Carter County Personal Representative Deed of Sale Form

Carter County Personal Representative Deed of Sale Form

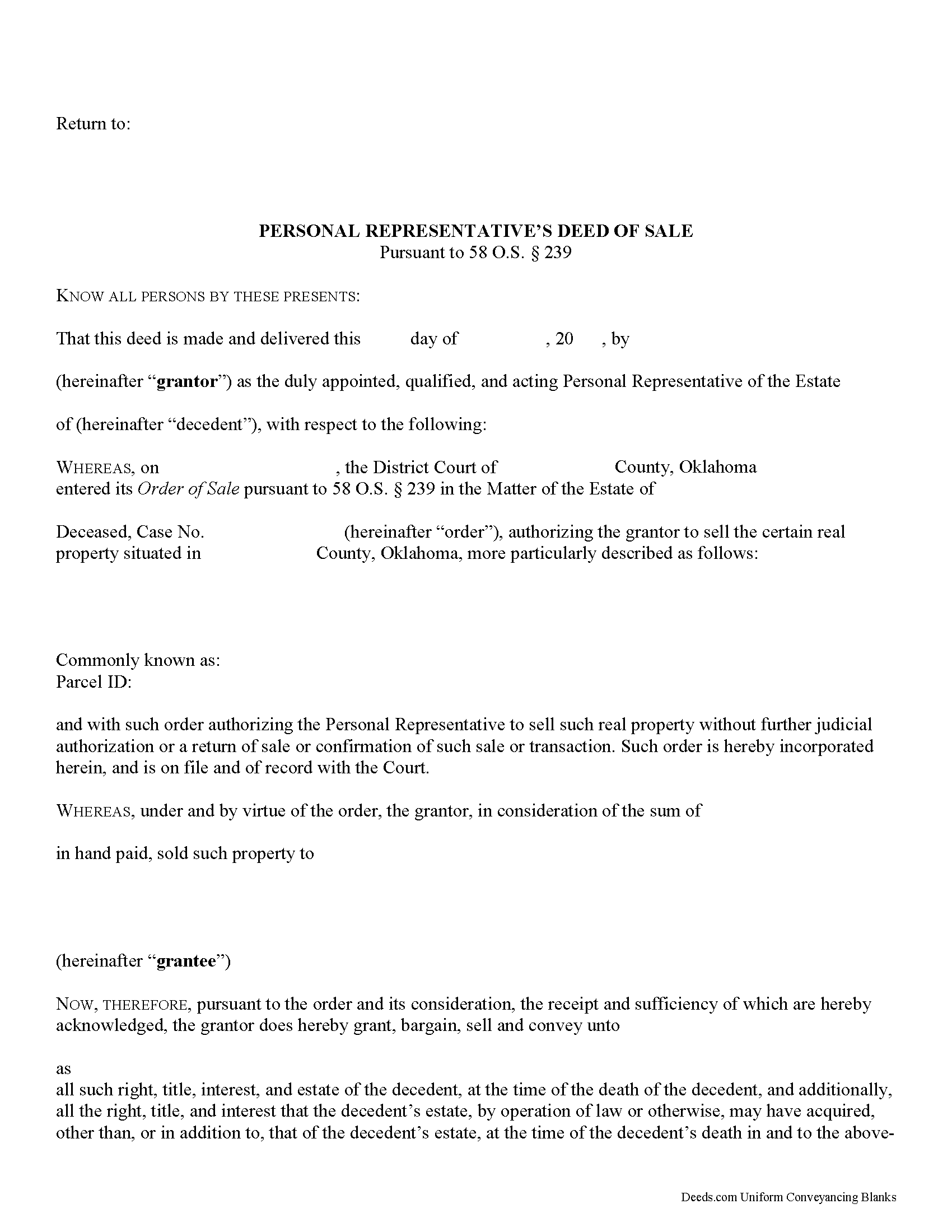

Fill in the blank form formatted to comply with all recording and content requirements.

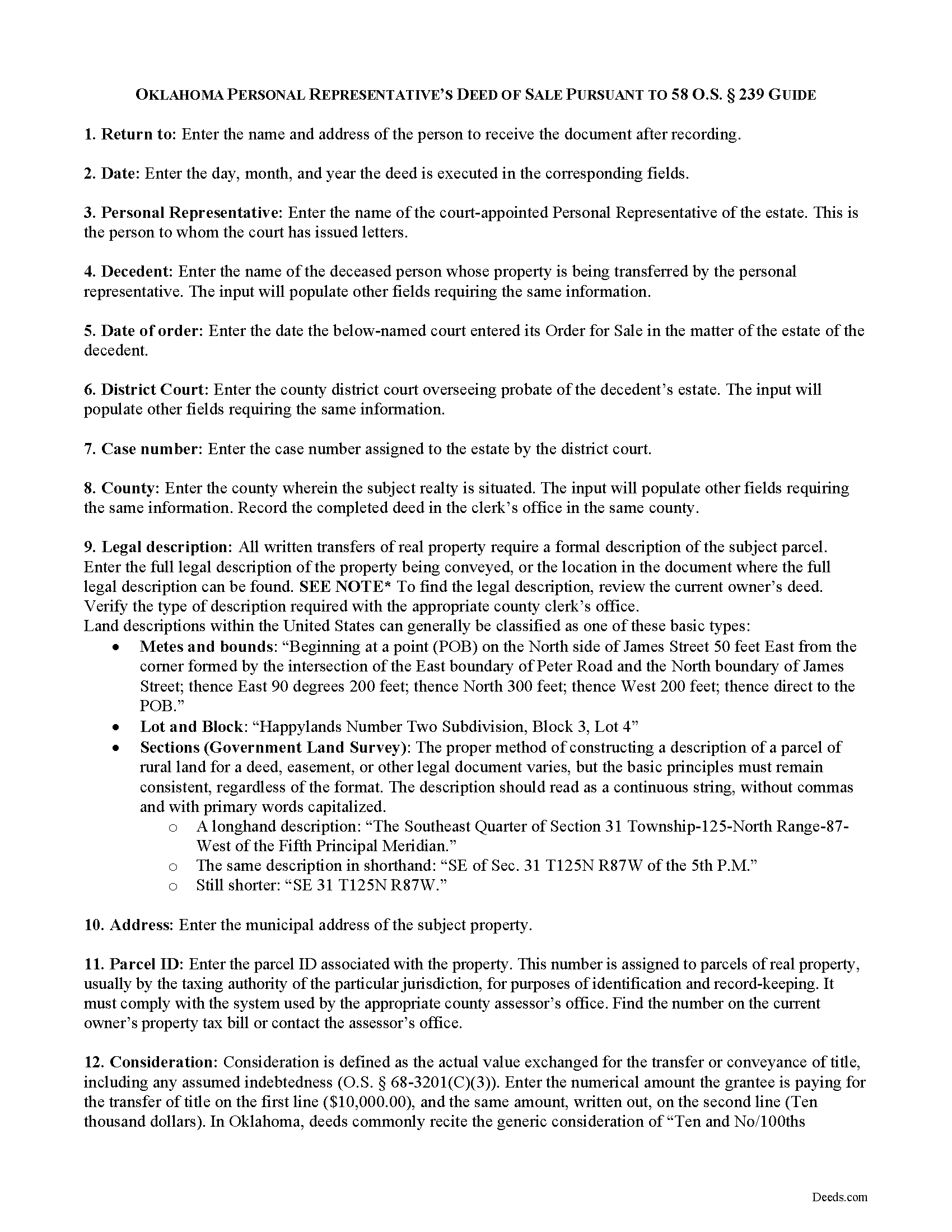

Carter County Personal Representative Deed of Sale Guide

Line by line guide explaining every blank on the form.

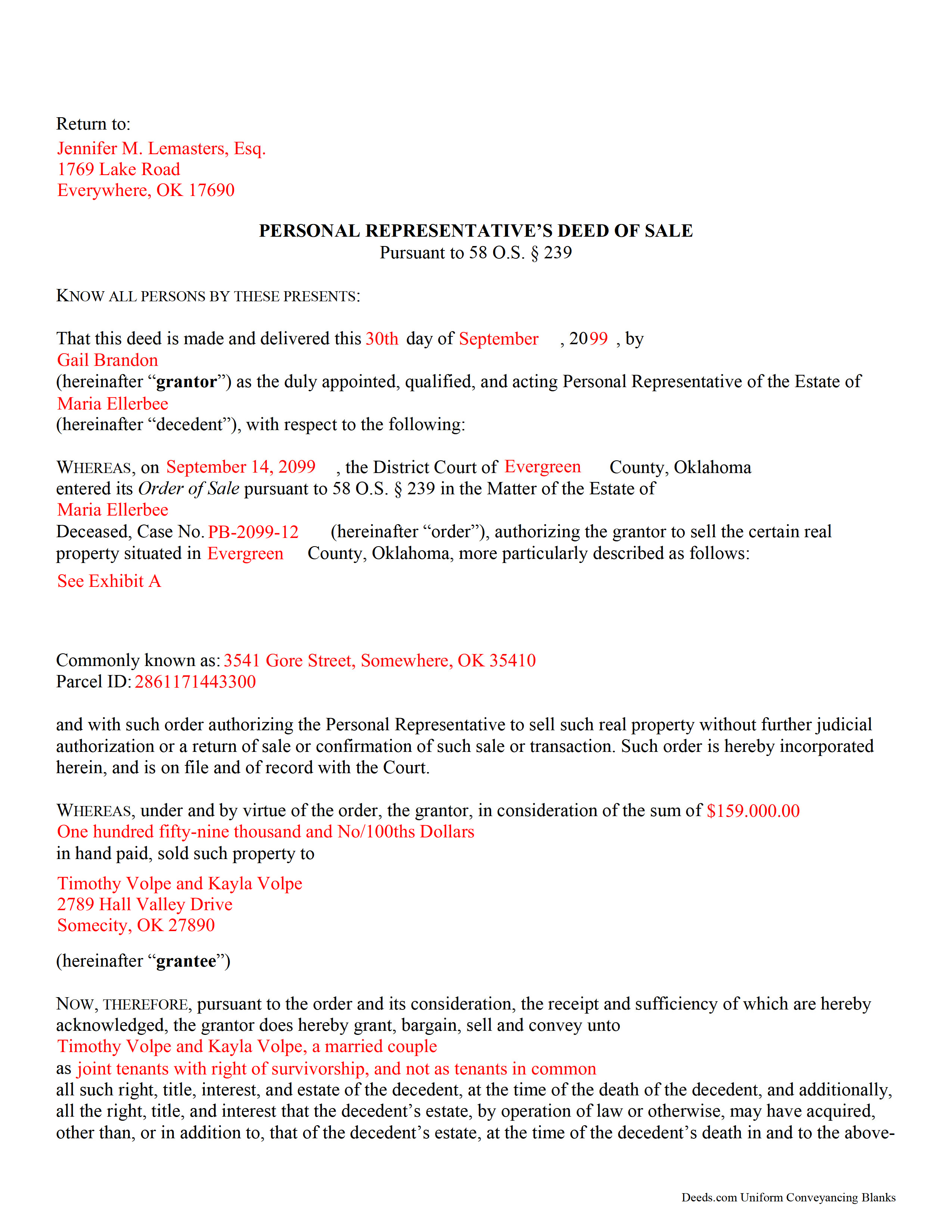

Carter County Completed Example of the Personal Representative Deed of Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Carter County documents included at no extra charge:

Where to Record Your Documents

Carter County Clerk

Ardmore, Oklahoma 73401 / 73402

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (580) 223-8162

Recording Tips for Carter County:

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Carter County

Properties in any of these areas use Carter County forms:

- Ardmore

- Fox

- Gene Autry

- Graham

- Healdton

- Hennepin

- Lone Grove

- Ratliff City

- Springer

- Tatums

- Tussy

- Wilson

Hours, fees, requirements, and more for Carter County

How do I get my forms?

Forms are available for immediate download after payment. The Carter County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Carter County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carter County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Carter County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Carter County?

Recording fees in Carter County vary. Contact the recorder's office at (580) 223-8162 for current fees.

Questions answered? Let's get started!

A personal representative's deed given under 58 O.S. 239 is a probate deed, and one of several fiduciary instruments that may be used in estate administration. This deed conveys title in situations where the debts of the estate require the sale to convert assets to cash. The personal representative's (PR) deed is named after the capacity of the granting party.

Before a personal representative can execute and record a deed, the sale and conveyance must be authorized by the district court. The PR must apply to the court for an Order Authorizing Sale of Real Property Pursuant to 58 O.S. 239.

Following an order of sale from the district court, use a personal representative's deed to transfer an interest in real property from a probate estate to a purchaser at public or private sale. The deed conveys all the right, title, interest, and estate of the decedent at the time of his death.

In addition to meeting all state and local standards for recorded documents, components of a properly executed PR deed of sale given under 58 O.S. 239 include the recital of probate details, including the name of the court-appointed personal representative, the decedent's name, the date of the order of sale, the case number assigned to the probate estate, and a statement that the order of sale exempts the PR from further authorization or confirmation of sale.

Other requirements for a lawful deed include the full legal description of the property and statement of consideration, reflecting the value exchanged for the transfer of title. In Oklahoma, deeds commonly recite a generic consideration of "Ten and No/100ths Dollars," with the true purchase price reflected on an Affidavit of Purchase Price. This affidavit is a tool for the register's office to calculate the documentary stamp tax, a tax levied on all transfers of real estate in Oklahoma. Any exemption from the tax under 68 O.S. 3202 must be noted on the face of the instrument.

Record the completed, signed, and notarized deed, along with a certified copy of the order of sale, signed by a judge, in the office of the register of deeds in the county wherein the property is situated.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Oklahoma with questions regarding personal representative's deeds, as each situation is unique.

(Oklahoma PRD of Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Carter County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed of Sale meets all recording requirements specific to Carter County.

Our Promise

The documents you receive here will meet, or exceed, the Carter County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carter County Personal Representative Deed of Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

Charles B.

December 14th, 2019

Excellent andeasy to navigate website for non-lawyers. Needed some forms for a specific county in a specific state, and Deeds.com took me right there, where I downloaded the forms and a guide on how to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Teri B.

January 7th, 2019

Glad to have all of the helpful extra information, even though they don't answer all questions for all situations. So, I accessed public records and asked questions at the auditor's office. Also, on my Mac computer, filling out the actual deed form is a challenge because the screen jumps to the last page everytime I try to type a few letters or hit the return key, so I'm rollling back up to the first 2 pages after most keystrokes. A bit annoying. Overall, happy to have these form options are available! There is really no need to wait and pay for an attorney when all the information needed is available via public records. Fill in the blanks!

Thanks so much for the feedback Teri. There are known issues between Adobe and Mac, we try to work around them as much as possible. Have a wonderful day!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!

Thomas T.

August 8th, 2022

Amazing site, been using it since 2018 for forms and never an issue.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory J.

March 6th, 2019

Ordered two separate forms for two separate states at two differnt times and couldn't be happier with my purchase. When compared to the cost of having two different attorneys prepare the forms I needed, the value of deeds.com couldn't be beat!

Thank you Gregory. We appreciate you taking the time to leave your feedback. Have a great day!

Rosalinda R.

January 4th, 2023

THESE FORMS ARE JUST WHAT I NEEDED, SHORT AND TO THE POINT. EXCELLENT QUESTIONS FOR MY NEED. THAK YOU!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

JACQUELINE R.

March 23rd, 2021

We have been waiting for a Title Company to put a release of Lien together for the past 3 months. I figured it was taking way to long and decided to use template here instead. In less than hour I was able to add all the information on the template and provide forms to our Seller to use. We were buying and he didnt think they were necessary. But I refused to pay him in full until he agreed to sign papers at the bank, and of course in front of a notary. We turned around and filed the Release of lien paperwork at County Clerks office, we officially own our house. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Peter W.

February 28th, 2019

Thanks worked out great

Thank you for the follow up Peter. Have a great day!

Edwina L.

June 24th, 2020

Awesomeness a true life saver I'm very appreciative.

Thank you!

Judith L.

August 19th, 2019

I bought a package for doing a mineral deed in Sheridan County, Montana. I will now try to use it and we'll see, I guess, how easy it may or may not be, etc. Check back later perhaps for more details~

Thank you for your feedback. We really appreciate it. Have a great day!

Gary B.

September 16th, 2022

Great service. Comprehensive. Reasonably priced.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

March 12th, 2021

Well designed easy to use system. Provided all instructions and updates required, as well as catching an extra form required by our county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dean P.

October 6th, 2021

Very fast, efficient, and convenient - thanks Deeds.com! I would recommend this service to everyone needing to record documents, especially out-of-state customers such as myself.

Thank you for your feedback. We really appreciate it. Have a great day!

Randi J.

September 8th, 2020

Everything was so easy and self explanatory and very inexpensive. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

William S C.

June 11th, 2021

The Lady Bird Deed appears to be fine with me as are the instructions. However, there apparently are no specific laws in Texas addressing them other than they are OK. The problem is that lenders are surely going to use them as triggers for their due on sale clauses, especially as the current small mortgage rates begin to increase. The solution to that seems to be to sign and have them notarized, but not to record them unless the holder needs to enforce the provisions. It seems to me that you should consider your solution to that problem in your instructions.

Thank you for your feedback. We really appreciate it. Have a great day!