Caddo County Transfer on Death Deed Form

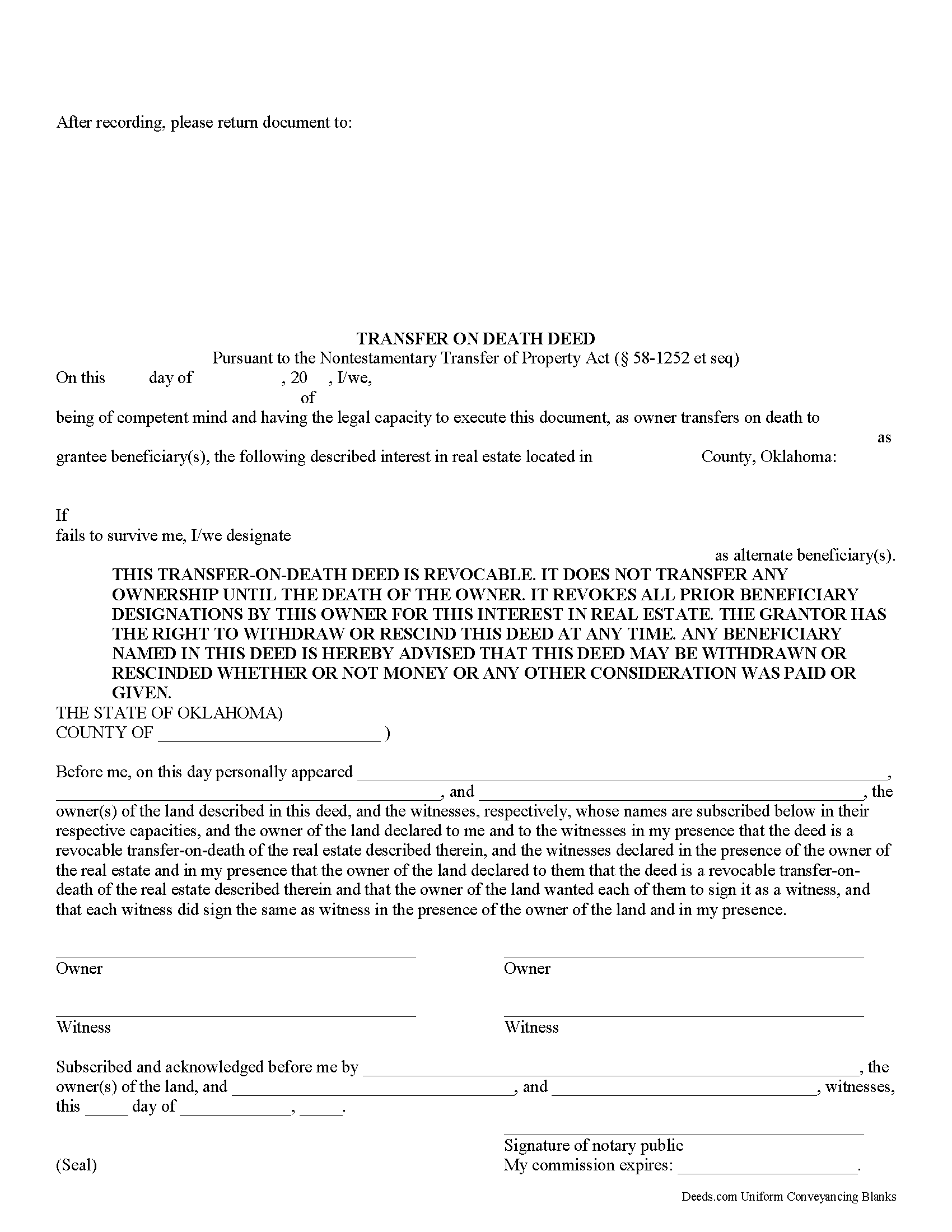

Caddo County Oklahoma Transfer on Death Deed

Fill in the blank form formatted to comply with all recording and content requirements.

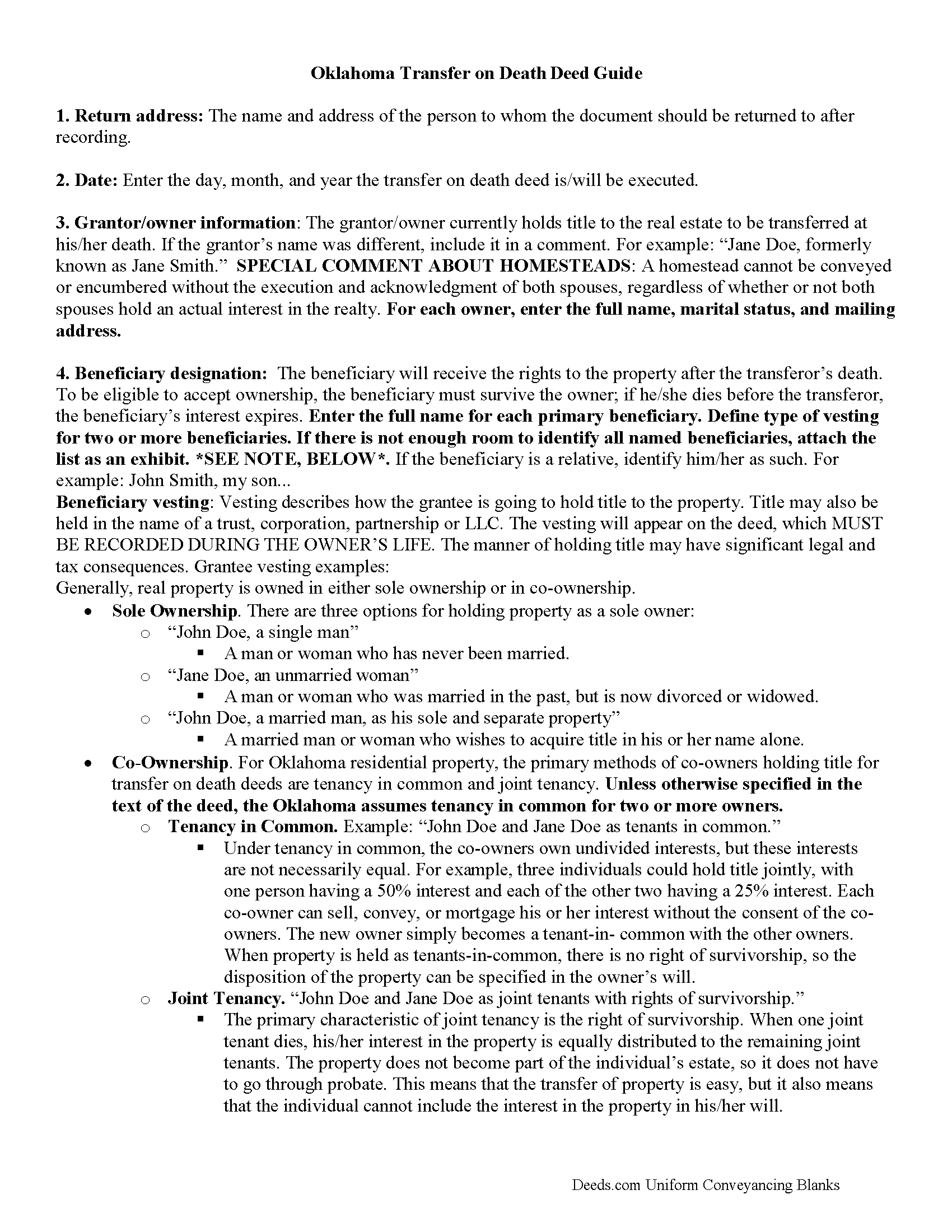

Caddo County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

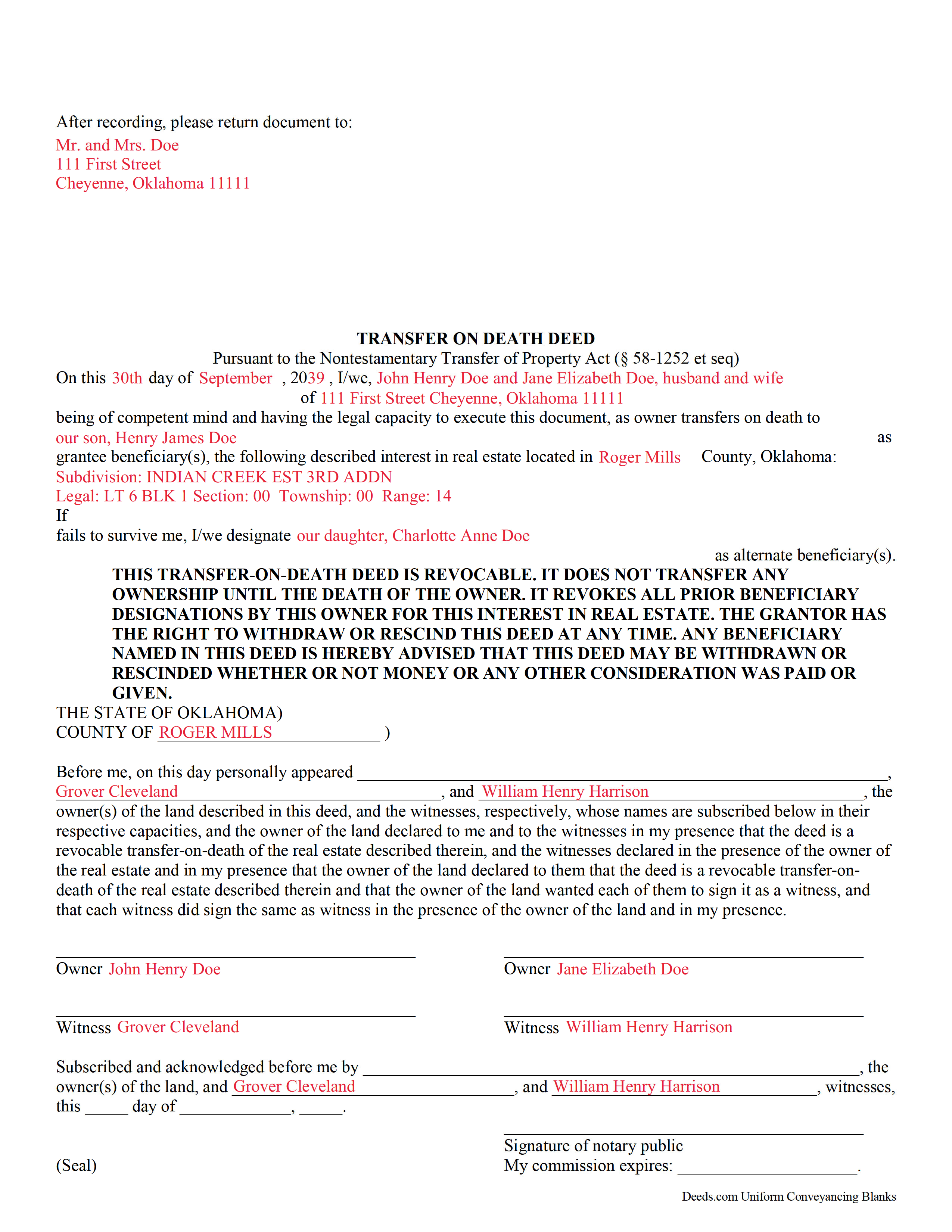

Caddo County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Caddo County documents included at no extra charge:

Where to Record Your Documents

Caddo County Clerk

Anadarko, Oklahoma 73005

Hours: 8:30 to 4:30 M-F

Phone: (405) 247-6609

Recording Tips for Caddo County:

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- Make copies of your documents before recording - keep originals safe

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Caddo County

Properties in any of these areas use Caddo County forms:

- Albert

- Anadarko

- Apache

- Binger

- Carnegie

- Cement

- Cyril

- Eakly

- Fort Cobb

- Gracemont

- Hinton

- Hydro

- Lookeba

- Washita

Hours, fees, requirements, and more for Caddo County

How do I get my forms?

Forms are available for immediate download after payment. The Caddo County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Caddo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Caddo County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Caddo County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Caddo County?

Recording fees in Caddo County vary. Contact the recorder's office at (405) 247-6609 for current fees.

Questions answered? Let's get started!

Transfer on death deeds (TODDs) in Oklahoma are governed by the Nontestamentary Transfer of Property Act (Title 58 O.S. 1251-1258), enacted in 2008. This law allows owners of interests in real property located in Oklahoma to designate one or more beneficiaries to receive those interests after the owner dies, but without the need for probate.

Owners who execute and record a TODD retain absolute control over and use of the property interest while living. In addition, they may modify, revoke, or otherwise convey the land any way they wish, without penalty or obligation to the beneficiaries. This is possible because unlike a traditional conveyance, there is no delivery requirement to notify the beneficiaries about what they might receive -- the deed only conveys a potential future interest in whatever remains after the owner's death ( 58-1252(B), 1257).

The statutes define an interest in real property to include "any estate or interest in, over or under land, including surface, minerals, structures and fixtures" ( 58-1252)(A)), meaning that the transfer is not limited to land, but can also include mineral rights and royalties.

Even though a TODD is not impacted by the owner's will, to reduce the likelihood of fraud and coercion, it demands the same standards of competence and capacity. Additionally, the document must be signed and acknowledged, in the presence of a notary, by the owner and two disinterested witnesses (individuals with no potential claims on the property rights) prior to recording ( 58-1253, 1258).

After the owner dies, each surviving beneficiary must execute and record an affidavit affirming his/her acceptance of the transfer ( 58-1252(C), (D)). The beneficiary takes the interest subject to all recorded obligations related to it.

NOTE: The transfer on death deed and any associated changes or revocations must be recorded, DURING THE OWNER'S LIFE, in the county where the property is located.

Overall, a transfer on death deed offers a convenient, flexible estate planning tool for owners of interests in Oklahoma real property. Each circumstance is unique, so consider all options carefully. For additional information or complex situations, contact a local attorney.

(Oklahoma TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Caddo County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Caddo County.

Our Promise

The documents you receive here will meet, or exceed, the Caddo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Caddo County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

Lloyd F.

September 13th, 2019

We were very pleased at how quickly the forms showed up and the guide and copy of a sample filled in form was very helpful. We will defiantly use you again if the occasion arises, and will highly recommend your company to friends and family. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary B.

September 28th, 2021

The whole experience was amazing. Your site was easy to work with and the staff was supper responsive. We were in and out in a flash!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda K.

July 5th, 2019

This service was easy, quick, and to the point. It was a lifesaver! Downloaded quickly and without issues. I was able to fill out a soecifice form for my state and county, which saved me from making errors from a universal form.

Thank you for your feedback. We really appreciate it. Have a great day!

David B.

January 27th, 2020

I'm not sure how a forms web-site could be so, but I find deeds.com to be sweet.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert J.

August 11th, 2020

Ordered the quitclaim forms. Amazing value! Received everything I needed and then some. The forms were easy to use and understand with the help of the guide. The best part was that once completed I used deeds.com's e-recording service to submit the document for recording (our county offices are still closed). Outstanding!

Thank you for the kinds words Robert, glad we could help.

DENISE E.

February 25th, 2021

I just submitted a beneficiary deed and it was accepted immediate and then recorded the next day! I like that I receive email messages notifying me of the process. The process was super easy and seamless. It's saved me so much time that I did not have to drive to downtown Phoenix to have this document record it. I love Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne G.

April 6th, 2020

I used deeds.com's services for the first time while the Stay at Home Order is in effect and found it to be very user friendly and seamless. I am very impressed.

Thank you Anne, glad we could help.

Dianne M.

June 30th, 2023

I find the resources on this website so helpful. The service is outstanding. Thank you.

Thank you!

Rajashree S.

January 2nd, 2019

Deed was easy to download and complete. Will use again if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOHN F.

May 24th, 2023

Quick and easy! I had previously prepared a Lady Bird deed, submitted it through Deeds.com and it was accepted/recorded by my county in just a few hours. The Deed.com $21 fee was well worth it as I saved fuel, tolls and parking costs not to mention at least 2-3 hours of my time that it would've taken to get downtown and back home!

Thanks for the feedback John. We appreciate you taking the time to share your experience. Have an amazing day!

Nora P.

January 10th, 2019

I'm typing along and suddenly I can't fit anything more into the page and there's plenty of room. This is my 2nd time using this site. No problem the first time years ago. Now it's an issue, looks like I'll need a typewriter to finish the form. Where do I find a typewriter?!! I can't complete the legal description!

Thanks for your feedback Nora. If you are unable to find a typewriter you can always do as the guide suggests and use the included exhibit page.

John W.

January 9th, 2019

The forms were easy to acquire and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri S.

July 3rd, 2019

Appreciate your diligent assistance.

Thank you!

April M.

May 1st, 2020

It was a very easy and quick site to use. Not to big of a fan price wise. But it gave me what I needed in a hurry. So all and all I'd definitely use this site again. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan C.

March 4th, 2019

easy to use to get copy of documents. given your website by recorder in the country offices.

Thank you Susan, we appreciate your feedback.