Baker County Assignment of Trust Deed by Beneficiary or Successor in Interest Form

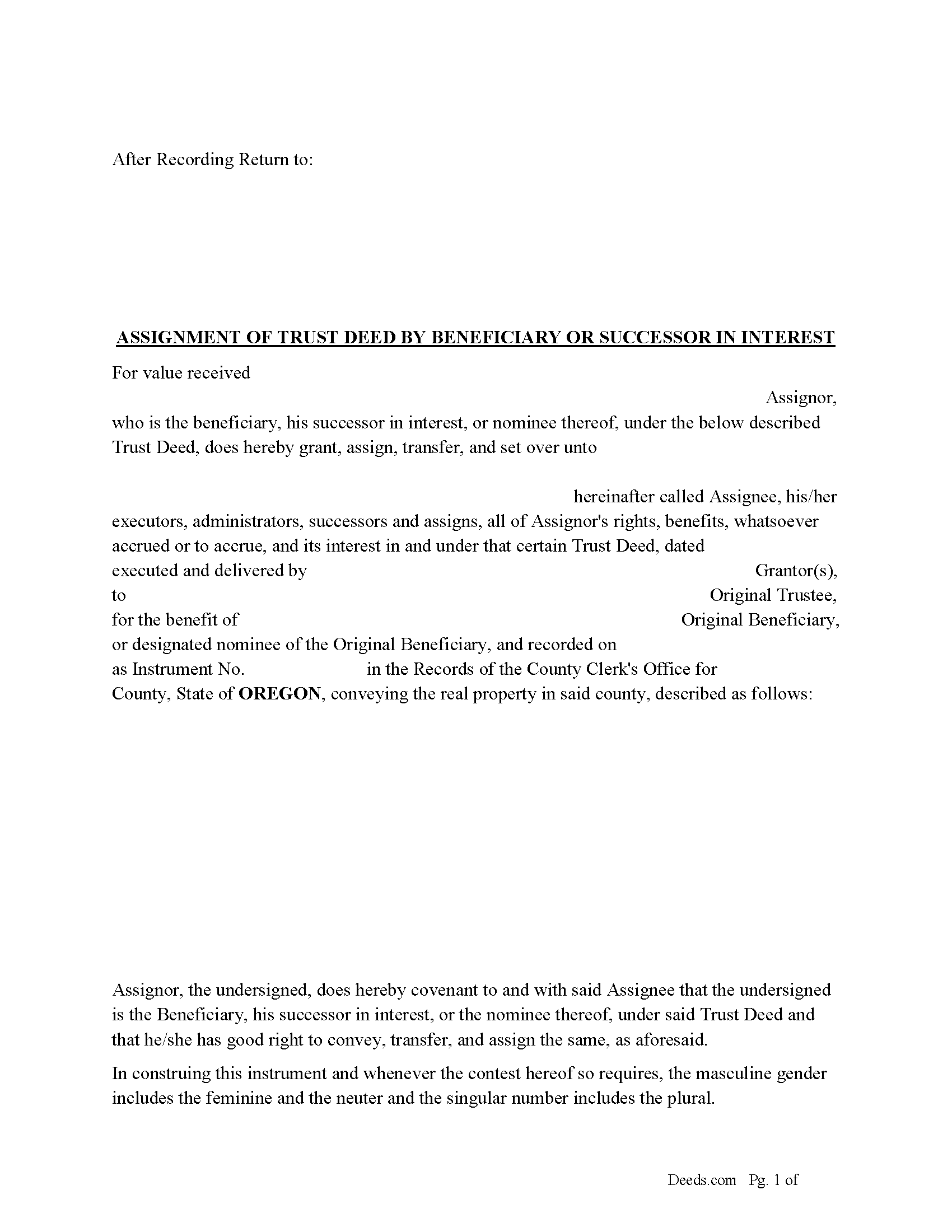

Baker County Assignment of Trust Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

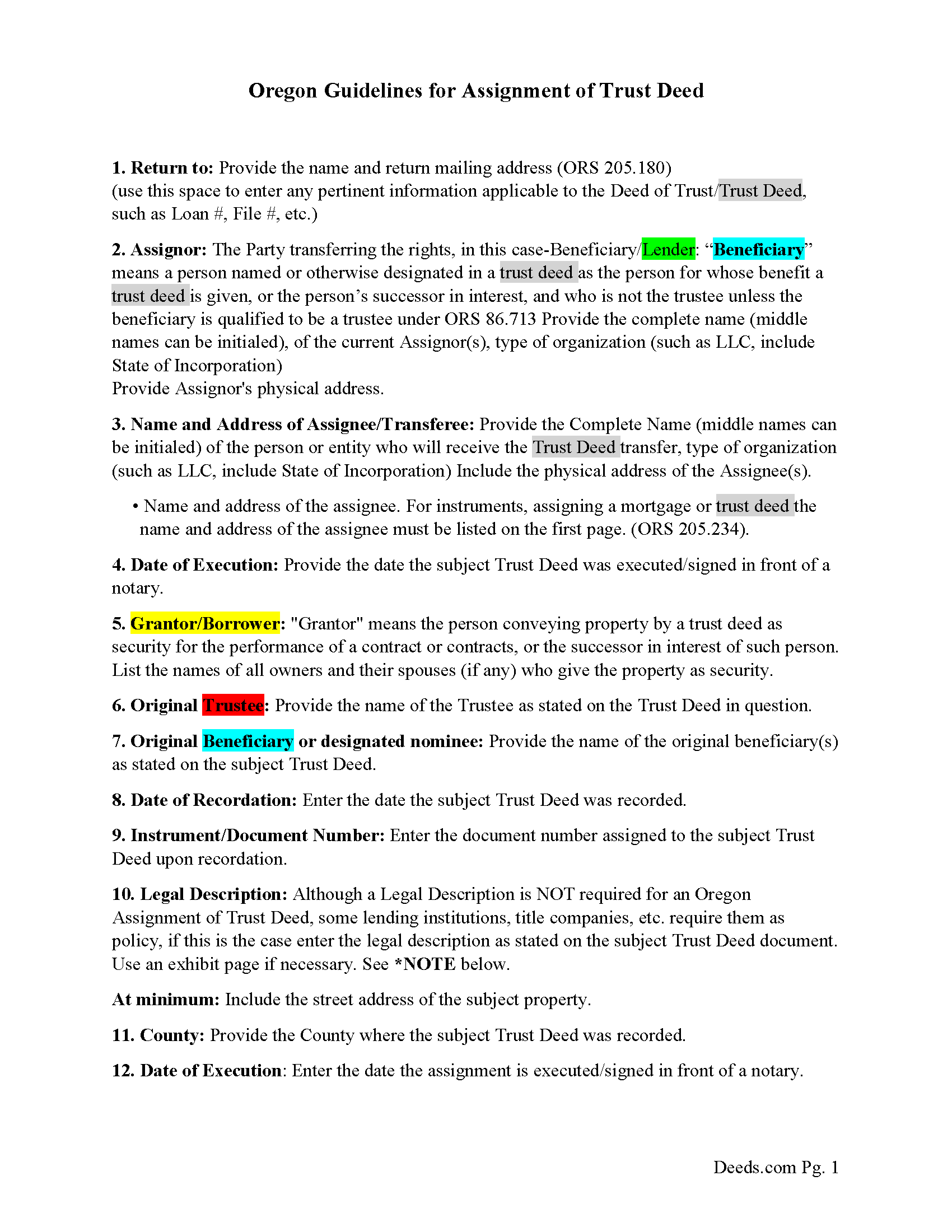

Baker County Assignment of Trust Deed Guidelines

Line by line guide explaining every blank on the form.

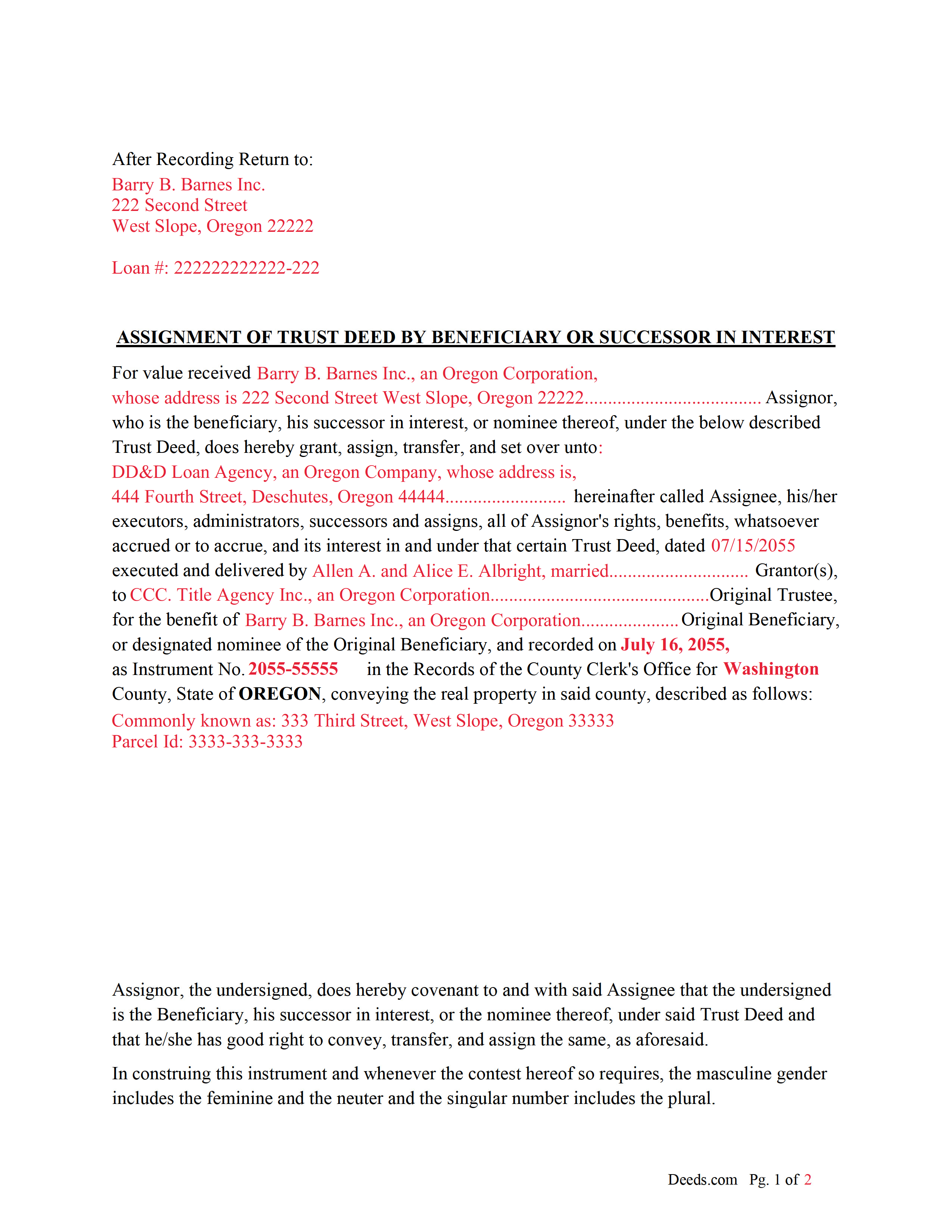

Baker County Completed Example of Assignment of Trust Deed Document

Example of a properly completed form for reference.

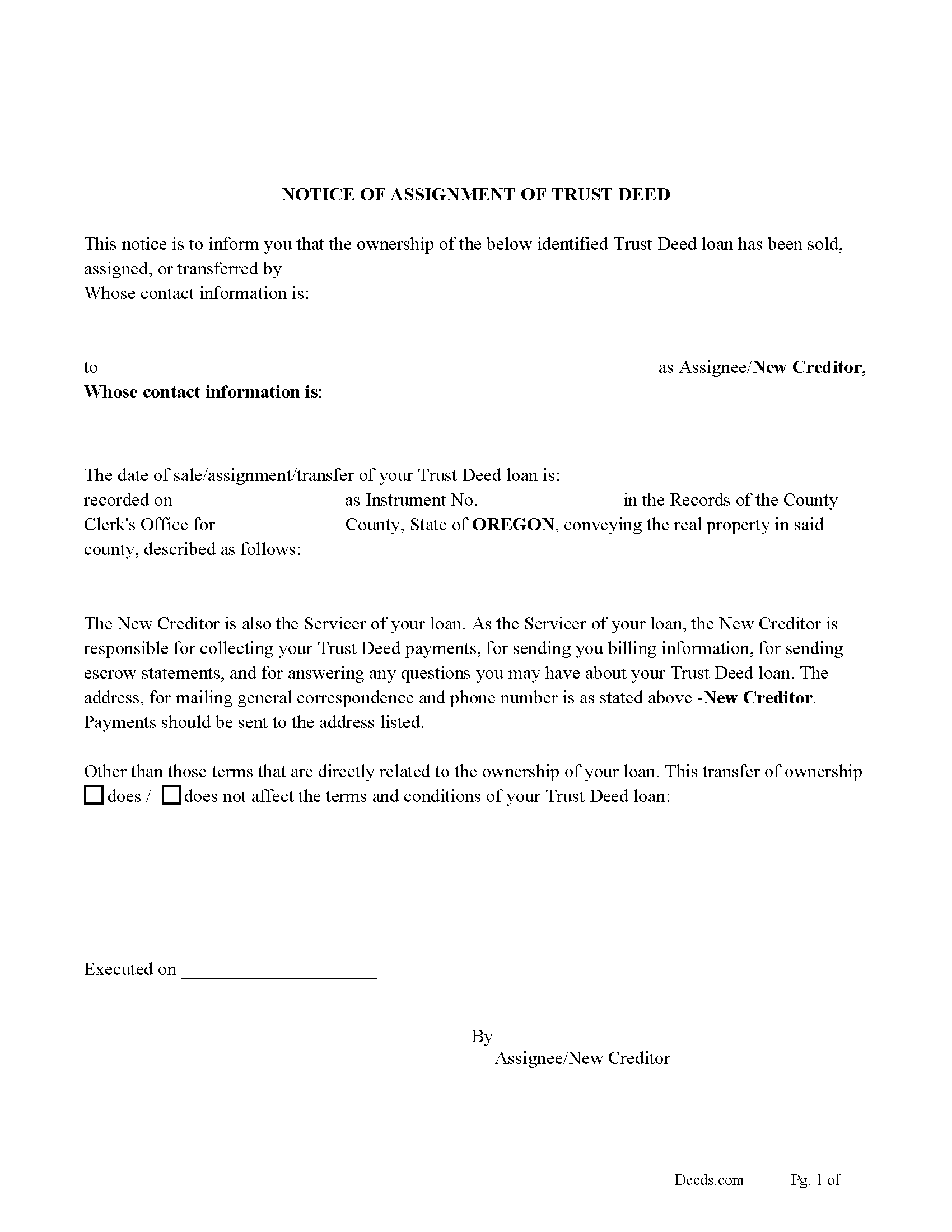

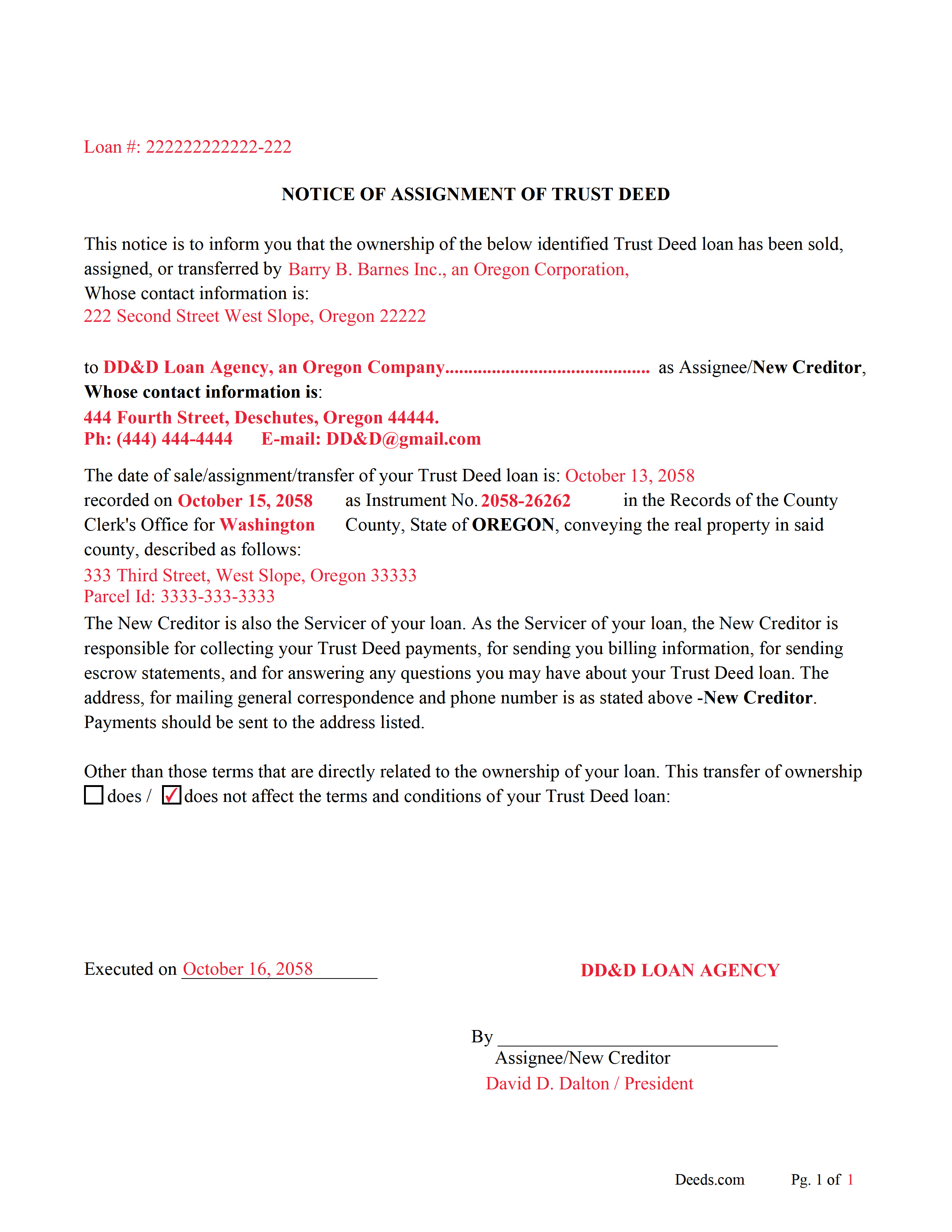

Baker County Notice of Assignment of Trust Deed Form

Fill in the blank form formatted to comply with content requirements.

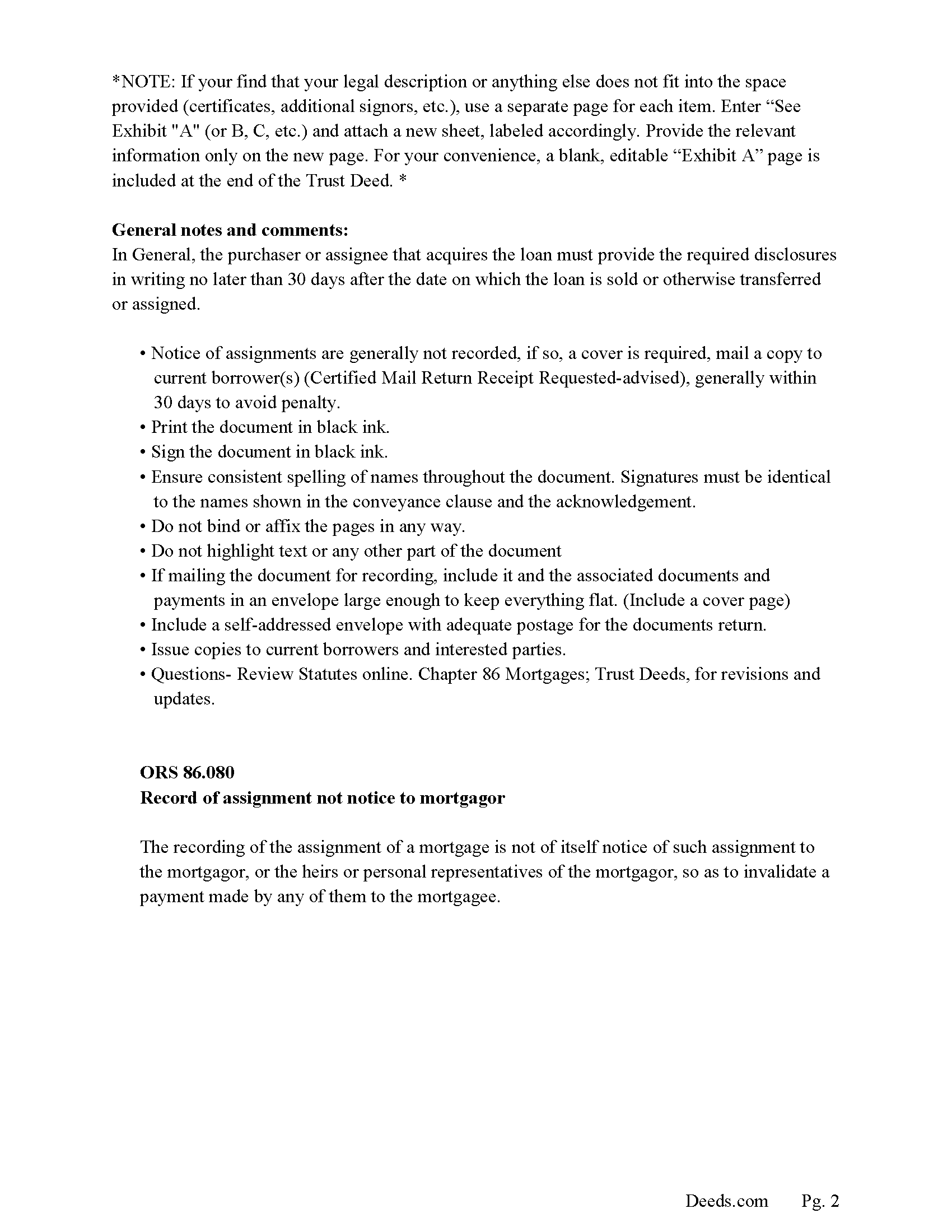

Baker County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Baker County Notice of Assignment-Completed Example

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Baker County documents included at no extra charge:

Where to Record Your Documents

Baker County Clerk

Baker City, Oregon 97814

Hours: 8:00am to 4:30pm.M-F

Phone: (541) 523-8207

Recording Tips for Baker County:

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Baker County

Properties in any of these areas use Baker County forms:

- Baker City

- Bridgeport

- Durkee

- Haines

- Halfway

- Hereford

- Huntington

- Oxbow

- Richland

- Sumpter

- Unity

Hours, fees, requirements, and more for Baker County

How do I get my forms?

Forms are available for immediate download after payment. The Baker County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Baker County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Baker County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Baker County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Baker County?

Recording fees in Baker County vary. Contact the recorder's office at (541) 523-8207 for current fees.

Questions answered? Let's get started!

In this form the assignment/transfer of a Trust Deed/Deed of Trust is made by the beneficiary/lender or successor in interest.

("Trust deed" means a deed executed in conformity with ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) that conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.) (ORS 86.705(8))

("Beneficiary" means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).) (ORS 86.705(2))

ORS 86.060 Assignment of mortgage Mortgages may be assigned by an instrument in writing, executed and acknowledged with the same formality as required in deeds and mortgages of real property, and recorded in the records of mortgages of the county where the land is situated.

ORS 86.715 Trust deed deemed to be mortgage on real property A trust deed is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced), in which event the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) shall control. For the purpose of applying the mortgage laws, the grantor in a trust deed is deemed the mortgagor and the beneficiary is deemed the mortgagee.

Included are "Notice of Assignment of Trust Deed" forms. The current Mortgagor/Borrower/Grantor must be notified of the assignment, generally within 30 days to avoid penalty.

ORS 86.080 Record of assignment not notice to mortgagor

The recording of the assignment of a mortgage is not of itself notice of such assignment to the mortgagor, or the heirs or personal representatives of the mortgagor, so as to invalidate a payment made by any of them to the mortgagee.

(Oregon Assignment Package includes form, guidelines, and completed example) For use in Oregon only.

Important: Your property must be located in Baker County to use these forms. Documents should be recorded at the office below.

This Assignment of Trust Deed by Beneficiary or Successor in Interest meets all recording requirements specific to Baker County.

Our Promise

The documents you receive here will meet, or exceed, the Baker County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Baker County Assignment of Trust Deed by Beneficiary or Successor in Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

GEORGE Q.

May 9th, 2019

Assistance from the associate was good. He told me what I needed to hear and took the time to look up deeds that I was looking for. Though the deed was not available he gave me recommendation on my future calls to ask. Great personality and very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy R.

August 27th, 2019

Actually, it was user friendly once I figured out where to go to get the forms. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Mike H.

February 11th, 2021

Great

Thank you!

Eric D.

March 21st, 2019

Very helpful and informative. It has saved me time going to get the forms at county recorder / clerk (as my county and state websites dont offer forms on their sites) and also provided help understanding the uses of the specific deed I needed to use.

Thank you Eric. Have a great day!

Dr. Rev. Cheryl T.

July 20th, 2021

five stars thanks so m,uch so easy to use and save. Good Job... Peace & many Blessings Sincerely, dr. Rev. Cheryl israel tibbrine

Thank you for your feedback. We really appreciate it. Have a great day!

Linda E.

August 22nd, 2019

Forms were perfect, guide was very helpful. Passed recording official's scrutiny with flying colors. Will be back should the need arise.

Thank you!

Wava B.

January 8th, 2021

Obtaining the form was quick and easy. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

albert C.

May 21st, 2021

thumbs up

Thank you!

Tressa P.

November 17th, 2020

This online service was very easy to use. I highly recommend Deeds.com. The quick response from the representative upon submitting your document is quick. If something needed to be adjusted they will send you message and you can in turn respond right away with a message. The pricing of this service is very reasonable.

Thank you!

Carolyn L.

February 17th, 2021

Easy and quick and reasonable!

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID E.

January 2nd, 2025

Very professional and knowledgeable. Great communication.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Sandra H.

February 26th, 2019

I am a retired attorney. I chanced upon this website while looking for a Florida Lady Bird Deed Form. It conforms to Florida Law and was exactly what I needed. The forms are easy to obtain and even easier to use and print out.

Thank you so much Sandra, we really appreciate your feedback.

LISA R.

May 4th, 2022

I was very pleased to find your website and the range of services you offer. I was recommended to hire an estate attorney, but the forms you provided will eliminate the need for that. Thank you for the help!

Thank you for your feedback. We really appreciate it. Have a great day!

Alan C.

December 10th, 2020

I thought the instructions could have been a little better. I didn't know how to do this if the spouses are married but living in separate residences. Also I didn't understand the "Prior Instrument Reference". That should be explained better. Very sketchy instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Joshua M.

March 15th, 2023

Fast service, very responsive. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!