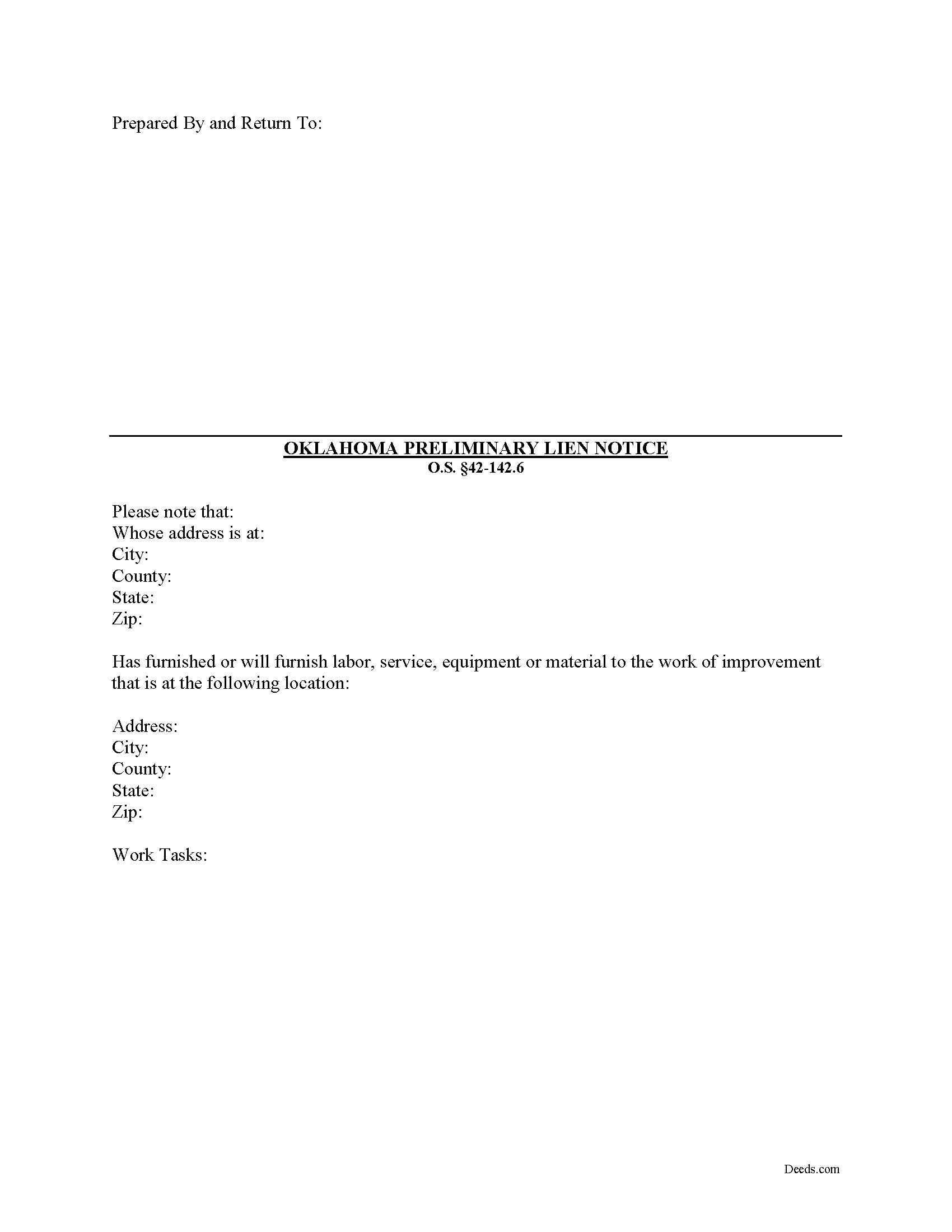

Mcclain County Preliminary Notice Form

Mcclain County Preliminary Notice Form

Fill in the blank Preliminary Notice form formatted to comply with all Oklahoma recording and content requirements.

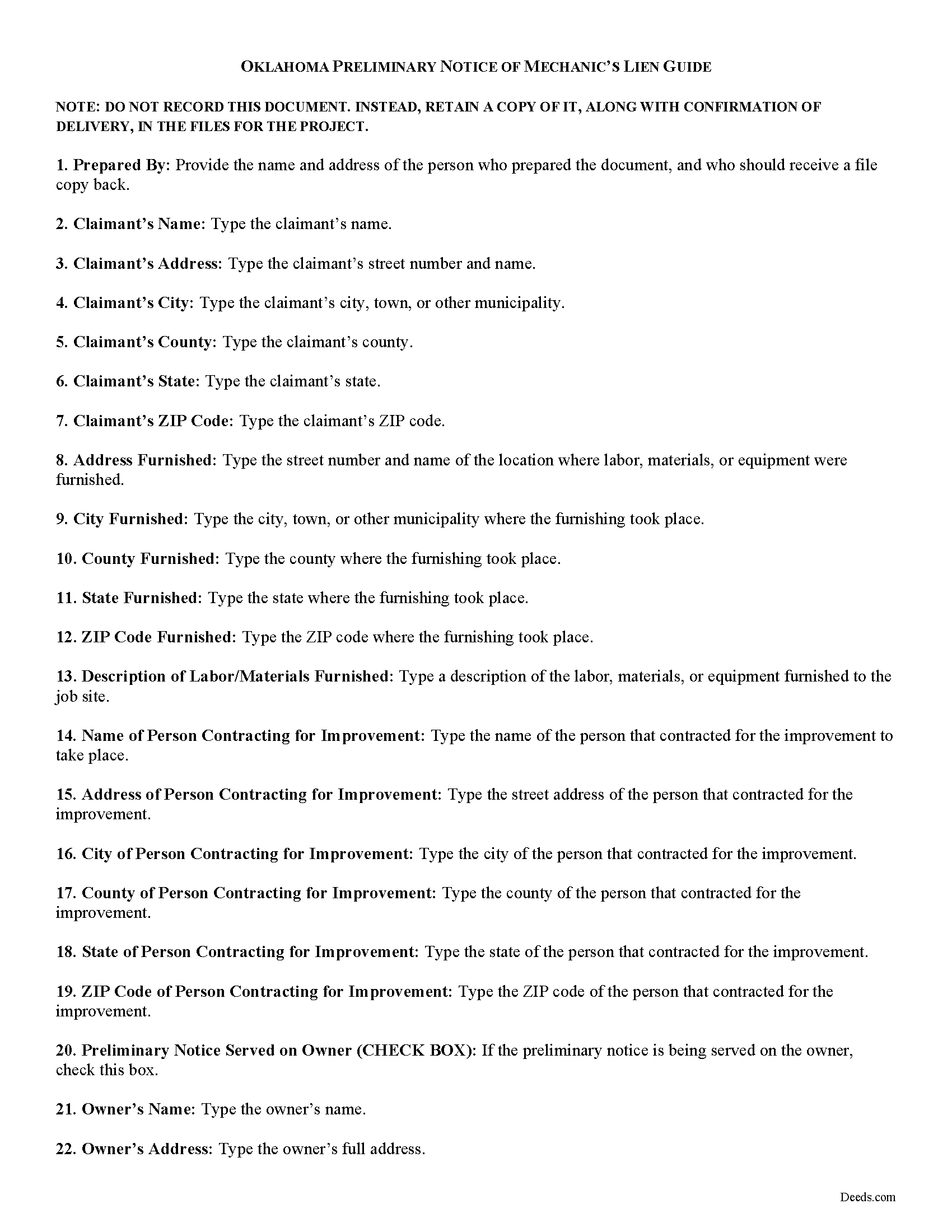

Mcclain County Preliminary Notice Guide

Line by line guide explaining every blank on the form.

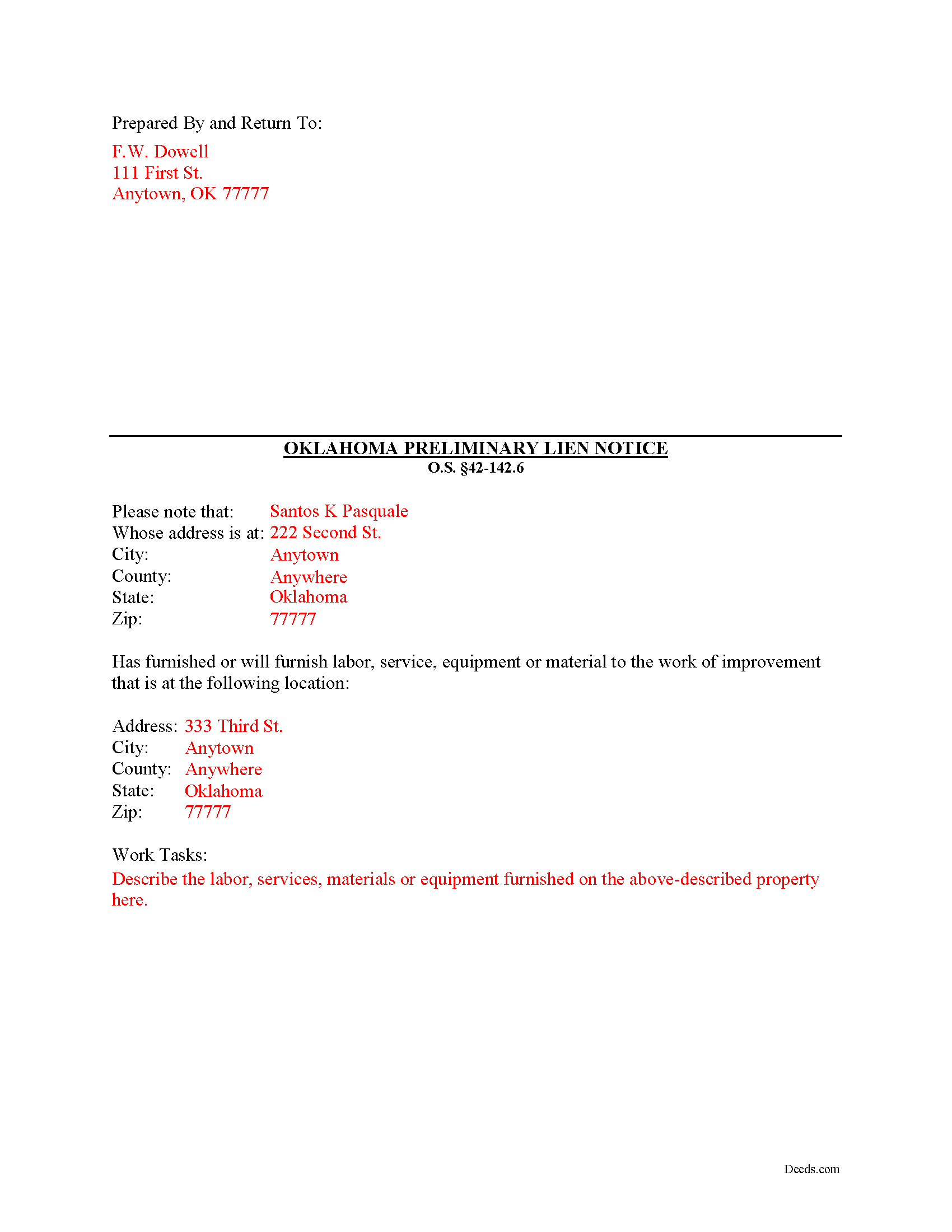

Mcclain County Completed Example of the Preliminary Notice Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Mcclain County documents included at no extra charge:

Where to Record Your Documents

McClain County Clerk

Purcell, Oklahoma 73080

Hours: 8:00 to 4:30 M-F

Phone: (405) 527-3360

Recording Tips for Mcclain County:

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Mcclain County

Properties in any of these areas use Mcclain County forms:

- Blanchard

- Byars

- Dibble

- Newcastle

- Purcell

- Washington

- Wayne

Hours, fees, requirements, and more for Mcclain County

How do I get my forms?

Forms are available for immediate download after payment. The Mcclain County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mcclain County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mcclain County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mcclain County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mcclain County?

Recording fees in Mcclain County vary. Contact the recorder's office at (405) 527-3360 for current fees.

Questions answered? Let's get started!

Many states, including Oklahoma, mandate that a contractor, subcontractor, or other service provider first serve a preliminary notice on a property owner in order to preserve the rights to claim a mechanic's lien. The purpose of such notice is to make the owner aware of the parties involved in their construction job, which in turn protects the property from any "hidden liens" filed claimants who later come out of the woodwork. As is often the case in construction jobs, contractors employ persons below them who could have a lien claim even if the owner paid the first contractor in full.

In Oklahoma, prior to filing a lien statement, no later than seventy-five (75) days after the last date of supply of material, services, labor, or equipment in which the claimant is entitled or may be entitled to lien rights, the claimant must send to the last-known address of the original contractor and an owner of the property a pre-lien notice. O.S. 142.6(B)(1). No lien affecting property occupied as a dwelling by an owner will be valid unless the pre-lien notice was sent within seventy-five (75) days of the last furnishing of materials, services, labor or equipment by the claimant. Id.

The pre-lien notice must be in writing and contain the following: (1) a statement that the notice is a pre-lien notice, (2) the complete name, address, and telephone number of the claimant, or the claimant's representative, (3) the date of supply of material, services, labor, or equipment, (4) a description of the material, services, labor, or equipment, (5) the name and last-known address of the person who requested that the claimant provide the material, services, labor, or equipment, (6) the address, legal description, or location of the property to which the material, services, labor, or equipment has been supplied, (7) a statement of the dollar amount of the material, services, labor, or equipment furnished or to be furnished, and (8) the signature of the claimant, or the claimant's representative. O.S. 142.6(B)(4).

The claimant may also request in writing, that the original contractor provide to the claimant the name and last-known address of an owner of the property. O.S. 142.6(B)(6). Failure of the original contractor to provide the claimant with the information requested within five (5) days from the date of receipt of the request shall render the pre-lien notice requirement to the owner of the property unenforceable. Id.

The claimant must also furnish to the county clerk at the time of the filing of the lien statement a notarized affidavit verifying compliance with the pre-lien notice requirements. O.S. 142.6(C). Any claimant who falsifies the affidavit will be guilty of a misdemeanor, punished by a fine of not more than $5000, or by imprisonment for a maximum of thirty days. Id.

Sending the preliminary notice is vital to protect lien rights. Failure by the claimant to comply with the pre-lien notice requirements will invalidate that portion of the lien claim without notice. O.S. 142.6(D). Therefore, by complying with the notice statute, potential claimants ensure their lien rights will be available if ever needed.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of a legal professional. Please contact an attorney with questions about preliminary lien notice, or any other issues related to liens in Oklahoma.

Important: Your property must be located in Mcclain County to use these forms. Documents should be recorded at the office below.

This Preliminary Notice meets all recording requirements specific to Mcclain County.

Our Promise

The documents you receive here will meet, or exceed, the Mcclain County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mcclain County Preliminary Notice form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Kevin P.

March 19th, 2023

Just what my parents and I have been looking for to do a Quit Deed to transfer property into my name.

Thank you!

Annette L.

August 25th, 2024

Excellent customer service and value!

Thank you for your positive words! We’re thrilled to hear about your experience.

pete k.

February 11th, 2021

Excellent service and quick turnaround time.I ordered a copy of my property deed and I received a downloadable digital copy in about 10 to 15 minutes. Very impressed. Thank You

Thank you for your feedback. We really appreciate it. Have a great day!

Karen C.

July 28th, 2022

Easily find and print forms necessary for peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

Joy R.

August 10th, 2020

Easy and efficient way to get a deed copy.

Thank you!

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

brian o.

September 17th, 2022

I was needing some forms from another state. I am a lawyer but don't have ready access to out of state forms. I was impressed with how thorough the intake process was. Very nice that I could download the form in Word so that I could adjust a few things. Very fine service. I recommend.

Thank you!

David B.

February 11th, 2021

The requested forms were easy to access. Thank you.

Thank you!

Kaleigh S.

April 8th, 2020

I used Deeds.com to record two judgments with the County Recorder's Office. The site was very easy to use and I had my recorded copies back the very next day. I highly recommend their service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

yasin a.

January 3rd, 2020

good service

Thank you!

JD S.

July 31st, 2020

I used Deeds.com recently. They were quick and got the job done quickly. Their online portal was extremely easy to use. I will definitely use them again.

Thank you!

Tommy P.

March 16th, 2019

This was simple! Thank you!

Thank you!

Bea Lou H.

December 2nd, 2022

easy access and easy to find what I was looking for. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Larry L.

January 20th, 2022

I am completely satisfied. It was easy to find the correct form and download it. The instructions were very clear.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pat G.

May 12th, 2020

Found correct form right away, easy to download and print. Thank you!

Thank you!