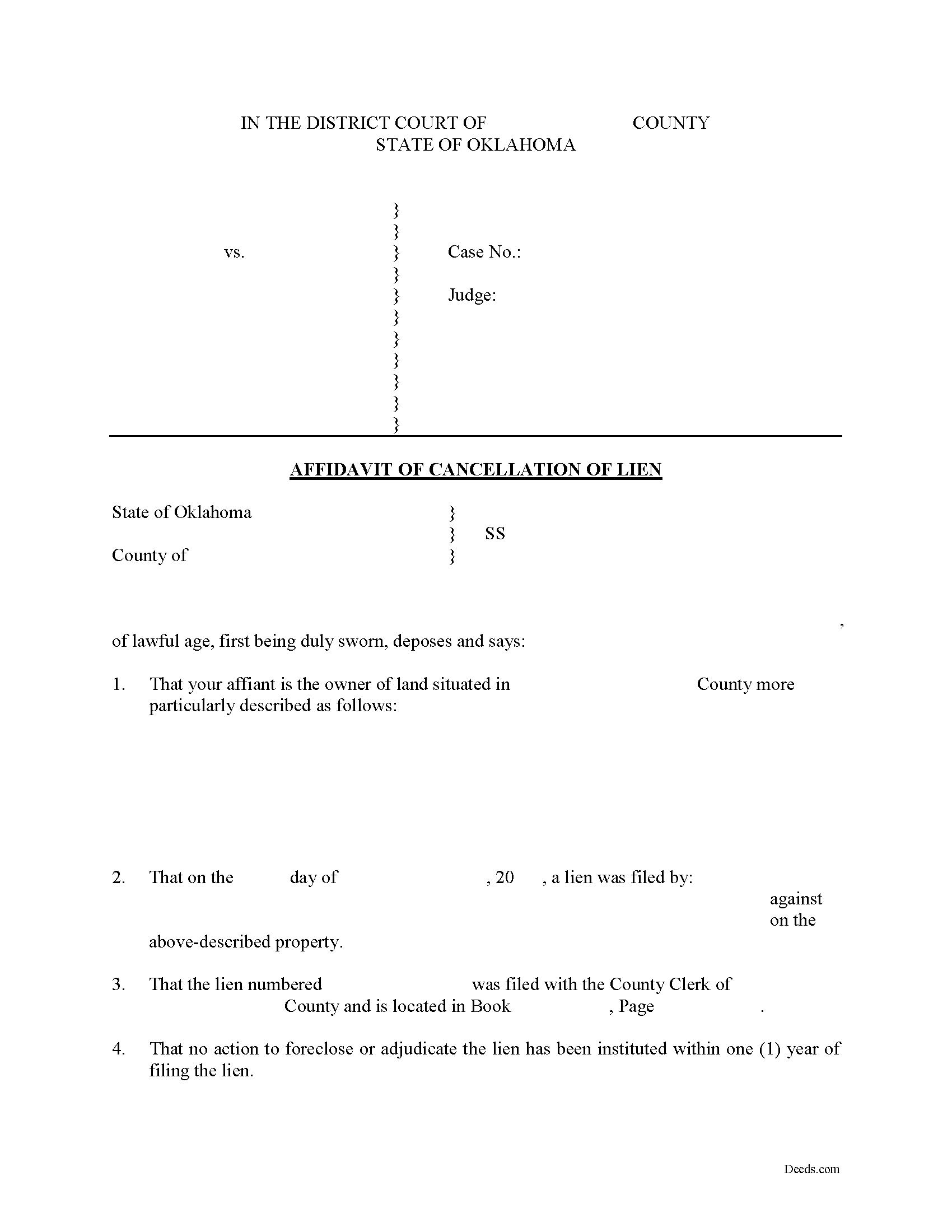

Carter County Affidavit of Cancellation of Lien Form

Carter County Affidavit of Cancellation of Lien Form

Fill in the blank Affidavit of Cancellation of Lien form formatted to comply with all Oklahoma recording and content requirements.

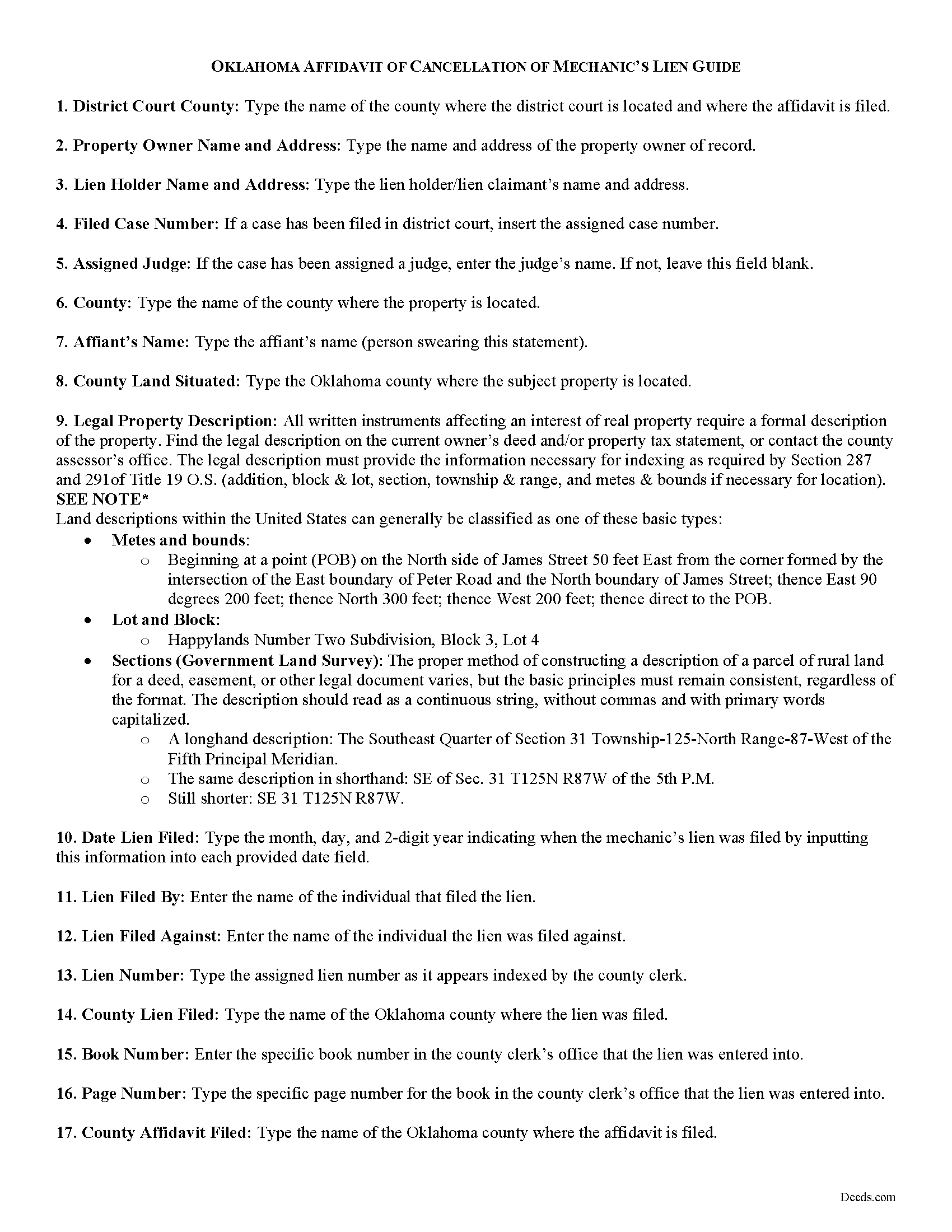

Carter County Affidavit of Cancellation of Lien Guide

Line by line guide explaining every blank on the form.

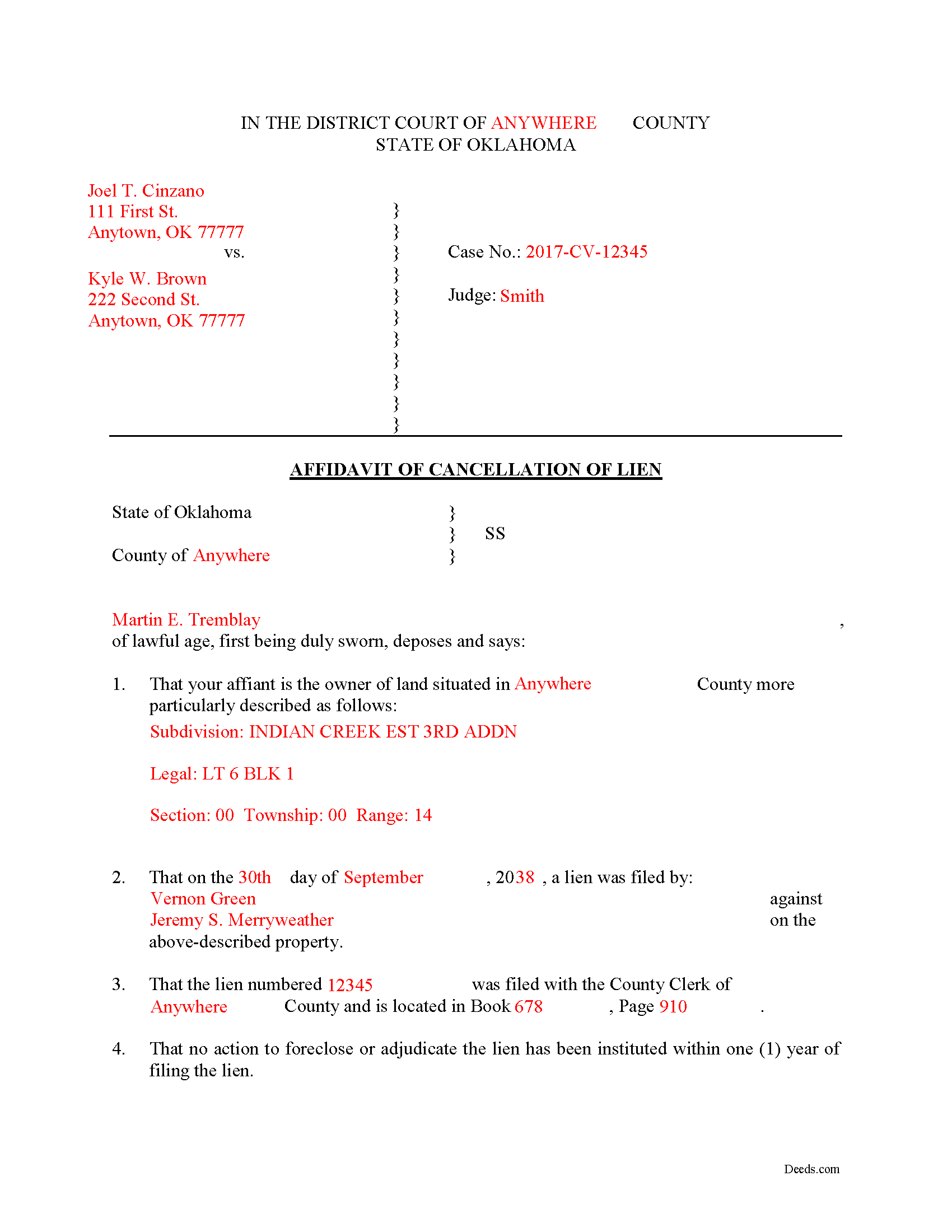

Carter County Completed Example of the Affidavit of Cancellation of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Carter County documents included at no extra charge:

Where to Record Your Documents

Carter County Clerk

Ardmore, Oklahoma 73401 / 73402

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (580) 223-8162

Recording Tips for Carter County:

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- Make copies of your documents before recording - keep originals safe

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Carter County

Properties in any of these areas use Carter County forms:

- Ardmore

- Fox

- Gene Autry

- Graham

- Healdton

- Hennepin

- Lone Grove

- Ratliff City

- Springer

- Tatums

- Tussy

- Wilson

Hours, fees, requirements, and more for Carter County

How do I get my forms?

Forms are available for immediate download after payment. The Carter County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Carter County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carter County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Carter County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Carter County?

Recording fees in Carter County vary. Contact the recorder's office at (580) 223-8162 for current fees.

Questions answered? Let's get started!

Liens are pesky creatures and if your property is plagued by one, you probably are looking for methods to remove it. Sometimes liens can be erroneously placed on your property or the claimant neglects to ever enforce the lien. Therefore, by filing an Affidavit of Lien Cancellation, you swear to the court that the facts behind the lien justify its cancellation.

If any lien is filed, and no action to foreclose the lien has commenced, the owner of the land may file a petition in the district court of the county in which the land is situated, naming the lien claimants as defendants, and requesting the court for an decision of the lien, and if the lien claimant fails establish a lien, the court may tax against the claimant the whole, or a portion of the costs of the action as may be just. O.S. 42-177.

Liens also can be cancelled by becoming time-barred. If no action to foreclose or settle the lien is filed within one (1) year from the filing of the lien, the lien is canceled by limitation of law. Id. If a lien is canceled by limitation of law, the owner of the land may file an affidavit proving its cancellation with the county clerk of the county in which the land is located. Id. Upon receipt of the affidavit, the county clerk will attach the affidavit to the original lien document in the lien docket file and enter a notation of the filing in the mechanics' lien journal. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. If you have questions about cancelling a lien, or any other issue related to liens in Oklahoma, please contact an attorney.

Important: Your property must be located in Carter County to use these forms. Documents should be recorded at the office below.

This Affidavit of Cancellation of Lien meets all recording requirements specific to Carter County.

Our Promise

The documents you receive here will meet, or exceed, the Carter County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carter County Affidavit of Cancellation of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Charles W.

July 7th, 2019

I was vey pleased with this service. It offered all of the necessary step by step information guides for completing the forms. Again, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RICHARD M.

May 12th, 2020

After a little glitch due to heavy volume at the County Recorder, my document was recorded. County Recorder was closed to public access at the office (due to the coronavirus issues) so all documents were either mailed to them or sent in electronically. Deeds.com was very efficient at their end with very quick responses to my questions and concerns. I would definitely use their services again.

Thank you for your feedback. We really appreciate it. Have a great day!

elizabeth m.

April 22nd, 2020

Wonderful service, forms were great. Completed and ready for recording. Will check back in after recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lance T. W.

August 23rd, 2019

All in all an easy, cost-effective approach to simple legal work.

Thank you for your feedback. We really appreciate it. Have a great day!

John L.

February 4th, 2020

Everything worked great. I hope I can get back to the document if I need to make changes. Thanks, John Lazur

Thank you!

CHARLES H.

December 3rd, 2022

Easy to fill-in forms, easy instructions, worth purchasing

Thank you!

David G.

February 27th, 2025

Very easy to fill out and understand. Thank You!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

oscar r.

December 17th, 2021

VERY MUCH HELPFUL SAVED ME 600 on not having to hire attorney

Thank you!

STEPHEN C.

January 22nd, 2020

Excellent service. Easy to use. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rhobe M.

May 8th, 2023

Very user friendly site. I was able to get the information I needed fast.

Thank you!

Hanna M.

June 10th, 2019

Very helpful information! Thank you for your service!

Thank you!

Sue C.

December 1st, 2023

Very helpful. Easy to use. Able to avoid the cost of having an attorney prepare the document I needed.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

LeRoy E.

June 20th, 2022

So thankful I found this. I was feeling stressed out and reluctant about doing this on my own.

Thank you!

Jo A B.

June 18th, 2022

Clean crisp website with helpful information; however. If the site states the following files are included, a single .zip, .rar, , ,download should be available instead of individual.

Thank you for your feedback. We really appreciate it. Have a great day!

Jerome R.

July 26th, 2023

Deeds.com handled my needs quickly and very economically. I would recommend them to anyone needing the services they offer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!