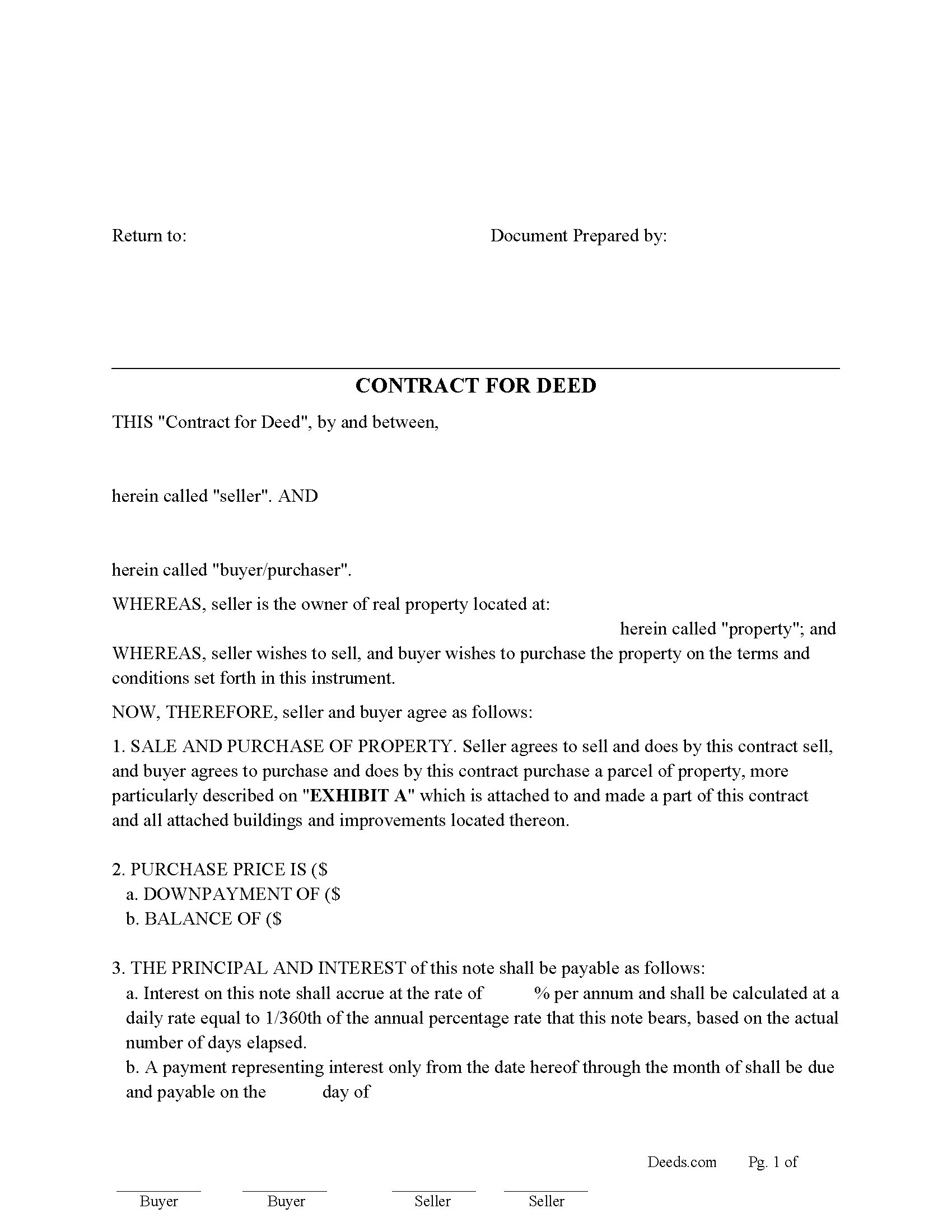

Caddo County Contract for Deed Form

Caddo County Contract for Deed Form

Fill in the blank Contract for Deed form formatted to comply with all Oklahoma recording and content requirements.

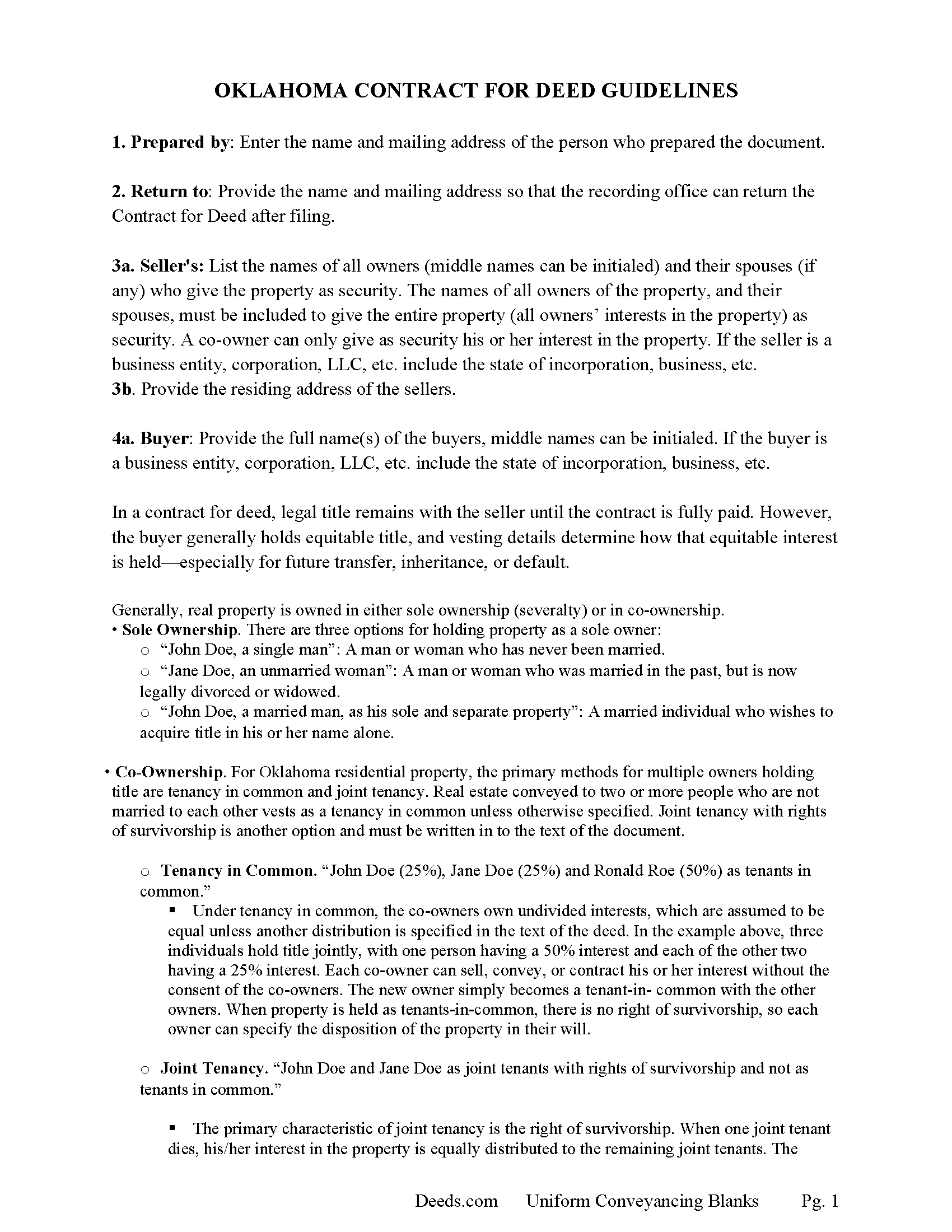

Caddo County Contract for Deed Guide

Line by line guide explaining every blank on the Contract for Deed form.

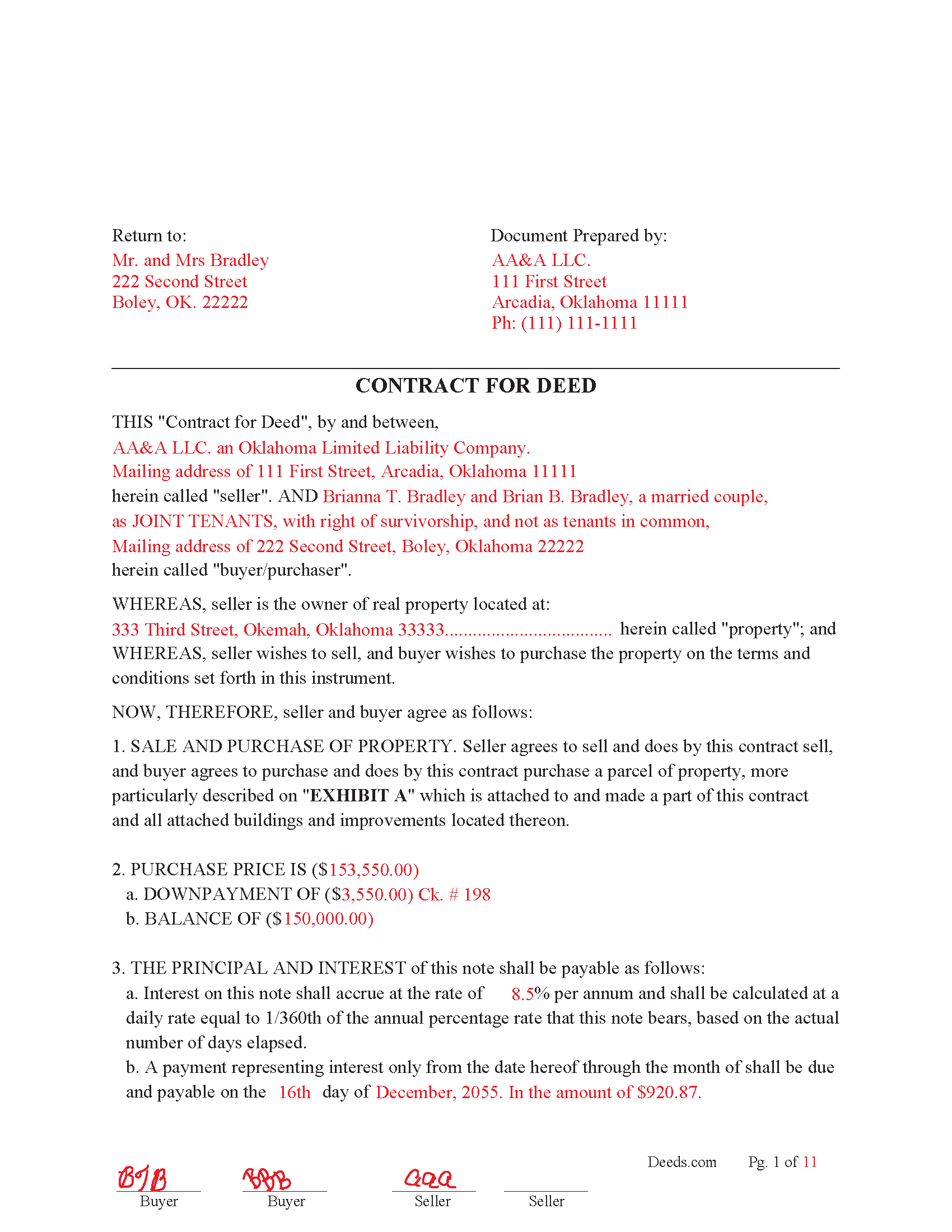

Caddo County Completed Example of the Contract for Deed Document

Example of a properly completed Oklahoma Contract for Deed document for reference.

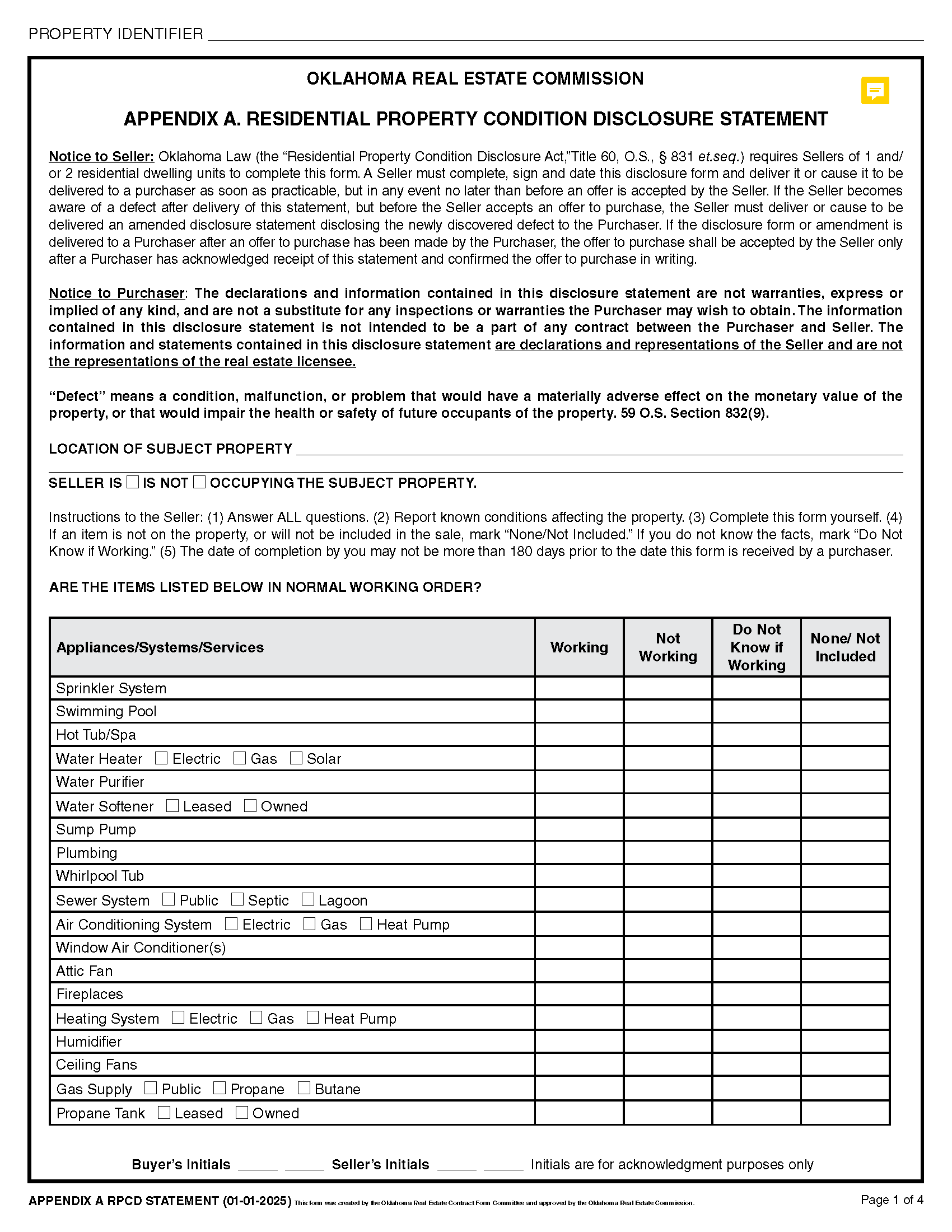

Caddo County Residential Property Disclosure A

Sellers Residential Disclosure Form

Caddo County Residential Property Disclosure B

Seller instructions: Oklahoma Law (the “Residential Property Condition Disclosure Act,” 60, O.S. Section 831 et. seq., effective July 1, 1995) requires a seller of 1 and 2 residential dwelling units to deliver, or cause to be delivered, a disclaimer statement to a purchaser as soon as practicable, but in any event before acceptance of an offer to purchase if you, the seller: 1) have never occupied the property and make no disclosures concerning the condition of the property; and 2) have no actual knowledge of any defect concerning the property.

Caddo County Seller's Lead Based Paint Disclosure Form

Applicable to residential property built before 1978

Caddo County Lead Based Paint Brochure

Issue to buyers if applicable.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Caddo County documents included at no extra charge:

Where to Record Your Documents

Caddo County Clerk

Anadarko, Oklahoma 73005

Hours: 8:30 to 4:30 M-F

Phone: (405) 247-6609

Recording Tips for Caddo County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Recorded documents become public record - avoid including SSNs

- Have the property address and parcel number ready

Cities and Jurisdictions in Caddo County

Properties in any of these areas use Caddo County forms:

- Albert

- Anadarko

- Apache

- Binger

- Carnegie

- Cement

- Cyril

- Eakly

- Fort Cobb

- Gracemont

- Hinton

- Hydro

- Lookeba

- Washita

Hours, fees, requirements, and more for Caddo County

How do I get my forms?

Forms are available for immediate download after payment. The Caddo County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Caddo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Caddo County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Caddo County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Caddo County?

Recording fees in Caddo County vary. Contact the recorder's office at (405) 247-6609 for current fees.

Questions answered? Let's get started!

In Oklahoma, a Contract for Deed (also called an installment land contract or real estate contract) is a financing tool where the seller acts like the lender. Instead of giving the buyer a deed at closing, the seller keeps legal title until the buyer makes all agreed payments, while the buyer gets equitable title and possession from day one.

COMMON USES IN OKLAHOMA

Owner Financing

Used when the buyer can’t qualify for a traditional mortgage, or wants to avoid bank lending requirements.

Low or No Down Payment Sales

Attractive to buyers with limited upfront cash.

Selling Property with Existing Liens

Sometimes used when a seller still owes money but can collect payments from the buyer to pay off the lien.

Faster, Private Transactions

Fewer formalities compared to traditional closings (though recording is still required to protect the buyer).

Rural or Unconventional Properties

Properties that might not meet bank lending standards (e.g., certain rural land, mobile homes without land, etc.).

REQUIREMENTS IN OKLAHOMA

While there isn’t one single statute titled “Contract for Deed Law,” several Oklahoma statutes govern parts of the process — mainly in Title 16 (Conveyances), Title 46 (Mortgages), and Title 68 (Revenue and Taxation).

KEY REQUIREMENTS:

Written Agreement

Must be in writing and signed by both parties to be enforceable under the Oklahoma Statute of Frauds (15 O.S. §136).

Recording: Oklahoma treats a recorded Contract for Deed as a mortgage (46 O.S. §1, §4).

Must be recorded with the county clerk within a reasonable time to protect the buyer’s equitable interest. In Oklahoma, you can record a Memorandum of Contract for Deed instead of the full contract.

Recording triggers mortgage recording tax under 68 O.S. §1904.

MORTGAGE TAX

Tax is based on the principal debt stated in the contract. Payment is due at the time of recording.

Disclosure of Terms

Contract should clearly state purchase price, interest rate, payment schedule, who pays taxes/insurance, default remedies, and conveyance terms.

Delivery of Deed

Seller delivers a warranty deed (or other agreed deed) only after all payments are made.

Default & Remedies

Oklahoma allows forfeiture clauses, but enforcement may require judicial action if the buyer has paid a significant portion of the contract.

Possession & Risk of Loss

Buyer usually takes possession immediately and bears risk of damage or loss from that point.

Best Practice in Oklahoma:

Record the Contract for Deed immediately and pay the mortgage tax so the buyer’s equitable title is protected. If it’s unrecorded, the buyer’s interest is at risk if the seller gets sued, goes bankrupt, or sells to someone else.

If you want, I can give you a sample Oklahoma Contract for Deed outline that includes the statutory mortgage tax language and meets county clerk recording standards so it doesn’t get rejected. That way it’s valid, enforceable, and protects both parties.

Important: Your property must be located in Caddo County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Caddo County.

Our Promise

The documents you receive here will meet, or exceed, the Caddo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Caddo County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Jenifer L.

January 2nd, 2019

I'm an attorney. I see youve mixed up the terms "grantor" and "grantee" and their respective rights in this version. Anyone using it like this might have title troubles down the line.

Thank you for your feedback Jenifer, we have flagged the document for review.

JAMES M.

July 17th, 2023

The forms are just what I needed! Easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shaaron Z.

August 29th, 2019

So far, this is working well. However, I don't see a form to change name due to marriage.

Thank you!

Jana H.

December 23rd, 2020

I love this recording service! They are so fast and let me know in advance if they think something is wrong and will be rejected! They are reasonably priced too!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dee R.

November 14th, 2019

Quick, Simple order process with many options of forms to download!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

RAMONA F.

July 29th, 2020

Good communication but they were unable to help me

Thank you for your feedback. We really appreciate it. Have a great day!

Giovanni S.

February 23rd, 2023

Simple and easy going process

Thank you!

Kristopher K.

October 22nd, 2021

Process is easy but system would not accept 3 different credit cards on first day. No phone number to call. Sent message and response was all 3 cards must have been declined. However, next day one of those cards went through with no problem.

Thank you for your feedback. Unfortunately we have no control over which payment get approved or declined.

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

John M.

September 16th, 2022

Easy to use site with a good selection of documents

Thank you!

Carol R.

February 19th, 2023

I found the site to be useful,informative and very accessable. Thank You

Thank you!

Judith M.

April 7th, 2021

You all have been very patient and helpful. Thank you.

Thank you!

Janey M.

March 12th, 2019

Easy to use site. Just what I needed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Connie J L.

August 26th, 2020

Fast and easy to use. Easy to print.

Thank you!