Carroll County Fiduciary Deed Form

Carroll County Fiduciary Deed Form

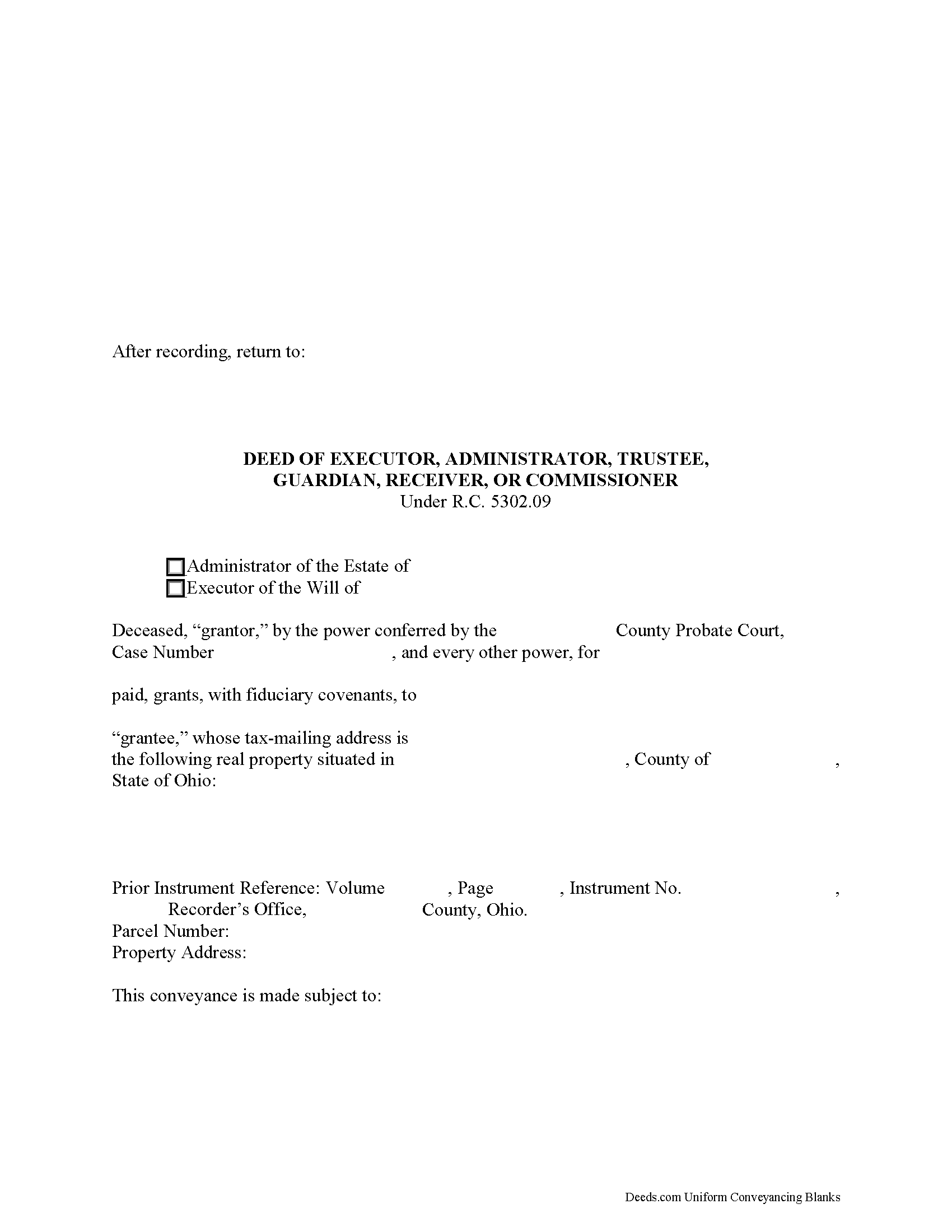

Fill in the blank form formatted to comply with all recording and content requirements.

Carroll County Fiduciary Deed Guide

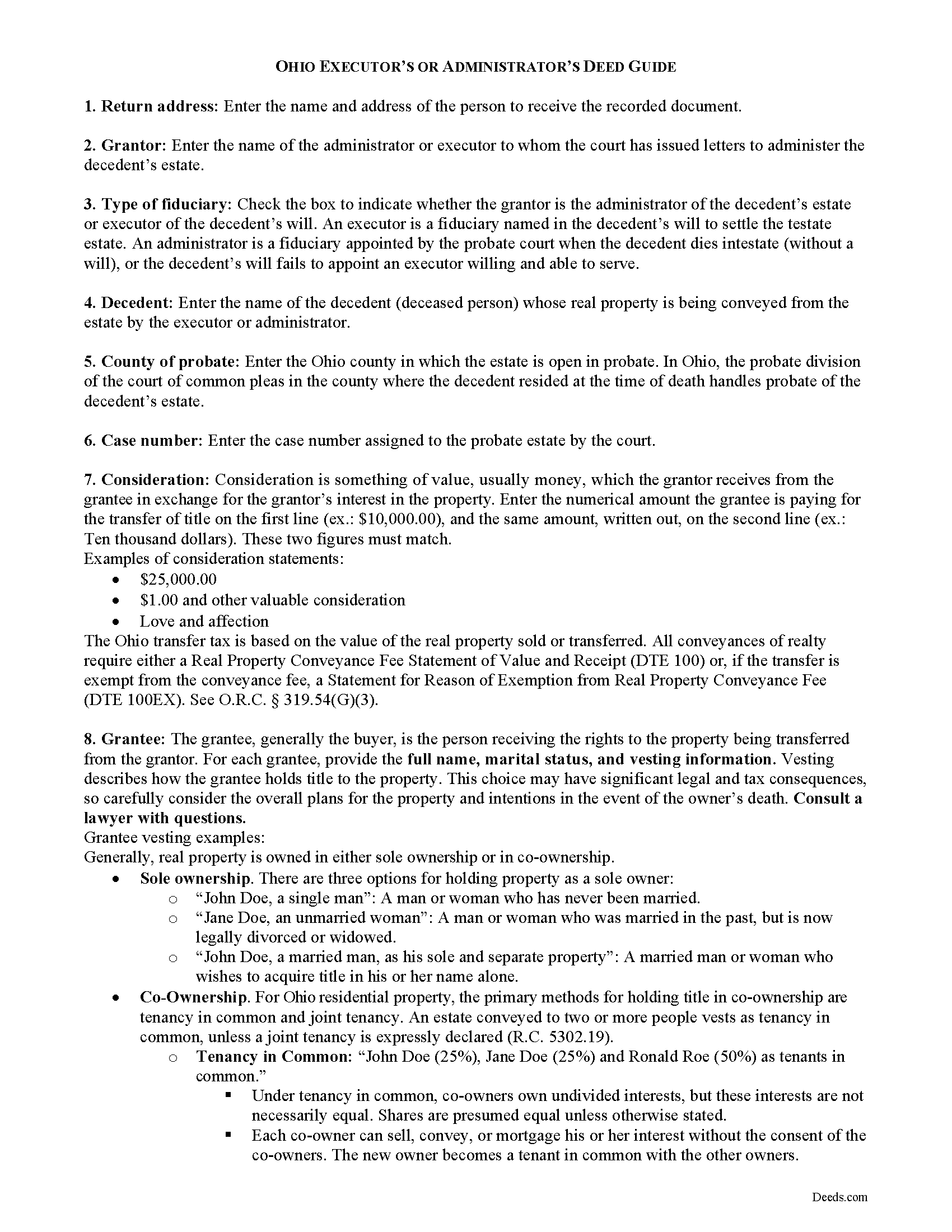

Line by line guide explaining every blank on the form.

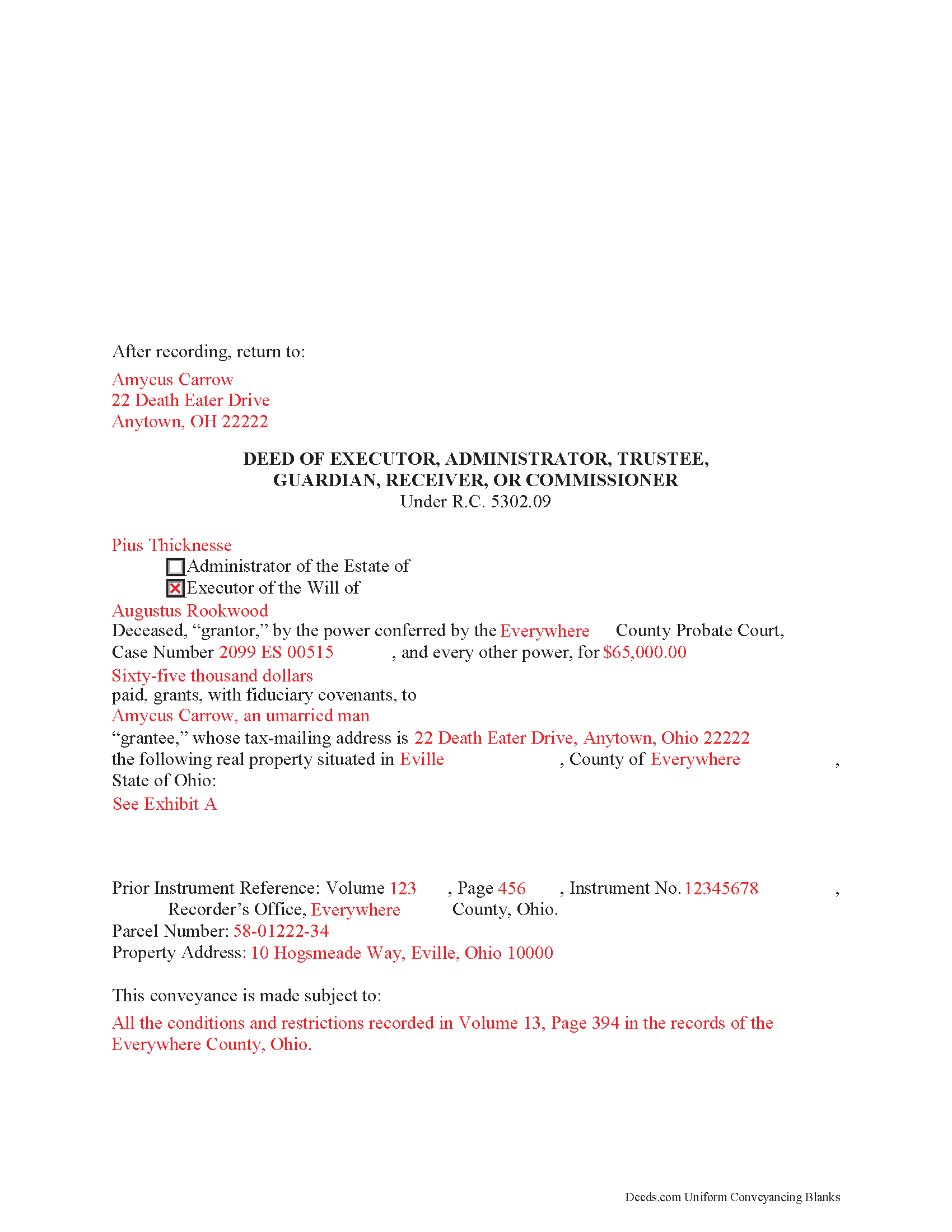

Carroll County Completed Example of the Fiduciary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Carroll County documents included at no extra charge:

Where to Record Your Documents

Carroll County Recorder

Carrollton, Ohio 44615-0550

Hours: Mon–Fri 8:00 to 4:00 / Same-day recording until 3:30

Phone: (330) 627-4545

Recording Tips for Carroll County:

- Bring your driver's license or state-issued photo ID

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Carroll County

Properties in any of these areas use Carroll County forms:

- Augusta

- Carrollton

- Dellroy

- Harlem Springs

- Leesville

- Malvern

- Mechanicstown

- Sherrodsville

Hours, fees, requirements, and more for Carroll County

How do I get my forms?

Forms are available for immediate download after payment. The Carroll County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Carroll County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carroll County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Carroll County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Carroll County?

Recording fees in Carroll County vary. Contact the recorder's office at (330) 627-4545 for current fees.

Questions answered? Let's get started!

Ohio Fiduciary Deed for Executors and Administrators

Probate is the legal process of settling and distributing a decedent's estate according to the terms of a probated will or laws of intestate succession. In the context of estate administration, a fiduciary is either an executor (when named in a will) or an administrator (when the decedent dies without a will or does not name an executor) assigned by the court of common pleas to administer the decedent's estate.

If the estate's assets are insufficient to pay debts, the fiduciary may need to sell the decedent's property. Fiduciaries must obtain the court's permission to sell assets from the estate, unless authorized or directed by the decedent's will.

In Ohio, executors and administrators use fiduciary deeds to convey real property from an estate to a purchaser pursuant to a court order. A fiduciary deed is a statutory form (R.C. 5302.09) containing fiduciary covenants that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property. Additionally, the grantor covenants with the grantee that in the proceedings of the sale, he or she has complied with statutory requirements (5302.10).

A fiduciary deed names the executing fiduciary's as grantor, and identifies the county and case number in which the decedent's estate is opened in probate. The deed states the amount of consideration the grantee is paying for the transfer of title, and titles the property in the name and manner of vesting of the grantee.

Deeds in Ohio require a recital of the grantor's source of title, including the prior instrument volume and page numbers. A full legal description of the subject parcel is required. Any restrictions on the property should also be noted. The executing fiduciary must sign the deed in the presence of a notary public before recording in the county where the subject property is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Ohio with questions regarding fiduciary deeds, as each situation is unique.

(Ohio Fiduciary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Carroll County to use these forms. Documents should be recorded at the office below.

This Fiduciary Deed meets all recording requirements specific to Carroll County.

Our Promise

The documents you receive here will meet, or exceed, the Carroll County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carroll County Fiduciary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Edward S.

November 9th, 2021

Easy to use and comprehensive in content. Would recommend to anyone that is looking for a cheaper alternative to a lawyer. (They hate services that cut into their business)

Thank you!

Ralph E.

March 24th, 2019

I wish I had found this site earlier!!! Not only was it helpful and just what I needed but I got my information so fast AND on the weekend. I would recommend this site to everyone. I plan on using it more. Its cheap and I can get my information while sitting at home. Very impressed!

Thank you for the kinds words Ralph. Have a great day!

Pegi B.

January 24th, 2022

This service is fast and easy to use. We will definitely use this service again. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark S.

September 22nd, 2019

No Brainer. Easy to use. Good service. I recommend this.

Thank you for your feedback. We really appreciate it. Have a great day!

Diane G.

August 5th, 2022

easy to use

Thank you!

Leonard H.

November 21st, 2019

Just perfect for what I needed. Made the property transfer very easy.

Thank you!

James M.

August 30th, 2022

Just what I needed to help clear ownership of what has been deeded to be by inheritance

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia D.

January 5th, 2019

I looked around for forms and came to this site. I had to do 15 deeds and this form was very useful to completing that. Very impressed. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Michael R.

August 25th, 2025

A suggestion: Include instructions on how to add your spouse to the deed, rather than transferring completely to a third party

Thank you for your thoughtful feedback. Adding a spouse to a deed is a common need, and suggestions like yours help us identify where additional guidance would be useful. We’ll take this into consideration as we continue improving our resources.

Albo A.

September 25th, 2020

Deeds.com was fast and easy to file documents

Thank you!

Cherif T.

June 17th, 2019

I wish every state offered such an easy and economical download of these forms. You were reasonable in price, I received one of every form you offered along with instructions, and it made my day so easy. Why pay a lawyer a fortune for these simple (almost) everyday forms when you can do it all for less than $20. Thank you for being reasonable, well organized, and available for common use! Cherif T.

Thank you!

richard s.

March 26th, 2020

had exactly what i needed and good price

Thank you Richard! Have an amazing day.

nannette b.

October 27th, 2019

got what I needed quick and easy thank you!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Bryan C.

August 2nd, 2019

Fast and just as promised

Thank you for your feedback. We really appreciate it. Have a great day!

Janice S.

February 28th, 2019

Really easy downloading the forms the directions everything was really easy thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!