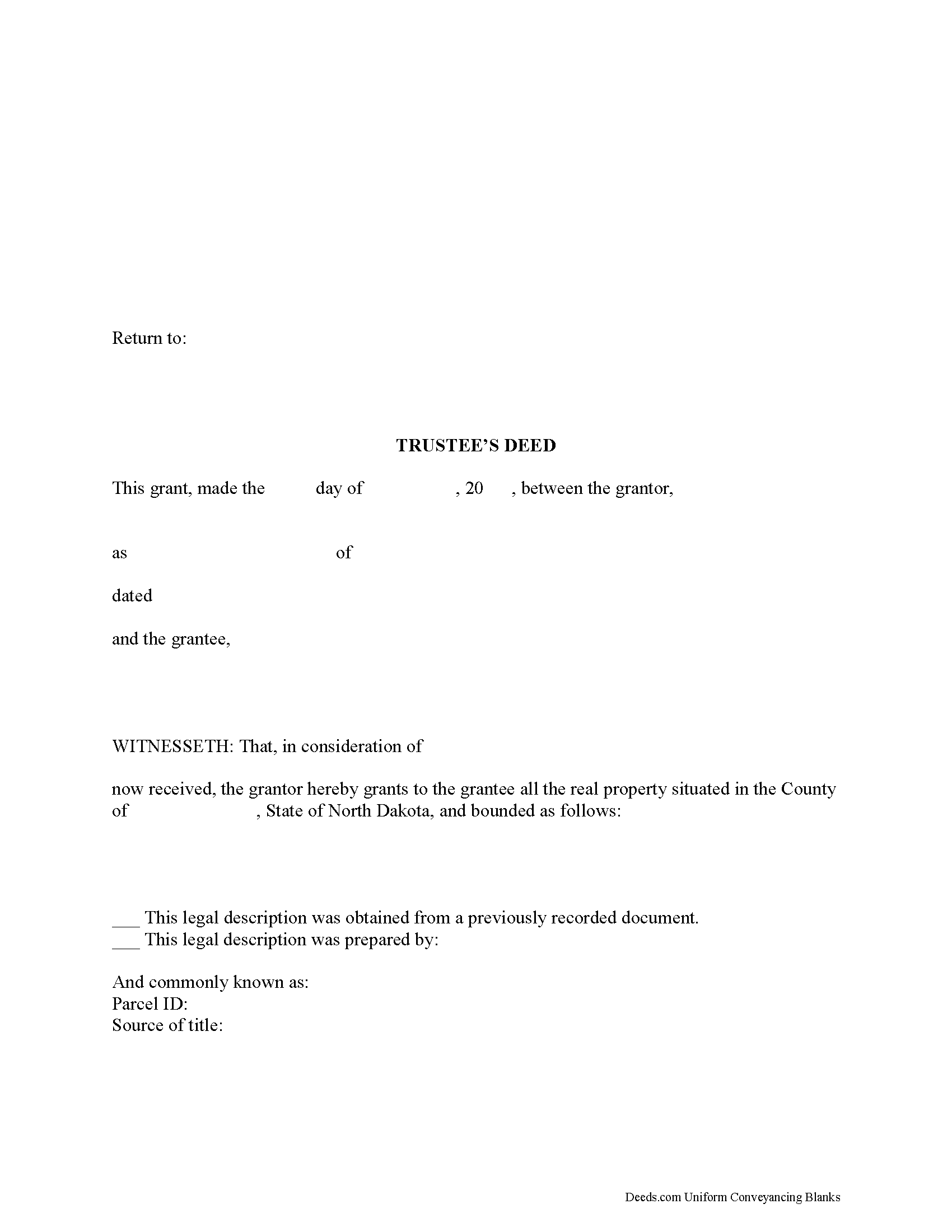

Mercer County Trustee Deed Form

Mercer County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

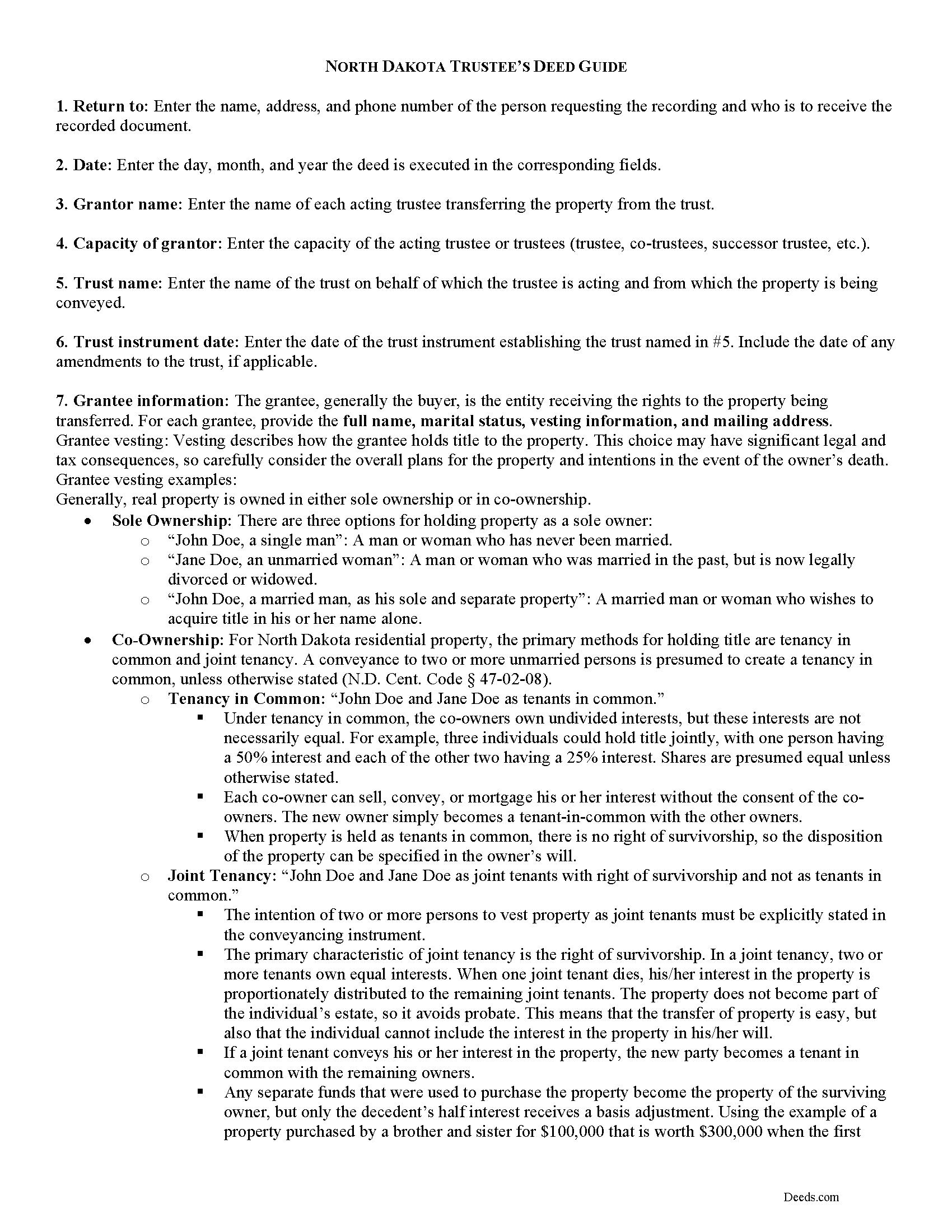

Mercer County Trustee Deed Guide

Line by line guide explaining every blank on the form.

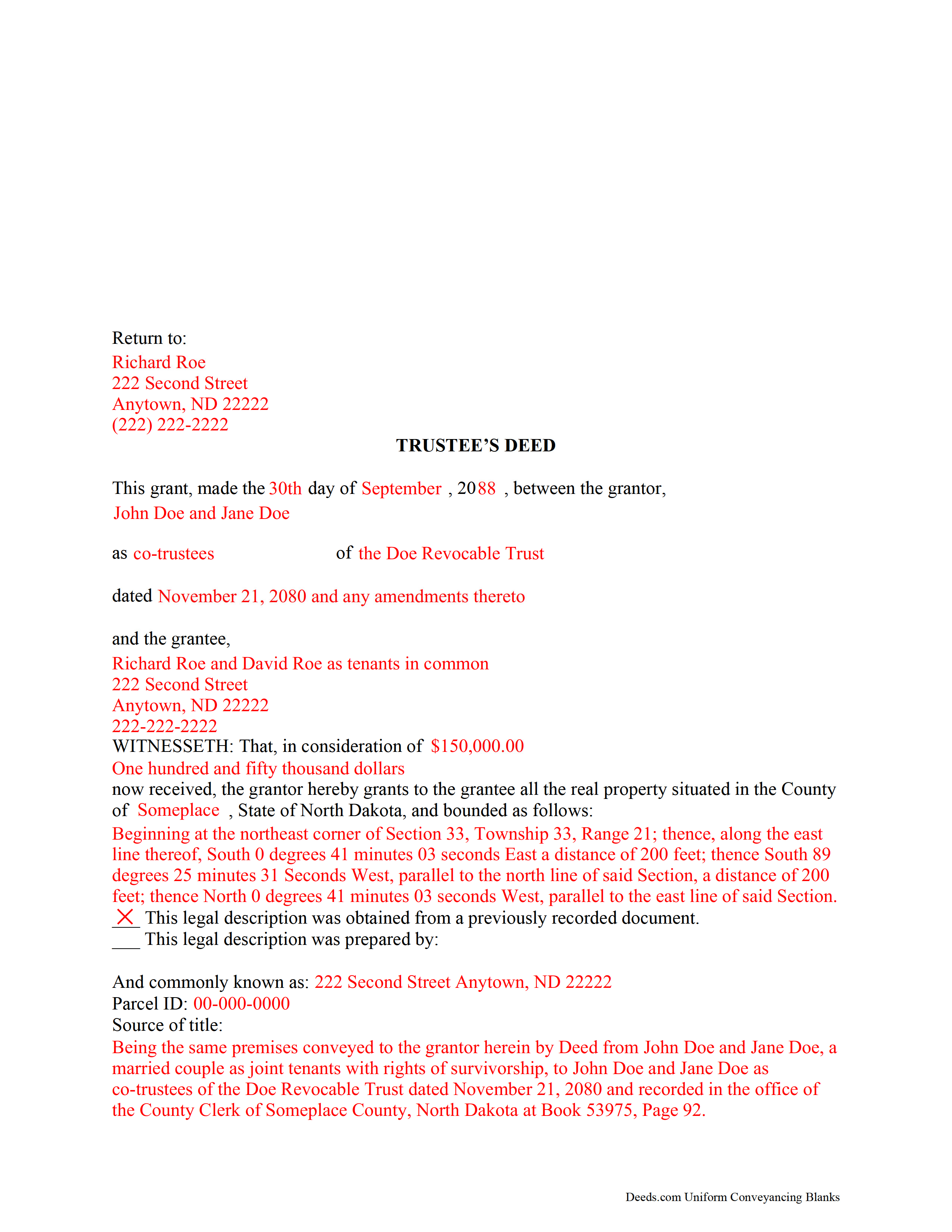

Mercer County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Mercer County documents included at no extra charge:

Where to Record Your Documents

Mercer County Recorder

Stanton, North Dakota 58571-0039

Hours: 8:00 a.m. to 4:00 p.m. MT

Phone: (701) 745-3272

Recording Tips for Mercer County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Mercer County

Properties in any of these areas use Mercer County forms:

- Beulah

- Golden Valley

- Hazen

- Stanton

- Zap

Hours, fees, requirements, and more for Mercer County

How do I get my forms?

Forms are available for immediate download after payment. The Mercer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mercer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mercer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mercer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mercer County?

Recording fees in Mercer County vary. Contact the recorder's office at (701) 745-3272 for current fees.

Questions answered? Let's get started!

Transferring Real Property from a Trust in North Dakota

A trust is an arrangement whereby a person (the grantor or settlor) transfers property to another (the trustee) for the benefit of a third (the beneficiary). In general, trusts in North Dakota are governed by Chapters 59-09 through 59-19 of the North Dakota Century Code as the North Dakota Uniform Trust Code.

To create a trust, the settlor transfers property to a trustee either during his lifetime (an inter vivos trust) or by will upon his death (a testamentary trust) (N. D. Cent. Code 59-12-01). It must be created for lawful purposes and have a definite beneficiary, or a person with "a present or future beneficial interest in a trust, vested or contingent, including the owner of an interest by assignment or transfer" ( 59-09-05, 59-12-04; 59-09-03(3)(a)).

In North Dakota, trusts relating to real property are invalid without a written instrument signed by the trustee ( 59-12-18). The trust instrument is an unrecorded document executed by the settlor that "contains [the] terms of the trust, including any amendments to the record" ( 59-09-03(25)). In addition to designating the trustee (and successor, if the settlor also serves as the original trustee) and conferring specific powers upon the trustee, the trust instrument establishes the scope of trust's assets and identifies trust beneficiaries.

An inter vivos (living) trust is an alternate method of holding title to real property for estate planning purposes. The settlor transfers real property into the trust by executing a deed titling the property in the name of the trustee as representative of the trust. The trustee administers the trust according to the terms set forth in the trust instrument.

The trustee "is presumed to have the power to sell, convey, and encumber the real property unless restrictions on that power appear in the records of the county recorder" ( 47-140-26). The trustee's authority to convey property is further established by the statutory general power of trustees to exercise "all powers over the trust property which an unmarried owner, who is not an incapacitated person, has over individually owned property of the trustee" and the specific power to sell property, as established by the North Dakota Uniform Trust Code ( 59-16-15, 59-16-16(2)).

In order to convey real property out of the trust, the trustee executes a trustee's deed. The form of conveyance takes its name from the granting party rather than from the type of warranty of title given, as with a warranty deed or special warranty deed, for example.

In North Dakota, the trustee's deed is typically a special warranty deed passing fee simple title, containing the covenants that the grantor has not previously conveyed right, title, or interest to another person and that the property is free from encumbrances made by the grantor or persons claiming under the grantor. These covenants are implied unless explicitly stated otherwise in the form of the conveyance ( 47-10-19).

Because real property held in trust is titled in the name of the trustee on behalf of the trust, in addition to naming each acting trustee, the trustee's deed should reference the trust and date of execution of the instrument establishing the trust. A certificate of trust under 59-18-13 or trustee's affidavit is typically unnecessary, though in some cases is advisable. Consult a lawyer with questions.

Deeds executed by trustees must meet all the same requirements for form and content for documents affecting interests in real property, including a statement of full consideration and legal description of the property being conveyed. All acting trustee signatures, made before a notary public, should be present before the deed is recorded in the office of the recorder of the county in which the subject property is located.

(North Dakota TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Mercer County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Mercer County.

Our Promise

The documents you receive here will meet, or exceed, the Mercer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mercer County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Susan K.

July 13th, 2021

They were unable to complete the task and my money was immediately refunded.

Thank you for your feedback Susan, sorry we were unable to assist.

David C.

October 10th, 2022

I got what I expected. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

L B W.

January 22nd, 2021

Bottom line - it was certainly worth the $21 (+-?) I paid for the form and instructions, etc. Admittedly the form is a little inflexible in terms of editing for readability but I understand that offering greater flexibility would likely make theft more likely. So I'm happy with what I got. One suggestion - add more info about what's required in the "Source of Title" section.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa D.

December 7th, 2022

Had the correct forms I needed with guides and examples to follow on filling them out. Very easy to use. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine A.

December 28th, 2018

So far do good. Don't understand the billing procedure yet and have just sent a request for information. Awaiting reply. Thank you, Christine Alvarez

Thanks for the feedback. Looks like your E-recording invoice is available. It takes a few minutes for our staff to prepare documents for recording and generate the invoice.

Claudia H.

May 21st, 2022

***** Have not used this option before. Found it easy to use and understand. Cost was reasonable and options on recording helpful. Would use again in a heartbeat.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl W.

August 10th, 2019

Have yet to use. Appears over whelming, we will see.

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Ann M.

August 18th, 2022

Easy from the download to just fill out and print. Good instructions to follow. A cover letter form would be a extra plus

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ANA I p.

December 14th, 2020

Wow this was nice that I could used the service . Love it

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl S.

April 30th, 2021

quick response

Thank you!

Mark G.

May 22nd, 2019

I would recommend this product for little effort needed to complete any action you might require.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janette K.

May 17th, 2019

I ordered a Transfer of Deed on Death document. It was easy to fill in, came with a useful guide and was customized to my county/state. It got the job done and was well worth the money!

Thank you for your feedback. We really appreciate it. Have a great day!

Angela S.

April 29th, 2021

Very easy process and efficient. Made my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia N.

February 25th, 2021

great service, quick and easy!

Thank you!

Judith S.

February 15th, 2022

Nice and Easy: two of my favorite things.

Thank you!