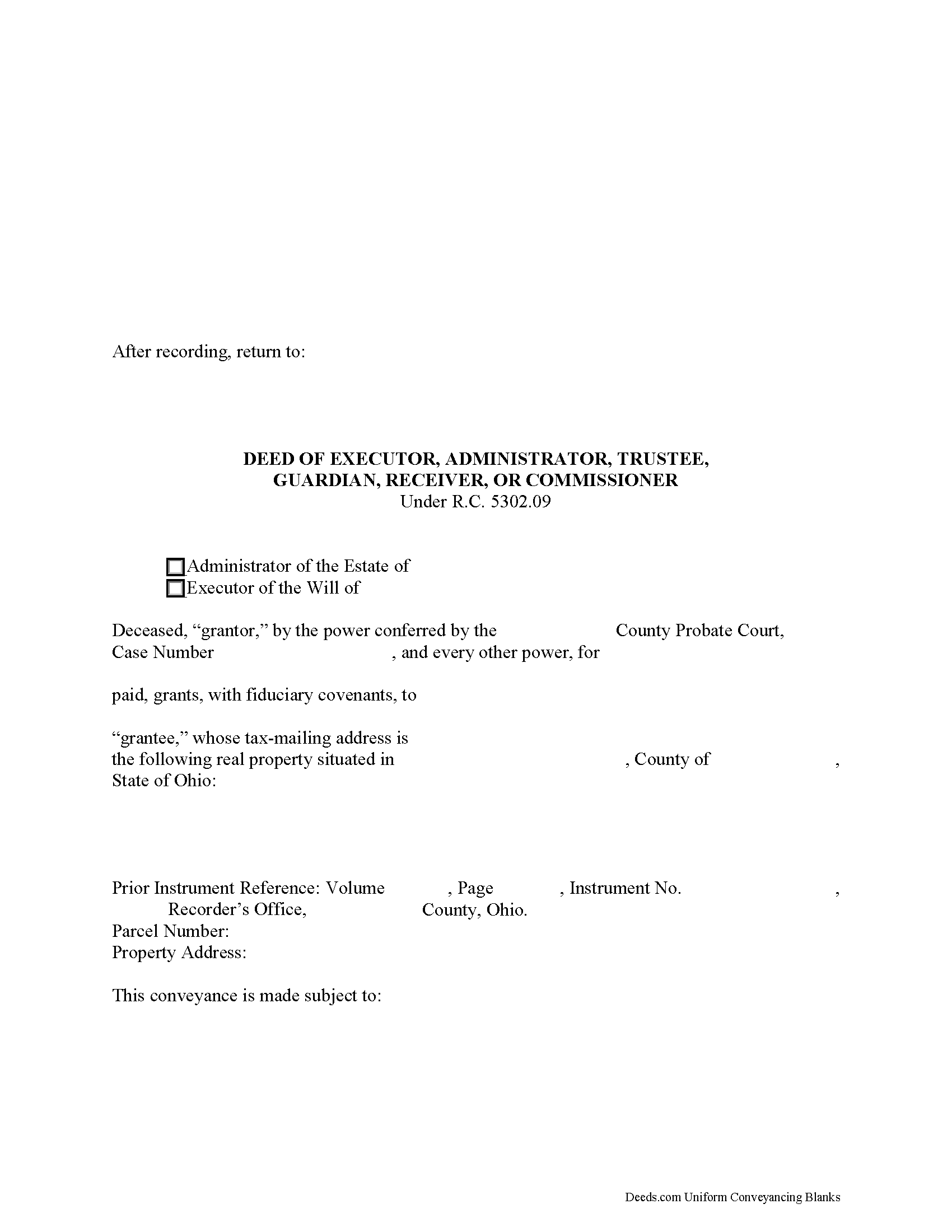

Morrow County Fiduciary Deed Form

Morrow County Fiduciary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

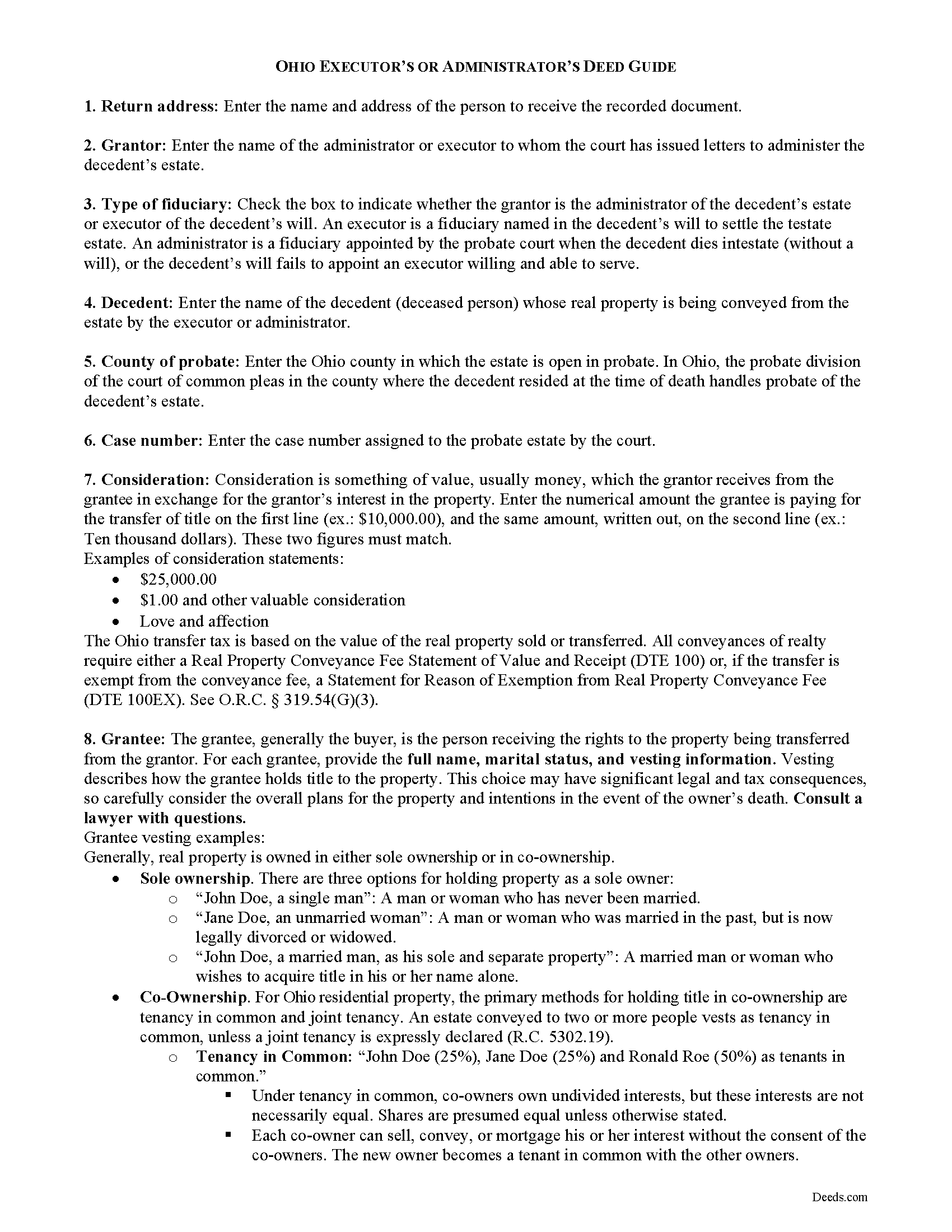

Morrow County Fiduciary Deed Guide

Line by line guide explaining every blank on the form.

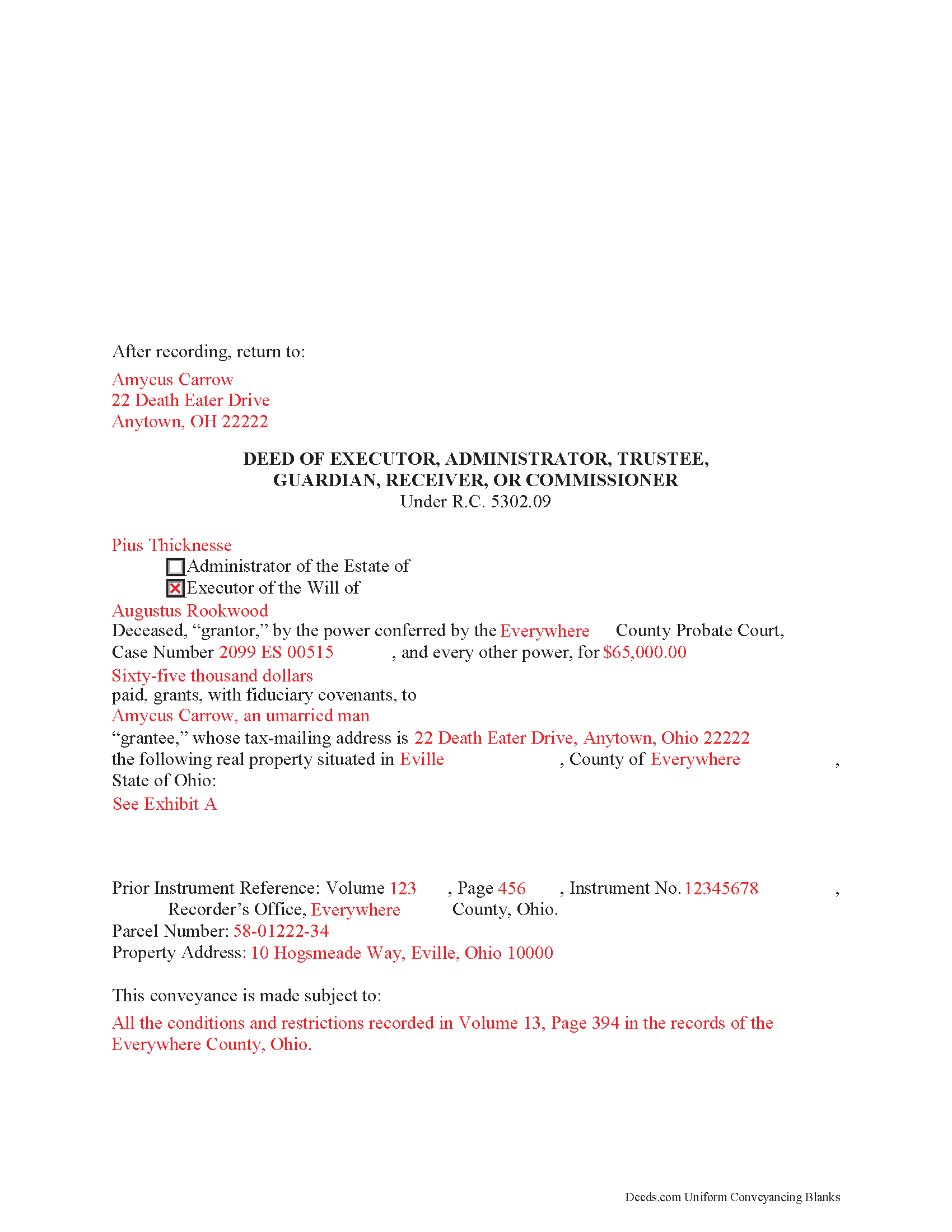

Morrow County Completed Example of the Fiduciary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Morrow County documents included at no extra charge:

Where to Record Your Documents

Morrow County Recorder

Mt. Gilead, Ohio 43338

Hours: 8:00 to 4:00 Monday thru Friday

Phone: 419-947-3060

Recording Tips for Morrow County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Morrow County

Properties in any of these areas use Morrow County forms:

- Cardington

- Chesterville

- Edison

- Fulton

- Iberia

- Marengo

- Mount Gilead

- Shauck

- Sparta

Hours, fees, requirements, and more for Morrow County

How do I get my forms?

Forms are available for immediate download after payment. The Morrow County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morrow County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morrow County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morrow County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morrow County?

Recording fees in Morrow County vary. Contact the recorder's office at 419-947-3060 for current fees.

Questions answered? Let's get started!

Ohio Fiduciary Deed for Executors and Administrators

Probate is the legal process of settling and distributing a decedent's estate according to the terms of a probated will or laws of intestate succession. In the context of estate administration, a fiduciary is either an executor (when named in a will) or an administrator (when the decedent dies without a will or does not name an executor) assigned by the court of common pleas to administer the decedent's estate.

If the estate's assets are insufficient to pay debts, the fiduciary may need to sell the decedent's property. Fiduciaries must obtain the court's permission to sell assets from the estate, unless authorized or directed by the decedent's will.

In Ohio, executors and administrators use fiduciary deeds to convey real property from an estate to a purchaser pursuant to a court order. A fiduciary deed is a statutory form (R.C. 5302.09) containing fiduciary covenants that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property. Additionally, the grantor covenants with the grantee that in the proceedings of the sale, he or she has complied with statutory requirements (5302.10).

A fiduciary deed names the executing fiduciary's as grantor, and identifies the county and case number in which the decedent's estate is opened in probate. The deed states the amount of consideration the grantee is paying for the transfer of title, and titles the property in the name and manner of vesting of the grantee.

Deeds in Ohio require a recital of the grantor's source of title, including the prior instrument volume and page numbers. A full legal description of the subject parcel is required. Any restrictions on the property should also be noted. The executing fiduciary must sign the deed in the presence of a notary public before recording in the county where the subject property is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Ohio with questions regarding fiduciary deeds, as each situation is unique.

(Ohio Fiduciary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Morrow County to use these forms. Documents should be recorded at the office below.

This Fiduciary Deed meets all recording requirements specific to Morrow County.

Our Promise

The documents you receive here will meet, or exceed, the Morrow County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morrow County Fiduciary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Robert L.

May 10th, 2022

I did not use your service. $19 to upload a document to our local tax accessor office is a bit high. I drove the document to the office myself.

Thank you for your feedback Robert. Glad to hear that you got your document recorded. Sorry to hear that your time, fuel, and wear on your vehicle are valued at less than $19. Have a wonderful day.

Michael F.

March 12th, 2020

Very useful and right at your fingers when you need a form. Recommend these forms highly. Thank you!!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leslie Y.

December 10th, 2019

I had my doubts going in but was pleasantly surprised at the thoroughness of the documents and information provided. Will use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bob B.

September 14th, 2021

Good so far. Will be great if you get the deed recorded.

Thank you!

ronnie y.

May 22nd, 2019

well worth the money thank you

Thank you!

Scott D.

March 31st, 2025

I am very satisfied with the quality of the product I ordered. I have done similar property transfers/recording in the past on my own but paying for the forms and guidance is well worth it. The AI question area is extremely helpful. The example for the forms is perfect (as it has to be). I will absolutely use Deeds.com in the future for any related property needs. A+

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie P.

December 9th, 2020

So far Deeds.com has done everything they say they'll do and very promptly.

Thank you for your feedback. We really appreciate it. Have a great day!

Esther R.

February 25th, 2019

Very easy to follow and complete.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronney O.

December 16th, 2021

Great Experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott O.

April 3rd, 2022

Very efficient and surprisingly quick.

Thank you for your feedback. We really appreciate it. Have a great day!

diana c.

February 24th, 2022

quick and easy, thankyou

Thank you!

LeRoy E.

June 20th, 2022

So thankful I found this. I was feeling stressed out and reluctant about doing this on my own.

Thank you!

Tracey T.

July 19th, 2019

Lots of great information. Might need to view it again but found it very helpful!

Thank you!

Donna B.

January 10th, 2019

Really liked the quick access to documents. Great service, thanks.

Thank you Donna, we appreciate you taken the time to leave your feedback. Have a great day!

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!