Garfield County Preliminary Notice Form

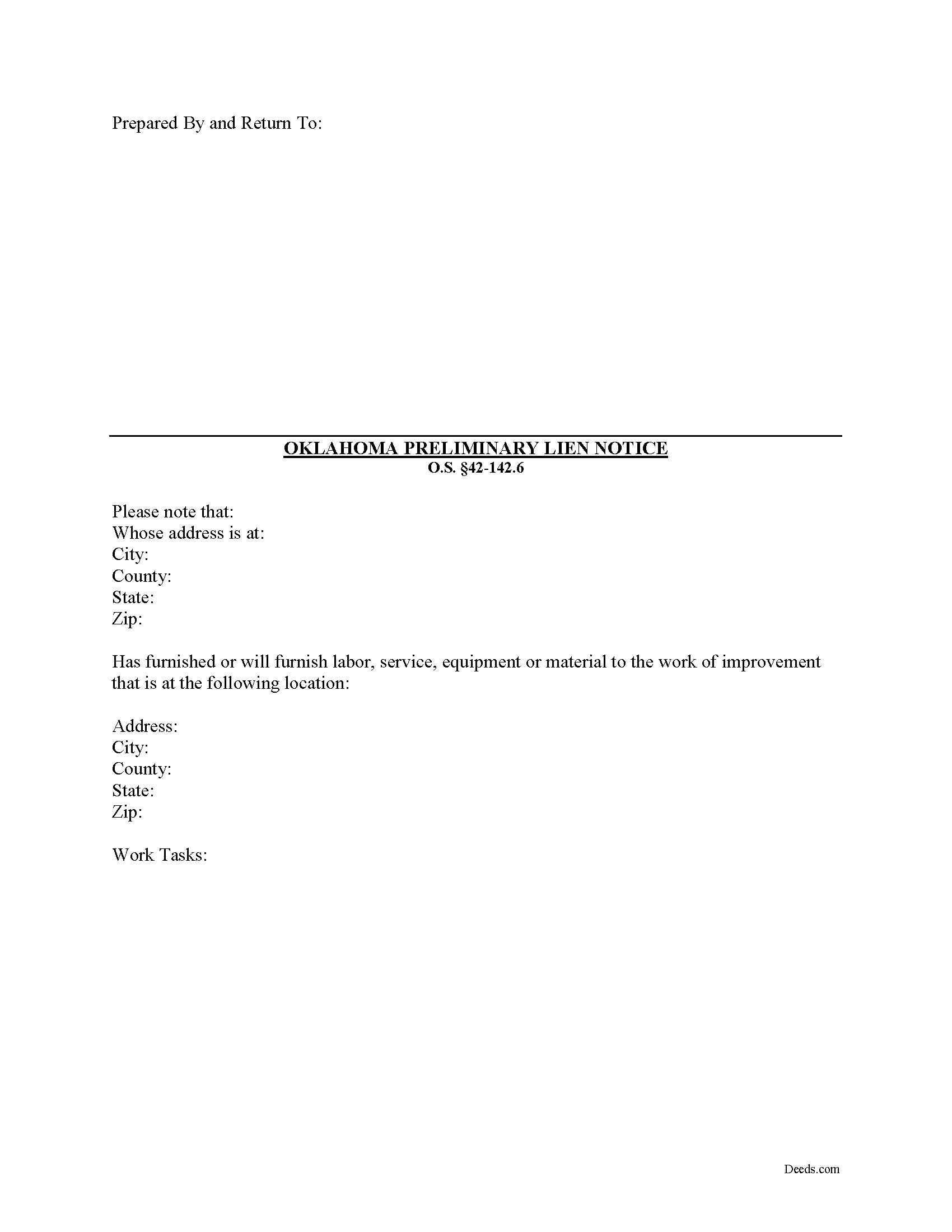

Garfield County Preliminary Notice Form

Fill in the blank Preliminary Notice form formatted to comply with all Oklahoma recording and content requirements.

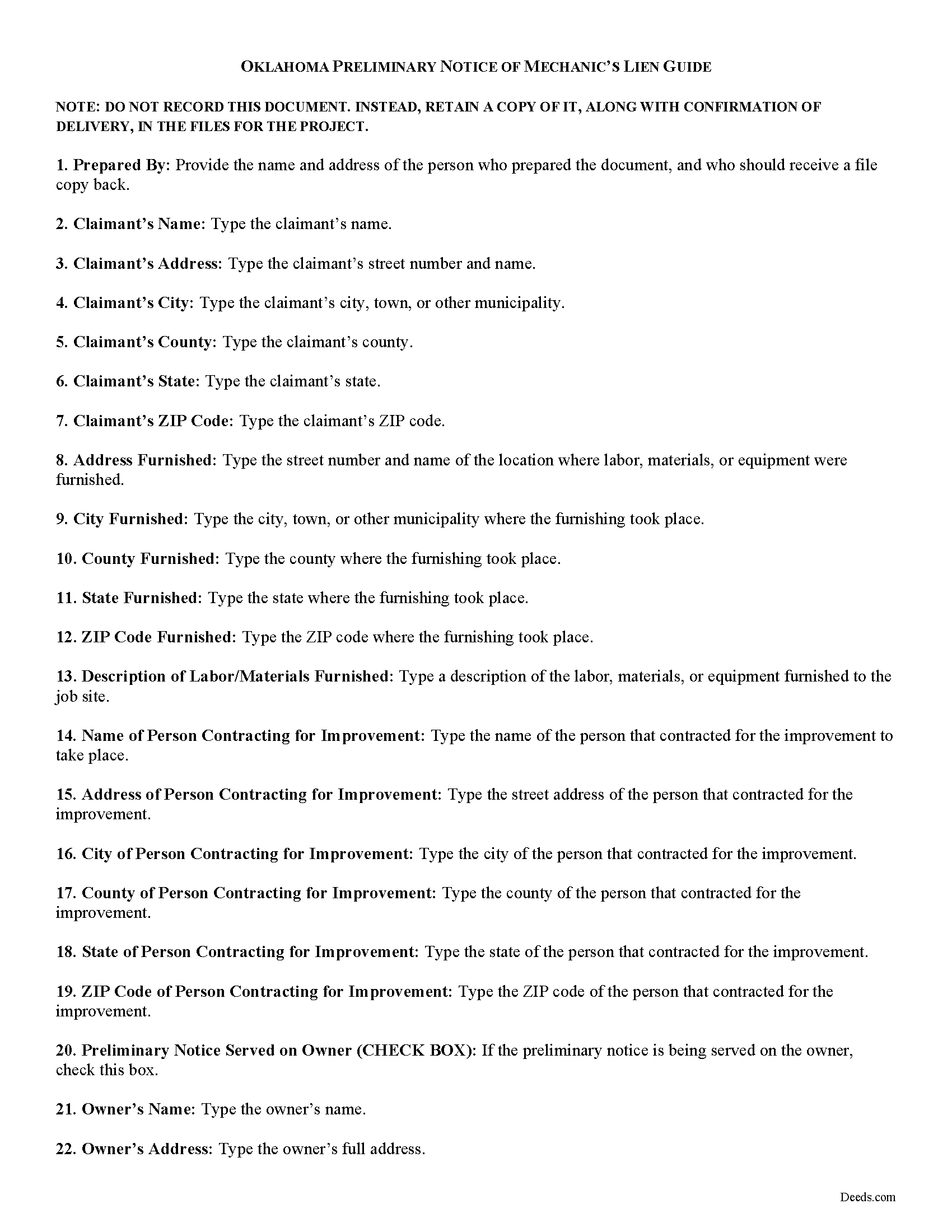

Garfield County Preliminary Notice Guide

Line by line guide explaining every blank on the form.

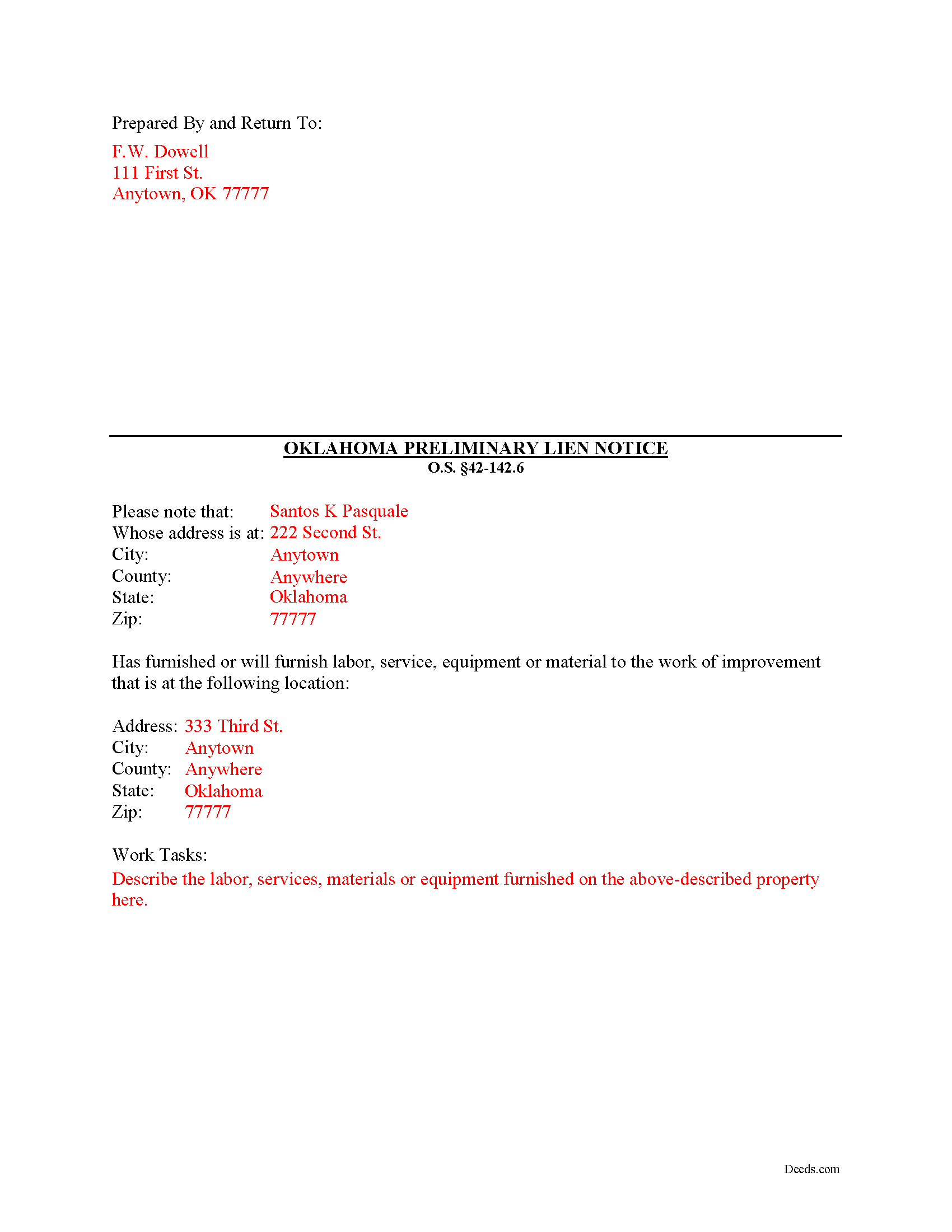

Garfield County Completed Example of the Preliminary Notice Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Garfield County documents included at no extra charge:

Where to Record Your Documents

Garfield County Clerk

Enid, Oklahoma 73702

Hours: 8:00 to 4:30 Monday through Friday

Phone: (580) 237-0225 or 237-0226 (Deeds Dept)

Recording Tips for Garfield County:

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Garfield County

Properties in any of these areas use Garfield County forms:

- Bison

- Carrier

- Covington

- Douglas

- Drummond

- Enid

- Fairmont

- Garber

- Hillsdale

- Hunter

- Kremlin

- Lahoma

- Waukomis

Hours, fees, requirements, and more for Garfield County

How do I get my forms?

Forms are available for immediate download after payment. The Garfield County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Garfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Garfield County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Garfield County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Garfield County?

Recording fees in Garfield County vary. Contact the recorder's office at (580) 237-0225 or 237-0226 (Deeds Dept) for current fees.

Questions answered? Let's get started!

Many states, including Oklahoma, mandate that a contractor, subcontractor, or other service provider first serve a preliminary notice on a property owner in order to preserve the rights to claim a mechanic's lien. The purpose of such notice is to make the owner aware of the parties involved in their construction job, which in turn protects the property from any "hidden liens" filed claimants who later come out of the woodwork. As is often the case in construction jobs, contractors employ persons below them who could have a lien claim even if the owner paid the first contractor in full.

In Oklahoma, prior to filing a lien statement, no later than seventy-five (75) days after the last date of supply of material, services, labor, or equipment in which the claimant is entitled or may be entitled to lien rights, the claimant must send to the last-known address of the original contractor and an owner of the property a pre-lien notice. O.S. 142.6(B)(1). No lien affecting property occupied as a dwelling by an owner will be valid unless the pre-lien notice was sent within seventy-five (75) days of the last furnishing of materials, services, labor or equipment by the claimant. Id.

The pre-lien notice must be in writing and contain the following: (1) a statement that the notice is a pre-lien notice, (2) the complete name, address, and telephone number of the claimant, or the claimant's representative, (3) the date of supply of material, services, labor, or equipment, (4) a description of the material, services, labor, or equipment, (5) the name and last-known address of the person who requested that the claimant provide the material, services, labor, or equipment, (6) the address, legal description, or location of the property to which the material, services, labor, or equipment has been supplied, (7) a statement of the dollar amount of the material, services, labor, or equipment furnished or to be furnished, and (8) the signature of the claimant, or the claimant's representative. O.S. 142.6(B)(4).

The claimant may also request in writing, that the original contractor provide to the claimant the name and last-known address of an owner of the property. O.S. 142.6(B)(6). Failure of the original contractor to provide the claimant with the information requested within five (5) days from the date of receipt of the request shall render the pre-lien notice requirement to the owner of the property unenforceable. Id.

The claimant must also furnish to the county clerk at the time of the filing of the lien statement a notarized affidavit verifying compliance with the pre-lien notice requirements. O.S. 142.6(C). Any claimant who falsifies the affidavit will be guilty of a misdemeanor, punished by a fine of not more than $5000, or by imprisonment for a maximum of thirty days. Id.

Sending the preliminary notice is vital to protect lien rights. Failure by the claimant to comply with the pre-lien notice requirements will invalidate that portion of the lien claim without notice. O.S. 142.6(D). Therefore, by complying with the notice statute, potential claimants ensure their lien rights will be available if ever needed.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of a legal professional. Please contact an attorney with questions about preliminary lien notice, or any other issues related to liens in Oklahoma.

Important: Your property must be located in Garfield County to use these forms. Documents should be recorded at the office below.

This Preliminary Notice meets all recording requirements specific to Garfield County.

Our Promise

The documents you receive here will meet, or exceed, the Garfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Garfield County Preliminary Notice form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

janice b.

April 29th, 2021

This is a very helpful site when you don't know exactly what to do. Very clear in explaining the wording on deeds. Thank you it made a big difference knowing the right way to do things.

Thank you for your feedback. We really appreciate it. Have a great day!

Eugenia T.

August 9th, 2023

I am the Kent County Recorder of Deeds in Central Delaware. I am impressed by the accuracy of your website. All data you post is correct regarding forms, fees, etc. We have just spent several months researching Property Theft, using many cites from various sources. I just discovered your white paper on this subject, and it is excellent. It also covers a few things we did not, such as house flipping and immigrants. Congratulations!

Thank you for your kind words and thoughtful review! It's an honor to know that our resources have been valuable to the Kent County Recorder of Deeds. Your feedback is particularly meaningful to us, and we are glad that our white paper contributed to your research on Property Theft. We fully support your vital efforts to combat property theft and deed fraud, and if there's anything else we can assist you with or any further insights you'd like to share, please don't hesitate to reach out. Keep up the outstanding work!

Michael L.

December 28th, 2018

I accidentally ordered the wrong deed package. Was looking for a quit claim deed and got a trustee deed. I immediately emailed the company, nothing back from them. I would like to exchange my purchase.

Thank you for your feedback. We replied to your message on December 20th at 2:05 pm, the reply was as follows: As a one time courtesy we have canceled your order/payment for the Trustee Deed document.

Peter M.

July 30th, 2020

GREAT! site, had everything we needed to complete our estate planning for our children

Thank you for your feedback. We really appreciate it. Have a great day!

William H.

July 18th, 2023

It was quick and easy to download the forms I need to modify a property deed. No problems n the least.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Adriane L.

November 20th, 2024

great experience. Great communication and very fast turn around ty Adriane

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Christine W.

December 30th, 2020

excellent

Thank you!

Linda C.

February 23rd, 2019

If I hadn't spent my career as an escrow officer (albeit in another state), I may have had a hard time figuring out exactly which deed I needed and how to prepare them, even with the back-up informational, how-to pdf documents, without an attorney. My experience speaks to how much the general public doesn't understand and how confusing it can be. Nonetheless, the access to so many documents at a fairly reasonable cost, the basic how-to docs made available along with the purchased doc makes all the difference. I appreciate having such things available to the public. Many thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eileen B.

April 5th, 2022

I was quoted $525 to do the exact same thing from Deeds.com for only $25. Seems like a no brainer to me!

Thank you for your feedback. We really appreciate it. Have a great day!

Angela L.

November 2nd, 2020

AWESOME!

Thank you!

CAROLYN H.

July 14th, 2022

Thanks. Was simple and easy to use.

Thank you!

Karen M.

July 19th, 2020

Excellent and easy process to use the online fill in the blank sections, especially when you provided a example of what each topic/section should look like. Highly recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra N.

April 13th, 2019

Very quick and painless process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth K.

April 19th, 2020

Really great experience. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

JIM H.

July 21st, 2022

Excellent service Always find the documents in minutes. Supporting docs is a super plus!

Thank you!